Level 🆙

@levelusd

Level is the leading stablecoin protocol powered by blue-chip lending protocols. Backed by @dragonfly_xyz @polychain

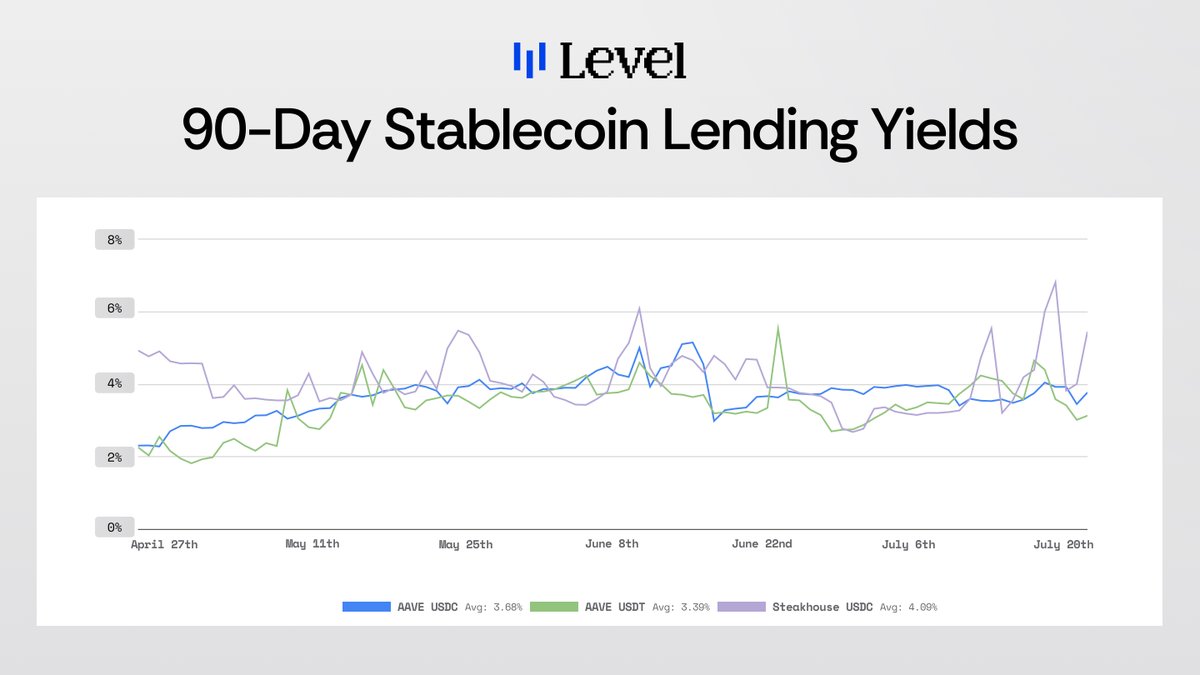

Covering slvlUSD weekly yield fluctuation TL;DR: → APY moved from 7.89% → 7.99% → 📈 Rates up → 👥 More stakers Still, net yield per staker slightly up. The reasons behind the 0.1pp APY increase (7.89% → 7.99%) Everyone saw the slight bump this week. But what actually…

July 25th weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 7.99% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $36.24M in aUSDC → $38.27M in steakUSDC (Morpho) Total Reserves: $74.5M Check out our live Transparency Dashboard:…

July 25th weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 7.99% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $36.24M in aUSDC → $38.27M in steakUSDC (Morpho) Total Reserves: $74.5M Check out our live Transparency Dashboard:…

🗓️ Friday, 4 PM UTC (12 PM EST) Pizza 🍕 & Poker 🃏 with @superformxyz More details on Discord 🐙

@levelusd x @superformxyz face off in the Tezza Poker battlefield ♠️🔥 🎉 Join us this Friday at 4PM UTC (12PM EST) for some wild poker action 🏆 $200 in lvlUSD & PIGGY up for grabs — Top 8 get paid Bring your best hand. Let’s play. Join our Discord for full details 👇

Seen way too many CT takes on @levelusd that just ain’t it, so I made a quick explainer vid. Ask me anything, I’ll reply to all. Let’s go 👇

The most reliable yield source in DeFi 1️⃣ Real demand = real yield 2️⃣ Battle-tested 3️⃣ Low Volatility 🔁 Lending = DeFi’s “risk-free rate”

.@levelusd PT positions on @pendle_fi are currently trading at a +10% implied APY. Meanwhile, @M11Credit markets on @MorphoLabs allow borrowing lvlUSD at 2.88% and 4.27% using PT-lvlUSD and PT-slvlUSD as collateral.

