Richard Allen RAVAS

@TheRising_Moon

Spokesperson for Retailers Against VAT Abuse Schemes. Campaigning against those who profit from Market Abuse and watching those responsible for preventing it.

In January 2021 the UK extended Postponed VAT Accounting to all imports. This meant that Chinese entities could import goods into the UK without having to pay VAT. Industrial levels of fraud followed. Is it time to scrap PVA ? ravasglobal.com/post/postponed…

'Government has lost control of this industry' Campaigner Feargal Sharkey spoke to #BBCBreakfast after the publication of a major report into the water industry in England and Wales including replacing the water regulator Ofwat and introducing mandatory water meters…

RAVAS warned of industrial import VAT and duty fraud in 2020 prior to the implementation of the £135 de minimis and Postponed VAT Accounting on Chinese Imports. ravasglobal.com/post/11-500-co…

The UK Govt is on the verge of reviewing crucial VAT legislation for Online Marketplaces. RAVAS believes that there is an opportunity to kill abuse, level the playing field for sellers and secure VAT by extending VAT to all sales ravasglobal.com/post/billions-…

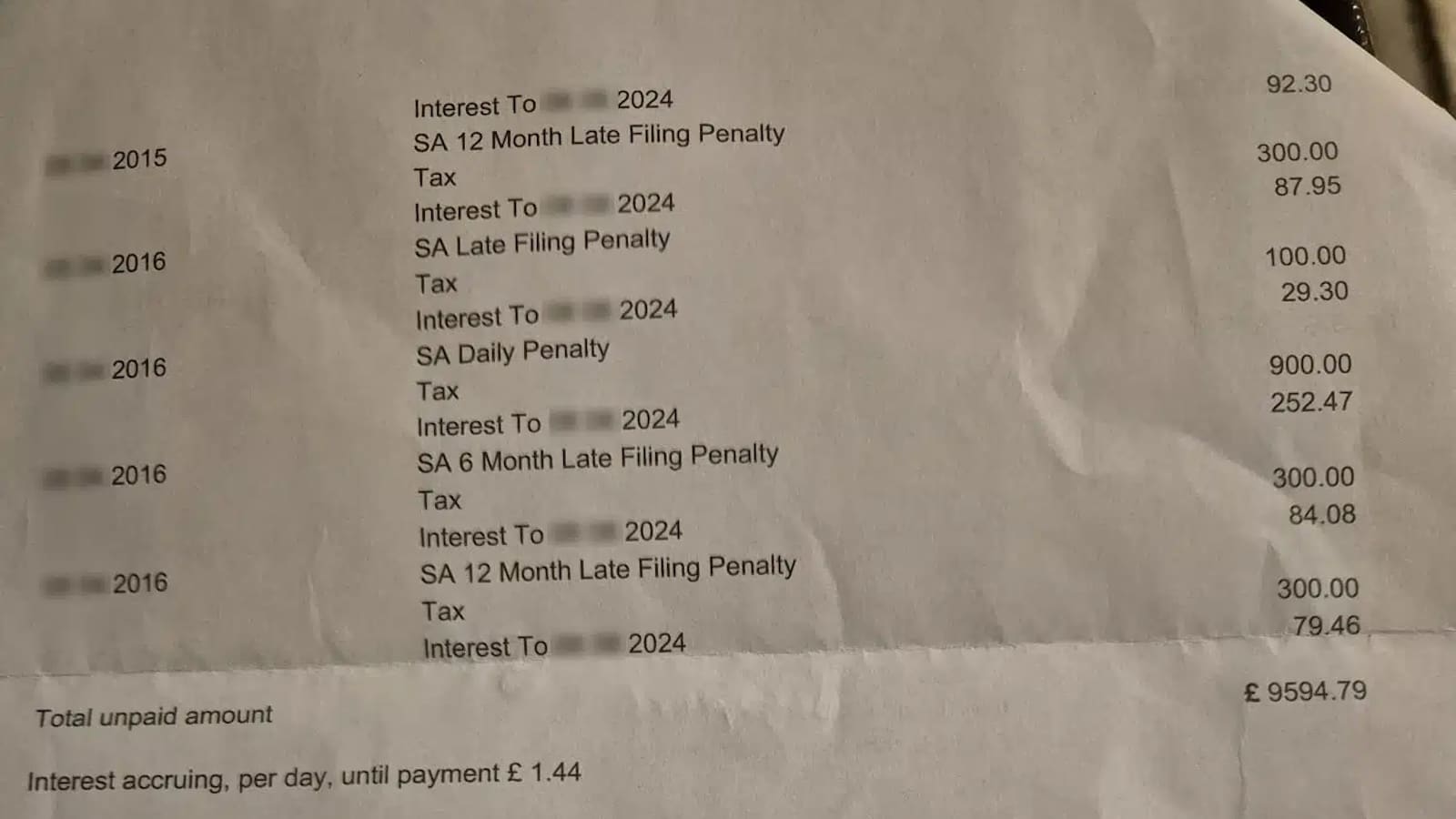

"one woman with severe mental-health difficulties was pursued for £10,000; another was driven into bankruptcy" Individuals would have had to process those cases.... taxpolicy.org.uk/2025/07/06/hmr…

LOAN CHARGE: A staggering relevelation that settlements with firms were done for 15% of the tax due, but the same terms were not offered to individuals. All kept secret during the last review by Sir Amyas Morse, despite being known. #LoanChargeScandal It would be entirely fair…

Now it’s known that #HMRC settled for just 15% (85% discount) with large companies, victims of mis-selling MUST be offered at least as good terms. The current review into settlements must now conclude this to have any credibility. We’ve written to Ray McCann urging him to do so.

Sureally, the switch in western countries from professional customs organisations to dedicated border forces (partly driven by 9/11) has resulted in a dilution of the customs approach, because of conflicting priorities and a loss of skills).

And what is shocking is that this was both predictable and preventable. The UK is in control of import duty and VAT yet officials threw the doors wide open to cheap imports with no benefit to the UK ecomomy.

