Qualtrim

@qualtrim

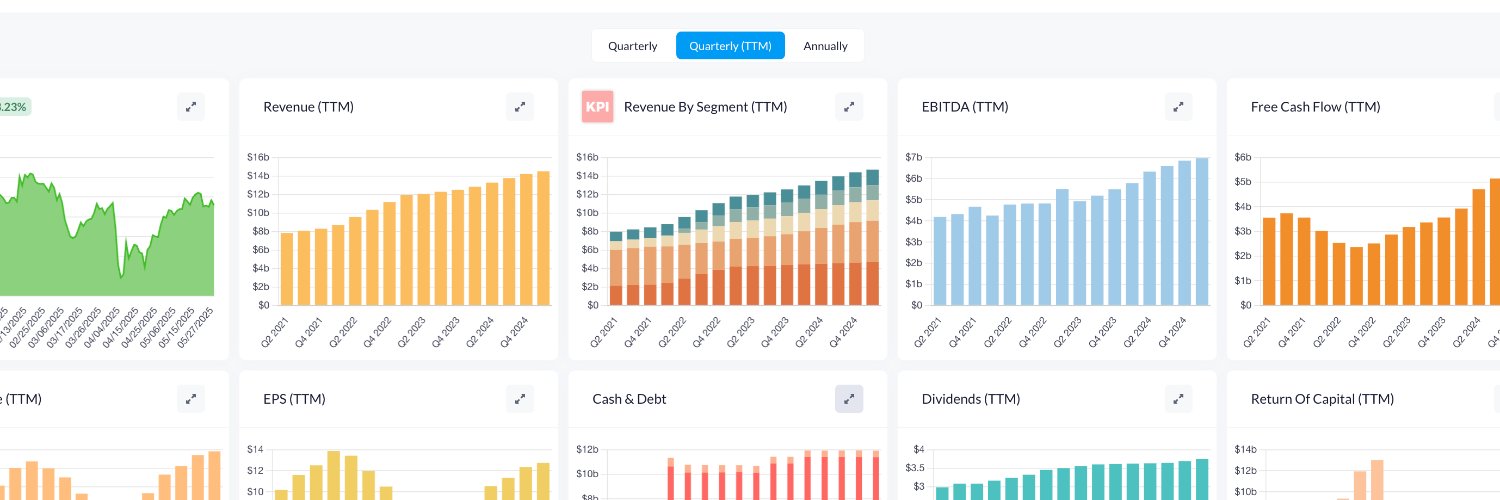

Qualtrim is a robust, simple, AI-powered stock analysis platform. It has DCF Calculator, Earnings Calendar, portfolio AI analysis, and 20+ years of financials.

Googles TTM eps ($GOOG | $GOOGL) • Google’s earnings power has accelerated meaningfully in the last 5 years. • There was a temporary slowdown in 2022, but the trend quickly resumed upward. • EPS growth has outpaced most large-cap peers, compounding around 30% annually.

$MSCI has grown free cash flow per share by over 20% for the past decade.

Here's Waymo, Tesla, and Zoox weekly paid rides over time. Tesla and Zoox are both currently at zero, so the bars don't show yet, but we'll be tracking the progress of the robotaxi industry and keep this chart up to date.

Spotify’s current valuation appears stretched: Even assuming 40% EPS growth over the next five years and a P/E multiple of 30, the expected annual return is only around 8%. To achieve a 15% annual return under these same assumptions, the stock would need to be purchased at $518.

The Return Of Capital chart shows that Adobe $ADBE is plowing money into buybacks. They spent over $10 billion in the past 12 months on buybacks. The share count is down 4% year over year. Investors aren't sold on the strategy yet.

So far Adobe $ADBE has shrugged off AI concerns. The company is generating all-time high free cash flow.

$SPOT Is up +53% this year, +115% over the trailing year, and up +280% over the past 5 years. Similar to $NFLX, this performance is driven by more users, explosive free cash flow growth and huge operating leverage. People are in love with Spotify.

Ulta stock is up +11% today after the company reported better than expected Q1 financial results and raised guidance. Ulta is a buyback machine, with share count declining -4.75% year over year.

$COST Costco Total Cardholders has now reached 142.8 million. This KPI has never had a down quarter.