Ron Shamgar

@RonShamgar

Head of Aussie Equities & Portfolio Manager of TAMIM All Cap/Small Cap Funds. 21 yrs experience in ASX small caps. Investing is my passion. Views are my own.

🏆🏆 PERFORMANCE UPDATE 🏆🏆 Since joining 1/1/2019 the TAMIM All Cap Fund annualised +17.73% pa net (6 years) One of the best performing funds in Australia for mid/small caps 🚀 🏆 CY24 Fund was up +28.93% net 🏆 🏆 CY23 Fund was up +31.25% net 🏆 CYTD25 Fund up +4.00% 💪🏻💪🏻

For those interested, it’s worth dialing into Monday 5.30pm Webinar by $BXN Founder & CFO will give more detail about the biz and outlook Worth a listen 👇👇👇

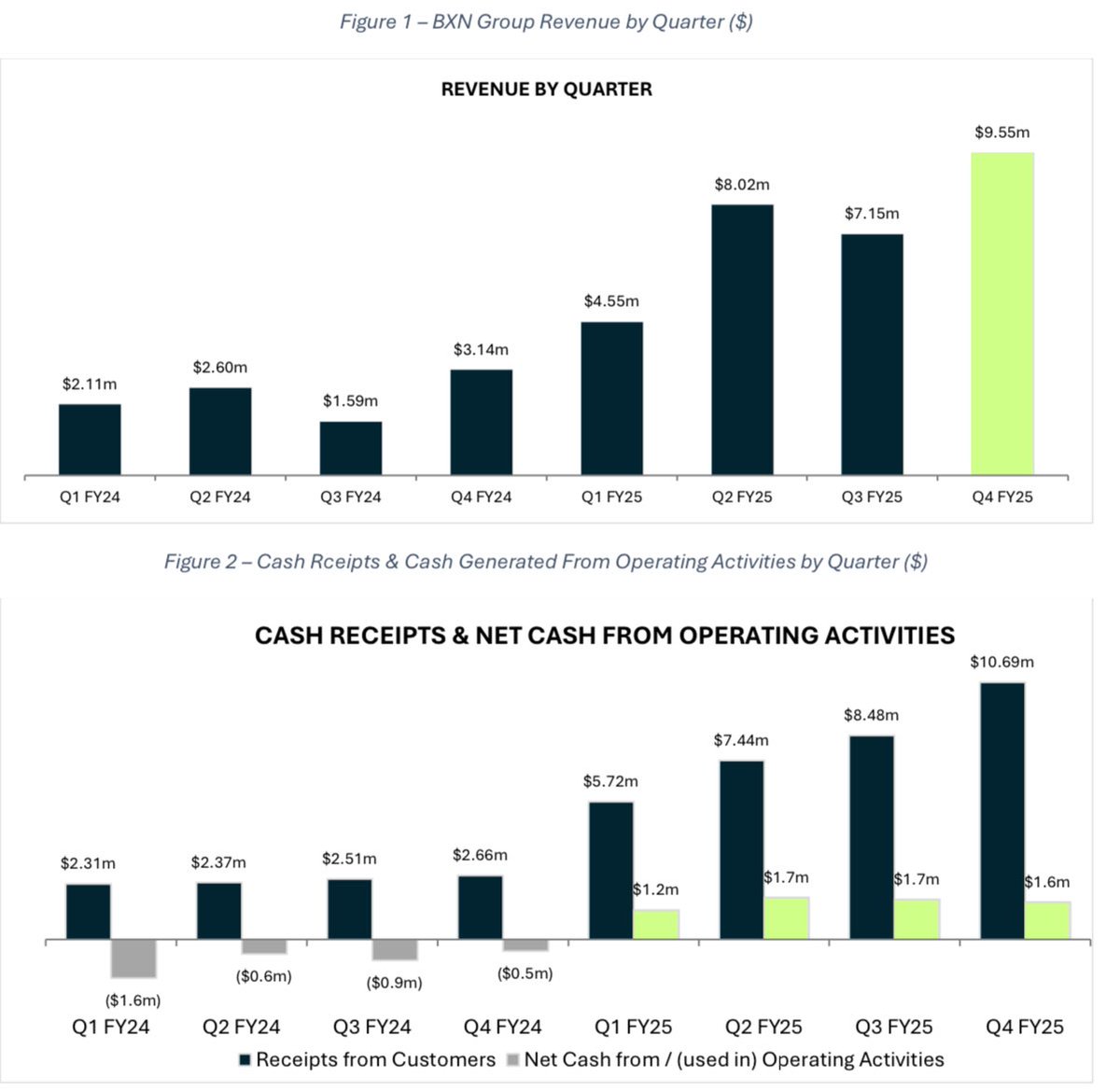

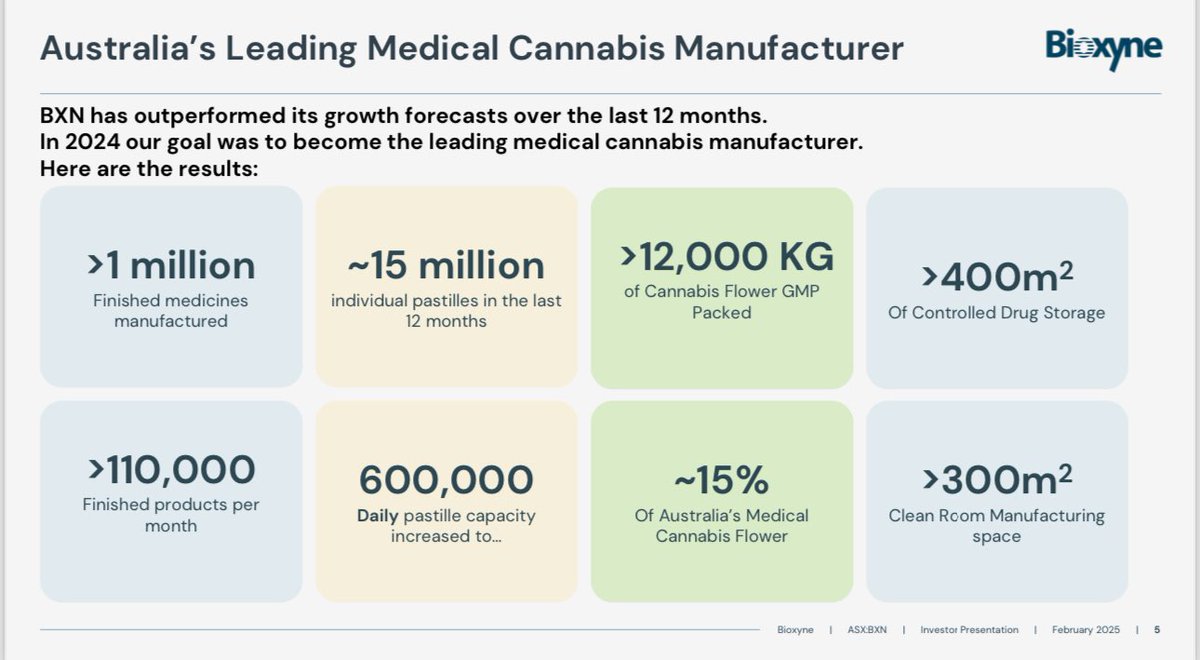

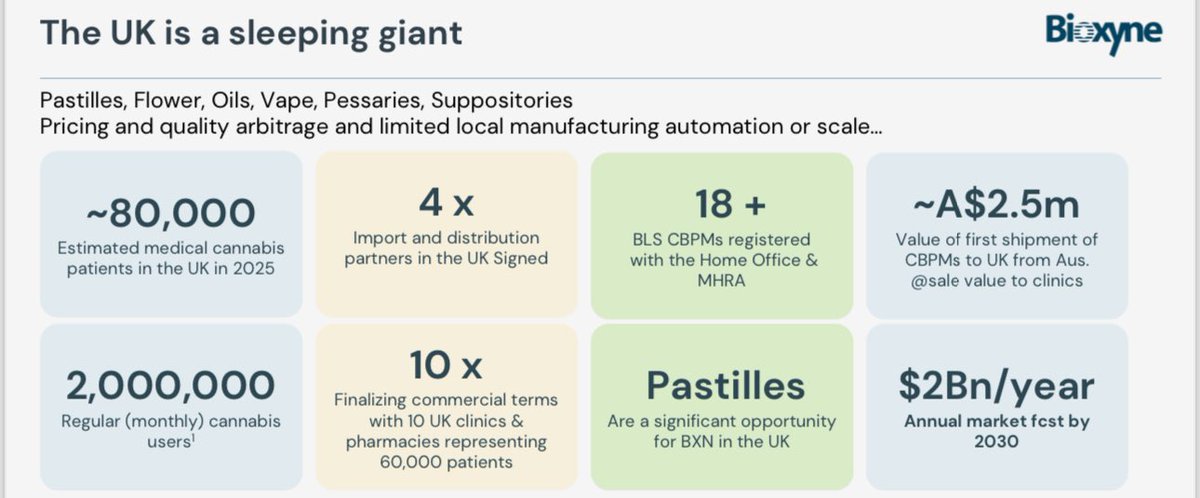

BioXyn $BXN is quietly becoming the Foxconn of medical cannabis. GMP-certified, scalable, profitable. EU contracts. Founder-led. One to watch. 👉 tamim.com.au/stock-insight/… Disc: $BXN is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially…

