Tax Foundation

@TaxFoundation

Leading nonpartisan tax policy research and analysis

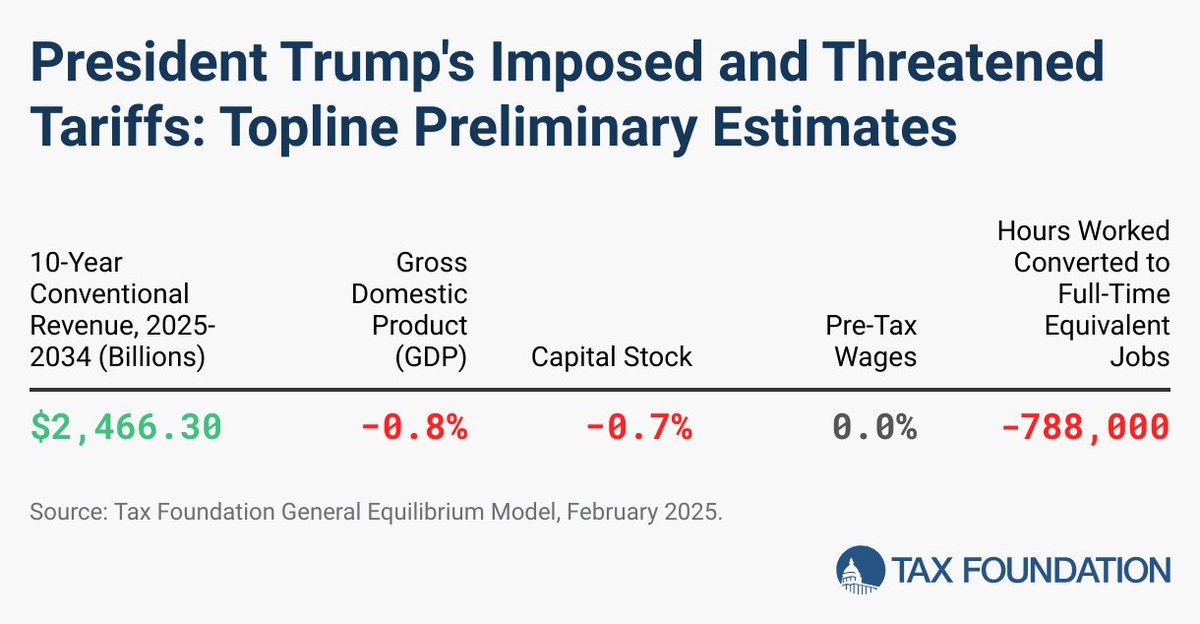

⚡️ Our new analysis finds that the Trump tariffs threaten to offset much of the benefits of the new "Big Beautiful Bill" tax cuts, while falling short of paying for them.

With pandemic-era savings now fully depleted and the majority of Americans pointing to their finances as their biggest source of stress, one thing is clear: the US needs policies that help people save more. Read more: hubs.ly/Q03x_q8d0 via @TaxEDU_

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost…

Our analysis finds that the Trump tariffs threaten to offset much of the benefits of the new "Big Beautiful Bill" tax cuts, while falling short of paying for them.

Rather than adding another overly complicated savings vehicle to the mix, the ideal solution would be to scrap the current piecemeal savings system in favor of universal savings accounts. hubs.ly/Q03x_r7s0 @ahardtospell

The most competitive tax codes in the OECD: 1. 🇪🇪 Estonia 2. 🇱🇻 Latvia 3. 🇳🇿 New Zealand 4. 🇨🇭 Switzerland 5. 🇱🇹 Lithuania 6. 🇱🇺 Luxembourg 7. 🇭🇺 Hungary 8. 🇨🇿 Czech Republic 9. 🇸🇰 Slovak Republic 10. 🇮🇱 Israel

