red pill rick

@igetredpilled

Think for yourselves, don’t be sheep.

Hedge Funds and Hazy Politics: How Carney’s Budget Blackout Could Trigger a Bond Market Meltdown. 🧵

Insiders be dooming hard.

Insiders have rarely been this bearish before: Only 11.1% of companies with insider activity are seeing more buying than selling by corporate officers and directors, the lowest share on record. Over the last decade, this figure has never fallen below 15%. This means insiders…

Probably because the wealth gap has never been bigger and the average family can’t afford a house.

Never fails to amaze me how pessimistic this place is. Bull market, new high and it still feels like a funeral.

Beef inflation in Canada is 10%.

Carney is raising the prices in the USA. Damn you Trudeau carbon tax!

In 2014, GDP per capita in U.S. was 8% higher than Canada. Today, it’s 61% higher. We just lived a lost decade and are now set up for another one. Whose fault do you think that is?

This is in USD. Stop blaming Trudeau and look at what is happening around the world.

Who would buy a Cybertruck when this exists?

Yes or No, Are you a fan of the Cybertruck?

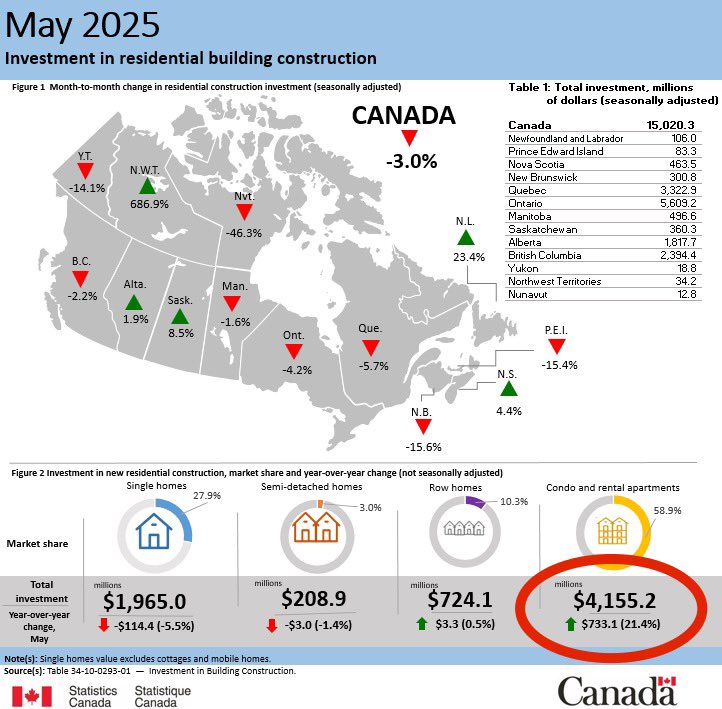

Investment in construction by home type (y/y): Single family: -5.5% Semis: -1.4% Row homes: +0.5% Condos/Rentals: +21.4% No wonder rents are tanking.

Lmao no one takes these idiots seriously anymore.

BESSENT SAYS AUGUST 12 TARIFF DEADLINE LIKELY TO BE EXTENDED

Couldn’t have said it better myself.

Give me a break. Just let housing prices fall and it will solve a lot of problems. Sorry about your investments.

