Otavio (Tavi) Costa

@TaviCosta

Macro thinker, history student, value-oriented investor. Native of Sao Paulo, Brazil 🇧http://instagram.com/tavicostamacro

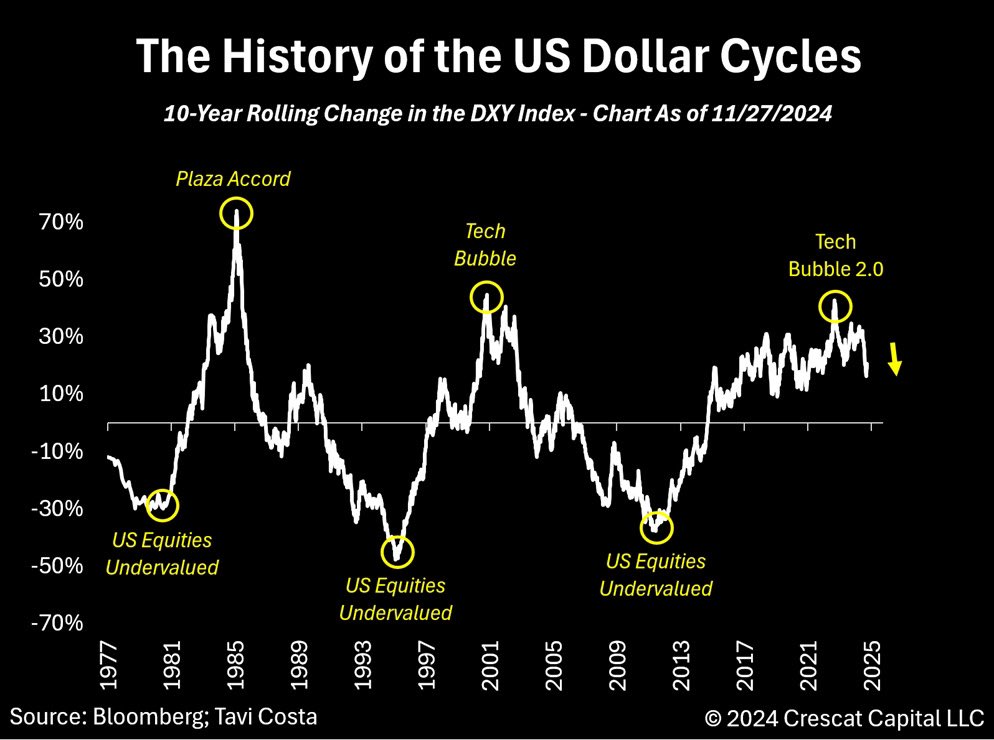

Today, a new set of structural pressures has brought the US dollar to a critical juncture. Thread 👇👇👇

One of the longest-standing silver companies globally is, in my view, on the brink of breaking out from a 45-year resistance level. A new silver bull market is likely unfolding, in my opinion. Apologies for sounding repetitive, but I genuinely believe this is one of the most…

