Echelon

@EchelonMarket

Modular Money Market powered by Move.

Echelon is now part of LFM - Aptos growth engine for the next generation of ecosystem leaders. From $0 to $200M+ TVL, we've built the leading stablecoin and money market layer on @Aptos. Now we’re just getting started.

As a Move-powered modular money market and stablecoin powerhouse on Aptos... Please join us in welcoming @EchelonMarket to LFM 🌐 Echelon allows users to lend and borrow assets, unlock liquidity, and earn interest on their assets while helping to push Aptos DeFi forward.

LFM with @EchelonMarket!

As a Move-powered modular money market and stablecoin powerhouse on Aptos... Please join us in welcoming @EchelonMarket to LFM 🌐 Echelon allows users to lend and borrow assets, unlock liquidity, and earn interest on their assets while helping to push Aptos DeFi forward.

Earning pretty solid yields just looping sUSDE-USDC on @EchelonMarket @ReserveTokenAPT should look at deploying into this strategy!

USDC Borrowing Incentives Are Now Active Incentives for borrowing USDC are now live on @Aptos network, with incentives managed by @gauntlet_xyz to optimize capital efficiency and risk. USDC borrowing APR has dropped from 12.6% to 5.99% Borrow smarter → app.echelon.market

WBTC incentives are now live on Echelon ⚡️ WBTC deposits are now earning ~11% APR. With 70% LTV and seamless access to stablecoin strategies, it’s one of the most capital-efficient ways to put BTC to work on-chain. Aptos is for BTCfi.

currently @EchelonMarket offers the highest sUSDE apr across ANY protocol 16.5% apr on good size (currently around ~$50m supplied) plus @ethena_labs points and echelon points on top aptos defi and echelon looking good here, highest stable yields out there right now

From the first Thala Foundry project to the leading money market on @Aptos - congrats to @EchelonMarket on joining LFM. Since launch, Echelon has delivered: • $200M+ in TVL • $95M+ in BTC liquidity • Deep sUSDe integration • Support for staked LP positions (xLPTs) • First…

Echelon is now part of LFM - Aptos growth engine for the next generation of ecosystem leaders. From $0 to $200M+ TVL, we've built the leading stablecoin and money market layer on @Aptos. Now we’re just getting started.

Lending APRs on Echelon are up to double digits for stables with sUSDe is now yielding 16%+, the highest across any protocol, all powered by APT incentives and @ethena_labs staking APR. ICYMI: kAPT & stkAPT markets live with 1500 kAPT incentives provided by @kofi_finance

Introducing Aptos Reserve, a protocol dedicated towards the advancement of @Aptos/ $APT Aptos Reserve operates $RESERVE token, which collects fees from trading on @ThalaLabs, generates yield through treasury strategy, and allows for borrowing at book value on @EchelonMarket 🧵

