💡 TaxEDU

@TaxEDU_

Tax education, discussion, and understanding. Elevating the tax debate to achieve better, more principled tax policy. From @TaxFoundation

Tariffs are taxes too. 💡 Tax basics 101: taxfoundation.org/taxedu/videos/…

💡What is bonus depreciation? Bonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. hubs.ly/Q03z2jnq0

Tax rates are not the only thing to know about taxes. Their effectiveness in raising revenue and impact on personal and business decision-making are also dependent on their base. ▶️ Watch: hubs.ly/Q03z2dxF0

💡 Join TaxEDU for a webinar this Wednesday addressing the importance of tax literacy and ways to improve it for you, your children, or your students. Date: July 30, 2025 Time: 7 PM EST | 4 PM PST Register at the link below ⬇️ hubs.ly/Q03z2gp40 #FinancialLiteracy…

It’s important to know what’s being taxed and what the rate is, so you can make meaningful choices and decisions. But some taxes are virtually invisible — so much so that you may not even realize you’re paying them. Like #tariffs. hubs.ly/Q03yLFg-0

Simpler tax codes result in less taxpayer dollars spent on administration and compliance, more revenue, and more time for businesses and taxpayers to invest in and do what they’re good at. ▶️ Watch: hubs.ly/Q03yLBwR0

It's important to understand how income tax brackets work. But when it comes to state income taxes, not all are levied in that way. An income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. Learn…

Not every tax you pay at the register is a sales tax, some are excise taxes. An excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting,…

💡 It’s important to remember that every dollar you pay in taxes starts as a dollar earned as income. One of the main differences among the tax types outlined below is the point of collection—in other words, when you pay the tax. Check out the 𝘛𝘩𝘦 𝘛𝘩𝘳𝘦𝘦 𝘉𝘢𝘴𝘪𝘤…

💡 Join TaxEDU for an upcoming webinar addressing the importance of tax literacy and ways to improve it for you, your children, or your students. Date: July 30, 2025 Time: 7 PM EST | 4 PM PST Register at the link below ⬇️ hubs.ly/Q03yLtKn0 #FinancialLiteracy #FinLit…

Not only have taxes been around for a really long time, they’ve also played a huge role in all sorts of major historical events. ▶️ Watch: hubs.ly/Q03yLxH80