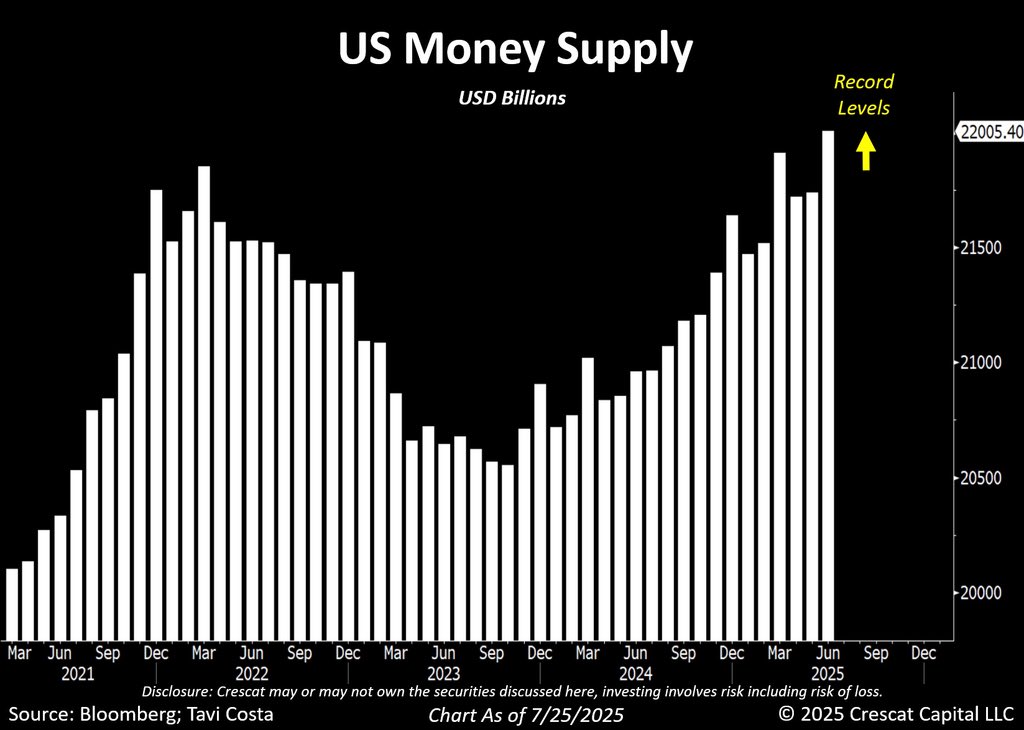

Meanwhile: US money supply just reached all-time highs again.

Tavi Costa: New Highs for Silver are the Next Step in this Market x.com/PalisadesRadio… @tavicosta @crescat_capital #Metals #Gold #Silver #Copper #Platinum #Palladium #Zinc #Nickel #Mining #Commodities #Inflation #Energy #Infrastructure #Materials #Onshoring #USDollar…

Tavi Costa: New Highs for Silver are the Next Step in this Market @tavicosta @crescat_capital #Metals #Gold #Silver #Copper #Platinum #Palladium #Zinc #Nickel #Mining #Commodities #Inflation #Energy #Infrastructure #Materials #Onshoring #USDollar #EmergingMarkets…

Tavi Costa: New Highs for Silver are the Next Step in this Market @tavicosta @crescat_capital #Metals #Gold #Silver #Copper #Platinum #Palladium #Zinc #Nickel #Mining #Commodities #Inflation #Energy #Infrastructure #Materials #Onshoring #USDollar #EmergingMarkets…

My macro presentation starts now 👇👇👇

Crescat's Live Market Call - July 25th, 2025 Commentary x.com/i/broadcasts/1…

Crescat's Live Market Call - July 25th, 2025 Commentary x.com/i/broadcasts/1…

Stimulus checks..... Shadow Fed chair to lower rates... A Big Beautiful Bill... weaker dollar... Inflating our way out of a debt problem.

*TRUMP CONSIDERING STIMULUS CHECKS FOR LOW INCOME AMERICANS: PRESS POOL

This is a critical chart for metals: China’s solar capacity is surging. The growth this year alone consumes about 11% of the world’s annual silver supply. And that’s just China. What happens if the US and other major economies follow suit with similar expansion?

