Val

@Val_bpereira

Head of Growth @infiniFi_⚡️| learning web3 one block at a time 🫶

Not so hot take: we aren’t brining in liquidity we are renting it between ecosystems and the cost of acquisition is getting too high for rent Net Liquidity Flow Across Chains Shows Migration, Not Expansion - Ethereum: -$5.96B → The supposed DeFi capital hub lost nearly $6B in…

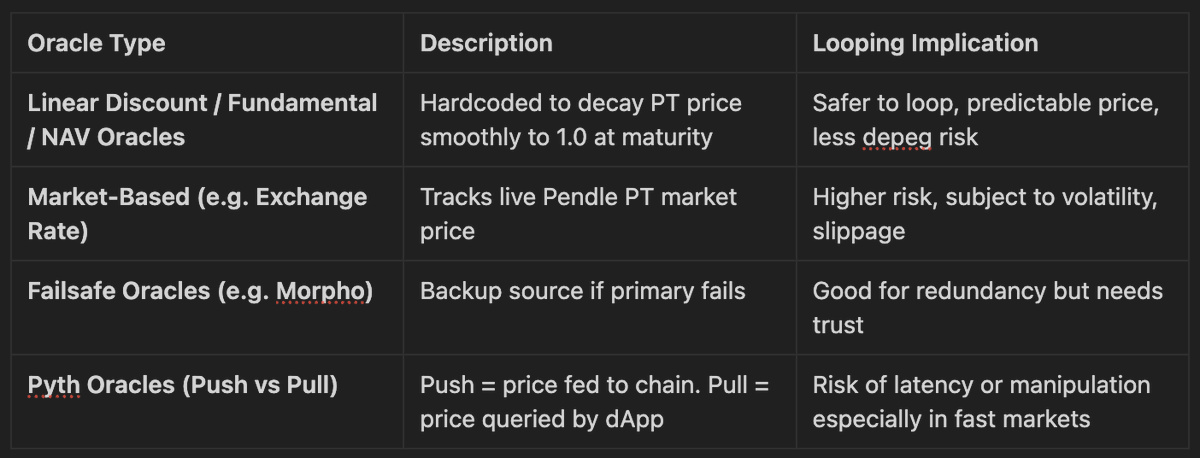

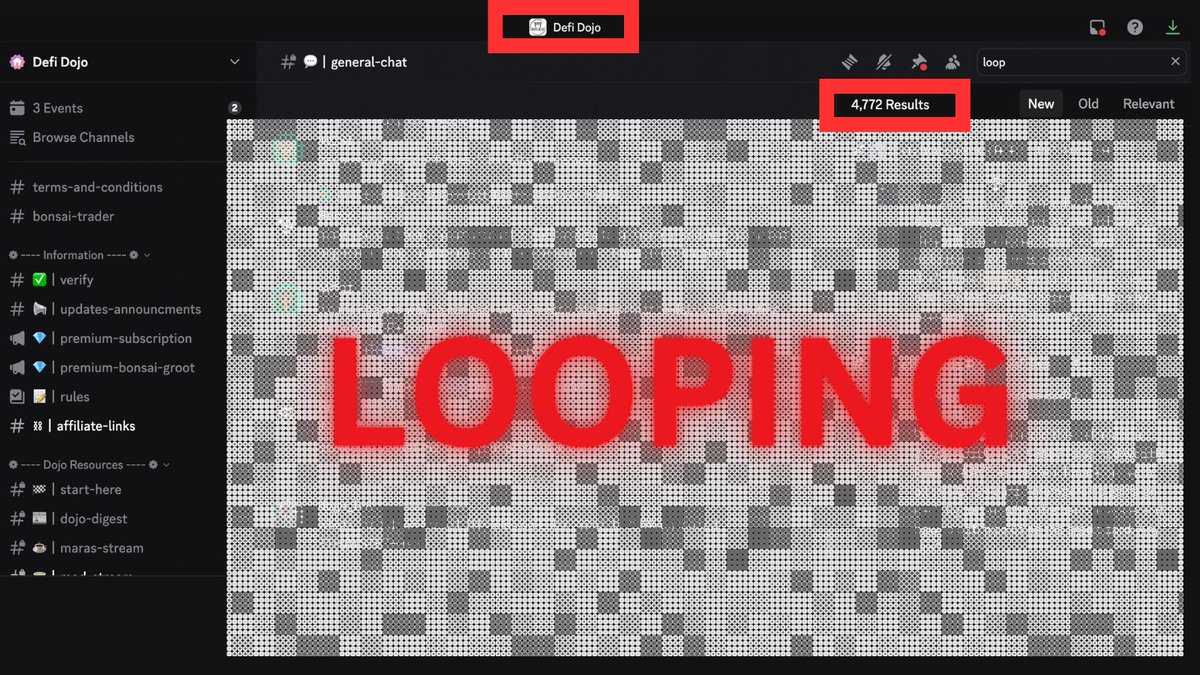

Everyone’s Looping. Few Survive. 4k+ looping mentions on @phtevenstrong Dojo Community. Here’s how to not get rekt: Spoiler: It’s usually the oracle or slippage. Looping PTs 1️⃣ Buy PTs on Pendle (at a discount, check IY) 2️⃣ Deposit PTs as collateral on lending protocol (e.g.…

The End of Mercenary LP - EulerSwap by @eulerfinance Euler didn’t launch a DEX. They launched a liquidity engine. EulerSwap makes bootstrapping liquidity capital-efficient, self-sustaining, and yield-generating. Instead of bribing mercenary LPs on traditional DEXs, protocols…

