infiniFi

@infiniFi_

Higher Yields. No Leverage. Better than Banks. Discord: https://discord.gg/infinifi

infiniFi - A new system with higher yields, unlimited scalability & no leverage. Your stables working for you.

The siUSD pool is now on @pendle_fi Earn 2.25x Points for LPing or holding YT & Lock in 13% APY on siUSD with zero active management. Access to siUSD's native yield + trading fees. No Leverage. Capital Efficiency. siUSD Pool 👇 app.pendle.finance/trade/markets/…

2) @infiniFi_ has one of my favorite USDC denominated yields (one of my largest positions). iUSD is redeemable & mintable 1:1 with USDC. You can stake iUSD for 9–16% APR ➢ 9% siUSD, no lock ➢ 14%–16% li-USD, 1–8wk locks Loopable on Morpho: ⇒ 59% APR on 10x liUSD-1wk

Reminder to cast your weekly vote on InfiniFi @infiniFi_ (earn a 0.15x multiplier per vote) Voting consistently every week can increase your multiplier. I’ve voted for 3 consecutive weeks and now have a 0.45x multiplier. To be eligible to vote, you need to lock at least 1…

Infinifi @infiniFi_ just launched a new @pendle_fi pool siUSD (staked version of $iUSD that generates yield ~7% APY) The main difference between the two lies in the yield mechanism: ▫ $iUSD does not generate yield ▫ $siUSD, on the other hand, does earn yield If you buy YT…

siUSD is Live on Pendle A new strategy for yield optimization with siUSD on @pendle_fi. More options. More yield. More points. No Leverage. Let’s break it down 👇

InfiniFi Labs is changing the game in decentralized finance by offering innovative ways to boost yields without using leverage segmenting stable assets for better returns while ensuring safety and efficiency in capital use. This protocol is seeing a rapid rise in its metrics…

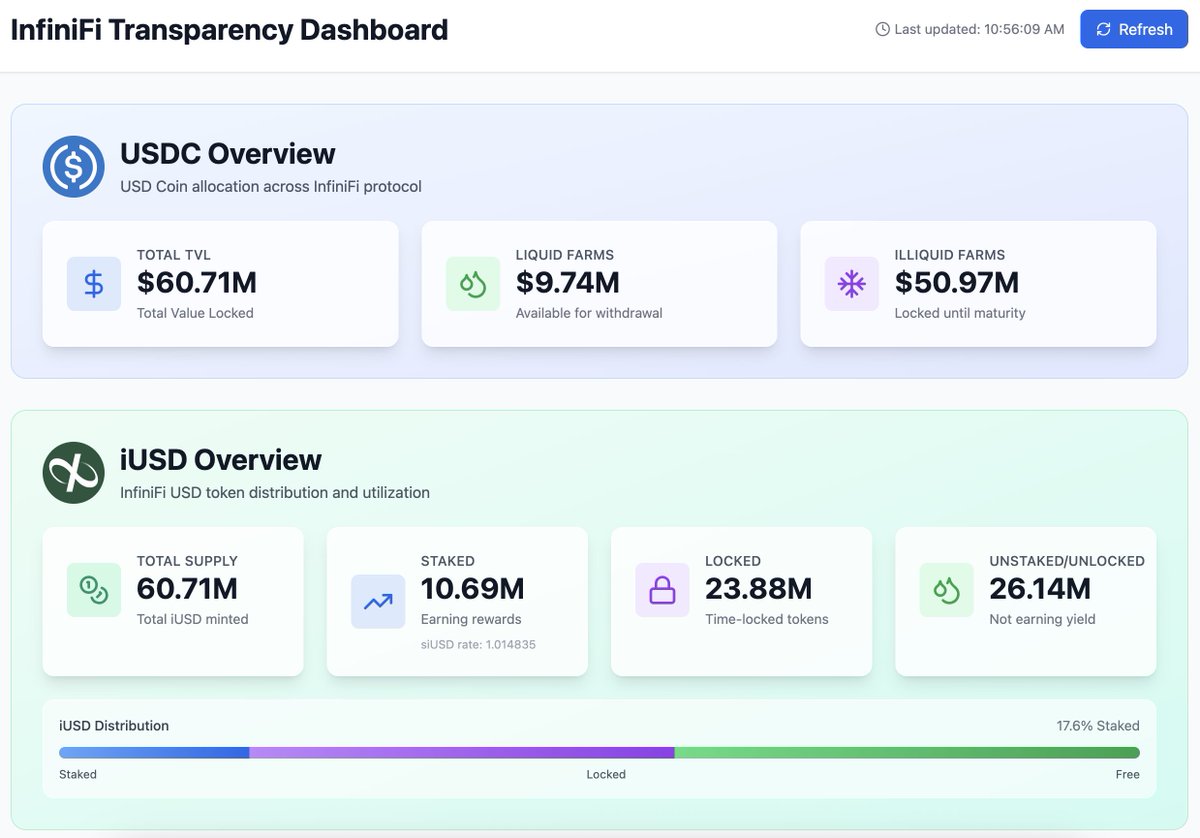

Have you checked out the infiniFi transparency dashboard? Track the infiniFi platform's DeFi stats including TVL (+60M), iUSD distribution, active farms & more. Bookmark > stats.infinifi.xyz

Btw, I wrote a bit more about $siUSD YT on @pendle_fi from @infiniFi_ in Yields of the Week (linked in next post) Check out how many words I used to say: "It's a good buy, and I think its about to go up"

The two biggest PT positions in infiniFi are PT-sUSDe & PT-USDe In 8 days, those PTs expire, and we rollover much of that capital to the new crop of higher earning Pendlethena Beyond just depositing to siUSD/liUSD, wonder who else could possibly benefit from such a thing?🤔

New Handle, Who Dis

Heads up - due to damage done to our brand by Kaito shills constantly tagging infiniFi in their attempts to shill a similarly named company, we have had to change the main infiniFi Twitter username. Official links are in Discord, and new handle is @infiniFi_ Gold check should…

As part of our alignment with @ethena_labs, infiniFi holds deep stacks of USDe assets; we're the 11th largest holder of PT-sUSDe! Next week, we're rolling-over $17M+ of expiring PTs to the newer versions, all automated, & with higher yields for our depositors than anywhere else.

Gm fellow DeFi-finally-maturing connoisseurs, We just had @RobAnon94 from @infinifilabs on the pod to dive into InfiniFi's yield tranching mechanism! Listen in to find out if it's all fractional reserve banking all over again, and how to beat 95% of DeFi yields out there ⬇️

Too Much TVL Kills Yield? Biggest question from @infinifilabs users: "Will more TVL mean less yield?" The short answer: no. infiniFi is built on a model that scales yield with volume, not against it. InfinfFi leverages the depth and maturity of DeFi fixed-yield markets to…

Join us tomorrow at 12 pm EST for a new Yield Talks on The @edge_pod featuring Ethena Head of Research, @ConorRyder and InfiniFi Founder @RobAnon94. RSVP 👉 x.com/i/spaces/1eaKb…

infiniFi - A new system with higher yields, unlimited scalability & no leverage. Your stables working for you.