Alex P. Guidi

@apguidi

Founder IREMCO Group. Investors in Technology, Precious Metals, Natural Resources, Real Estate. Views expressed are my own.

The Canadian beaver is a powerful national symbol of Canada, deeply tied to the country’s history and values. Beavers are natural builders, symbolic of innovation and practical intelligence, qualities often admired in entrepreneurs and tech developers. 🇨🇦🇨🇦🇨🇦🇨🇦 $LQWD…

As a significant LQWD shareholder, I’m increasingly concerned with two Canadian BTCTC's, namely LQWD & MATA having overlapping strategies, cross-shareholdings, and in particular shared board influence. This isn’t what I consider healthy competition, it’s a strategic conflict. I…

If you want more insight into the future of Copper and critical metals, listen the serially successful master @robert_ivanhoe. $IVN $IE

Appeared internationally on @BBCNews 'Talking Business' over the weekend.

Don’t look at price, look at hash.

₿REAKING: New Record Bitcoin Hashrate 921,000,000,000,000,000,000x per second

China’s gold move is a direct shot at SWIFT and the dollar. Beijing is building a new global payment system: - Instant settlement via blockchain (mBridge) - Gold vaults across the Belt and Road Initiative - Yuan now convertible to gold This could be the foundation of a BRICS-led…

There you go. A message from a mentor on how to properly fund a Venture company from one of the most prominent, highly successful and widely followed investors on the entire TSX and TSXV. @btc_overflow @tylev @shoneanstey @AshleyGarnot @Croesus_BTC @samcallah @DavidFBailey…

Use private placements until you have enough mass and volume, ( and a US listing) to use evergreen at the market financings.

Miners on the brink of a major breakout relative to gold prices. Game on.

The most used funding method for TSX Venture Exchange (TSXV) companies is: ⸻ ✅ Private Placements (Equity Financing) ⸻ 🔹 Why it’s the most common: •Flexible structure: Companies can tailor terms (price, warrants, hold periods). •Faster execution: Compared to public…

After 45 years of observing and participating in listed TSXV fundings as well as previously raising capital for my own companies, the winning methodology in the formative stages (at least in Canada) are non brokered Unit offerings with a hold. It not only attracts investors with…

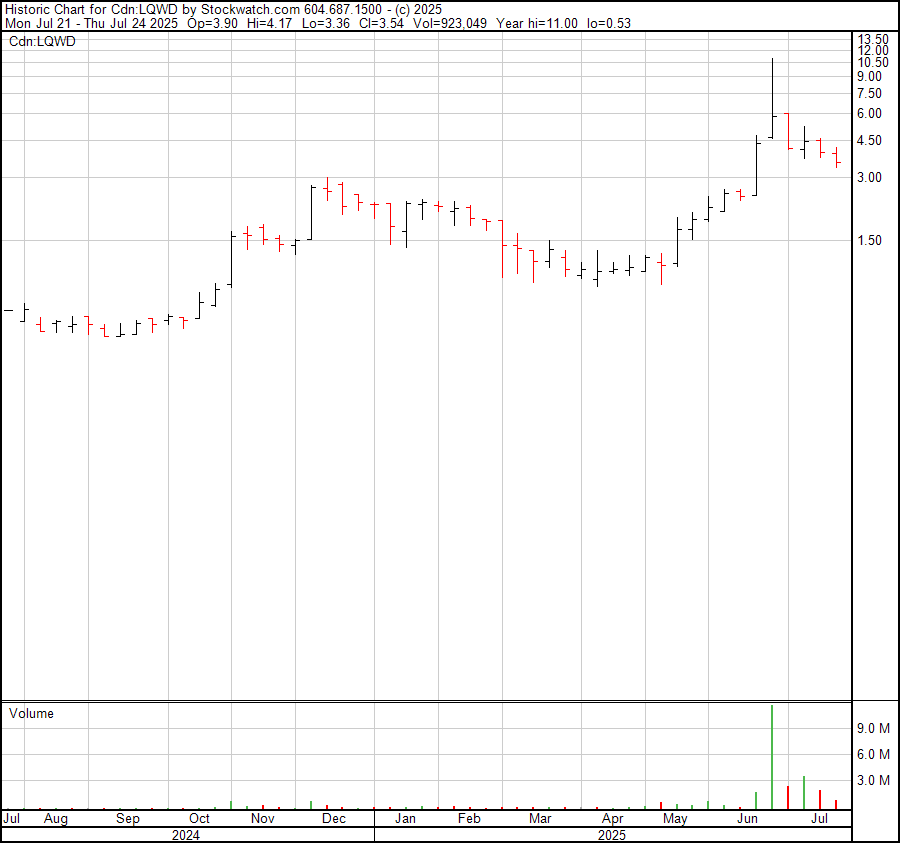

Take out the mysterious spike to $11 and $LQWD is probably trading where it should be. Base building above the previous high of $2.99. Actually, a nice looking chart.