Dennis the menace finally delivers a clean quarter for $IMB and a strong cashflow result for the quarter. Ebitda is a miss to broker $40m estimates But the token buyback carrot will please investors 👏👏

Good interview 👇👇 Core holding for us since $1.50 in 2022 $GTK

Our CEO, Gary Miles, spoke with @shaw_foundation about his journey from building software in post-Soviet Russia to leading Gentrack in transforming utility retail through flexible, scalable platforms. Read it here: online.fliphtml5.com/zczta/nfrd/#p=1 #TechWithPurpose #EnergyTransition

Good report on $RZI by @RaasGroup 💪🏻 We think it’s worth $1.00++ (Held) 👇👇👇

Great summary of $RZI.AX by black cat .. quality poster on X

Once in a while we find an opportunity that ticks all the boxes we look for: Founder led, industry leader, Growing profitably, Cashed up, under the radar & Cheap !! Bioxyne $BXN is ✅✅✅ 👇👇👇 tamim.com.au/stock-insight/…

Keep an eye out for our 4pm newsletter today….. will be disclosing an exciting and under the radar growth stock that no one owns or covers… yet! 👀 Stay tuned…. 👀

Falling rates should improve Raiz $RZI near term performance through: 1. Improving returns & public interest in the markets 2. Enticing new customers in search of better yields for their savings 3. Improving user engagement in the app 4. Increasing size of users monthly deposits

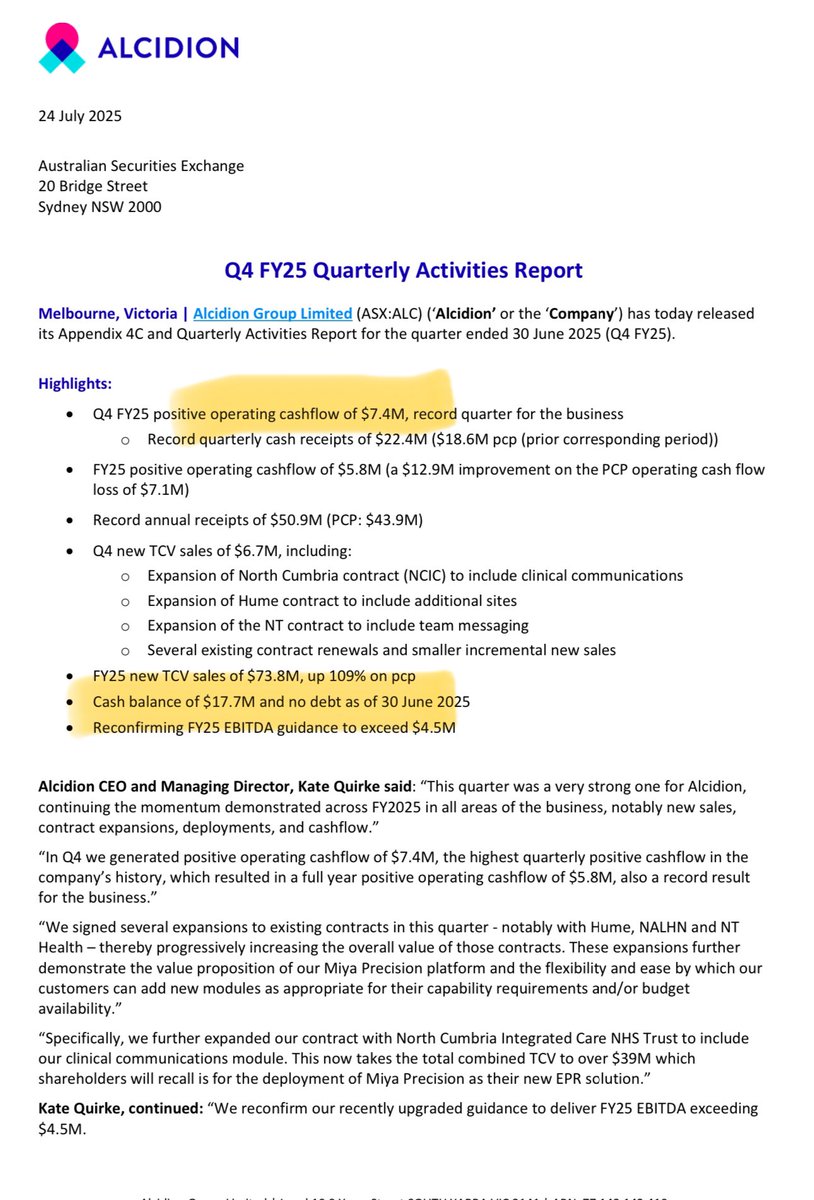

Strong quarter and finish to FY25 for our holding in Alcidion $ALC Unlike other software companies they don’t capitalize anything so Ebitda is PBT !! Growing healthcare tech biz, profitable and $18m cash in the bank! That’s how we like them 💪🏻 👇👇👇

Another reminder that new highs are part of investing and if you get scared when they happen, you'll likely miss out on continued gains.

