BlessedCharts

@blessedcharts

Offer hospitality to one another without grumbling. - 1 Peter 4:9

Every post I make and every chart I highlight is geared toward SWING TRADING. Buying cons as close to the money as possible, with 100+ days til expiration or more. (sometimes 6-18 months) Daytrading is cool but real money is made thru swinging. Buy yourself time, price your cons…

Banks, fintech, energy names (oil, nuclear, nat gas) ALL taking significant hits today while $GLD ramps up is definitely a disconnect from the "euphoria" we've been clipping thru...not calling top here but super cautious. $CCJ $UEC $EQT $LNG $AR $AFRM $SOFI Side note $EOSE…

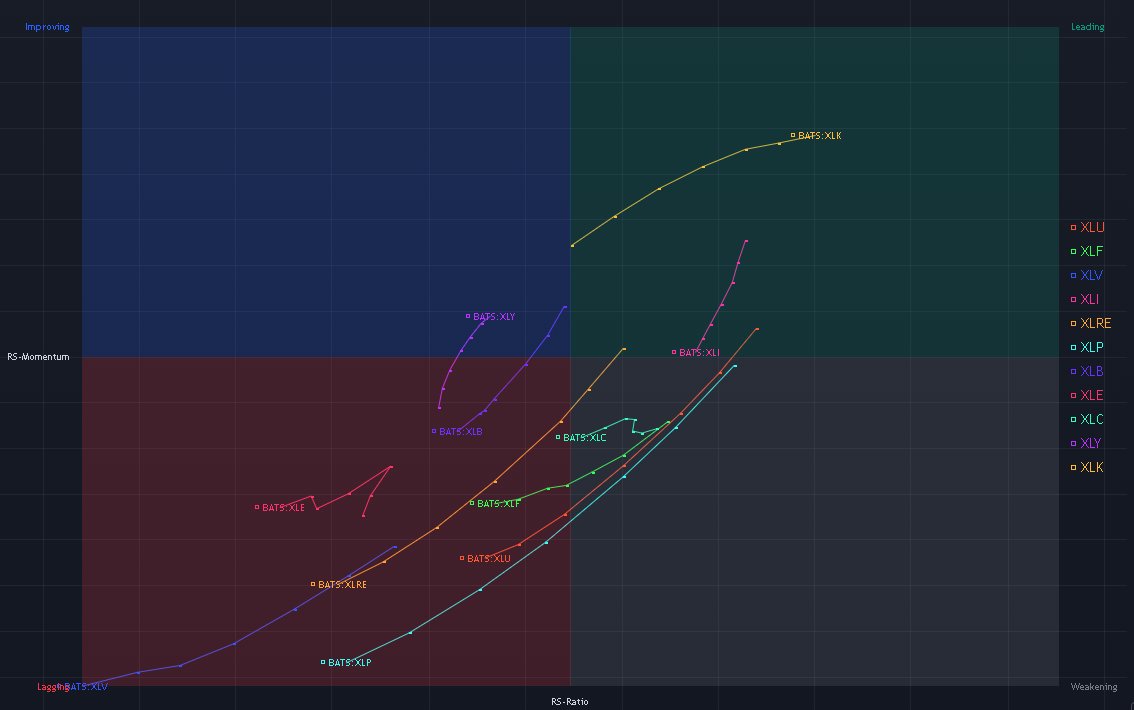

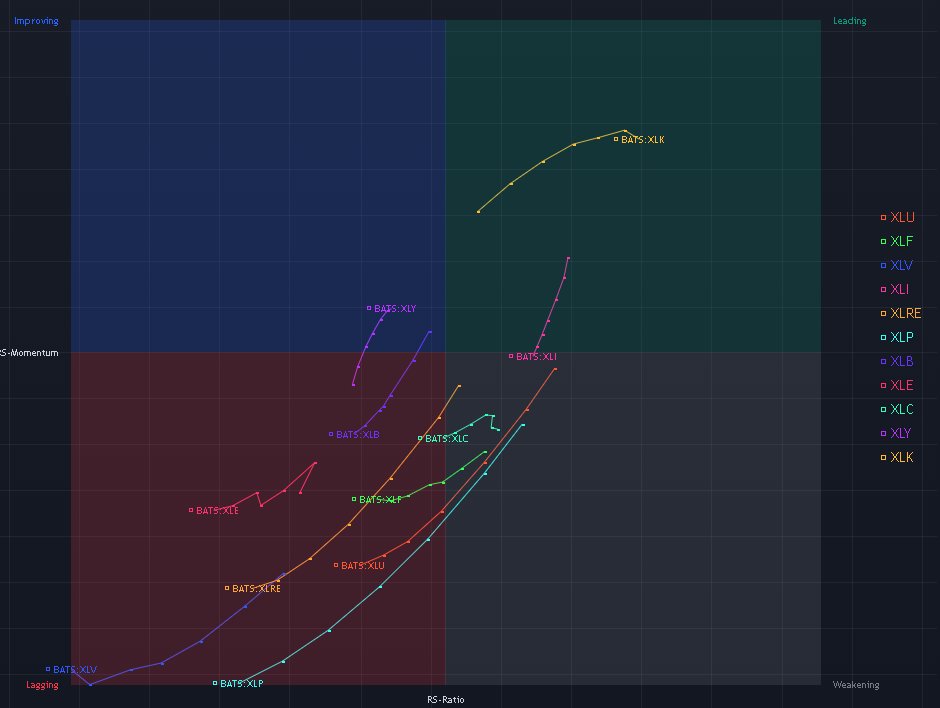

Relative Rotation $SPY Weekly Looks about the same as last week, Tech leading ( $XLK ) and Healthcare Lagging ( $XLV ), $XLRE and $XLP slipping