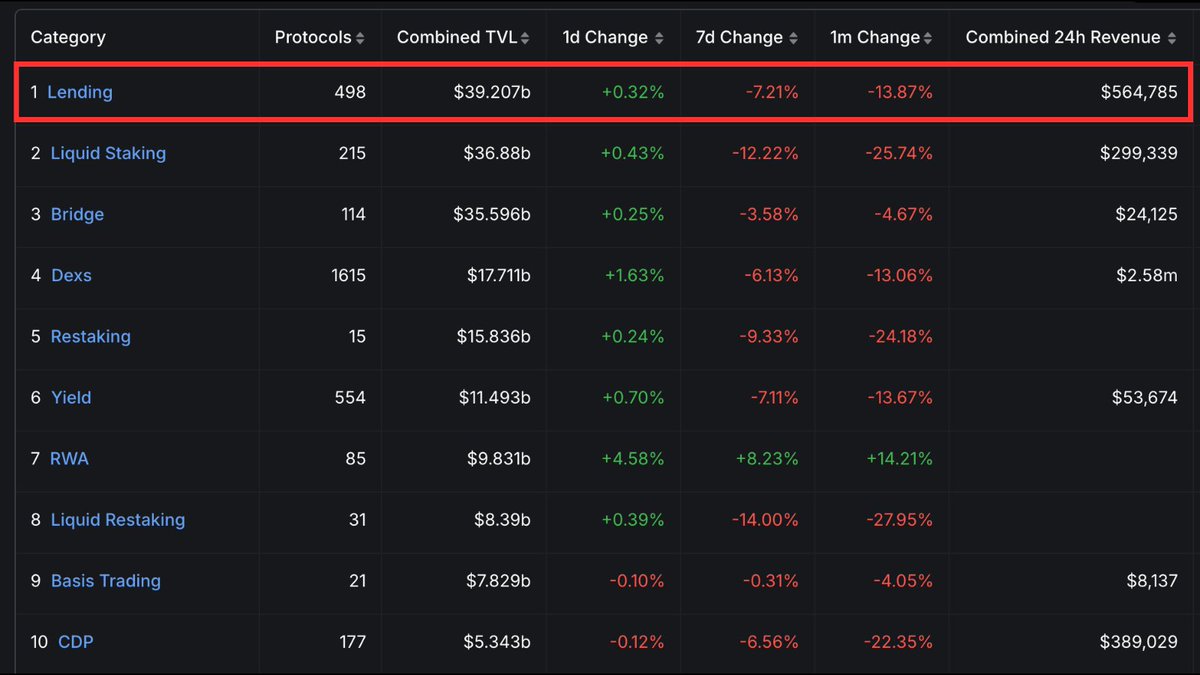

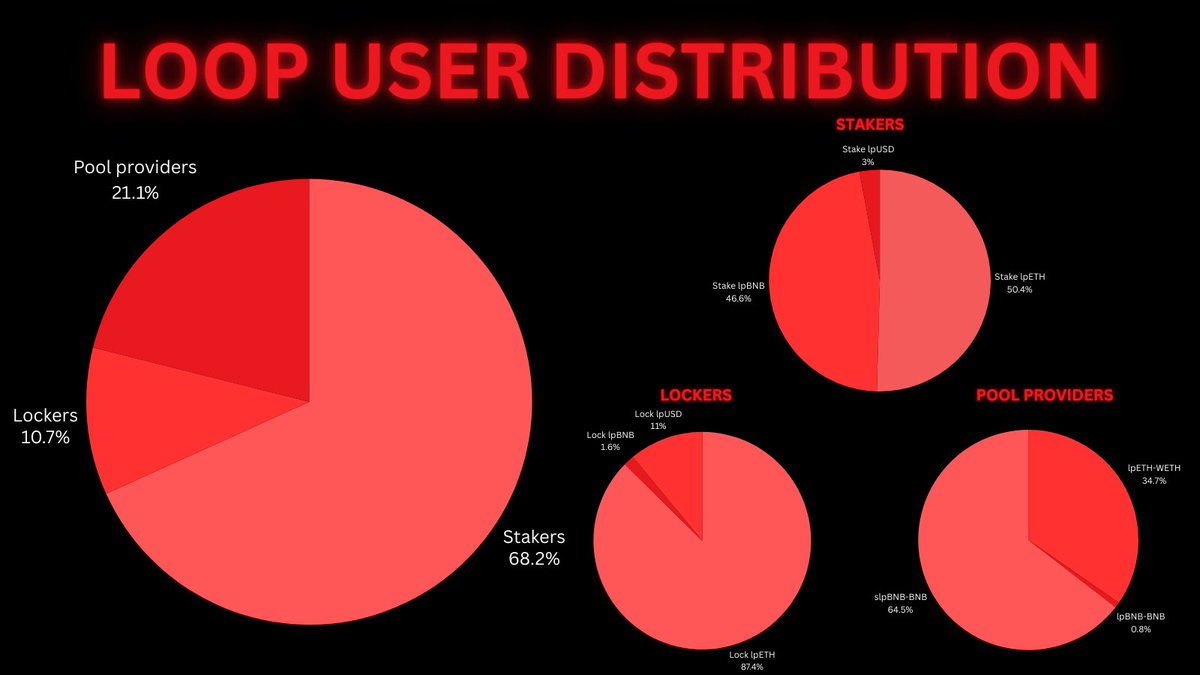

Lending ranks first in TVL by category Everyone’s yapping about stable yields, but you can’t sell ETH at the dip, so where’s the yield on ETH? @summerfinance_ : 26.21% only 2.73% is real yield the rest is token rewards @loopfixyz: 16.24% APY real yield @CurveFinance : 12.01% OR…

