jeroen blokland

@jsblokland

Founder of the Blokland Smart Multi-Asset Fund, a future-proof portfolio that invests in a smart combination of scarce assets, Quality Stocks, Gold, and Bitcoin

EXCITING NEWS 🚀! I’m thrilled to announce the launch of the Blokland Smart Multi-Asset Fund, which invests in Quality Stocks, Physical Gold, and Bitcoin. Interested? Contact [email protected] or visit bloklandfund.com for more info!

When Ursula talks about striking deals between global economic heavyweights, which countries does she mean? Europe?

Global money supply is skyrocketing again. Don't just look at central bank policy rates; global liquidity is spiking. So, while many experts are copy-pasting each other by showing the Shiller PE valuation (of the United States only), why not correct valuation for global liquidity…

Will the euro rise more? Apart from the structural flaws inherent in the euro, driven largely by the distinct characteristics of Eurozone member countries, there is a clear market-related reason why I believe the euro is too expensive relative to the dollar. Short-term movements…

Global heavy weights moving in opposite directions… ⬇️

Thank you, President Xi, for hosting us in Beijing. Europe and China are global economic heavyweights. Our relationship matters globally, and it must work for both sides, for our people and our businesses. Let’s shape that future together ↓

You know what would be 'fun?' If Ursula asks for another EUR 500 billion, doubling the EU budget to EUR 2,500 billion, to pay for a 'Japanese-style' US investment fund to close the deal with Trump. 😱

Ursula, who has achieved very little for Europe, is pushing it. She wants a EUR 2 trillion budget, a 40%(!) increase from the previous budget. She wants to issue EUR 400 billion in 'Eurobonds' for undefined adverse events. She introduced a range of new, fancy programs, whereas…

Tijd voor een ‘Teletekstje’. Uitvaarten zijn de afgelopen tien jaar 40% duurder geworden. Dat is 9 procentpunten meer dan de algemene inflatie. Veel mensen kunnen hun uitvaart niet betalen. Laat dit alles even rustig op je inwerken. Dat iets 40% duurder wordt in tien jaar tijd is…

How do you mean #tariffs are bad for stocks? The Nikkei Index spiked 3.5% and hit a record after Japan struck a deal with the US. 15% imports on Japanese cars and a USD 550 billion fund for direct US investments. Bonds, on the other hand, are down!