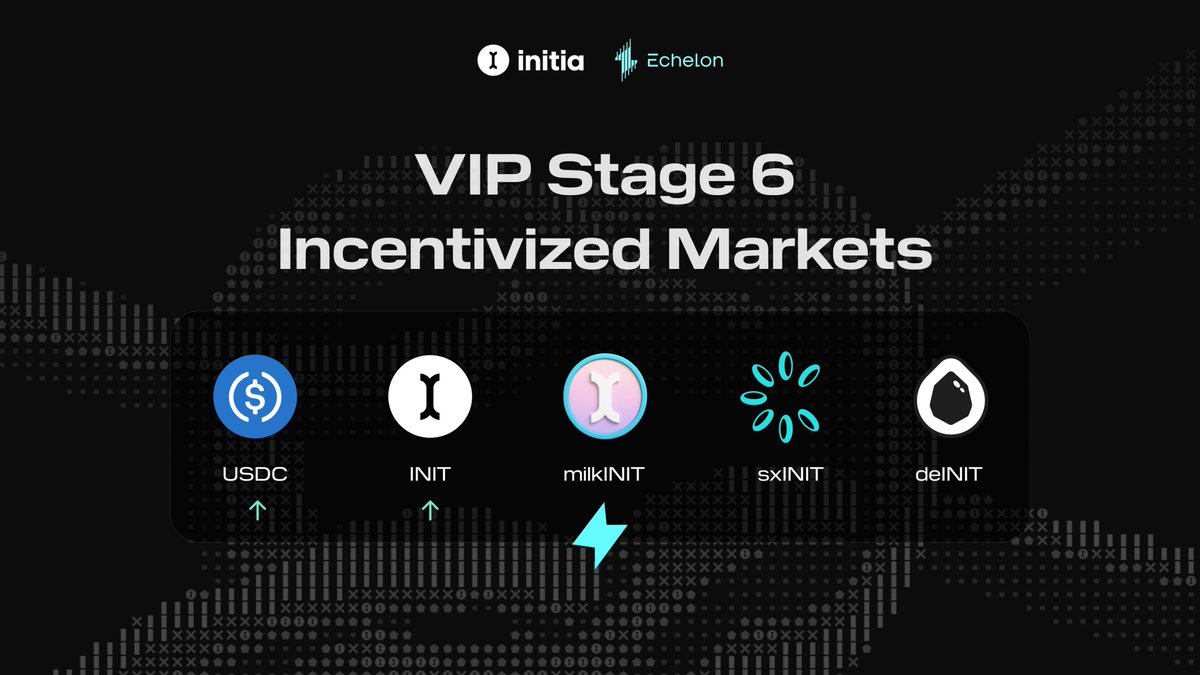

Supply caps raised across Initia LSTs 🧬 • milkINIT → 5,000,000 • sxINIT → 1,000,000 Supply APRs up to 60% - the most efficient way to farm INIT on-chain. More room for high-yield strategies, powered by @initia VIP rewards.

Aptos hit $1.35B in stablecoins - $170M+ of that is deployed on Echelon. Top stablecoin markets: • $66M+ USDC • $50M+ xLPTs • $45M+ sUSDe Earn up to 12% APR on stablecoins, E-Mode for higher LTV, and efficient loop strategies. Echelon is for stables.

MORE stables, MORE milestones, MORE proof: → Aptos is the chain of choice for stables. Cheers to +1.35B in stables now on-chain 🎉

kAPT & stkAPT are now live on Echelon. kAPT is a 1:1 liquid staked APT. stkAPT builds on top - earning from both staking rewards and MEV revenue, unlocking extra yield. Incentives are now live for 1 month with the following distribution: → kAPT: 1500 kAPT → stkAPT: 500 kAPT

Thrilled to be teaming up with @EchelonMarket! We’ve added 2,000 APT in boosted incentives to power your kAPT and stkAPT strategies on Echelon. It’s time to lend, borrow, and level up your DeFi plays on @aptos Let’s make every APT count ☕️💚

Initia VIP Stage 6 is live with 143,181 esINIT up for grabs 🧬 Current APRs: → deINIT: 105.72% → sxINIT: 71.97% → milkINIT: 69.05% → INIT: 13.45% → USDC: 9.56% Incentivized borrows this stage: INIT at -1.51%, USDC at 9.56%. That’s right, borrowing INIT earns you yield.

One of the top @Aptos DeFi strategies right now: • Stake APT → sthAPT on @ThalaLabs • Use sthAPT as collateral to borrow USDC at 8.61% APR on Echelon • LP USDC/USDT → xLPT • Supply xLPT for 12.83% APR • Loop Reach ~30% net yield on stables + farm more Echelon Points ⚡️

Aptos 101: Easy Farming ⇥ Mint sthAPT on @ThalaLabs (liquid staking token) ⇥ Supply it on @EchelonMarket for ~7.5% APR and earn Echelon Points ⇥ Borrow USDC on Echelon using your sthAPT as collateral ⇥ Head back to Thala and LP USDC/USDT ⇥ Stake your LP tokens on Thala…

The @aptos ecosystem at a glance • @aave: First Non-EVM deployment on Aptos • @ThalaLabs: The Top DeFi app on Aptos by cumulative & daily volume • @EchoProtocol_: BTC liquidity layer with the largest TVL on Aptos • @hyperion_xyz: Concentrated Liquidity AMM with $120M+ TVL •…