Artemis

@artemis

Fundamentals matter in crypto. Find what's real in crypto and stablecoins👇

1/ We’ve created an entirely new metric to measure the total size and economic activity of blockchains. It is flexible and widely applicable to chains with various use cases and user behaviors. It also has a strong relationship with Market Cap:

If you're paid in stablecoins, $USDT or $USDC are the best options on-chain. Don't believe in every stablecoin.

Fun Fact: The scrolling metrics bar near the top of the Stablecoin Directory site is powered by @artemis 👀

Leverage is building, but as % of the money supply, #DeFi active loans have only crossed 50% of the level reached last cycle.

Messari’s @0xSynthesis1 speaks with @anthonyyim of Artemis to discuss the findings in the State of Stablecoins 2025 1:17 Survey & B2B Payment Trends 7:17 Speed & Card Usage 17:17 Stablecoin Behavior & Liquidity 22:09 Regulation & Government Response 31:54 Adoption Challenges…

Thank you @RyanSAdams! Here's our updated piece as the previous one linked to our draft: x.com/artemis/status…

Killer ETH report by @artemis "Much like how Bitcoin overcame early skepticism to earn recognition as “digital gold,” Ether (ETH) is establishing its distinct identity—not by emulating Bitcoin’s narrative, but by maturing into a more versatile and foundational asset. ETH is…

🧐 Ready to unlock the true potential of stablecoins? This incredible map from @artemis isn't just a chart; it's a blueprint of a rapidly expanding ecosystem! From lightning-fast payments to sophisticated treasury management, #stablecoins are aggressively paving the way for a…

4️⃣ USDC Ecosystem-Level Supply Trend on @artemis At the most granular level, ecosystem-specific trends offer high-signal insights. Ecosystem-native catalysts (protocol launches, incentive programs, or bridge integrations) can trigger sharp, localized surges in USDC supply.…

5/ For more on TEA, including our findings across several major chains, check out the full post: research.artemis.xyz/p/reading-the-…

$ETH Stablecoins are poised to explode over the next decade. But when it comes to RWAs — tokenized bonds, stocks, private companies — we’re still very early.

$ETH $SBET $BMNR Our fundamental analyst @kevinlhr88 lays out a bull thesis for Ethereum (ETH) treasuries and highlights how they diverge from traditional $BTC treasuries. Here are the Key Takeaways: 1. While tokenization once dominated the crypto narrative, adoption has come…

x.com/i/article/1947…

👀

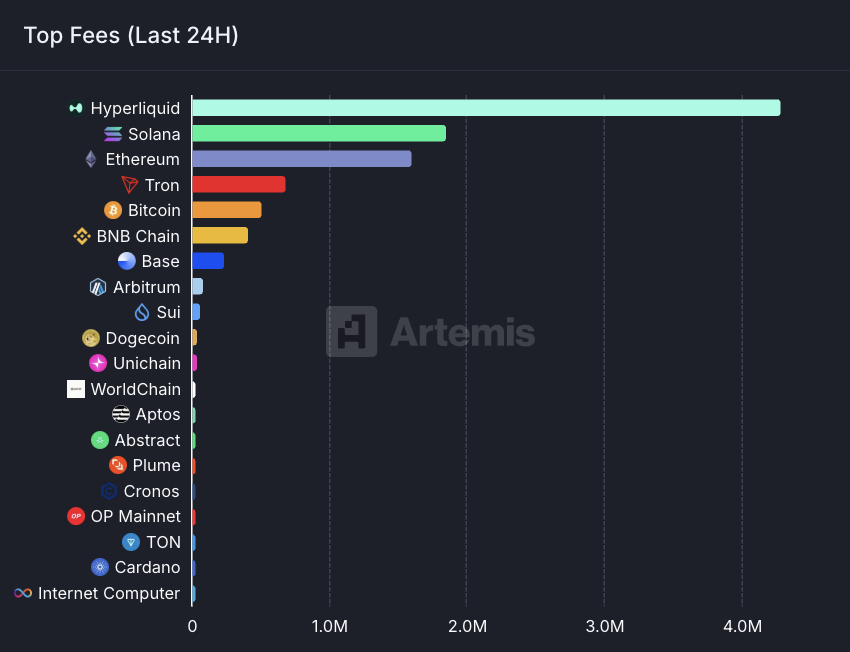

DEFI: HYPERLIQUID LEADS ALL NETWORKS IN DAILY FEES WITH $4.2M, SURPASSING ETHEREUM Source: @artemis

DeFi / Fintech Multiples only going higher.

Fintech Multiples growing as well. $HOOD now trades at 26.1x annualized revenue and 72x earnings at $96B marketcap $COIN now trades at 13.1x annualized revenue and 50.7x earnings at $106B marketcap. $CRCL now trades at 24.6x annualized revenue and 219x earnings at $56B…

With GENIUS bill passing and signed into law, won't be surprised if Stablecoin Supply reaches $1T in the next 12 months. Stay tuned as stablecoins proliferate and the mix shift changes.