Keith McCullough

@KeithMcCullough

CEO, Hedgeye Risk Management

I’ve spent 24 years perfecting my investing process for family and clients. I’m sharing that blueprint—for FREE. Download my new 52-page eBook today: info.hedgeye.com/keith-master-t… It's called, “Master the Market: A Hedge Fund Manager's Guide to Process and Profit." Whether you’re…

Cartoon of the Day: Bessent vs. The Fed's Basement app.hedgeye.com/insights/16898… via @hedgeye @SecScottBessent

Risk Management Should Be the Primary Component of Every Investment Process - KM a gem from @KeithMcCullough today

Management (aka Jonesy @HedgeyeDJ ) gave Mucker Jr. the week off to go to tryouts!

Congrats to your son. But is that ok to poach your star intern?

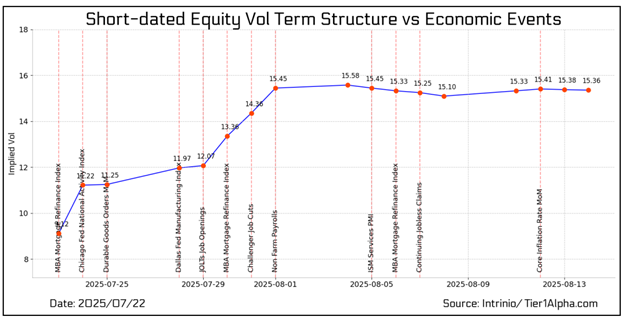

CHART OF THE DAY: Short-Dated Equity Vol Term Structure vs. Economic Events app.hedgeye.com/insights/16899… via @hedgeye

Yep, my son was drafted by the NJ Titans Jr. team so I'm here with him for training camp - rain check on lunch! but thanks

Did I hear Middletown on the Macro show? I am nearby, probably too short notice, but would love to buy you lunch as a thank you....still learning the process, but it's all starting to make sense!

From The Call to The Macro Show, we roll

Get hedge fund-quality research you won't find anywhere else. Tune into our morning meeting with 40+ analysts hosted by @KeithMcCullough THE CALL @ HEDGEYE 📲 LIVE @ 7:45AM ET Join us info.hedgeye.com/TCNY

$OPEN’s Volume Spike to 1.9B Shares Is the Biggest I’ve Ever Seen app.hedgeye.com/insights/16897… via @hedgeye

That's a political statement, not a P&L one

But they said no inflation?

BREAKING: Dr. Copper inflates another +1.8% to all-time highs

The People didn't have a process to play against Consensus US Hedge Fund positioning... Until we gave them Hedgeyes

Our Natural Gas Short $UNG (not a Consensus US Hedge Fund Short) is down again this morning but its signaling what we call immediate-term TRADE #oversold within its Bearish @Hedgeye TREND

Modern Day Market Quote of The Day from Craig Peterson (Founder of @t1alpha ) "Navigating modern markets requires a structural lens, not just a thematic one, as mechanical flows increasingly dominate the landscape" @profplum99 @Mike_Taylor1972 @ForexDavid @HedgeyeAI

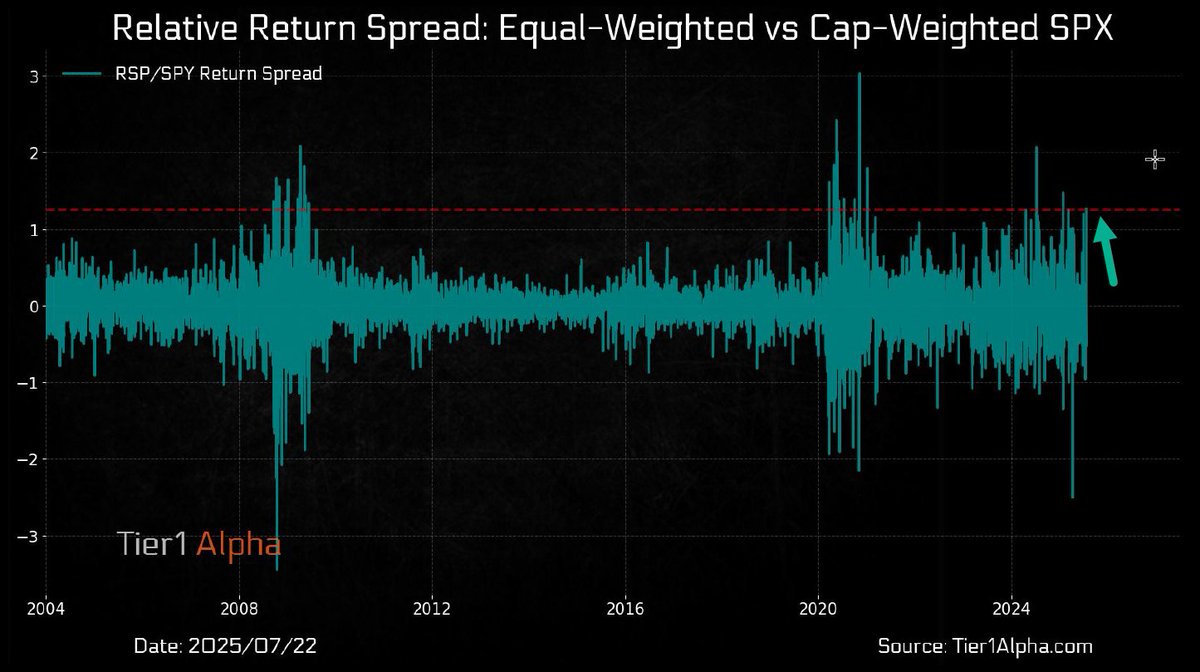

Bullish BREADTH "more than 81% of its components skewed higher, with an average gain of over 2%. In fact, the equal-weight SPX closed nearly 1.3% higher yesterday, marking the 13th widest spread between it and the market cap-weighted index in the past 25 years" @t1alpha…

Consensus Hedge Funds keep getting rinsed too Goldman's Mo Pair (consensus hedge fund longs minus shorts) had a DOWN -5% day yesterday!

With an eye-watering Implied Vol PREMIUM of +100% this morning , $SPY Bears continue to get mauled by #Quad3

#NazVol (NASDAQ Volatility) is down -436bps in the last month, perpetuating all-time highs in our Fractal Signaling process

EARNINGS: 15% of the companies in the NASDAQ100 have reported an aggregate EPS growth rate of +20% so far in EPS Season One of the many Bullish Factors that's kept us long of US Growth in $QQQ terms

Today in 1903, The Ford Motor Company sold its 1st car $F