Mat Cashman

@mat_cashman

Bloomberg asked PMs and institutional desk managers how recent volatility has impacted trading strategies 2 out of 5 PMs say it didn't affect their investment or execution decisions. this is your CONTRA.

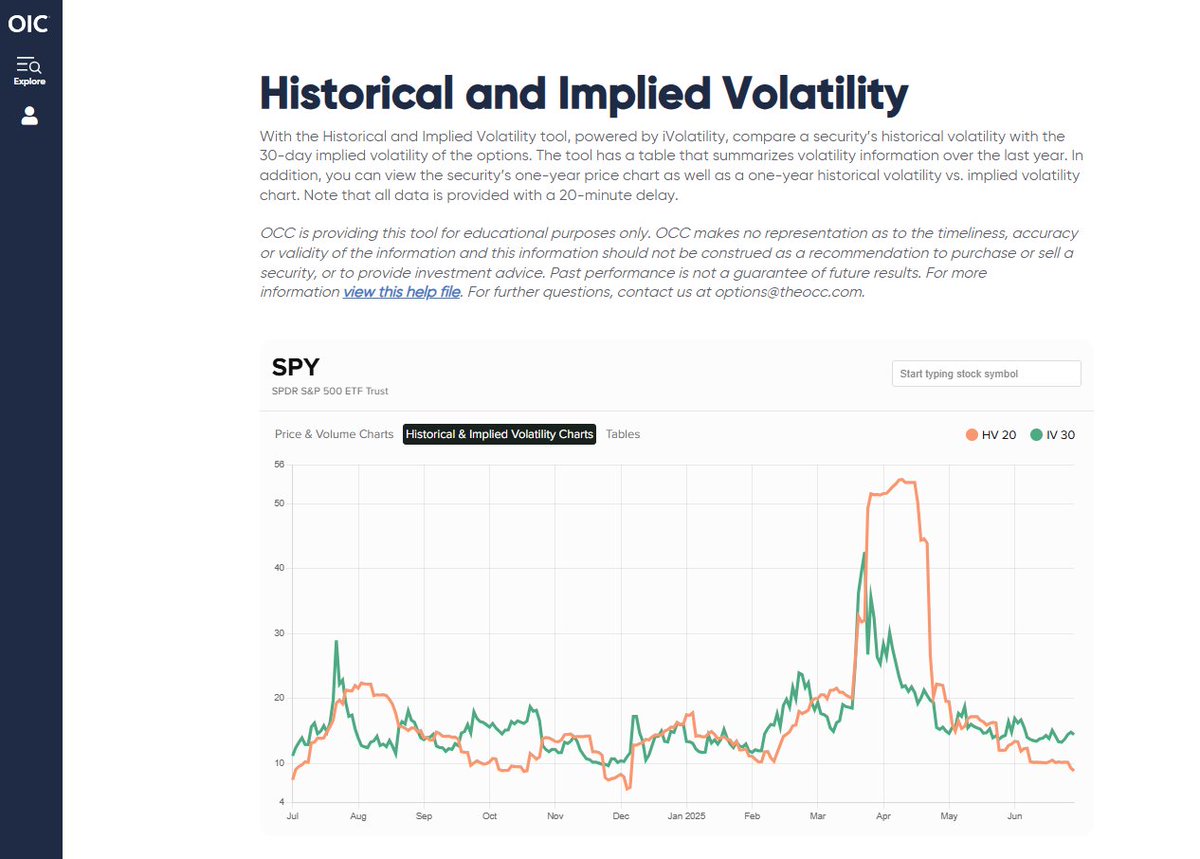

Today’s tool from @Options_Edu: Historical & Implied Volatility. Compare current IV to historical (delivered) vol across timeframes - Adds valuable context around expectations. Free with login: optionseducation.org Tool: optionseducation.org/toolsoptionquo… Questions? [email protected]