He is spot on.

Companies better figure out how to defend their mNAV or the shorts will “eat their lunch”

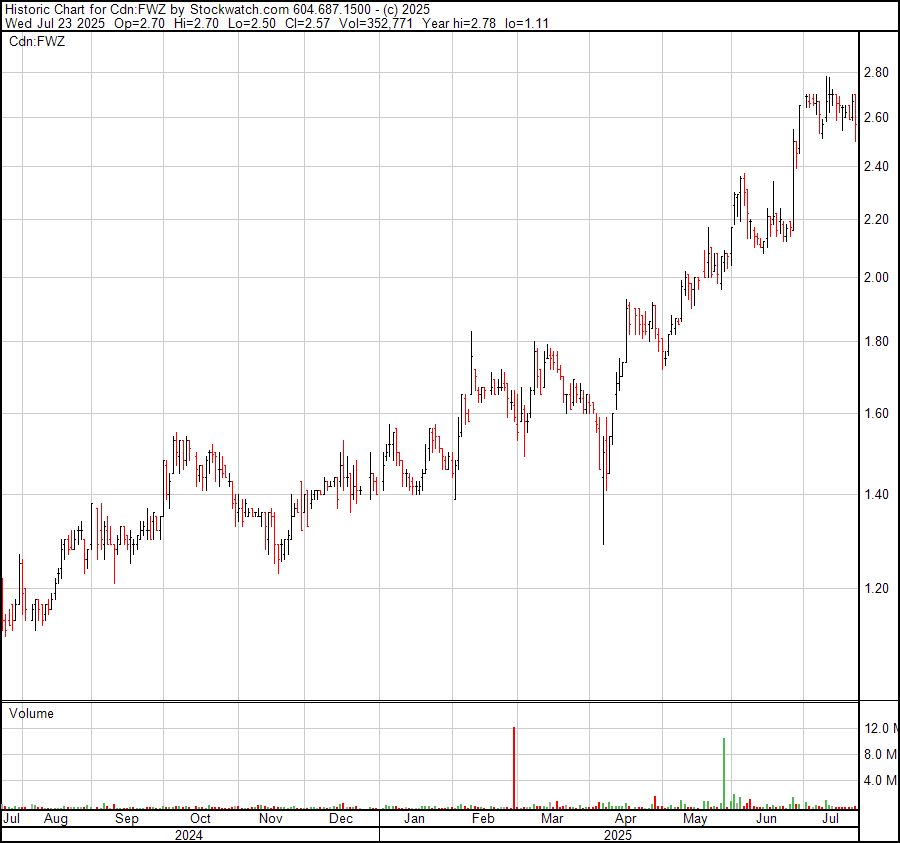

The @LundinGroup's critical minerals developer, Fireweed Metals $FWZ $FWEDF has lots of running room left, IMO. With a market cap of only CDN$500M, I suspect it trade several multiples higher as they further develop their projects and into production. I'm taking the…

Communism: The government takes both cows & gives you some milk. Socialism: The government take one cow & gives it to your neighbor. Fascism: The government take both cows & sells you the milk. Naziism: The government takes both cows & shoots you. Capitalism: You sell one cow &…

Declared shorts have covered as of July 15. We reviewed the $200M in trading driving the stock to $11 during the period of June 15 to July 17. I’m starting to get a clearer picture on the games and maintain that there remains a significant undeclared short position. $LQWD $LQWDF

It's remarkable to see silver approaching $40/oz, yet still historically undervalued relative to gold. Game on.

“Greatest Bitcoin explanation of all time”

When @shoneanstey first approached me to fund $LQWD in its early stages, the Bitcoin Lightning Network was virtually unknown, at least to the investment community. Few had even heard of it, let alone understood Bitcoin and its immense future potential as a utility. At that…