Arkis

@ArkisXYZ

Arkis is a digital asset prime brokerage, offering a leverage protocol that enables undercollateralized lending for capital providers and asset managers.

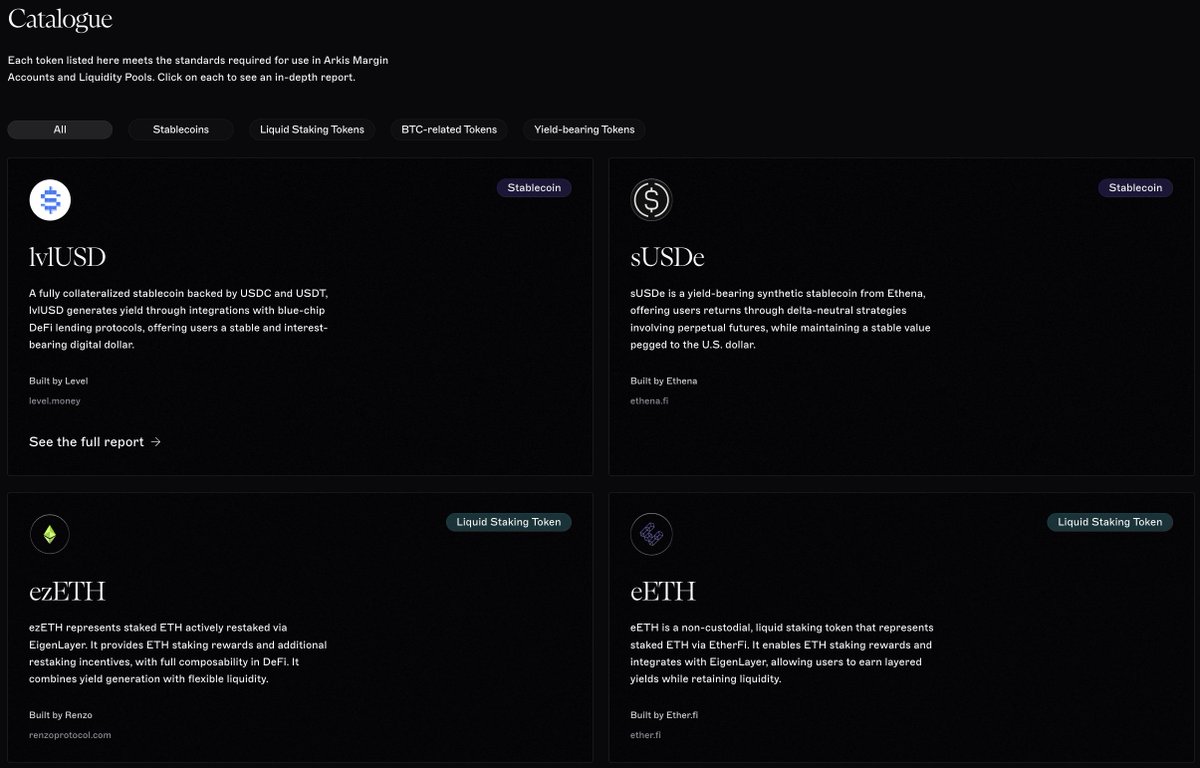

I really like what @ArkisXYZ is doing with their new asset listings. Every time they add something new, they don’t just list it. They go deep. Full collateral reports with risk, design, and liquidity breakdowns? That’s how it should be done in DeFi. The latest one is lvlUSD…

📢 Arkis now has a public collateral page: arkis.xyz/whitelisted-as… Each token listed meets our standards for use in Arkis margin accounts & liquidity pools. The list is ever-growing and actively maintained. Whether you're a protocol interested in listing your asset, or an LP…