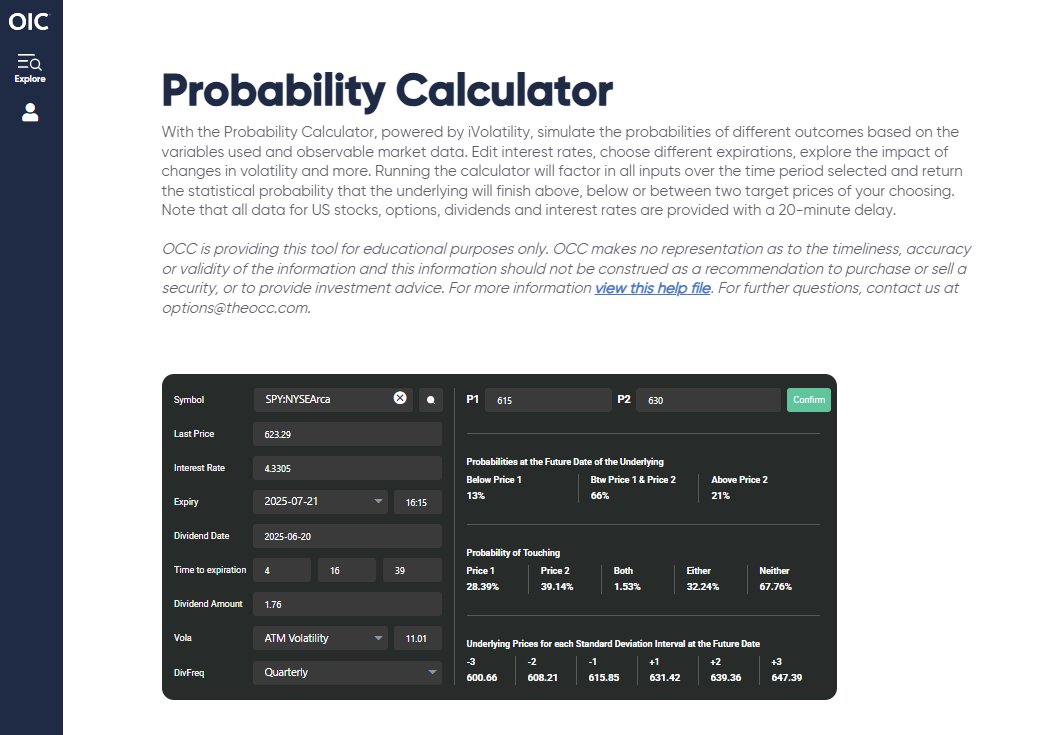

Today’s tool from @Options_Edu: The Probability Calculator Estimate the chance a stock finishes above, below, or between certain levels at expiration based on market data Free with login: optionseducation.org Tool link: optionseducation.org/toolsoptionquo… Questions? [email protected]