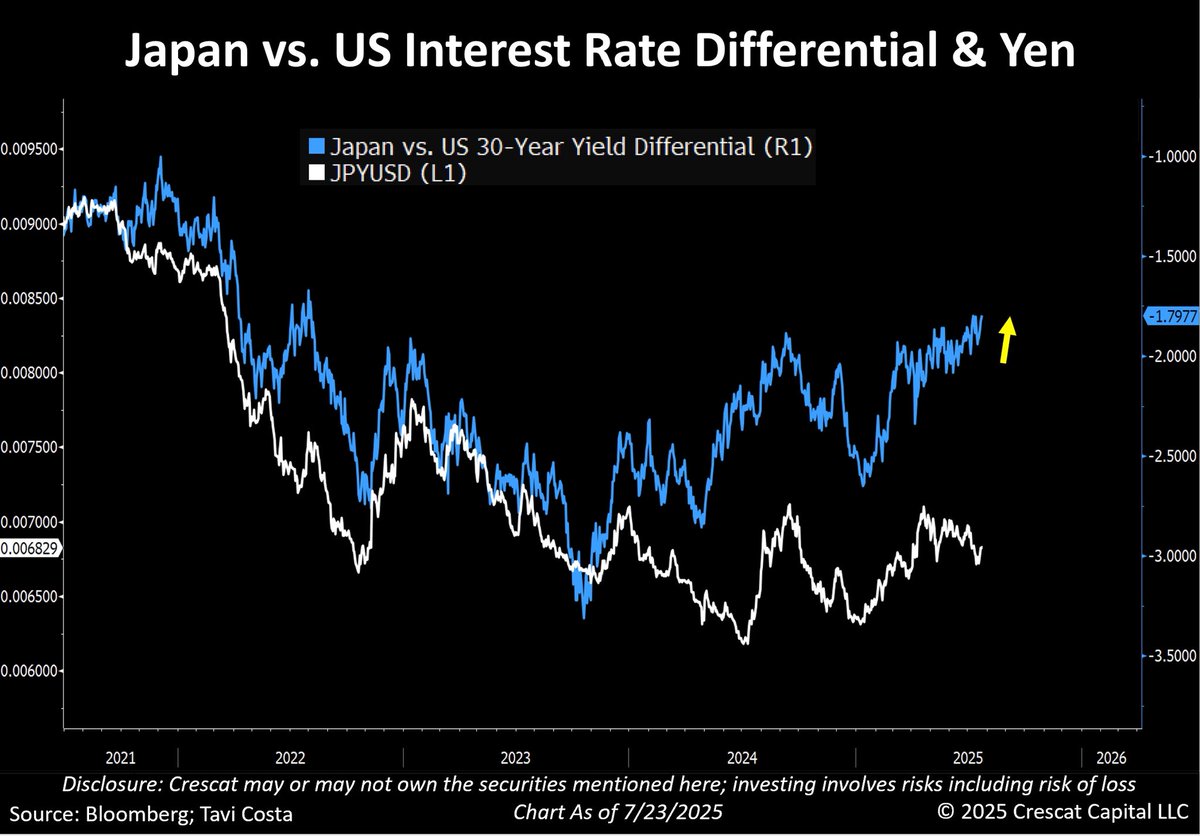

While it hasn’t been openly discussed, I strongly believe a central but hidden objective of these trade agreements is to intentionally push the US dollar lower relative to other major fiat currencies. One possible lever to support that effort could be Japan allowing its…