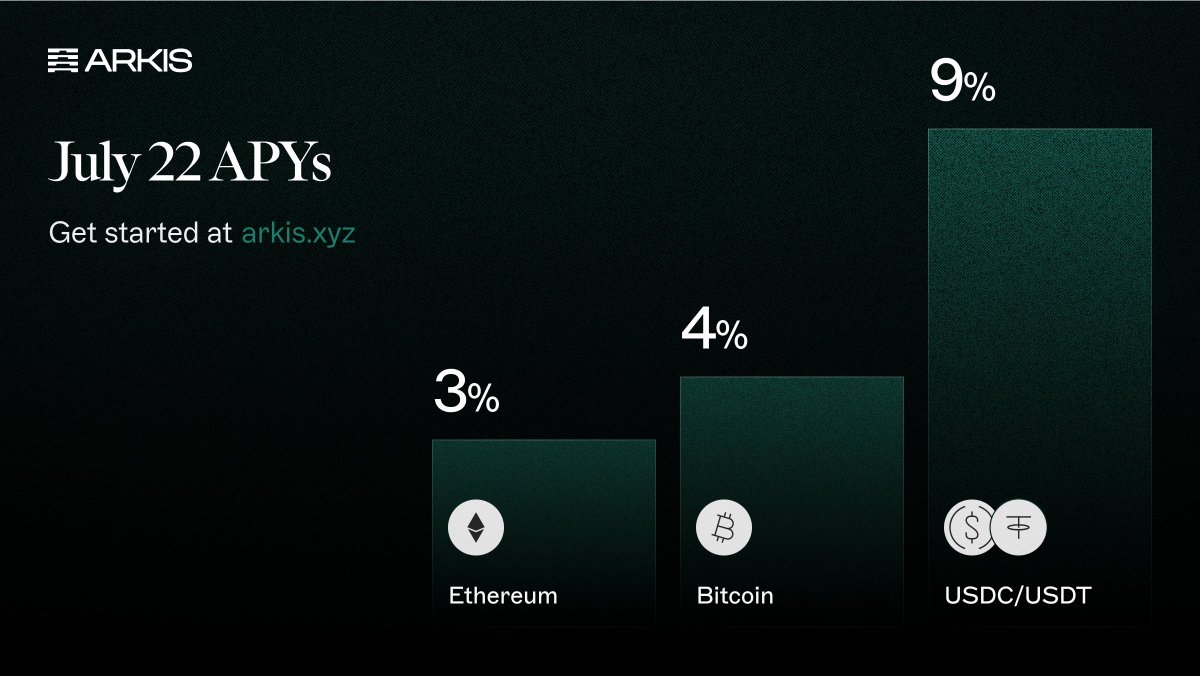

Earning on your idle ETH yet? Weekly rates are live on Arkis! Tap in → arkis.xyz 📈

Huge news , @levelusd just got greenlit as collateral on @ArkisXYZ , backed by a full breakdown of its design, liquidity, and onchain risk management. lvlUSD proves you can be stable and productive. Now it’s officially collateral-worthy. This is what grown-up DeFi looks like.…

🧱 Every new asset on Arkis gets a full collateral report—risk, design, and liquidity, all covered. lvlUSD by @levelusd is the latest: a lending-based stablecoin backed by USDC/USDT, generating yield via Aave & Morpho. Dive in 👇 arkis.xyz/whitelisted-as…

ARKIS Just Level🆙️ With lvlUSD @ArkisXYZ recently introduced lvlUSD as collateral aligns with the growing trend of decentralized finance (DeFi) platforms integrating yield-generating stablecoins. 🏷 lvlUSD's backing by USDC and USDT taps into the stablecoin market's…

🧱 Every new asset on Arkis gets a full collateral report—risk, design, and liquidity, all covered. lvlUSD by @levelusd is the latest: a lending-based stablecoin backed by USDC/USDT, generating yield via Aave & Morpho. Dive in 👇 arkis.xyz/whitelisted-as…

🧱 Every new asset on Arkis gets a full collateral report—risk, design, and liquidity, all covered. lvlUSD by @levelusd is the latest: a lending-based stablecoin backed by USDC/USDT, generating yield via Aave & Morpho. Dive in 👇 arkis.xyz/whitelisted-as…

In addition to XRP, Arkis supports most native assets with >$50M daily spot volume as collateral. Check out the full list 👇docs.arkis.xyz/home/concepts/…

$XRP is accepted as collateral on Arkis. Borrowers can access flexible, non-custodial credit using $XRP across permissioned credit lines. Tap into $30B of idle capital → arkis.xyz

$XRP is accepted as collateral on Arkis. Borrowers can access flexible, non-custodial credit using $XRP across permissioned credit lines. Tap into $30B of idle capital → arkis.xyz