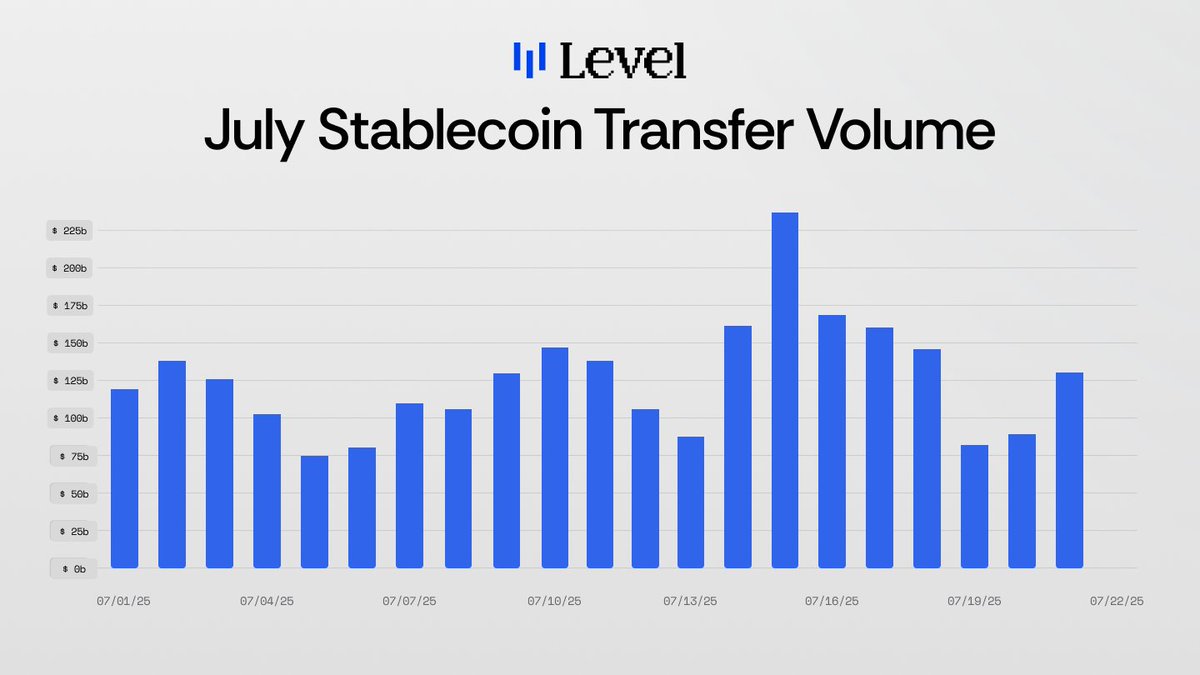

Stablecoin activity is on the rise. With several $100B+ days in July, stablecoins are becoming the default for onchain value transfer. As clarity around this asset improves, this trend is expected to grow even further.

Active borrowing demand on @Aave and @Morpho (Ethereum) has climbed from $10.98B in April to $18.26B today, its all-time high. For lending-based systems like Level, rising borrow demand directly translates into stronger lending rates. It's real, onchain yield.

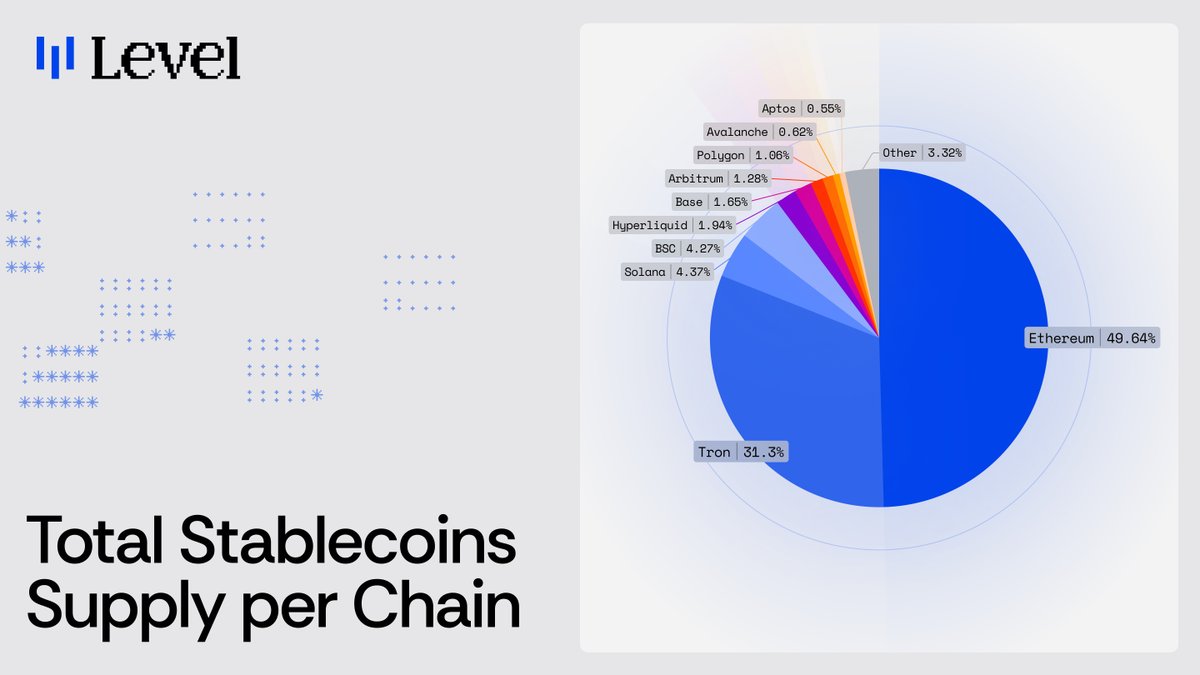

Stablecoin supply has been climbing nonstop. But the dominant house is still Ethereum.

glevel for the ones chasing onchain yield.

July 18th weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 7.89% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $47.6M in aUSDC → $33.2M in steakUSDC (Morpho) Total Reserves: $80.78M Check out our live Transparency Dashboard:…

Lending composability starts here.

How Level unlocks capital composability for Lenders 1️⃣ Your lending protocol receipt tokens are under-earning Parking USDC or USDT in @Aave, earns the baseline crypto “risk-free” rate, yet the aTokens that represent your position rarely do more than sit idle. You forfeit a…

🧱 Every new asset on Arkis gets a full collateral report—risk, design, and liquidity, all covered. lvlUSD by @levelusd is the latest: a lending-based stablecoin backed by USDC/USDT, generating yield via Aave & Morpho. Dive in 👇 arkis.xyz/whitelisted-as…