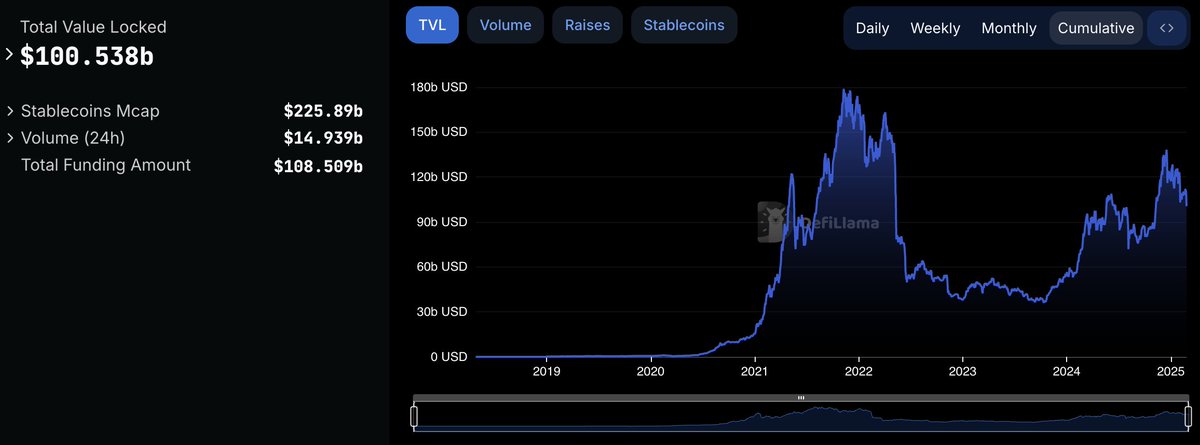

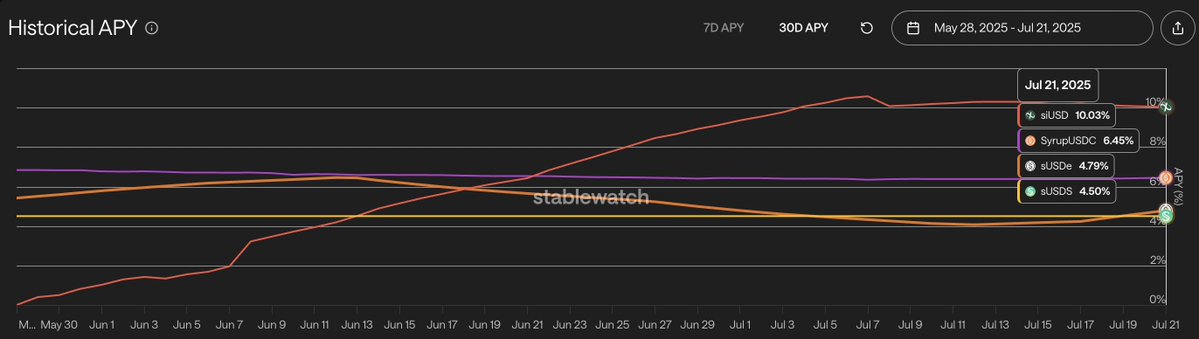

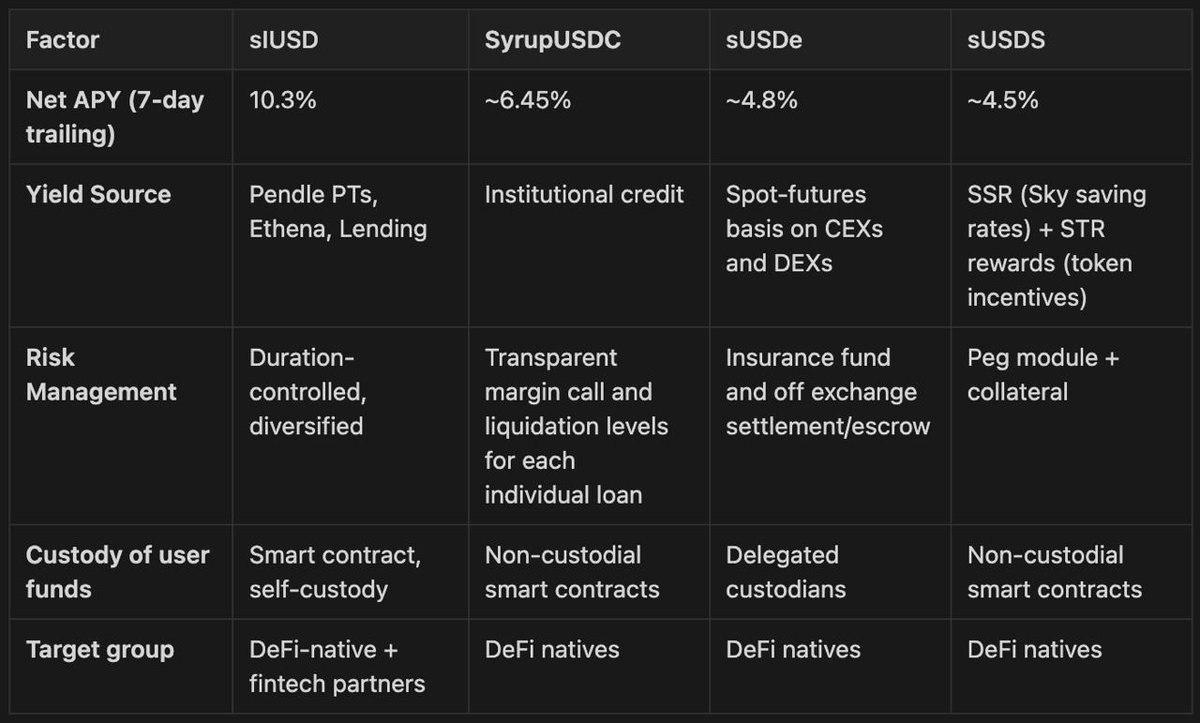

Too Much TVL Kills Yield? Biggest question from @infinifilabs users: "Will more TVL mean less yield?" The short answer: no. infiniFi is built on a model that scales yield with volume, not against it. InfinfFi leverages the depth and maturity of DeFi fixed-yield markets to…

9) @solana USDC Yield via @humafinance I KNOW I just posted about syrupUSDC on Kamino and was genuinely excited for that, despite not realizing it had low liquidity. YES, I know it's now at -14% at max leverage. Consider this my public apology. I was just eager to finally…

Wen a fresh LP apes in, nukes your farm... and even he’s stunned by the yields

TELEGRAM ACCOUNT HACKED I’ve received a bunch of messages on X about it, so I want to say: I’m really sorry if you got any strange messages from me. Here’s what happened: I woke up at 6AM (shoutout to the early risers) and @zerototom warned me something was off. The hacker had…

Loop connects capital with opportunity - lenders with borrowers. Lend it and forget it. EARN: 37.4% APR on ETH 62.84% APR on USDC Passive yield, powered by smart systems.

BNB Demo Day Takeaways + @cz_binance ’s Advice on @BNBCHAIN 1️⃣ Delay TGE Strategically CZ emphasized the importance of delaying your TGE as long as possible to maximize community growth and product traction. Launching too early with a small community often leads to immediate…

Stablecoin Yields on Mainnet Ranked by real yield first, not just the highest APY that’s mostly rewards 17.22% – slpUSD Staking APY (real yield) on @loopfixyz 6.86% – slvlUSD Staking APY (real yield) on @levelusd 6.69% – USDS APY (real yield) for @SkyEcosystem on @yearnfi 6.54%…