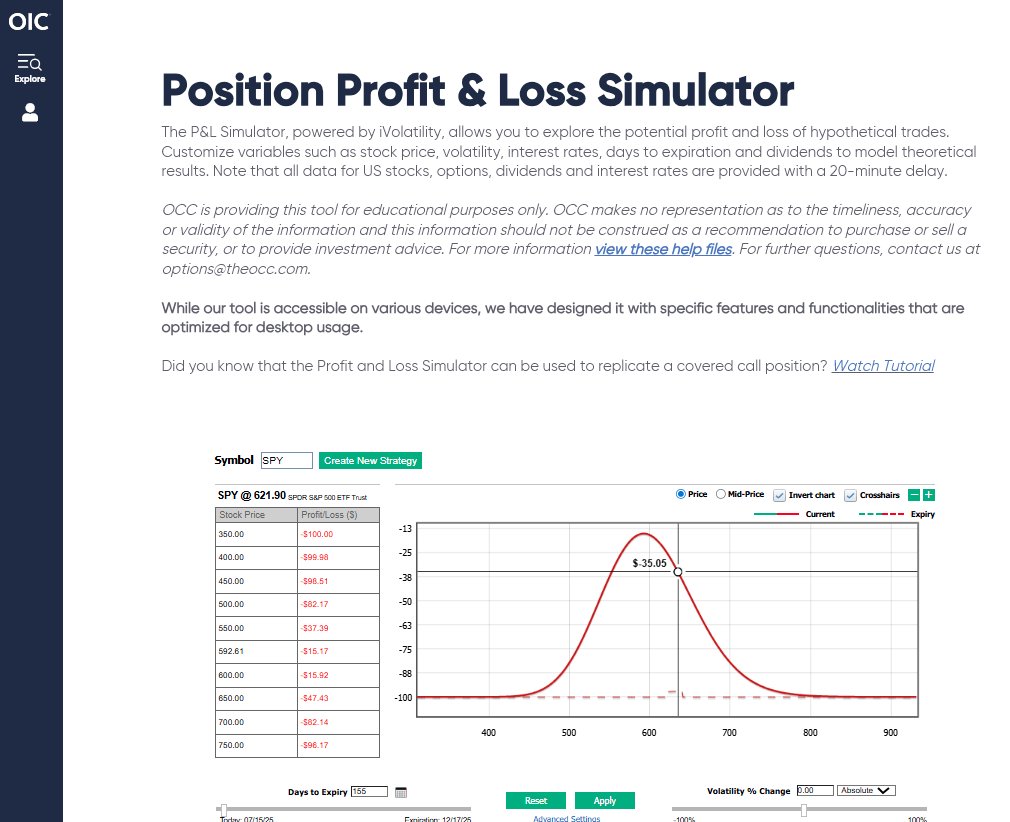

Today’s tool from @Options_Edu: The Position P&L Simulator. Plot single or multi leg trades and visualize how they respond to changes in price, time, or volatility. Free with login: optionseducation.org Tool link: optionseducation.org/toolsoptionquo… Questions? [email protected]

Thanks for joining today’s “Understanding Options Skew” webinar on @WebullGlobal Slide deck here for those who have asked: drive.google.com/file/d/1qQ6zZB… Explore more: optionseducation.org Questions? Email: [email protected]