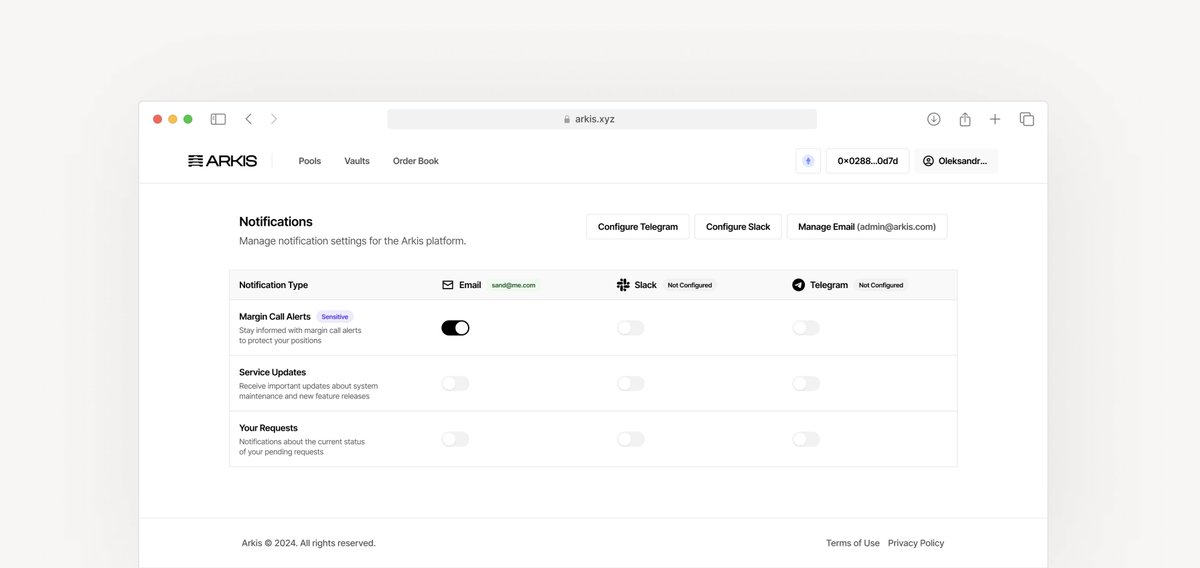

Margin calls aren’t the end of the world—unless you miss them. Arkis keeps you in control with real-time alerts and direct communication: • Auto alerts when risk shifts • Live updates via Telegram/Slack • Emergency phone calls if needed You’ll always know before it’s too…

Check out this 26% APY strategy—built with Arkis infrastructure. Borrow on Arkis. Trade across CEX + DeFi. Track margin, collateral, and liquidations with full transparency. Prime brokerage, rebuilt for onchain execution. 👇