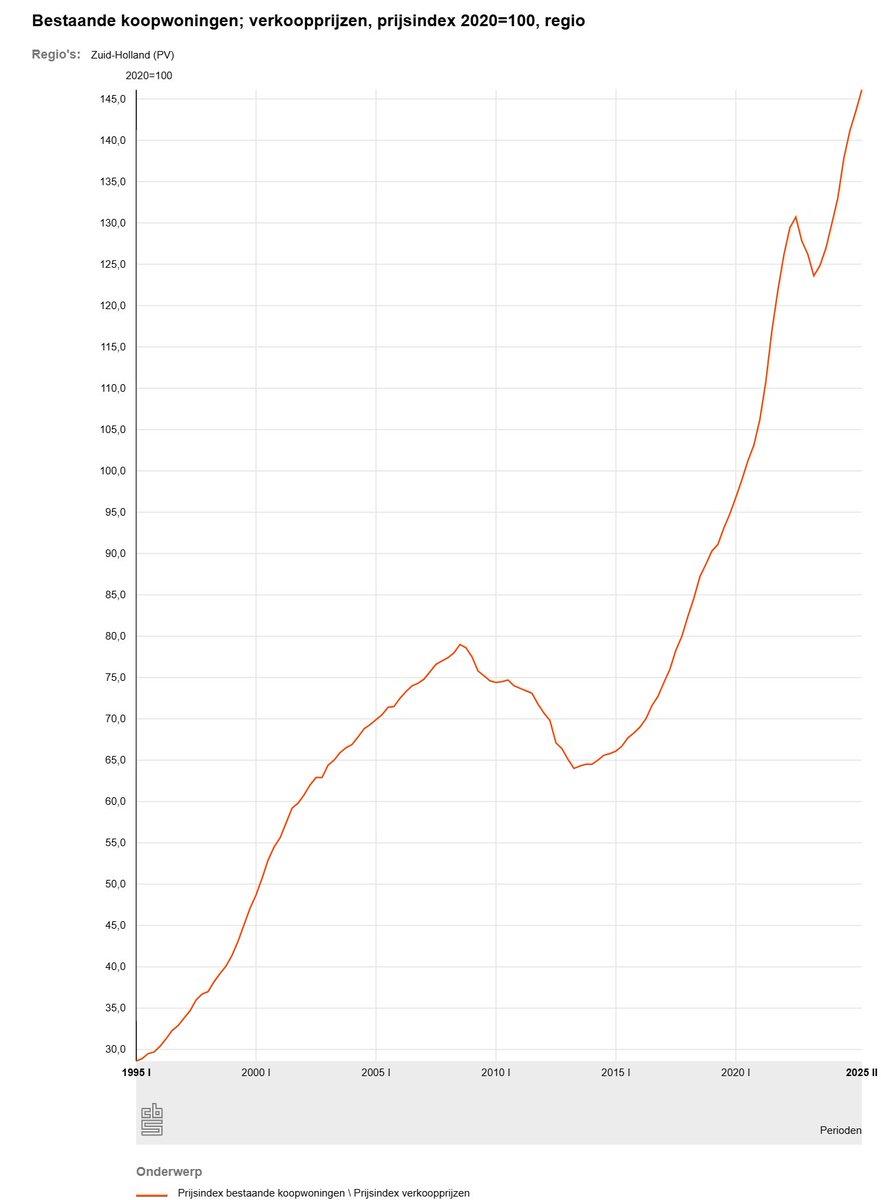

Huizenprijzen in Zuid-Holland sinds 1995. Gemiddeld 6% per jaar over de afgelopen 30 jaar. Gemiddeld ruim 7% per jaar sinds de bodem in 2013. Ter vergelijking: Goud 10% per jaar sinds 2013 ⚡️ Gemiddelde inflatie sinds 2013: 2,6% En schrik niet: Gemiddelde spaarrente sinds 2013:…

New day, same story! UK government net borrowing exploded in June. At £20.7 billion, borrowing was nearly 20% higher than expected. Interest payments ballooned to £16.4 billion, nearly double the amount paid in June last year. For those who argue that private debt looks…

I don't think people understand just how fragile the UK bond market is. Every week, stories emerge about the increased risks linked to the duration, liquidity, and volatility of UK bonds. This is not just about yields going up or down. The UK financial system, which floats on…

MANDATORY spending is what matters. Just ask Elon…

The future is unknowable, except when it comes to government spending.

The Blokland Smart Multi-Asset Fund newsletter is out! Edition 11: Debt is flaring up everywhere, Bitcoin hits record highs 📉 Bonds are the risk The worst 10-year return ever on US Treasuries. As long as inflation stays elevated, real losses remain a threat. 🪙 Bitcoin tops…

I don't think people understand just how fragile the UK bond market is. Every week, stories emerge about the increased risks linked to the duration, liquidity, and volatility of UK bonds. This is not just about yields going up or down. The UK financial system, which floats on…

Is something big brewing? Nearly every day, the systemic risks of the UK bond market are highlighted by politicians, budget agencies, and now the Bank of England. From Bloomberg: - Financial stability risks from leveraged hedge fund strategies in gilts are growing - Hedge funds…

Gordon Brown's "Brown's Bottom" saw the UK dump its gold at rock-bottom prices from '99 to '02. It's the blunder which may repeat itself if UK's sells its Bitcoin stash.

This is a massive bond chart. Yet, it misses one crucial factor… INFLATION!

This post from @robin_j_brooks ⬇️

China today released June trade data. Its exports to Nauru - the third smallest country in the world after the Vatican and Monaco - are up 6000% from a year ago. A symptom of how powerfully US tariffs are hitting China, pushing a flood of Chinese exports to everywhere else...

I took a walk this morning, listening to some @MacroVoices episodes, which offered more arguments why the case for owning #gold remains extremely strong. Listen to (at least) the last part of the @crossbordercap and (at least) the first part of the @LukeGromen podcast, and you…

👀

Siegel on CNBC: Powell should resign to safeguard Fed independence!

Mocht je hem gemist hebben! De nieuwste Blokland Smart Multi-Asset Fund nieuwsbrief is uit. 📬 Blijf op de hoogte van wat er écht speelt op de financiële markten – en wat dat betekent voor jouw beleggingen. 🧠 Schrijf je gratis in: bloklandfund.substack.com

De Blokland Smart Multi-Asset Fund nieuwsbrief is uit! Aflevering 11: Schulden spelen overal op, bitcoin stijgt naar recordhoogtes 📉 Obligaties zijn het risico Het slechtste 10-jaarsrendement ooit op Amerikaanse staatsobligaties. Reëel verlies blijft dreigen zolang inflatie…