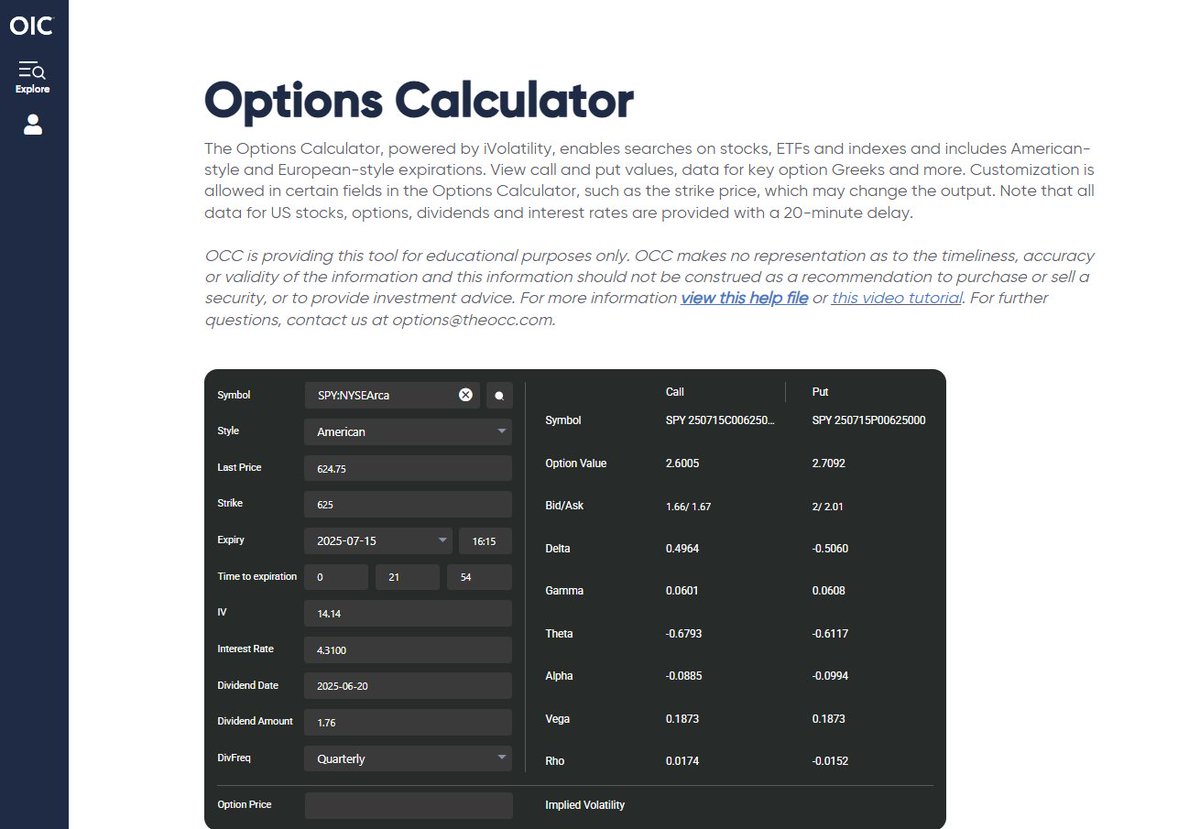

Today’s tool from @Options_Edu: The Options Calculator One of our most-used tools, and for good reason. See how price responds to changes in vol, time, and rates using Black-Scholes or Binomial models. Free with login: optionseducation.org Tool link: optionseducation.org/toolsoptionquo…

Today’s the day! Live at 1PM ET: “Understanding Options Skew” — hosted by @WebullGlobal + @Options_Edu. Why does skew exist? What does it tell us? Let’s get into it. See you there. Register at this link: webull.com/webinar/detail…

What’s options skew? And why does it matter? Join me tomorrow (7/15) at 1PM ET for a free @WebullGlobal + @Options_Edu webinar. We'll cover options skew, sentiment, pricing, and more. Register: webull.com/webinar/detail…

OIC instructor Roma Colwell is about to show you a balancing act this Wednesday – balancing risk and potential reward, that is. Join Roma on July 16th at 3:30 p.m. CT to explore collars, including traditional & creative variations. She will cover: – Collar construction –…

