Joseph Carlson

@joecarlsonshow

I buy really good companies. 600,000+ subscribers on YouTube. Follow The Joseph Carlson Show.

The term "compounder" is thrown around a lot. But what does it mean? I learned from the investing philosophies of Buffett, Munger, and others to boil down what I believe is the best overview of what a Compounding Machine actually is, and how to invest in them. These 8 slides…

The amount of random crap that’s pumping double digit percent in this market is starting to make me nervous.

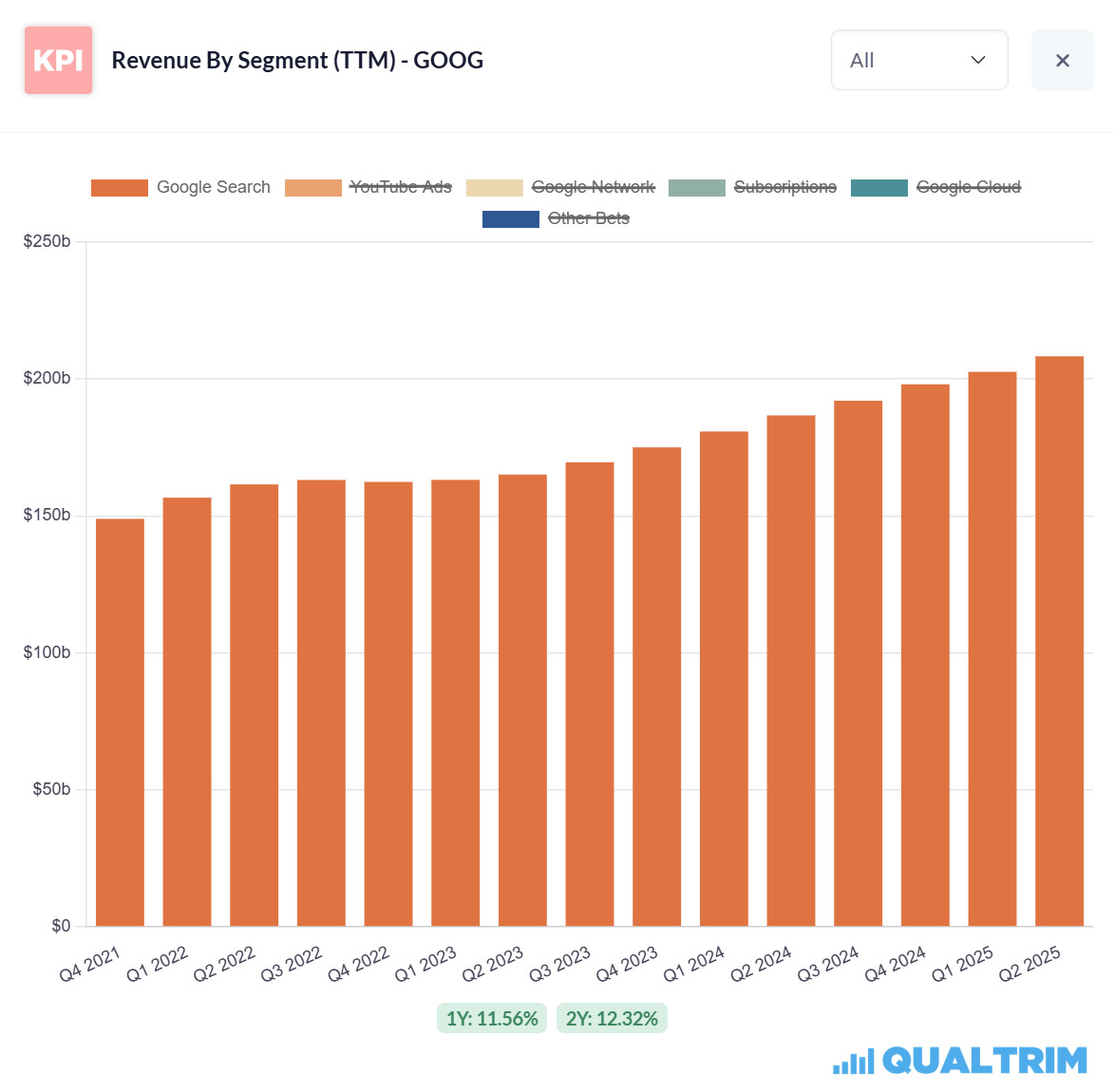

Googles TTM eps ($GOOG | $GOOGL) • Google’s earnings power has accelerated meaningfully in the last 5 years. • There was a temporary slowdown in 2022, but the trend quickly resumed upward. • EPS growth has outpaced most large-cap peers, compounding around 30% annually.

Investors will eventually realize Amazon is the best humanoid robot play, not Tesla.

Google should trade at a 25 fwd PE. That would give 25% upside in the stock on multiple expansion alone. Thats $245 price. It deserves to be there.

Tucker Carlson interviewed Trevor Milton, a convicted corporate fraudster and let him spew his lies for over an hour with no pushback by Tucker. The short seller that exposed Nikola and Trevor Milton for being frauds responds to the interview here.

I am Nate Anderson, the founder of Hindenburg Research referenced repeatedly in this bizarre and fantastical interview. During my career, I helped expose numerous financial scams, including over a dozen Ponzi schemes and numerous instances of public companies lying to and…

Each of these stocks has beat on the top and bottom line: - Netflix - ASML - Equifax - Google They are compounding machines, all of them growing earnings and revenue year after year. Next big one is Amazon.

I bet you everyone is no longer using google search in the same way everyone cancelled their netflix in 2022 and how everyone left Amazon to shop on Teemu and how everyone left Facebook and Instagram and moved to TikTok.

The bears are giving up on Google. The ChatGPT disruption narrative is dying before your eyes. Quarter after quarter of double-digit search revenue growth and increasing search query volume is beating down the bears. The people that go on podcasts continually talking about…

Google raised capex guidance because of growing cloud demand. This is like investors selling out of your food joint because you have so much demand you want to open up more restaurants.

In all honesty, this is an extremely solid report from Google. Investors should be happy with what they're seeing. I'll have a lot to say about it tomorrow.

Tesla misses on the earnings and revenue, which means the stock should go up.

Just to get this straight, Google once again, just like last time, crushed their EPS and Revenue estimates. Search, once again, grew double digits. Cloud, accelerated growth to 31% The stock is down after hours. You can't make this up.

This is what ASML earnings look like over the past 5 years.