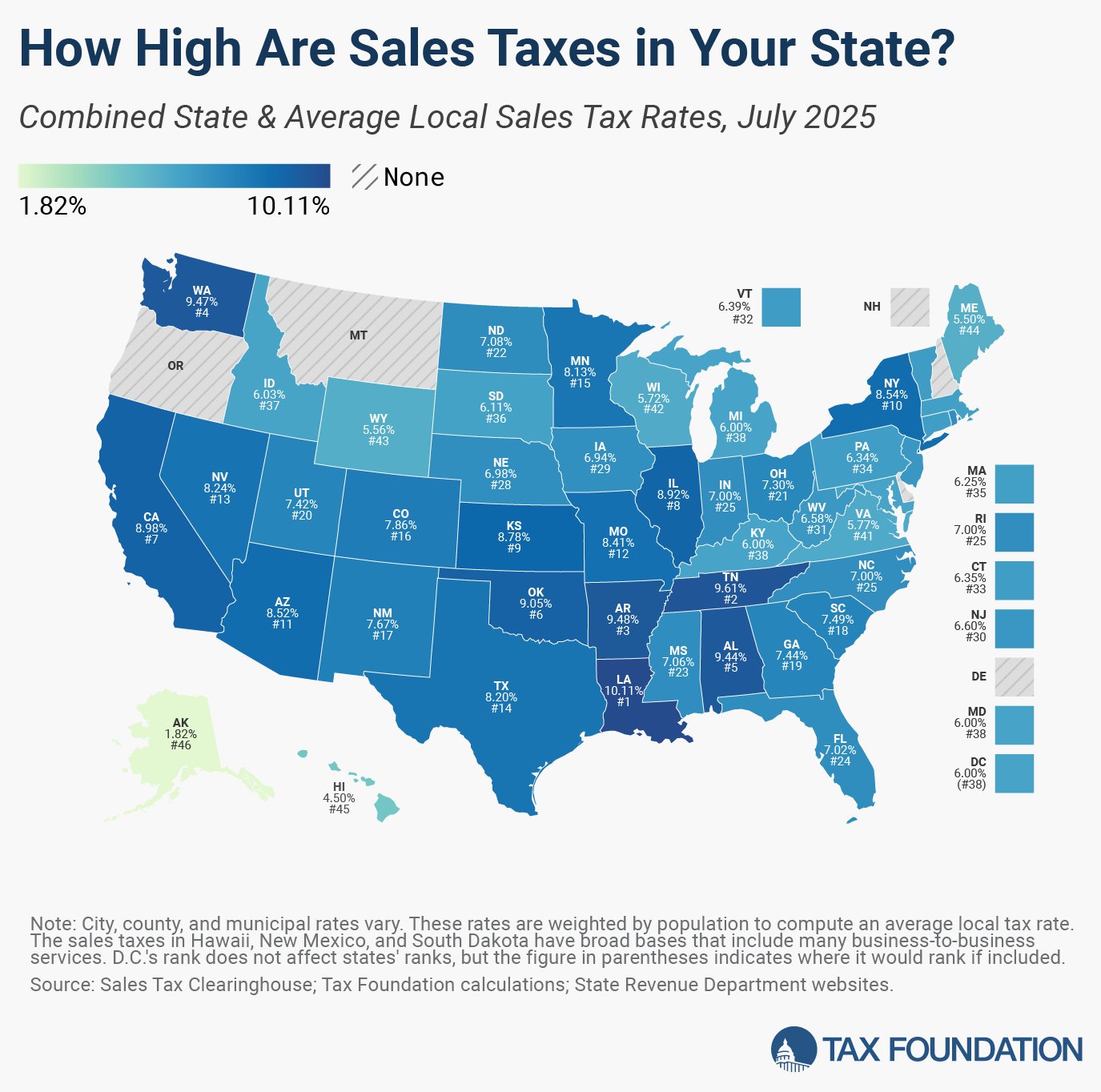

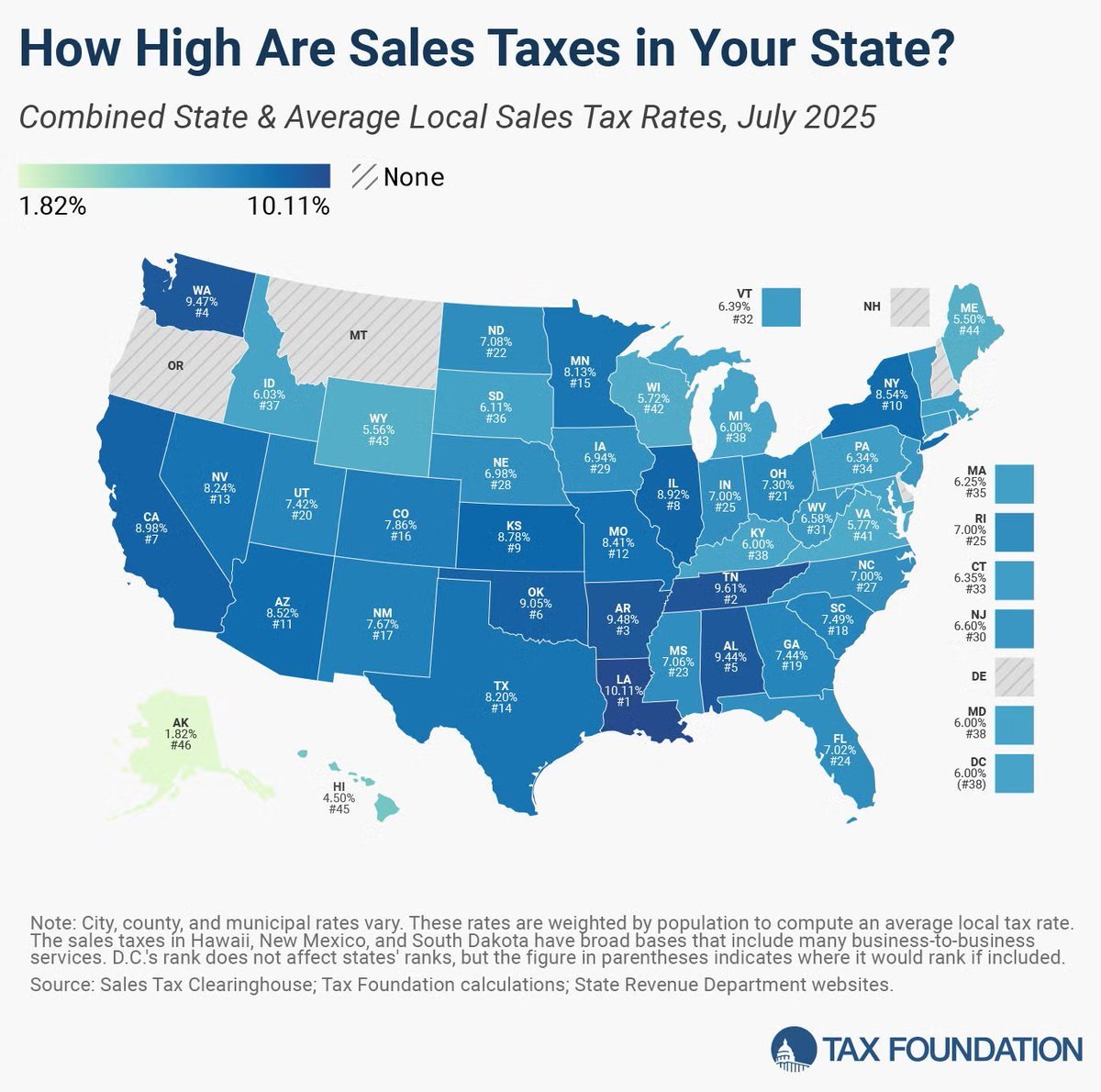

Sales tax rates aren’t the only factor that matters. The tax base—what is and isn’t taxable—can have a significant impact on the competitiveness of different sales tax regimes and the efficiency with which they raise revenue. Learn more about sales taxes:…

Tax rates are not the only thing to know about taxes. Their effectiveness in raising revenue and impact on personal and business decision-making are also dependent on their base. ▶️ Watch: hubs.ly/Q03ys-5d0

Taxes can be complicated, and understanding them requires going deeper than knowing the current tax code and how it impacts behavior. The #history of taxation—including why it was used and how it has influenced previous societies—can help us understand the potential benefits and…