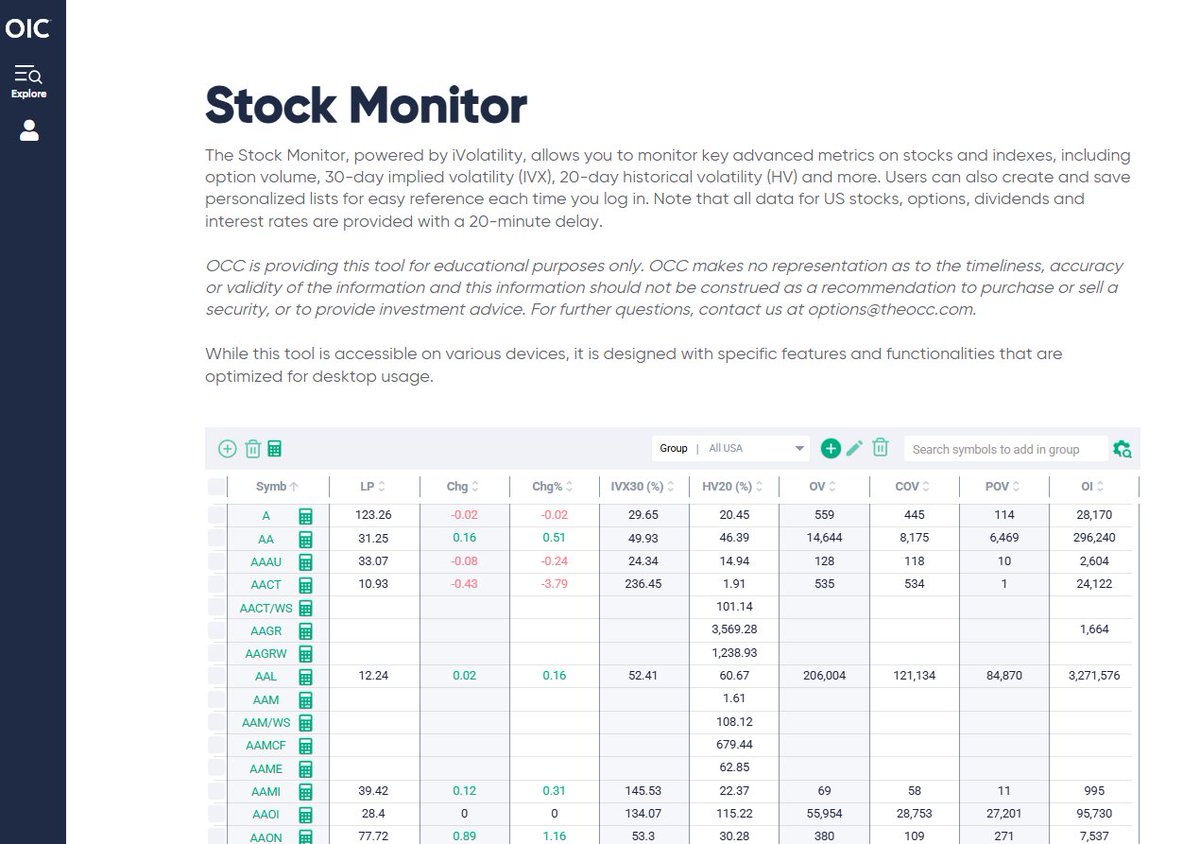

Today’s tool from @Options_Edu: The Stock Monitor. Before you trade an option, understand how the stock is behaving using price, volume, volatility, and more. Free with login: optionseducation.org Tool link: optionseducation.org/toolsoptionquo… Questions? [email protected]

