TokenLogic

@Token_Logic

We provide Capital Management Solutions for Institutions and DeFi Protocols.

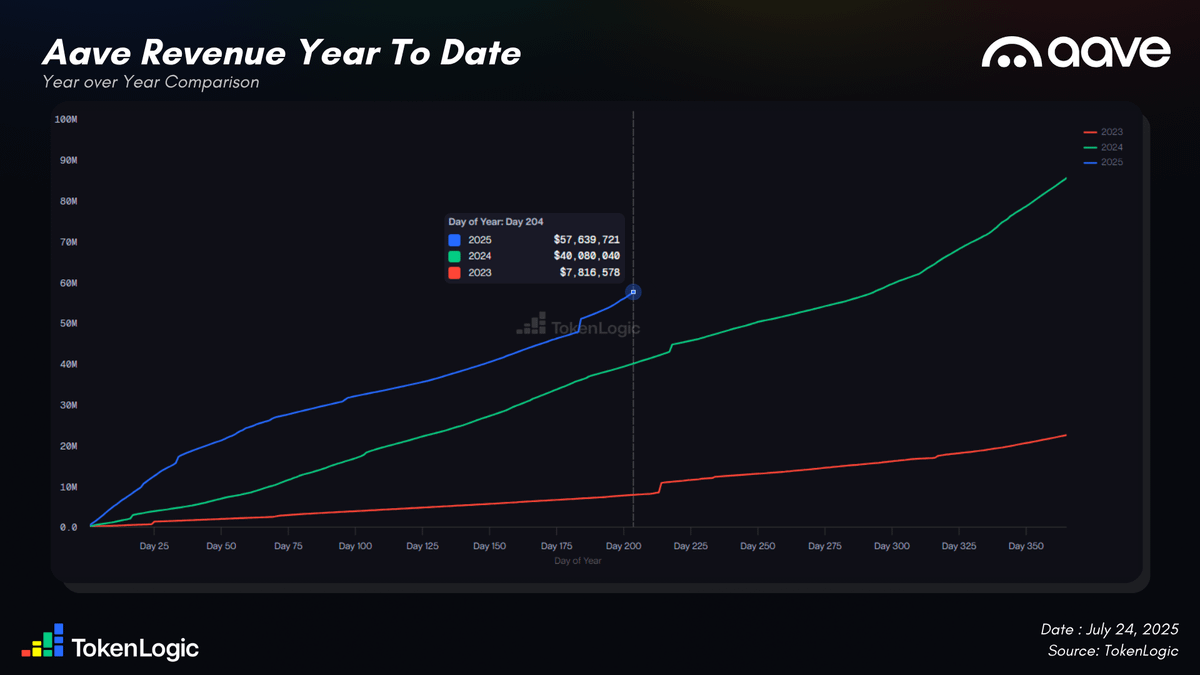

Aave has now reached $170M in cumulative revenue. With over $57M earned since the start of the year, Aave's 2025 revenue is already 1.44x higher than in 2024 and more than 7x higher than in 2023 at the same point in time. Over the past 90 days, daily revenue has surged by 187%.…

$sGHO supply just hit a new ATH at 160.75M! Today, you can earn 7.93% yield on a risk-free savings product, entirely funded by Aave’s $100M+ in annual revenue. No slashing. No cooldown period. Just $GHO yielding at 7.93%. Btw, PT on @spectra_finance lets you lock in a yield…

Umbrella has been live since June 5 and stkGHO, initially designed with slashing and cooldown, is now rebranded as sGHO, the new GHO saving product earning yield through the @AaveChan sGHO Merit campaign. Plenty of new ways to use $sGHO just dropped Let's dive in👇

Check it out 👇🏻 aave.tokenlogic.xyz/treasury

The @aave DAO Treasury (excluding $AAVE) just hit an ATH of $125M+, which is a 123% increase year-over-year. Treasury Composition: > 44% in stablecoins > 41% in $ETH > 15% in DeFi and $BTC The growth of the Treasury is reflective of a business that is consistently profitable.…

With over $285M in coverage, Aave is by far the most secure lending protocol in DeFi. Umbrella shields the protocol in real time from bad debt on $ETH, $USDC, $USDT, and $GHO. Together, $ETH, $USDC, and $USDT represent 87% of total borrowings on the Core instance, which is why…