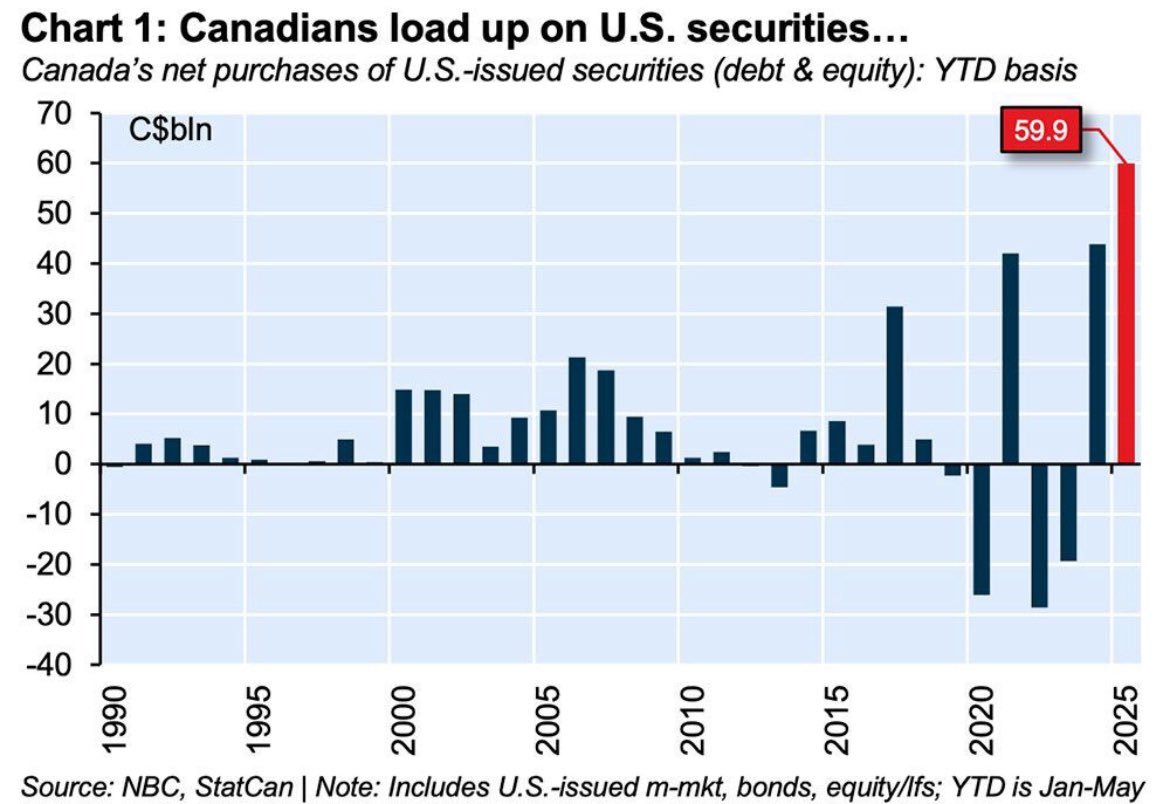

Canadians are buying a record high amount of U.S. securities — including treasuries. We’re financing the deficit of the government that’s repeatedly threatened our economic livelihood.

For the first time since 1988, the first 5 months of the calendar year produced no net foreign buying of Canadian portfolio assets. This is the complete opposite of what we need right now.

This is because inflation is outpacing wage increases. Think twice before you beg for more rate cuts.

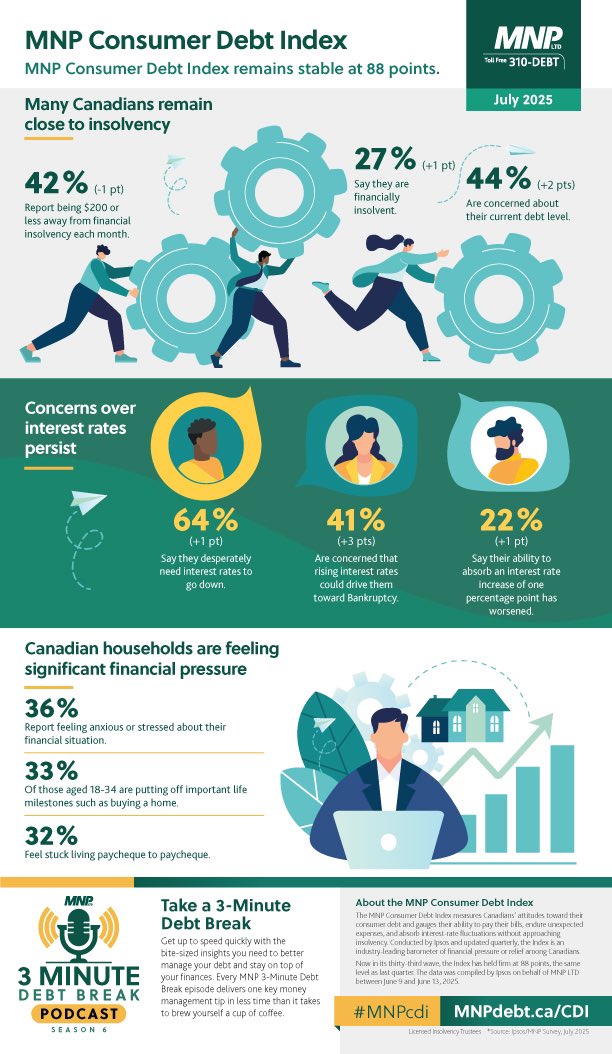

“About 14 million Canadians say they are close to financial insolvency, with little to no room to absorb an unexpected expense or income disruption” - Grant Bazian, President of MNP’s Insolvency Practice

46% of Canadians regret the amount of debt they have taken on. 54% won’t be able to cover all living expenses in the next year. 64% “desperately” need interest rates to go down. 42% are ~$200 from financial insolvency each month. These stats are terrifying.

46% of Canadians regret the amount of debt they have taken on. 54% won’t be able to cover all living expenses in the next year. 64% “desperately” need interest rates to go down. 42% are ~$200 from financial insolvency each month. These stats are terrifying.

I said the same thing yesterday and was called a broke doomer. Weird.

Canadian Rental Bear Market Is Just Getting Started: BMO betterdwelling.com/canadian-renta…

Omg BMO is a bunch of doomers! 😭

BMO sees prolonged bear market ahead for Canadian housing Real estate corrections likely to last years, not months, as prices keep sliding mpamag.com/ca/mortgage-in…

Good morning, here’s your red pill for the day.

That's always the endgame while we surfs fight over which overlords from the right/left uniparty we want to rule over us...

Yet the rich are still getting richer and the poor poorer. The wealthiest 20% account for 65% of Canada total net worth — the bottom 40% only account for 3%. Socialism doesn’t work the way you think it does.

Welcome to CANADA 🇨🇦 where the top 20% income earning families pay an average tax rate of 55% 🤯 it’s INSANE