America is winning 🚀

TRUMP ANNOUNCES JAPAN TRADE DEAL - $550B INVESTMENT FROM THE JAPANESE INTO THE US - 15% TARIFFS Japan was one of the big 7 countries to get a deal done with, if this is official… bullish 🚀

Great update from $AHC.AX today, continuing to blend organic and acquisitive growth well. With full run-rate from the recent NZ acquisition in FY26 they are on track to deliver $10-11m NPAT this year against the current $120m market cap with $15m in the bank.

Huge 👇👇

The United States just announced a new trade deal with Japan. Japan will invest $550 billion in America and they will also pay a reciprocal tariff of 15% to the US. Crazy.

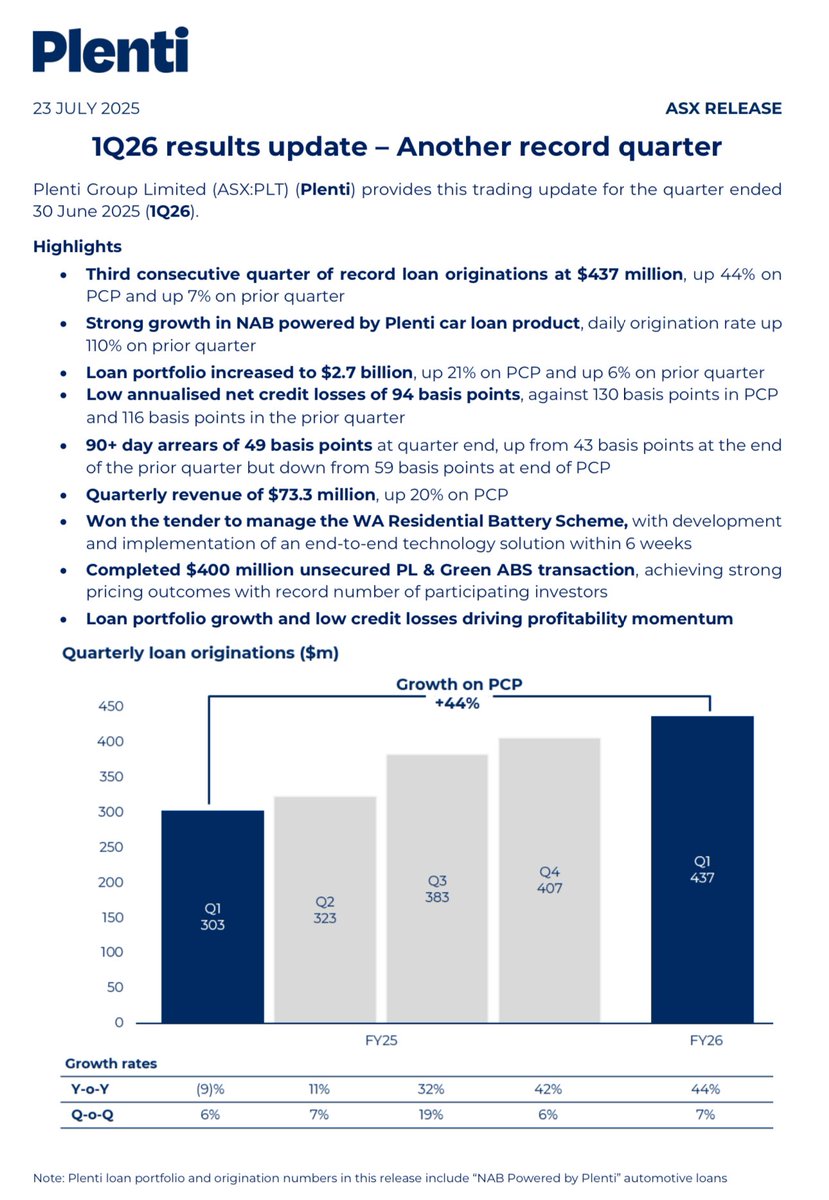

Plenti $PLT continues to deliver the highest quality lending growth on the ASX On track for at least $25m Cash NPAT this year We will be shocked if $NAB doesn’t acquire them within the next 3 years 👀 (Held) 👇👇👇

Incredibly strong result and an upgrade for our holding in Austco $AHC FCF in excess of $8.2m 💰💰💰 We think FY26 is setup for at least $17m of Ebitda No reason why this biz isn’t worth at least 45 cents 💪🏻 👇👇👇