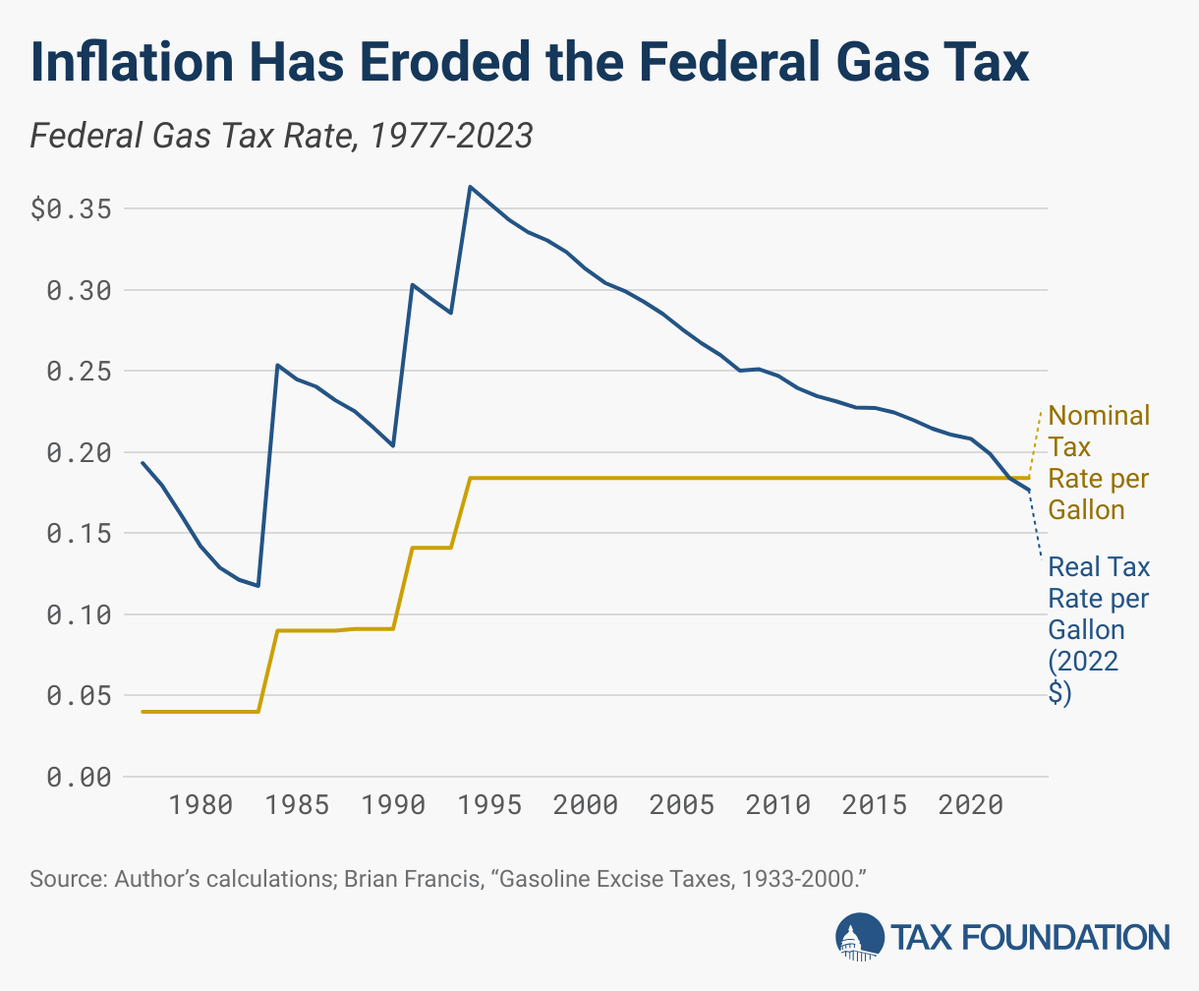

In recent years, highway funding has exceeded highway revenues, and the introduction of electric vehicles has made the gas tax increasingly obsolete. Read more: hubs.ly/Q03xCNN30

Who really pays tariffs? US firms and consumers, through higher prices. hubs.ly/Q03xD3J40

In 2022 the major college sports leagues (Big 10, Big 12, NCAA etc.) collectively earned $𝟑.𝟑 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 in program service revenues—mostly TV rights—all of which is untaxed. hubs.ly/Q03xCNWz0

Policymakers continue to debate international tax rules after the US gained agreement on a new approach at the G7 that could result in US anti-avoidance policies existing side-by-side with the global minimum tax. More from @danieldbunn: hubs.ly/Q03xCN-P0 #dst

⚡️ Tracking the economic impact of the Trump tariffs: Per US household, the tariffs altogether would amount to an average tax increase of nearly $1,300 in 2025 and nearly $1,700 in 2026.

The 10 states most in need of reform in the 2025 Index: 41. Massachusetts 42. Hawaii 43. Vermont 44. Minnesota 45. Washington 46. Maryland 47. Connecticut 48. California 49. New Jersey 50. New York hubs.ly/Q03xD5g00

Working from home is great. The tax complications? Not so much. hubs.ly/Q03xxWSx0 #remotework #taxes

What's in the One Big Beautiful Bill: 🟢 The Good 🟠 The Bad 🔴 The Ugly hubs.ly/Q03xnztJ0 @danieldbunn @ahardtospell @EconoWill

We provided an analysis of the key features of the Estonian income tax system—a simple, flat individual income tax combined with a distributed profits tax—and its potential effects if implemented in the United States. Growth & Opportunity Tax Plan: hubs.ly/Q03xnyRw0