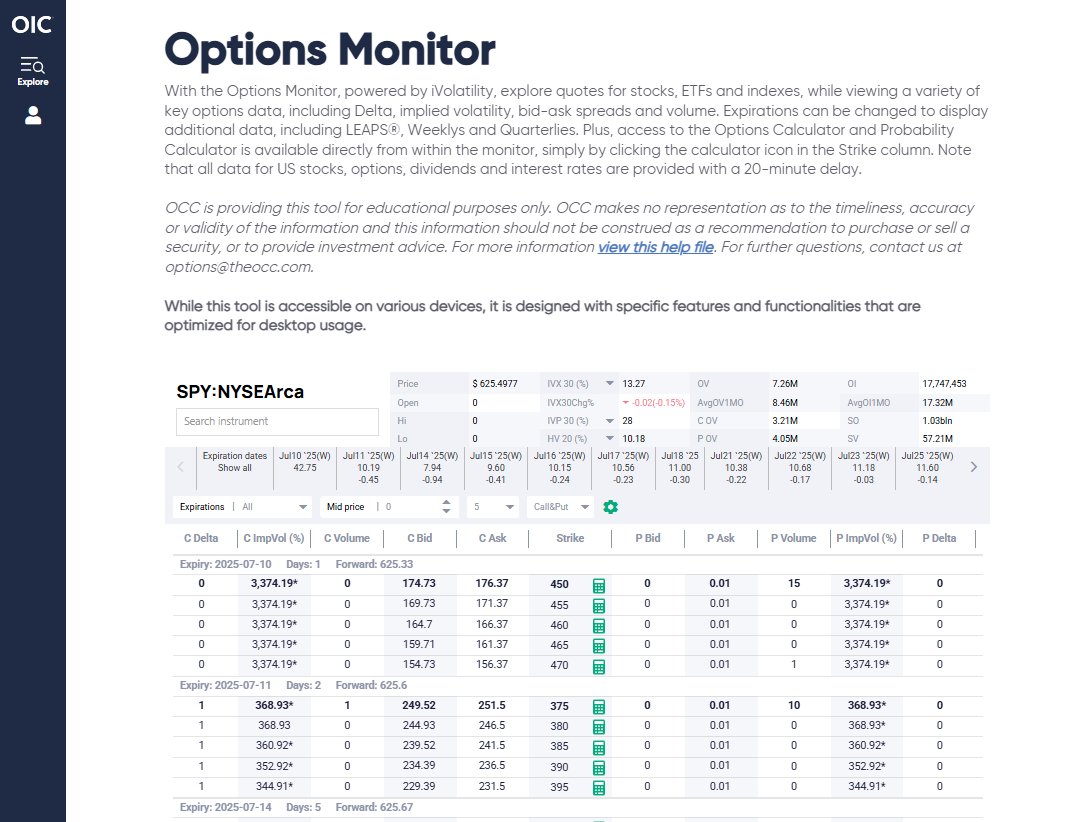

Today’s tool from @Options_Edu: The Options Monitor View full chains across expiries. Customize with Greeks, IVs, bid/ask, and more. Even launch the Calculator or Probability tools right from the chain. Free with login: optionseducation.org Tool link: optionseducation.org/toolsoptionquo…