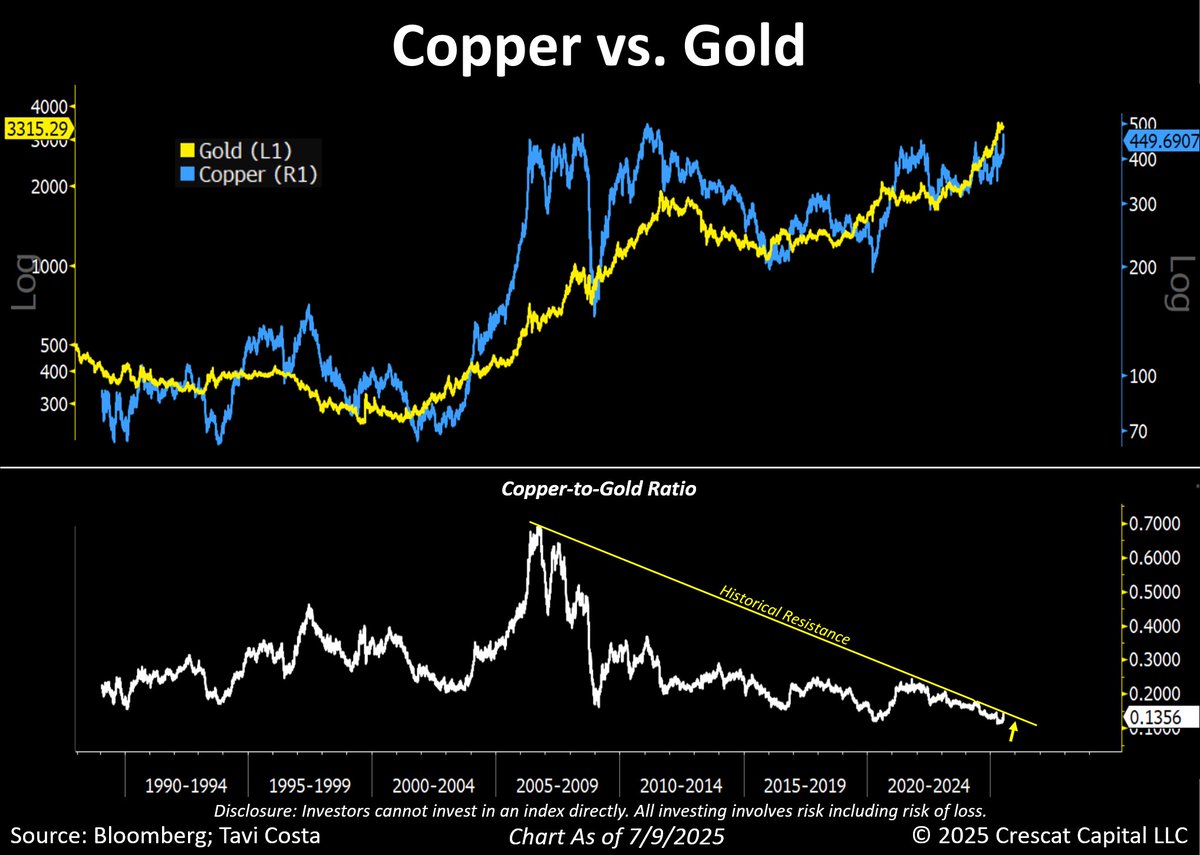

Worth highlighting: Despite copper reaching new highs, it remains at one of its most undervalued levels relative to gold in history. Notice that we are also approaching a potential major breakout in the copper-to-gold ratio. Copper has officially entered a price discovery…

None of us own enough copper.

Cable pr0n of @xAI GB200 servers at Colossus 2

Indeed. Metals!

Large US Grid Lacks Capacity for New Data Centers, Watchdog Says The biggest US grid has no spare supply for new data centers, meaning project developers will need to build their own power plants, according to the system’s independent watchdog. “There is simply no new capacity…

There goes another major gold/copper company making a significant move today. Game on.