gm (ghibli morning)! Thanks @andreaonchain for making this happen 🫶🏽

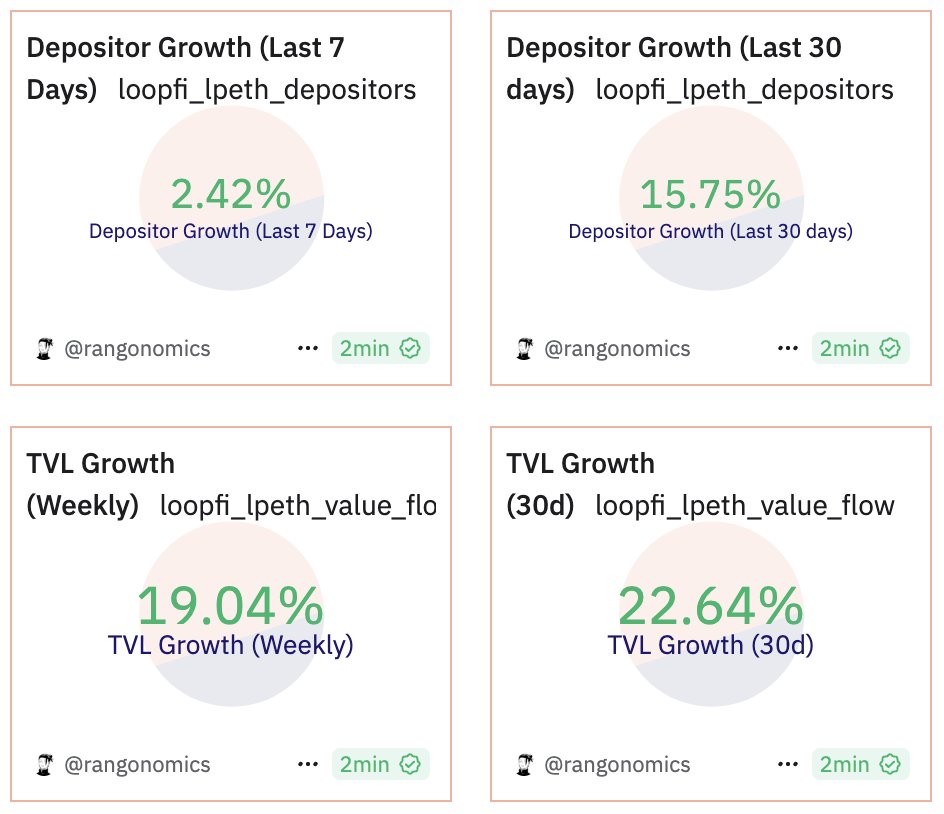

“This Isn’t on X, The Real Alpha Is in Private Chats” 237 Active Depositors, with an average deposit size of 7.46 ETH = (~15.4k USD) (out of the 1,770 ETH TVL) @loopfixyz Lenders Lenders can provide ETH, BNB, or USD, receiving a receipt token in return, lpETH, lpBNB, or lpUSD.…

