Maartje Bus

@maartjebus

President at The Medici Network. Former VP of Research at Messari.

1/ As we’ve entered the next risk-on phase, we asked liquid fund managers what they are most bullish on, on a 3-month horizon. Part of our new weekly insights series tapping into the braintrust of The Medici Network. Let’s get into it 👇🏼🧵

Summer reads tapping into the 🧠 power of @NetworkMedici - right in time for the holiday weekend 👇🏼

This week, we asked the @NetworkMedici to share summer reads - books, blogs, pods. Read on for recs from founders, traders, fund managers, and others. May the fourth be with you 🫡 🇺🇸

Our second weekly post tapping into the collective brain 🧠 power of @NetworkMedici.

1/ We asked five liquid funds to share “the most interesting chart in crypto right now” - and why it matters. 👇🏼👀

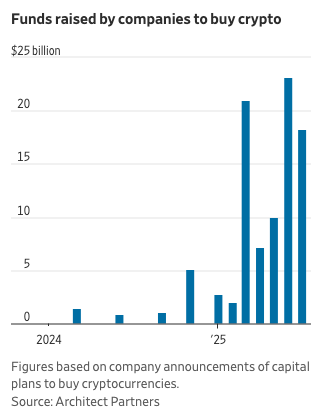

Per the WSJ, companies have raised $86B to buy #BTC and other crypto tokens since the start of 2025 - more than double what was raised in U.S. IPOs. Crypto is no longer a niche. Every Wall Street firm is paying attention and working on a strategy.

This has #zkTLS and @OpacityNetwork written all over it 🚀 coindesk.com/policy/2025/07…

1/What happens when 150 leading hedge fund managers, VCs, protocol founders, and institutional allocators meet off-the-record at our invite-only Medici LA event, held alongside Milken? This week, we're pulling back the curtain 👀 on five key insights from our event report.…

👇🏼Bullish for zk-TLS? Bloomberg: JPMorgan will start charging fees to FinTechs later this year, for access to their customers' bank account information bit.ly/3IDTcXI

More insights from the @NetworkMedici. This week we're featuring "the most important chart in crypto right now" shared by @veradittakit @reganbozman @Maven11Capital and @FinalityCap👇🏼

1/ This week, we asked VCs to share “the most important chart 📈 in crypto right now” - and why it matters. 👇🏼👀

When @defi_monk speaks, I'd listen. This guy has been right (and early) about a lot of things 👇🏼

Picking Winners in the CLOB Wars Key takeaways from my latest Messari Report In part 1 of our deep-dive into CLOBs we covered a new generation of order book DEXs that have formed the basis of the "CLOB Wars". Here's part 2, where I give my view on who wins 🧵👇:

Weekly @NetworkMedici insight No.3 👇🏼

When protocols meet liquid funds ... it's not always love at first sight. From our front-row seat at protocol pitch meetings - here are common pitfalls we see, and how founders can fix them 🧵👇🏼

Congrats to @tn_pendle and the team for the milestone🎉 Tune into our latest Level Up episode where TN breaks down @pendle_fi's PT economy, emerging collateral trends, and key growth levers ahead. Listen Here 🎧👉 levelup.medici.network/medici-level-u…

Pendle just crossed $5B in TVL — powered in large part by our growing PT economy. Today, ~$2.5B worth of Pendle PT is being used as collateral across money markets, making up ~5% of ALL collateral - a 52% increase since 4 months ago

New @NetworkMedici Level Up Podcast website out! Check it out to hear some of our interviews with top liquid token founders and investors: levelup.medici.network

👇🏼 @tn_pendle of @pendle_fi on Episode 6 of Level Up Big catalyst? Boros — launching June/July — is the first marketplace to fix, hedge & trade perp funding rates. “Boros is a zero-to-one product… the growth potential is massive.”

1/🎙️Medici Presents: Level Up – Episode 06 is LIVE! 🚀 Join @David_Grid & @SeanMFarrell as they sit down with @tn_pendle, Co-Founder of @pendle_fi, and @0xLouisT, Investment Partner @L1D_xyz to unpack: 🔹 PT/YT tokens: fixed-yield & yield-speculation 🔹 Pendle’s AMM vs.…

i know some are worried about the bitcoin treasury companies and their debt becoming a problem but for now we think those fears are overblown there really isn’t that much debt in the scheme of things, and most not due for 2+ years

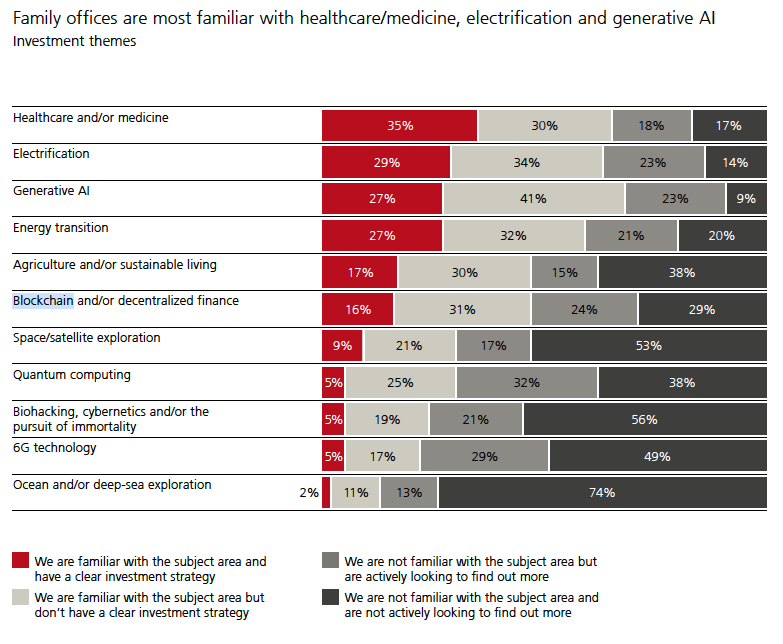

In UBS 2025 global family office report, #blockchain #DeFi ranks among the top areas where families want to learn more - alongside 6G, quantum computing, and AI. Still early.

Great read from @jdorman81 cutting through the noise around crypto treasury companies 🧠

The rise of publicly traded U.S. companies buying Bitcoin & other digital assets has been the talk of the town, but as usual, there are a lot of misconceptions. So we’ll do our best to parse through the facts and myths about these new buyers of digital assets. A thread 👇