a bit and $XLY popping mainly due to $TSLA. Pain trade remains LONG $XLV ( $UNH will catch a bid eventually) that should help propel…

I finally found my quant

I finally figured out why Google trades at such a low valuation. It turns out the stock is split between two tickers: GOOG and GOOGL, each one trades around $195. I think we should combine them so the stock trades at $390.

$SPY Relative Rotation - 1W Same story for the past few weeks now. $XLK leading while most other sectors remain stagnant at or near highs. Discretionary $XLY is strengthening on the back of $TSLA. Healthcare $XLV is attempting to breakout of it's firm position on the 200W, $UNH…

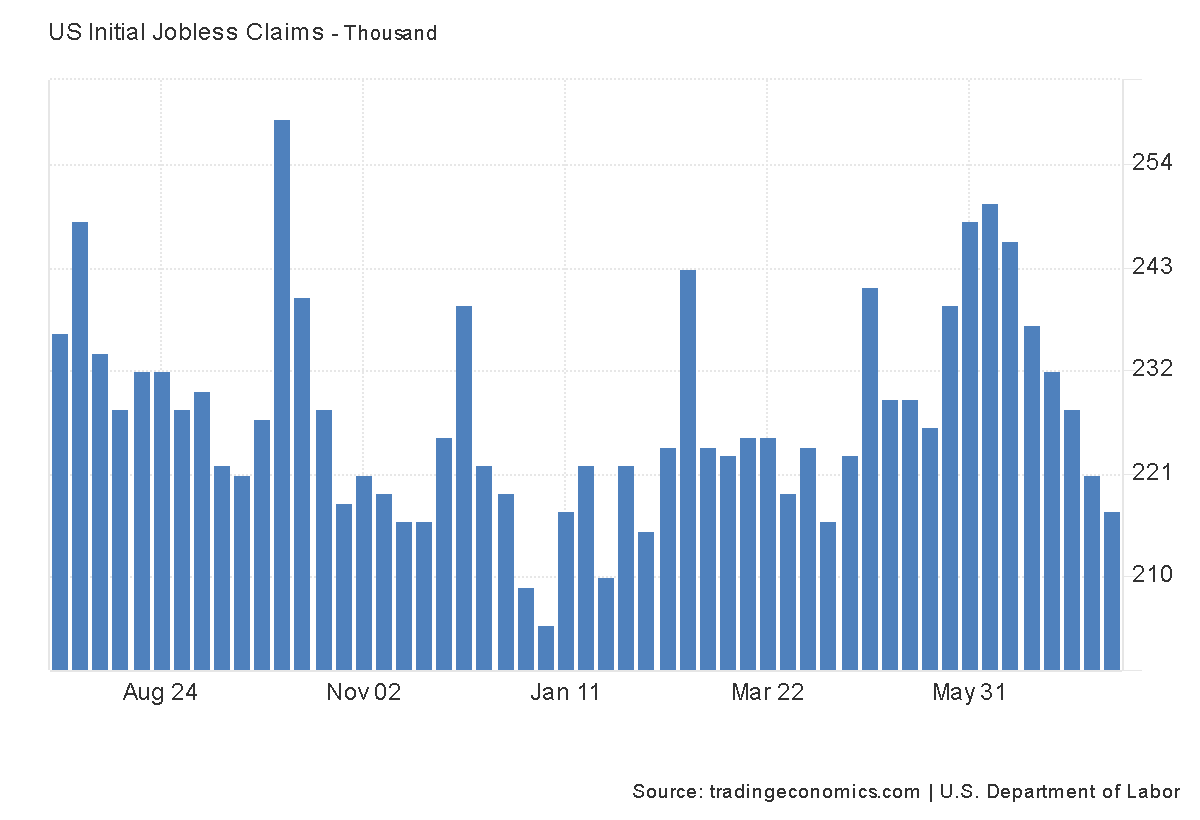

Initial jobless claims in the US fell by 4,000 from the previous week to 217,000 in the third week of July, well under market expectations that they would increase to 227,000