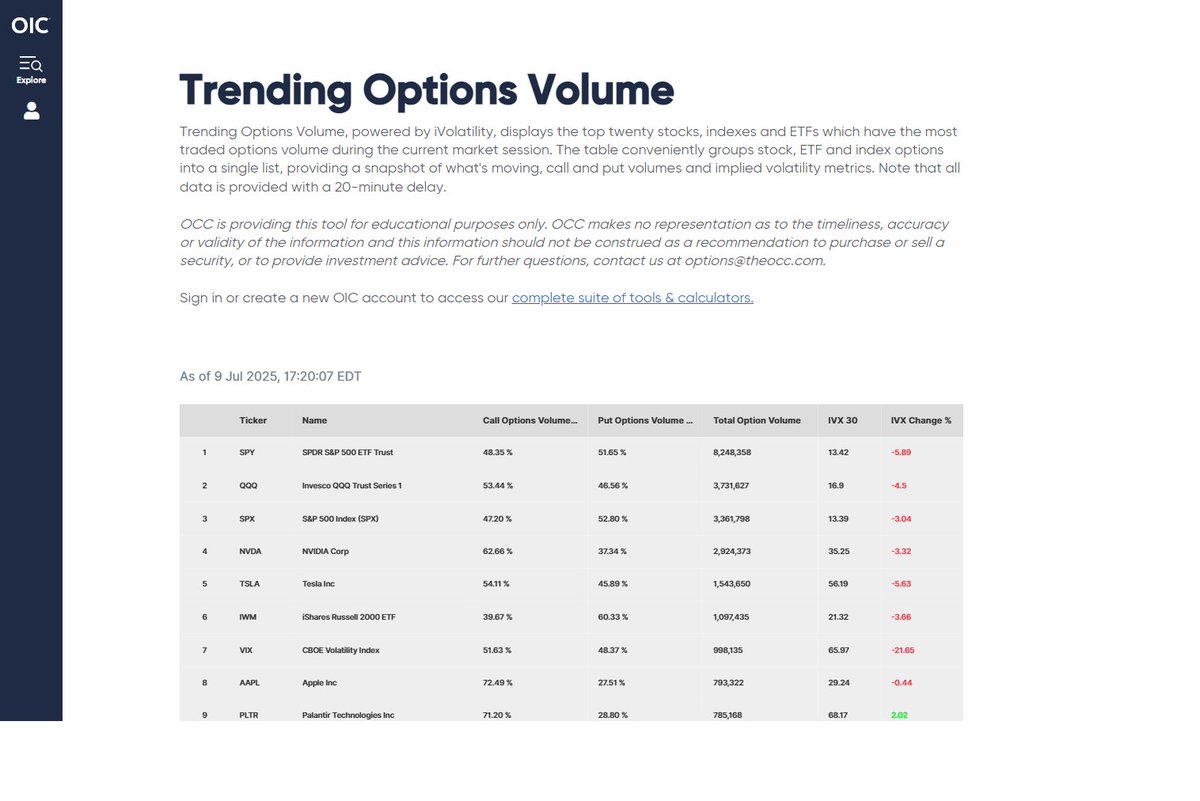

Today’s tool from @Options_Edu: The Trending Option Volume page. Tracks the top 20 names by volume, breaks down calls vs. puts, and shows changes in 30-day implied volatility. Create a free login to access: optionseducation.org Link to the tool: optionseducation.org/toolsoptionquo…

Starting tomorrow, I’ll be posting a daily series spotlighting powerful (and totally free) options tools from @Options_Edu. These tools help traders understand pricing, volatility, probability & risk — and they’re available to everyone. optionseducation.org

Since synthetic futures and index arb is top of mind this is the ELI5 version (well actually ELI11 as I used my kid's spreadsheet to teach it) I did with @CultishCreative youtube.com/watch?v=vYPulK…

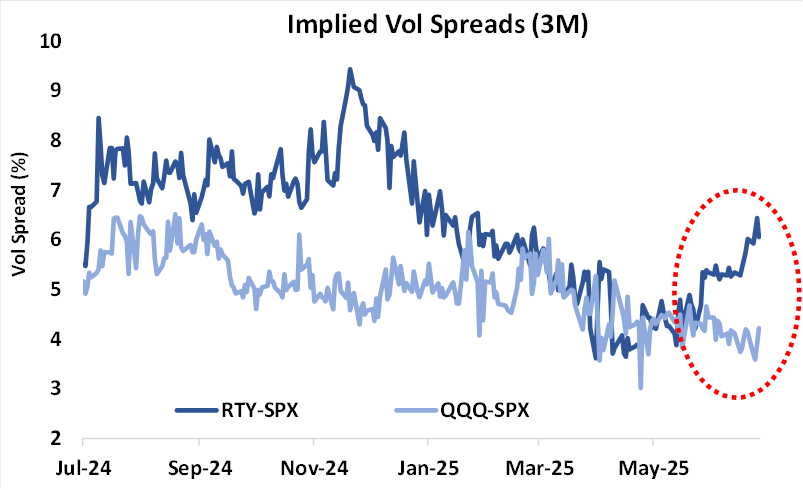

Interesting piece from Mandy Xu of @CBOE - you can find the full piece here: cboe.com/insights/posts… Talks about the "spot up, vol up" scenario and highlights the RTY/SPX Implied Vol spread and the skew divergence. ENJOY!

Short Vol with a Side of Vanna w/Mat Cashman (OCC) | SpotGamma x.com/i/broadcasts/1…

I'll be on Youtube Live with Brent Kochuba of @spotgamma at 12 Noon CT today. Come by and Lets talk options. See you there! youtube.com/live/2pqxwKNLr…

I'll be on Youtube Live with Brent Kochuba of @spotgamma Monday, July 7th at 1pm ET. We are going to talk all things option Vol and a few things Vanna. I'll post the link Monday morning. Hope to see you there. ENJOY!

Half our investor education emails are about corporate actions. Why? They’re complex. 3 key resources: OCC issues Info Memos when corp actions affect options Free search tool infomemo.theocc.com/infomemo/search New videos bit.ly/OCC-CorpActions Questions? Email us: [email protected]