Once upon a time Leicester was the beating heart of UK clothes manufacturing. The city was dotted with factories making clothes for big name brands. Now, according to one estimate, the number of clothes factories has dropped from 1500 in 2017 to under 100 this year. A 95% fall.

Richard has hit the nail in the head,people that have been given the position to regulate our taxes and have failed by design. Tax authorities have rewarded the criminal behaviour of few can only be seen as a golden circle that are well connected to political leaders. The…

1/4 There seems to be a complete lack of empathy at HMRC rdgarding the psychological impact that a 'tax issue' has on individuals. I lost my business due to VAT fraud carried out by competitors so I experienced the extreme anxiety that a lack of control can cause.

🚨BREAKING NEWS: Huge new FOI revelation in the #LoanChargeScandal raised by @gregsmith_uk in #TreasuryQuestions exposing #HMRC’s 15% settlement deal with large companies in 2015, as reported by Ray McCann to Lord Morse in 2019. All the while ruthlessly persecuting contractors.

This smacks of this revelation in 2015 between Richard Allen & a senior member of HMRC's VAT team, "the Treasury didn’t want us (HMRC) to be too hard on Amazon". Listen to recording in link waitingfortax.com/2018/01/23/don… #LoanChargeScandal @TheRising_Moon @JolyonMaugham @gregsmith_uk

🚨BREAKING NEWS: Huge new FOI revelation in the #LoanChargeScandal raised by @gregsmith_uk in #TreasuryQuestions exposing #HMRC’s 15% settlement deal with large companies in 2015, as reported by Ray McCann to Lord Morse in 2019. All the while ruthlessly persecuting contractors.

It's not often you see such an incredible tax justice victory like this and persistence by one person prepared to stand up for justice with so many forces against him. @alomohan is a #TaxJusticeHero. h/t @TheRising_Moon (another tax justice hero)

Dear @Barclays Bank When will someone fix your useless website ? If anyone is thinking of using it I would 100% recommend they don't. It's broken.

"I’m just an ordinary citizen who refused to be part of fraud.’ extra.ie/2023/06/12/new…

Incredibly nowhere on this UK Government website link does it say that you must provide a guarantor for payment of VAT if you are a Non Established Tax Payer importing goods into the UK. That's because you don't. More on this soon... gov.uk/guidance/check…

Great to see that @alomohan has won his battle to end the Irish Chicken VAT scam. He wasn't prepared to engage in this VAT fraud and after a long fight his campaign has finally ended it.