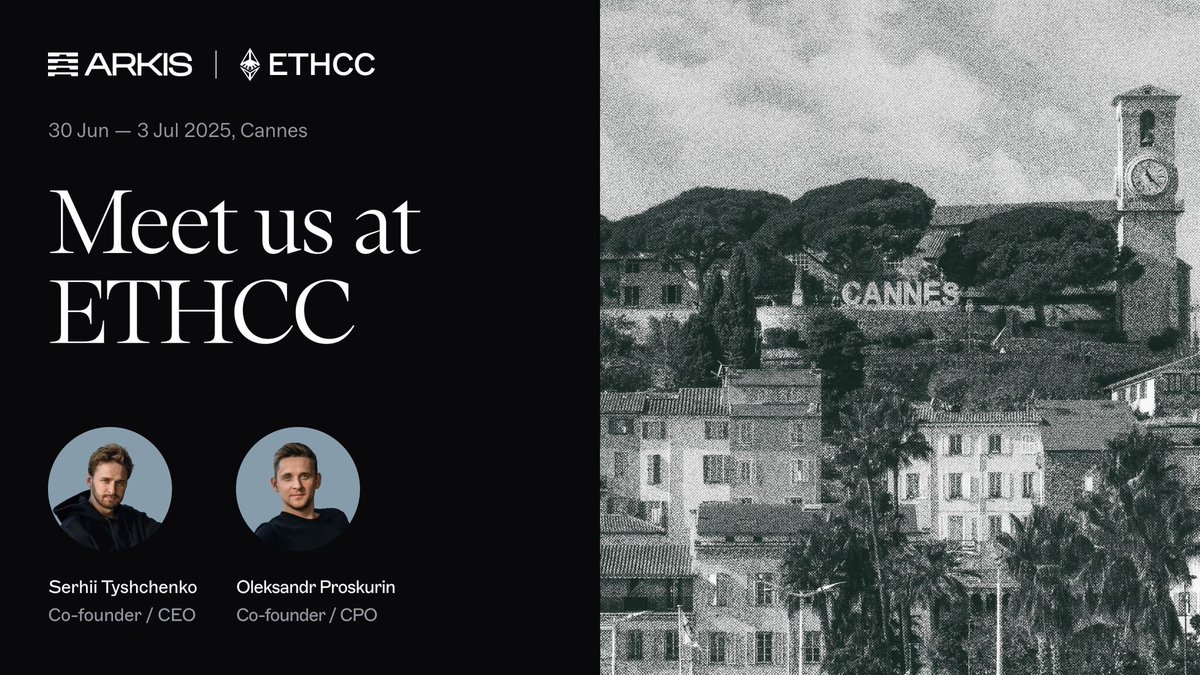

Arkis is attending ETHCC in Cannes from June 30 to July 3! 🇫🇷 Our co-founders @serjxyz and @proskurinalex are on the ground—connecting with protocols, credit funds, and DeFi users. Want to learn more about our prime brokerage protocol? Reach out—we’d love to chat in person…

During the June 12 HYPE sell-off, most accounts faced mounting liquidation risk. One Arkis client stayed well above water. With 70% of their HYPE hedged off-chain, Arkis extended margin credit for the hedge—thanks to our portfolio margining + Bybit DMA. Risk factors told the…

During the June 12 HYPE sell-off, one Arkis client stayed safely above liquidation thresholds—thanks to Arkis’s portfolio margining and Bybit DMA integration—even as unhedged accounts neared liquidation. With 70% of their HYPE collateral hedged off-chain, Arkis granted this…

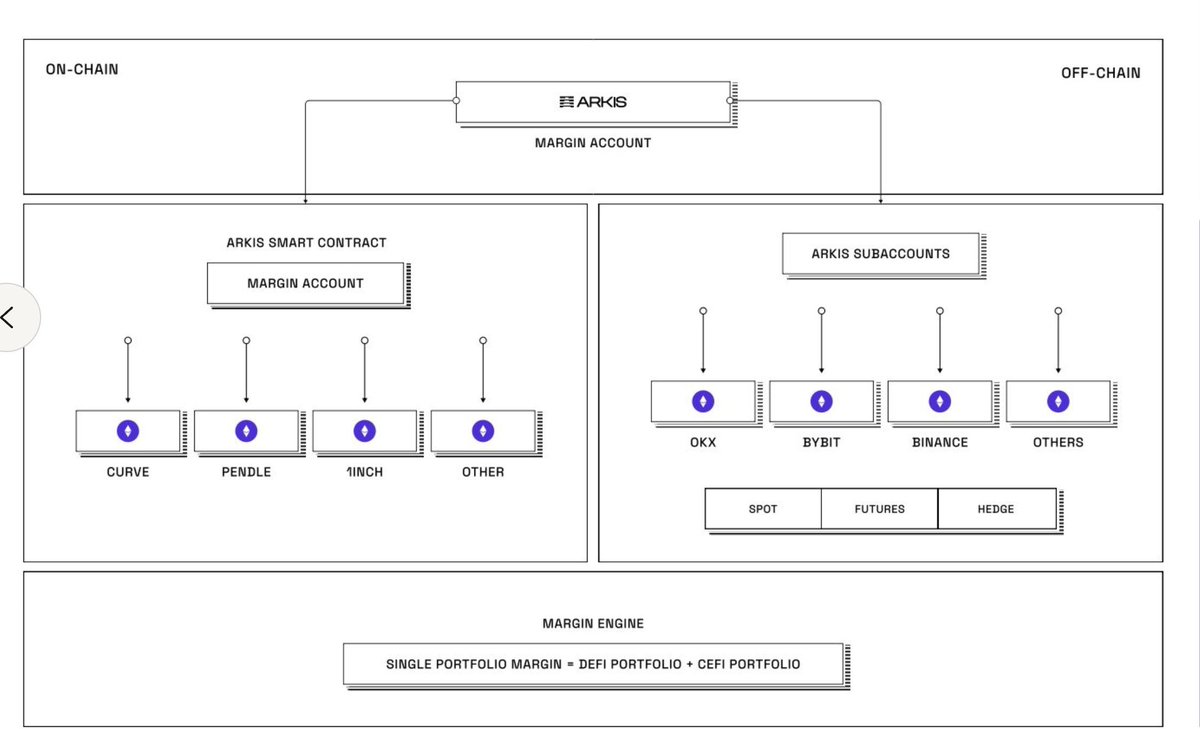

CEXs offer margin — but at the cost of custody, flexibility, and transparency. DeFi gives you control — but fragmented protocols, manual liquidation checks, and no real margin engine. 🌉 Arkis bridges the gap. We built the first prime brokerage system for hybrid strategies: •…