$BLDR played out well - Would like to see it stick and turn the 200D into support

Here we go again $BLDR Huge dip, should defend $120 going into earnings and FED rate decision (Both EOM). The combo could send it. Another move back to the 200D seems likely regardless...

😁

Uranus is warmer than we thought. New computer modeling techniques revealed that Uranus generates internal heat. This is similar to our solar system’s other gas giants, like Jupiter or Neptune. go.nasa.gov/44HzIKx

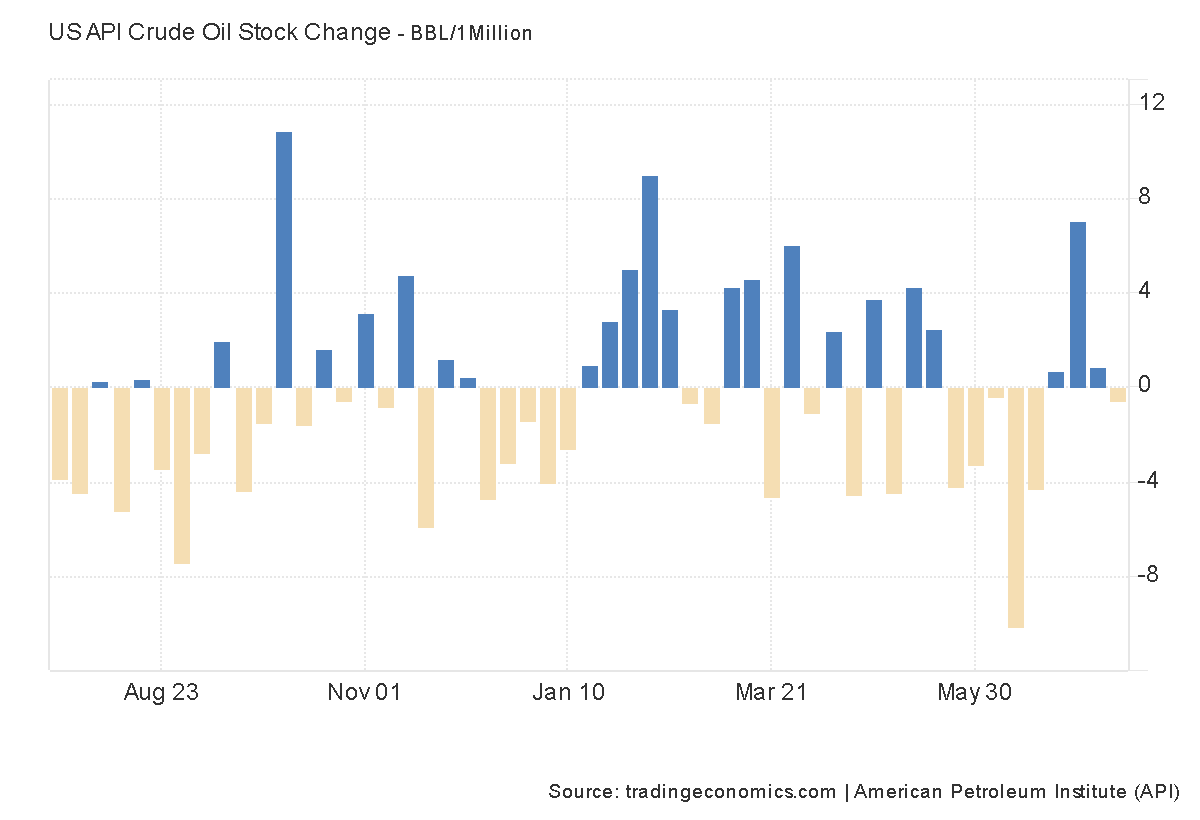

US crude oil inventories dropped by 577,000 barrels in the week ending July 18, 2025, reversing the previous week's downwardly revised 840,000-barrel build. The drawdown ended a three-week streak of rising stockpiles, signaling a potential shift in supply dynamics. #CRUDE $XOM…

