Thala

@ThalaLabs

The HyperApp and Liquidity Engine of Aptos. http://discord.gg/thala

Earning pretty solid yields just looping sUSDE-USDC on @EchelonMarket @ReserveTokenAPT should look at deploying into this strategy!

The most complete DeFi suite and liquidity engine of @Aptos. gthala.

Thala never rushed to win attention. They just kept building until it was impossible to ignore. From the earliest days of @Aptos mainnet, they were already laying the foundation While everyone was yelling about the next hype mint, Thala was quietly shipping core DeFi infra. A…

$55K in new incentives are live — tuned by @gauntlet_xyz for max efficiency. • USDC/USDT: 17.06%–31.33% • APT/USDC: 49.82%–82.83% APT/USDC now runs at 0.05% swap fees & incentivized—designed for tighter routing and more efficient trades. Best yields: app.thala.fi/pools

Incentives are live on the WBTC/USDC pool. APR ranges from 78% to 153.54%, with the highest returns for veTHL lockers - powered by thAPT incentives and real swap flow. BTCFi is here — and it’s yielding. Earn with WBTC → app.thala.fi/pools/0xb64243…

WBTC is live on @ThalaLabs. Two active core pools. Composable BTC on @Aptos.

WBTC is now live on @Aptos - fully supported on Thala. We’ve integrated the new @LayerZero_Labs OFT WBTC standard with two core pools now active: → WBTC / APT → WBTC / USDC The BTCFi era begins on Aptos - powered by @WrappedBTC and deep liquidity on Thala.

The road to $10B is in motion. As we push toward that milestone, CLMM is next - bringing deeper liquidity, tighter pricing, and more efficient markets to @Aptos. gthala

Thala Labs has reached $9 billion in cumulative volume. As the OG DEX with the highest total volume and the second-highest revenue-generating protocol on Aptos, Thala Labs is a staple in the ecosystem. Nearly every person on Aptos has interacted with it at least once. Today,…

Thala Labs surpassed $9B in total swap volume and is heading toward a major milestone at $10B. Thala generated $1.28M revenue since 2025, averaging $180K monthly. It ranks #1 among Aptos protocols for 30 day revenue, with $223,623 over the past 30 days. @ThalaLabs is rising…

Thala Labs has reached $9 billion in cumulative volume. As the OG DEX with the highest total volume and the second-highest revenue-generating protocol on Aptos, Thala Labs is a staple in the ecosystem. Nearly every person on Aptos has interacted with it at least once. Today,…

From the first Thala Foundry project to the leading money market on @Aptos - congrats to @EchelonMarket on joining LFM. Since launch, Echelon has delivered: • $200M+ in TVL • $95M+ in BTC liquidity • Deep sUSDe integration • Support for staked LP positions (xLPTs) • First…

Echelon is now part of LFM - Aptos growth engine for the next generation of ecosystem leaders. From $0 to $200M+ TVL, we've built the leading stablecoin and money market layer on @Aptos. Now we’re just getting started.

.@ThalaLabs on @aptos thala is a major fee engine on aptos, driving most of the app revenue last year and making up a large share of the 70% figure among top earners recent numbers: $51k in 7d, $237k in 30d, $1.4m over the past year swap v2 now settles 97% of trades and…

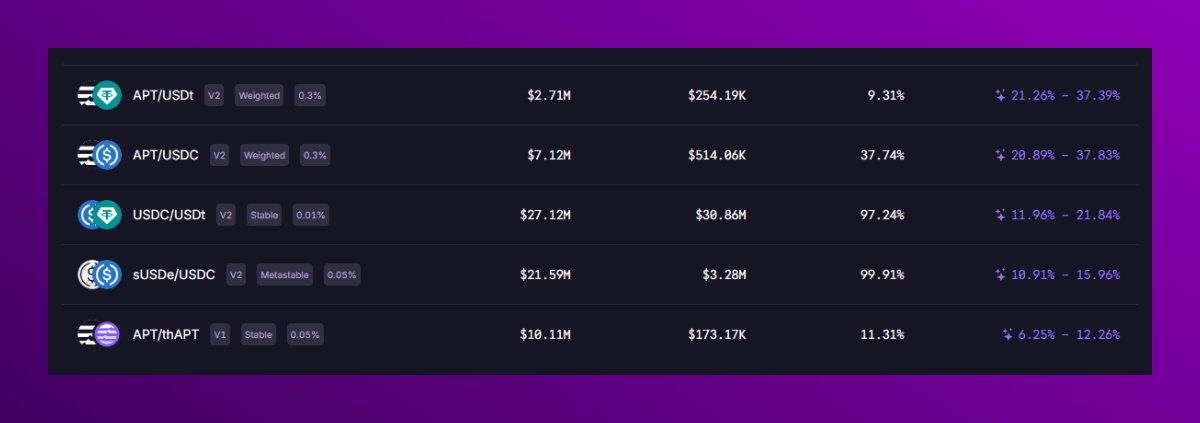

Fresh incentives are live across Thala pools. Yields now reach as high as 37.56% on APT pairs and 21.84% on stables, powered by thAPT incentives and swap fees. veTHL lockers receive a boost on rewards. Best yields → app.thala.fi/pools

$RESERVE aims to ultimately be the largest onchain owner of $APT from public market acquisitions. More soon.

Introducing Aptos Reserve, a protocol dedicated towards the advancement of @Aptos/ $APT Aptos Reserve operates $RESERVE token, which collects fees from trading on @ThalaLabs, generates yield through treasury strategy, and allows for borrowing at book value on @EchelonMarket 🧵

Reserve, @ReserveTokenAPT, is coming to ThalaSwap V3 soon. Stay tuned!

Introducing Aptos Reserve, a protocol dedicated towards the advancement of @Aptos/ $APT Aptos Reserve operates $RESERVE token, which collects fees from trading on @ThalaLabs, generates yield through treasury strategy, and allows for borrowing at book value on @EchelonMarket 🧵

Thala revenue is up 285% year-over-year, maintaining the highest revenue share on @Aptos since launch 💪 Rev engine of Aptos. Full report by @blockworksres ↓

2/ Application revenue serves as an indicator of success for businesses within an ecosystem. Applications on Aptos earned ~$835k in revenue in June, a new all time high and the 9th consecutive month of growth.

Thala 🤝 Plainshift @plainshift has completed an audit of our CLMM implementation, with a focus on edge cases, correctness, and robustness. As CLMM approaches mainnet, multiple audits are underway to ensure a secure and smooth launch. Read the report: docs.thala.fi/overview/opera…

Plainshift audited @ThalaLabs CLAMM, their team’s foresight on edge cases sets a high bar for CLAMM security. Get excited for mainnet!