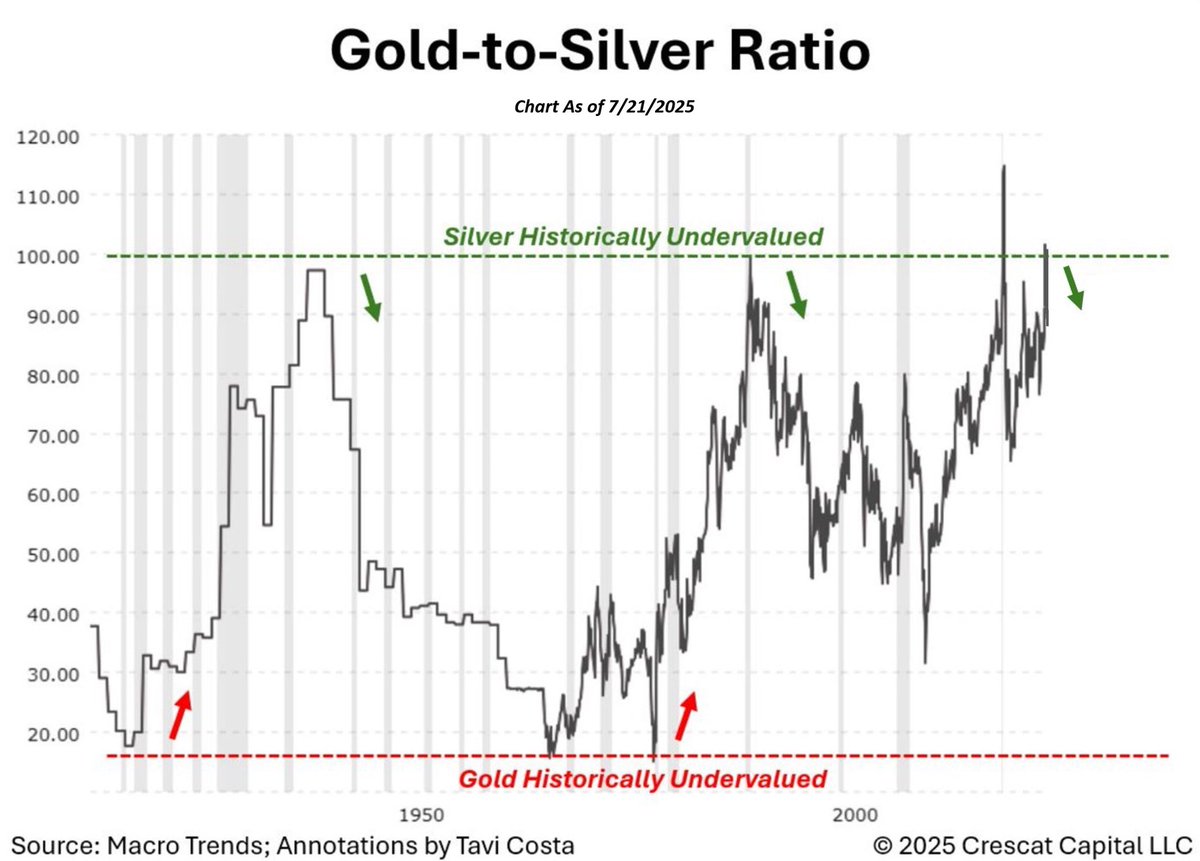

It's remarkable to see silver approaching $40/oz, yet still historically undervalued relative to gold. Game on.

Oil, Copper, Zinc: Tavi’s Top 3 ‘No-Brainer’ Hard Asset Bets! 👉 Watch the Full Episode: youtu.be/VRKxbyd4qV8 👉 Join Our Free Newsletter: stevebartonmoney.com 👉 Learn More: crescat.net Tavi Costa, partner at Crescat Capital, joins “In It To Win It” to…

What metal could become the backbone of tomorrow's electrified world? Copper. With energy demands rising, infrastructure evolving, and materials pivotal to progress, copper's role is only expanding. Watch copper’s surge—because the future is wired with it. 👉 Watch the Full…

An important reminder: When gold goes, silver leads. With gold now above $3,300, the silver side of the story is about to get a lot more interesting in my view. Silver has formed one of the longest cup-and-handles on record. From what I have seen historically, patterns like…

Inflation expectations are breaking out and approaching 3-year highs. Markets aren’t stupid. While the talking heads debate whether tariffs are inflationary or deflationary, here’s what’s really unfolding: ▪️Money supply is hitting new highs ▪️A shadow Fed Chair is in the mix…

Silver.

Jerome Powell is going to be fired. Firing is imminent.

The US dollar has strengthened over the past two weeks, largely as a result of positioning shifts from an extremely bearish stance. This tactical move is likely closer to the end than the beginning, in my view. I still believe we’re in the middle of a broader, structural…