$AAPL closed above the 200D for the first time since mid March

Say it a little louder for the people in the BACK

China Healthcare $ELV Silver barons Gold barons Stop looking at momentum

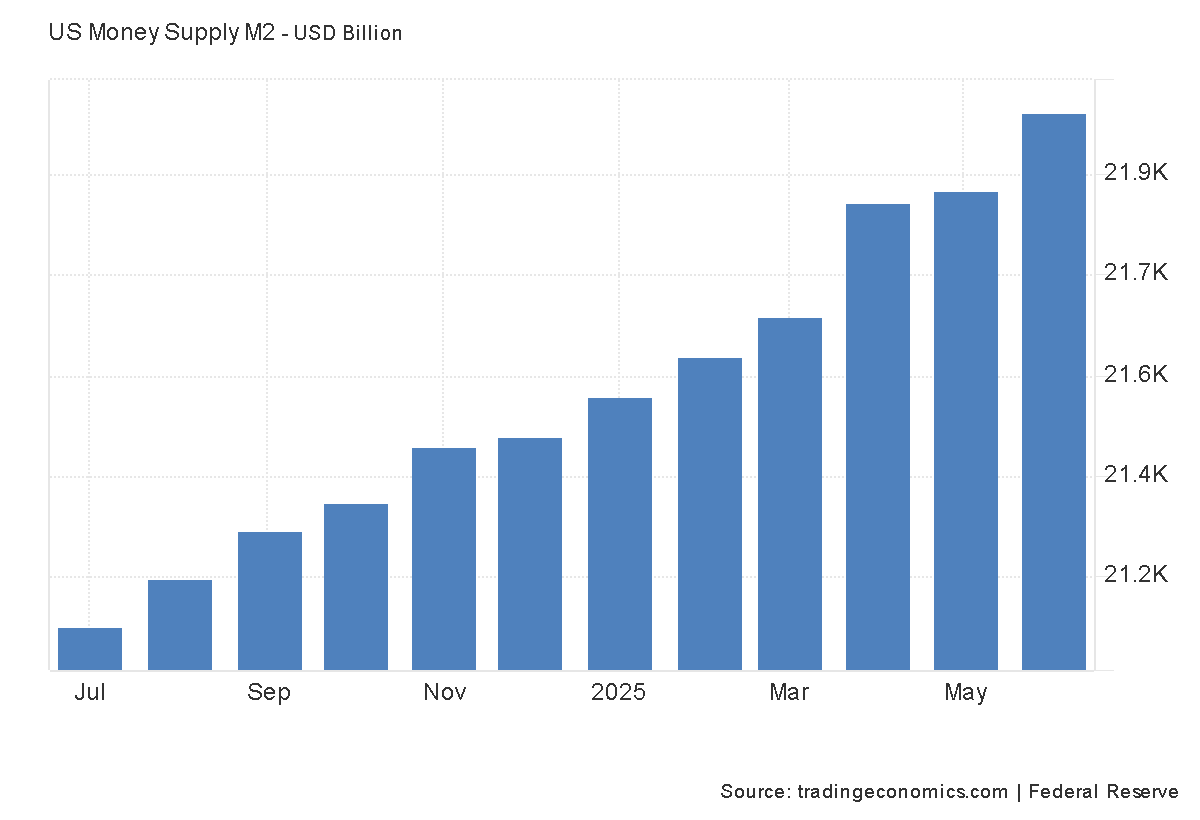

United States Money Supply M2 - The aggregate M2 money supply estimated by the Federal Reserve rose to $21.94 trillion in May 2025 from $21.86 trillion in April.

LandBridge $LB - Huge watch here. Oil and Real Estate combined. This channel has been very productive. Rate cuts are a factor here but this name moves both directions very quickly. Real estate is turning up but #OIL is touchy right now although I will say oil prices won't stay…

$XLV on a tear - Rotation out of beta

$XLV $AAPL and $GLD LOCK IN

Watch $EQT for a flush after earnings. Flushes down to the 200D from time to time and usually does well afterward. Trading #natgas is tough but worthwhile in situations like this. Watch $LNG as well, very similar opportunity arising.

Here we go again $BLDR Huge dip, should defend $120 going into earnings and FED rate decision (Both EOM). The combo could send it. Another move back to the 200D seems likely regardless...

Leg it up into close and let's go enjoy our weekend!! $SOC

$EOSE Squeezing - This should get interesting

$EOSE Short Interest 👀 Check out $QS and $EOSE earnings projections