Business investment in the UK significantly increased after two pro-investment reforms to depreciation allowances. Read more: hubs.ly/Q03xnzdB0 #uk #taxreform

Politicians often bemoan the trade deficit, but their disdain for this economic statistic is largely misplaced. The trade deficit reflects deeper choices about how we use our money, and reducing it may require lowering our standard of living. hubs.ly/Q03xnD-L0 via @TaxEDU_

Catastrophic rhetoric about US manufacturing is not justified. The tariffs are extremely counterproductive. Still, all is not well in the US manufacturing sector. What should we do? Read more: hubs.ly/Q03xnz0p0

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time). See how your state's tax code has changed: hubs.ly/Q03xnD0Z0

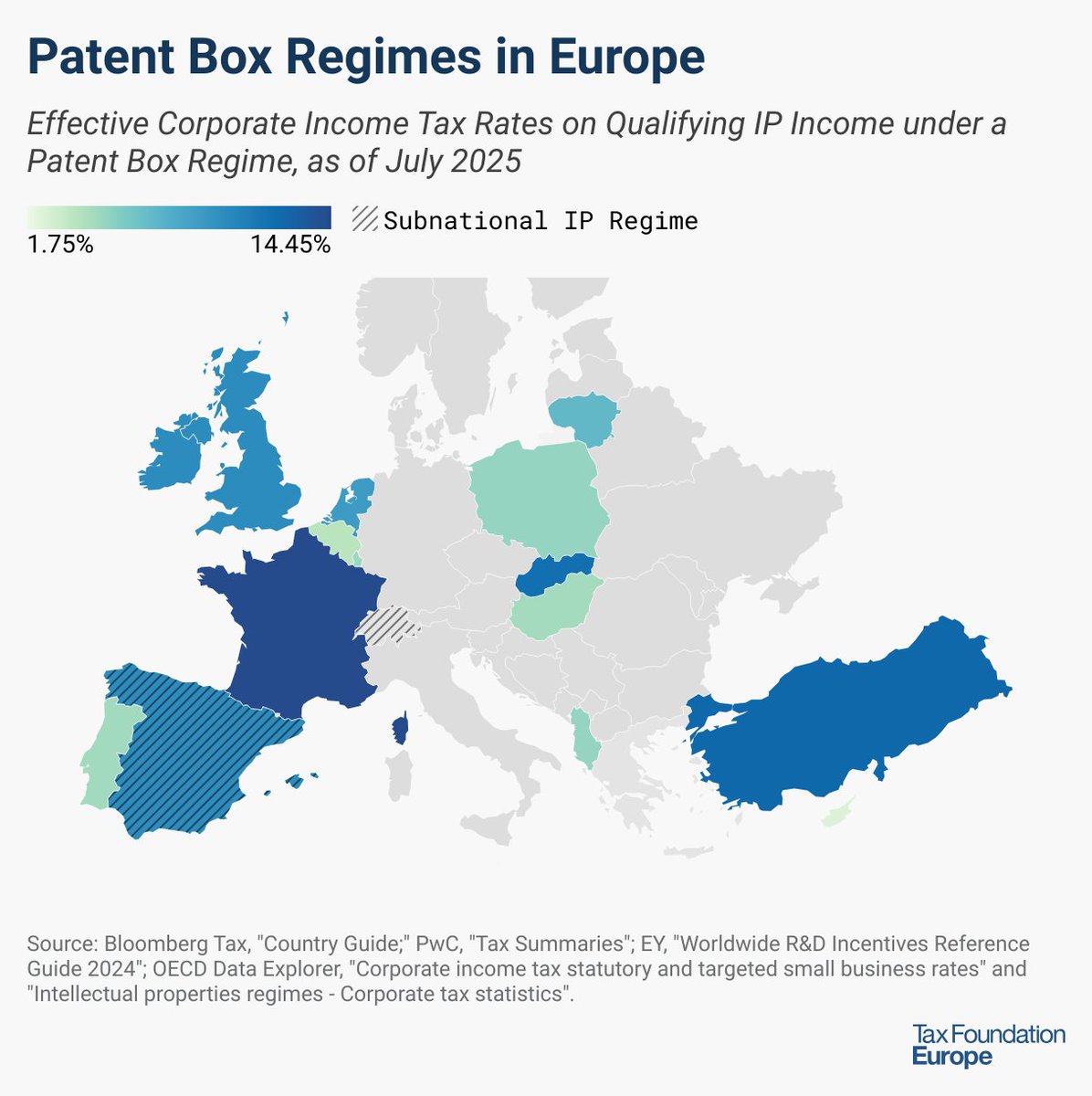

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions…