Chaitanya Jain

@_ChaitanyaJ

Bitcoin at @Strategy | Ex-Private Equity @Blackstone | MBA @HarvardHBS | Ex-Pres. HBS Bitcoin Club | Mechanical Engg. @iitbombay @iitb_moodi

1 month ago, I completed my MBA and transitioned into a full-time Bitcoin Strategist at @Strategy. Grateful for the journey and just getting started. 🚀

I’m happy to share that I’m starting a new position as Treasury and Investor Relations Intern at @MicroStrategy! @shirishjajodia @saylor

The supply shock from Bitcoin Treasury Companies converting permanent equity capital into Bitcoin is not priced in.

I track usage of words like huzz, soyboy, baddie, or mewing, not just to use in text messages with friends, but to include in this newsletter. bloomberg.com/opinion/newsle…

The Bitcoin 10 will fight to be the Bitcoin 1?

The Bitcoin 100 will fight to be in the Bitcoin 10.

We built a $BTC bridge. And it hasn't broken in 5 years.

One asset. One Strategy.

Simple. Homogenous. Transparent. Scalable.

DCA’d our way to $72 billion $BTC.

72 orange dots. $72 billion $BTC.

New IPO.

Strategy is offering $STRC (“Stretch”), a new Perpetual Preferred Stock via IPO, to select investors. $MSTR

Buying the top forever.

Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 $BTC acquired for ~$43.61 billion at ~$71,756 per bitcoin. $MSTR $STRK $STRF $STRD strategy.com/press/strategy…

Orange treasury > green treasury.

Our treasury ranks 9th vs S&P 500 companies.

Bitcoin equity issuance is cyclical and volatile. Bitcoin credit issuance is secular and stable.

In previous cycles, maxis only used savings, earnings, and debt to purchase more bitcoin. In this cycle, maxis will also use future expectations. Permanent equity capital. This is a profound expansion in the purchasing power of maxis.

$MSTR is high performance, high volatility Bitcoin.

$MSTR share price has compounded at >2x per year since adopting a $BTC strategy. 🚀

Inject Bitcoin into your b/s, drive up the optionality, liquidity, and volatility, and bring your company to life.

$MSTR closed at a record-high $129B market cap yesterday.

$MSTR Bitcoin accretion 11/20/24: $474/sh; 3.4x mNAV 07/16/25: $456/sh; 2.0x mNAV

A $BTC strategy can take you from $1B to $129B in 5 years.

$MSTR just closed at an all-time high market cap.

Our ATMs give new investors a smooth entry point, minimizing the risk of illiquid price spikes.

Our preferred equity ATMs are seeing record demand. $141M raised last week. $STRK $STRF $STRD

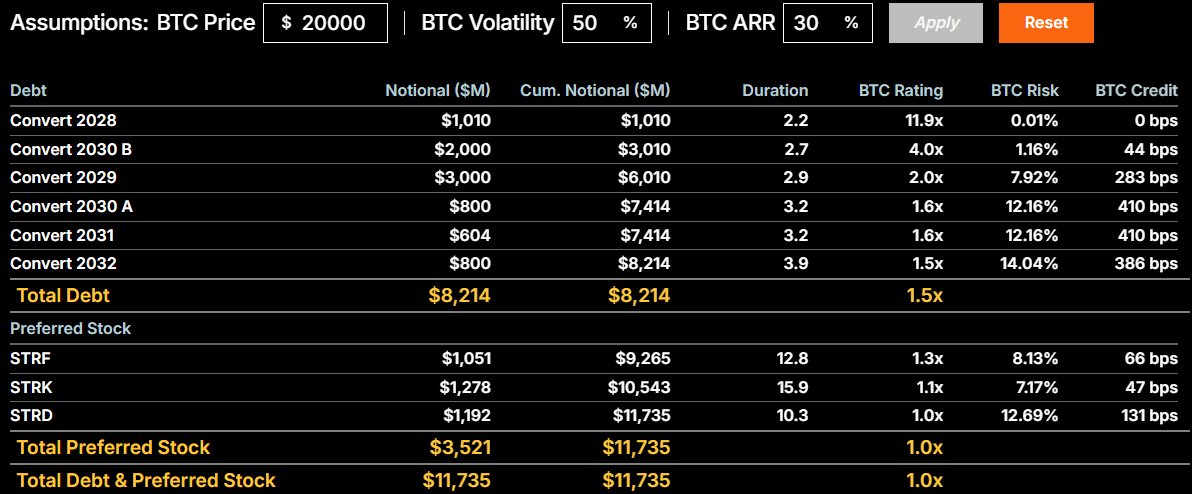

$BTC could crash to $20K and $MSTR would still have sufficient collateral to cover all liabilities. Model it yourself: Strategy.com/Credit

$MSTR has raised over $35 billion in the last 12 months. Bitcoin Treasury Companies are shifting the incentives in investment banking. Finance bros are becoming Bitcoiners.