beaver quant

@idro___

funding smashor

That’s peak performance. Python + git + uv + screen is the way to go

git add * git commit -m “update” git push

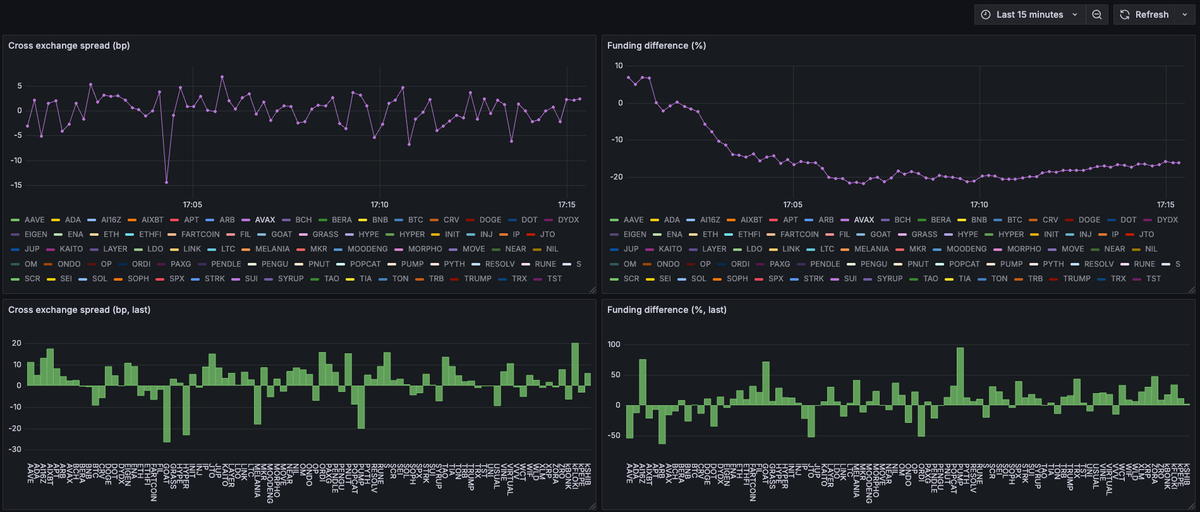

Fundings are crazy right now, Strat is back in production after being down for 6 hours. IM SO BACK

Not sure whether Daily Volume or Open Interest is a better indicator of how hard it is to enter a position. Any thoughts on the key differences or how to analyze this?

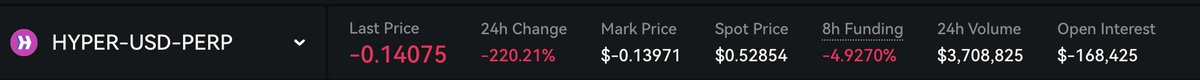

HYPER on Paradex is a shitshow: - mark price is currently calculated at a 60% discount to the actual perpetual price. - So due to their max slippage prevention it's impossible to buy. Not a single buy trade have been executed for more than 30min

Correlation between your signal and future returns is an important metric in quant trading. But what is a “good” correlation? Here’s a simple way to think about it.

Would you sleep well with 10% of your $ pool sitting on Kucoin ? I have a strategy I want to execute there but I’m curious about how to evaluate exchange risk

Been experimenting with feature plotting since I saw @idoccor tweet. I found that binned scatter plot + pyplot.hexbin is a great combo to understand large amounts of noisy data. code: pastecode.io/s/coohzpga x.com/idoccor/status…

I've been using this style of plot for 10+ years now, bucket by percentile and plot the mean + sd of each bucket. Thanks to LLMs, I now know this is called a "binned scatter plot". Anyways, I hate scatter plots. They suck. These are way better:

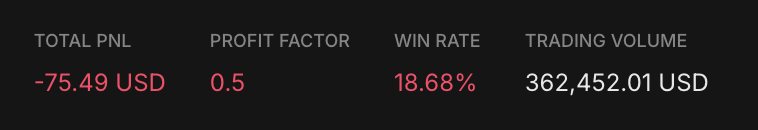

x.com/idro___/status… After conducting an in-depth analysis and some research, we will examine when this can occur and how to prevent it. -> Forgot to put the other leg of the trade 🤡 Let's call it operational risk

Loosing money on basis + funding

I've been using this style of plot for 10+ years now, bucket by percentile and plot the mean + sd of each bucket. Thanks to LLMs, I now know this is called a "binned scatter plot". Anyways, I hate scatter plots. They suck. These are way better:

"You want to short the double-A rated Fart Coin collateralized mortgages? I don't understand, those never fail."

Fannie Mae and Freddie Mac are preparing to count crypto as assets for mortgages.