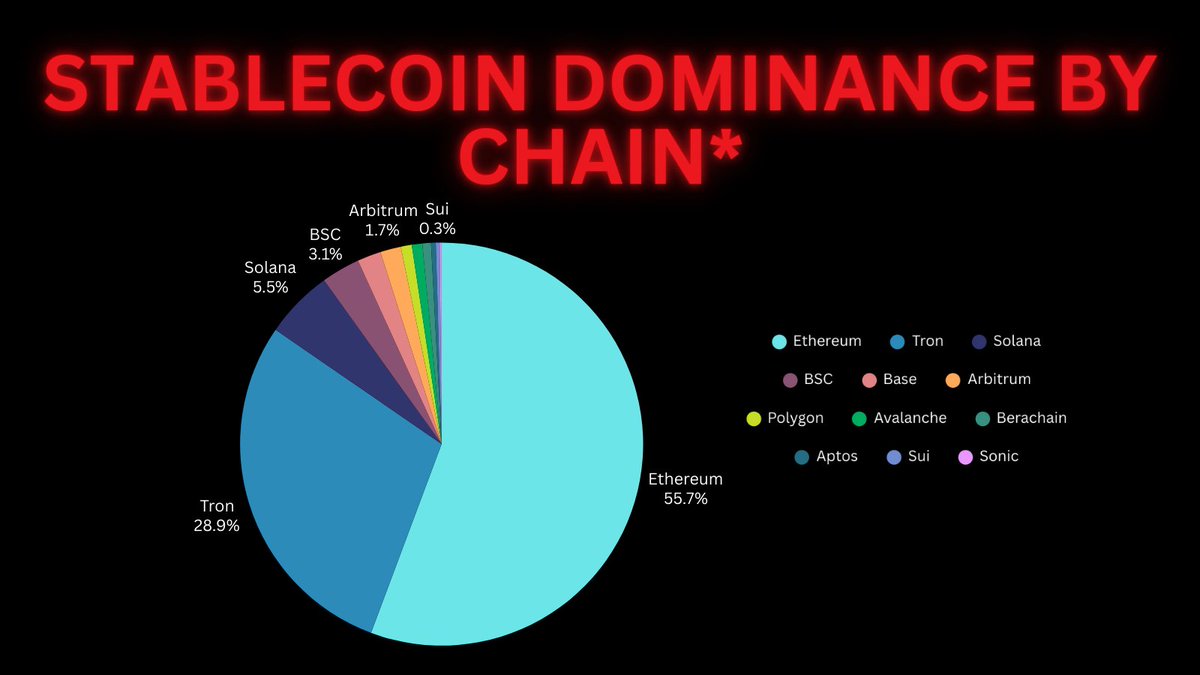

Stablecoins Now Move More Money Than Visa The stablecoin market just hit an all-time high of $230B, outpacing everything else in crypto. While AI and memes get rekt, stablecoin TVL grows 3% MoM, now facilitating $35T+ in annual transfers, 2x Visa’s volume. But stablecoins aren’t…

Want 103.65% APY on your $ETH? Here's How.👇 Step 1) >Go to @YieldNestFi >stake your ETH for ynETH Step 2) >go to @loopfixyz >deposit your ynETH token >choose 5x Loop Factor ♦️+62.42% APY from Leveraged Yield ♦️-42.18% APY from borrowing costs ♦️+83.42% estimated APR from…

3X IN 3 MONTHS AIRDROP @loopfixyz airdrop calculations, and why it’s underfarmed. 13.9M qualoops distributed 20M Valuation Consider: FDV at 20M 100M total token Supply 11% of total supply distributed on TGE this makes 13.9M qualoops = 11M $LOOP At 20M FDV this makes every…

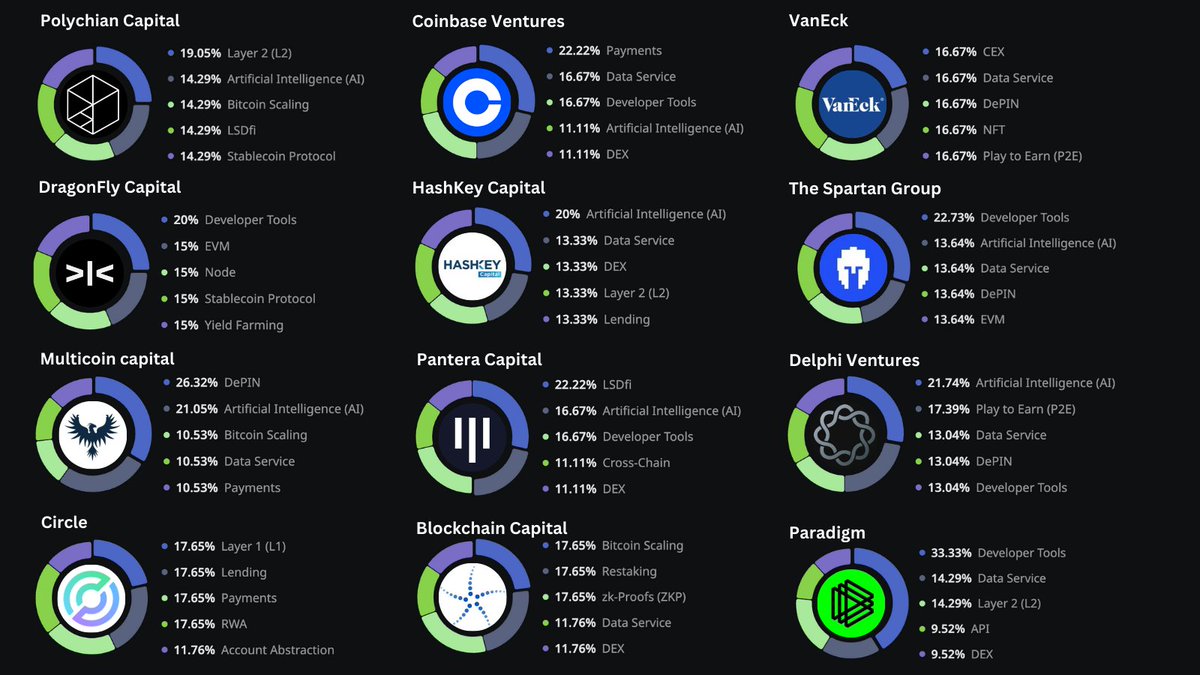

Narratives Tier-1 VCs Are Betting On The hottest investment themes based on funding rounds and allocation across top firms. Artificial Intelligence (AI): ~14-22% (@HashKey_Capital, @Delphi_Ventures, @PanteraCapital, @TheSpartanGroup, @dragonfly_xyz) Developer Tools: ~14-23%…

