Daniel Lacalle

@dlacalle_IA

PhD #Economist #Author. Chief Economist, Tressis. #Professor @IEbusiness #Advisor @frdelpino. YouTube: https://www.youtube.com/c/DanielLacalleInEnglish

Thanks for following! Check my website with all my articles, videos and books 🇺🇲 🇬🇧 English content: dlacalle.com/en/ Amazon Book Page: amazon.com/Daniel-Lacalle… 🇬🇧🇺🇲 English-only YouTube Channel: youtube.com/channel/UCLOgS…

The US Dollar Remains the World’s Top Reserve Currency. The Fiat Alternatives Are Much Worse. theepochtimes.com/opinion/the-us… vía @epochtimes

The Federal Reserve is Building the Most Expensive Building in DC History? @mises @ryanmcmaken mises.org/podcasts/power…

U.S. COMPANIES ABANDON CHINA INVESTMENTS youtu.be/EwaNk6lsnZM?si… via @YouTube

This is so typical. "Nobody"? Markets know. Ignoring strong macro, earnings and inflation figures because the fear-mongering narrative must be preserved.

Trump scores $36MILLION in 'big win' settlement with CBS 60 Minutes mol.im/a/14930185 via @MailOnline

Gold discounts more monetary insanity from irresponsible governments. cnbc.com/quotes/@GC.1

US Companies Freeze Investment in China: Survey ntd.com/us-companies-f… vía @NTDNews

UK. Higher taxes and more spending. What could go wrong? New figures from the Office for National Statistics show borrowing was £20.7 billion in June – £6.6 billion more than last year, the second-highest since records began in 1993. order-order.com/2025/07/22/jun…

$2.5 Billion For One Building? The Fed Needs a Full Audit app.hedgeye.com/insights/16891… via @hedgeye @SecScottBessent

The European Commission just announced another monster tax on corporate revenues added to existing ones. Uncertainty on tariffs? There is certainty on destructive taxation. European stocks set for another lower open as tariff uncertainty dents sentiment cnb.cx/4eXvnGq

I will be in 🇺🇲 Washington DC from the 18th to the 23rd September 🇺🇲 Requests and info: [email protected]

The Fed and inflation... I wonder why President Trump criticises them...🤔 Another reason why rates should float freely and not be set by central planning.

Easy. Eliminate the EU barriers. Ah... no? U.S. plays hardball on tariffs deadline as EU battles for a deal cnb.cx/4kTGD8m

"...However, politicians prefer stagnation over free trade as trade barriers give them power." Why am I forced to declare the tweet of the day mid-day? The tweet of the day has landed!

The EU has the easiest trade deal with the US. It only needs to lift the enormous tariff and non-tariff trade barriers that have brought the EU economy to stagnation. According to the IMF and the EC, these cost the EU 1 trillion euro a year. However, politicians prefer…

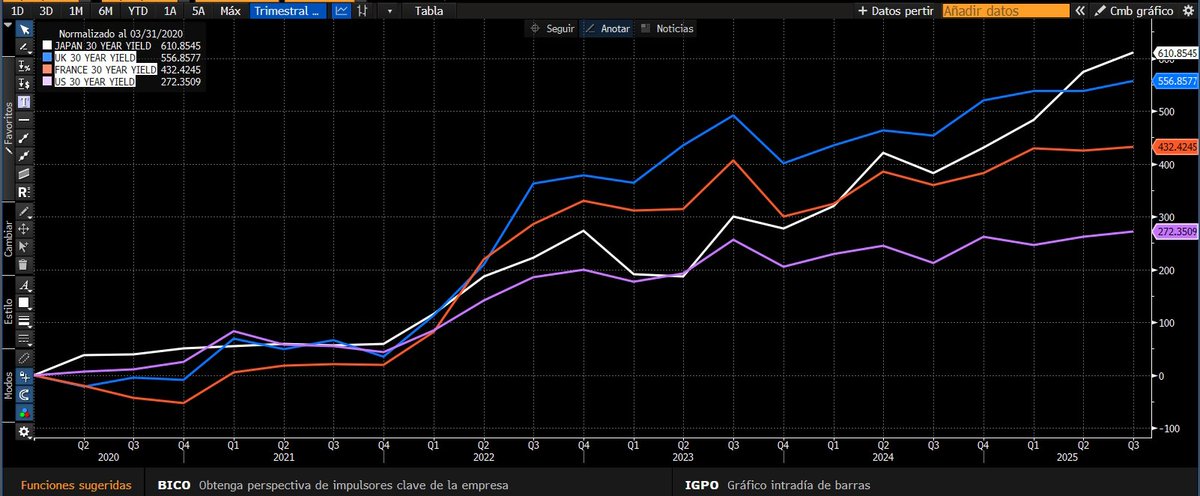

No, it is not Bitcoin. It is the Japanese 30-year bond yield, after following the failed strategy of "the government can spend and borrow as much as it needs and not cause inflation as long as the central bank keeps rates low and high purchases" ... via Bloomberg

Inflation expectations are at December 2023 levels and below the level at which the Fed found it was necessary to cut rates in September 2024. The Fed is waiting for reality to match its models. Again. via Bloomberg

Read this by @judyshel

Judy Shelton on CNBC: "If American people knew that the Fed was paying billions in 'interest' to foreign banks they would be outraged" The American people should have known for years:

The Elephant In The Room: Keynesianism and Money Printing Fail. Recently you may have heard a lot about US debt and its sustainability, and rightly so. However, guess which countries have seen 30-year yields soar despite massive central bank purchases and financial repression…

Bessent is once again demonstrating his mastery of sovereign debt markets, increasing debt issuance slowly so as not to shock markets while refilling Treasury's cash account and unwinding the last 6 months of extraordinary measures:

The Fed Is To Blame For The Dollar’s Recent Weakness. Still, There Is No Fiat Alternative. dlacalle.com/en/the-fed-is-…