💡 What is the Alternative Minimum Tax (AMT)? The AMT is a separate tax system that requires some individual taxpayers to calculate their tax liability twice—first, under ordinary income tax rules, then under the AMT—and pay whichever amount is highest. The AMT has fewer…

💡What is bonus depreciation? Bonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias…

Most taxes can be divided into three buckets: Taxes on what you 𝗲𝗮𝗿𝗻 Taxes on what you 𝗯𝘂𝘆 Taxes on what you 𝗼𝘄𝗻 Learn more: hubs.ly/Q03ystbr0

⚡𝐅𝐀𝐐: 𝐓𝐡𝐞 𝐎𝐧𝐞 𝐁𝐢𝐠 𝐁𝐞𝐚𝐮𝐭𝐢𝐟𝐮𝐥 𝐁𝐢𝐥𝐥 𝐀𝐜𝐭 𝐓𝐚𝐱 𝐂𝐡𝐚𝐧𝐠𝐞𝐬 Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code. hubs.ly/Q03ywmZL0

However well-intended they may be, sales tax holidays remain the same as they always have been—inefficient and ineffective. Read more: hubs.ly/Q03yn1wD0 #taxfreeweekend

In the US, retail sales taxes are a significant source of revenue at the state and local level. Forty-five states impose state-level sales taxes, while consumers also face local sales taxes in 38 states. Learn more about sales taxes around the US: hubs.ly/Q03yd49s0