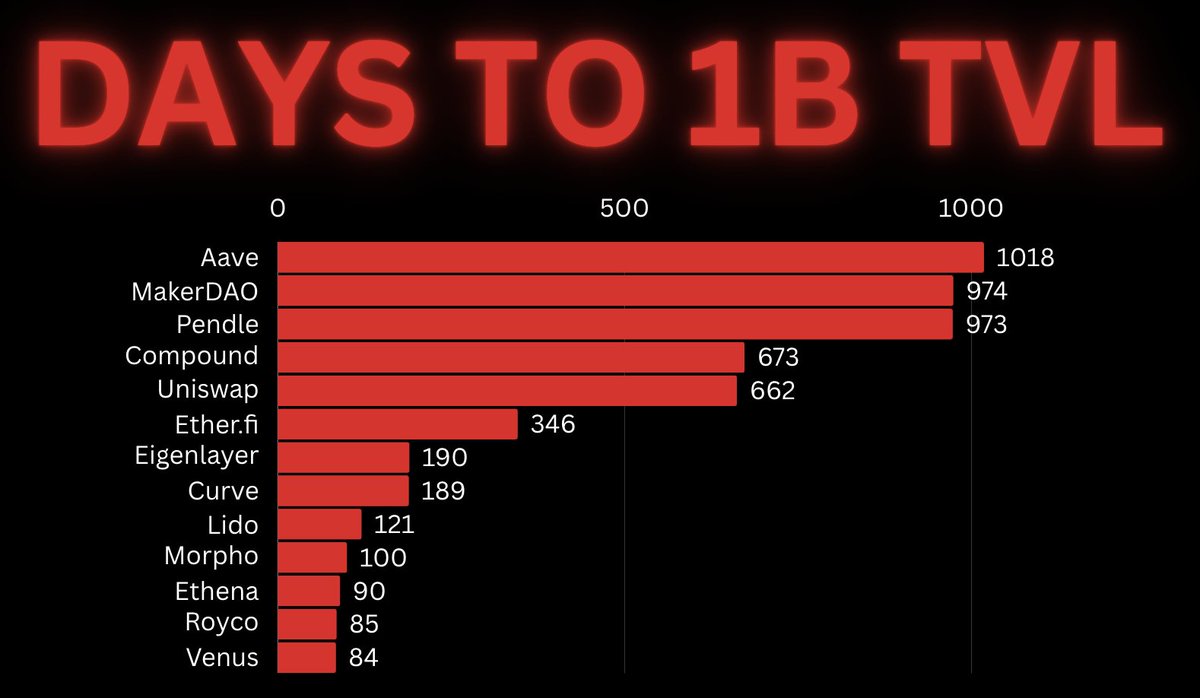

Timeline of how fast major DeFi protocols hit $1B TVL and the contrast is pretty wild. @aave: 1018 days @SkyEcosystem: 974 days @pendle_fi: 973 days @compoundfinance: 673 days @Uniswap: 662 days @ether_fi: 346 days @eigenlayer: 190 days @CurveFinance: 189 days @LidoFinance: 121…