AT

@ryu_tay

ASX investing whinging diary | No financial expert 🤷🏻♂️ | Core Portfolio - Top 15 stocks ~60%; 35 stocks ~40%; 100% invested at all times

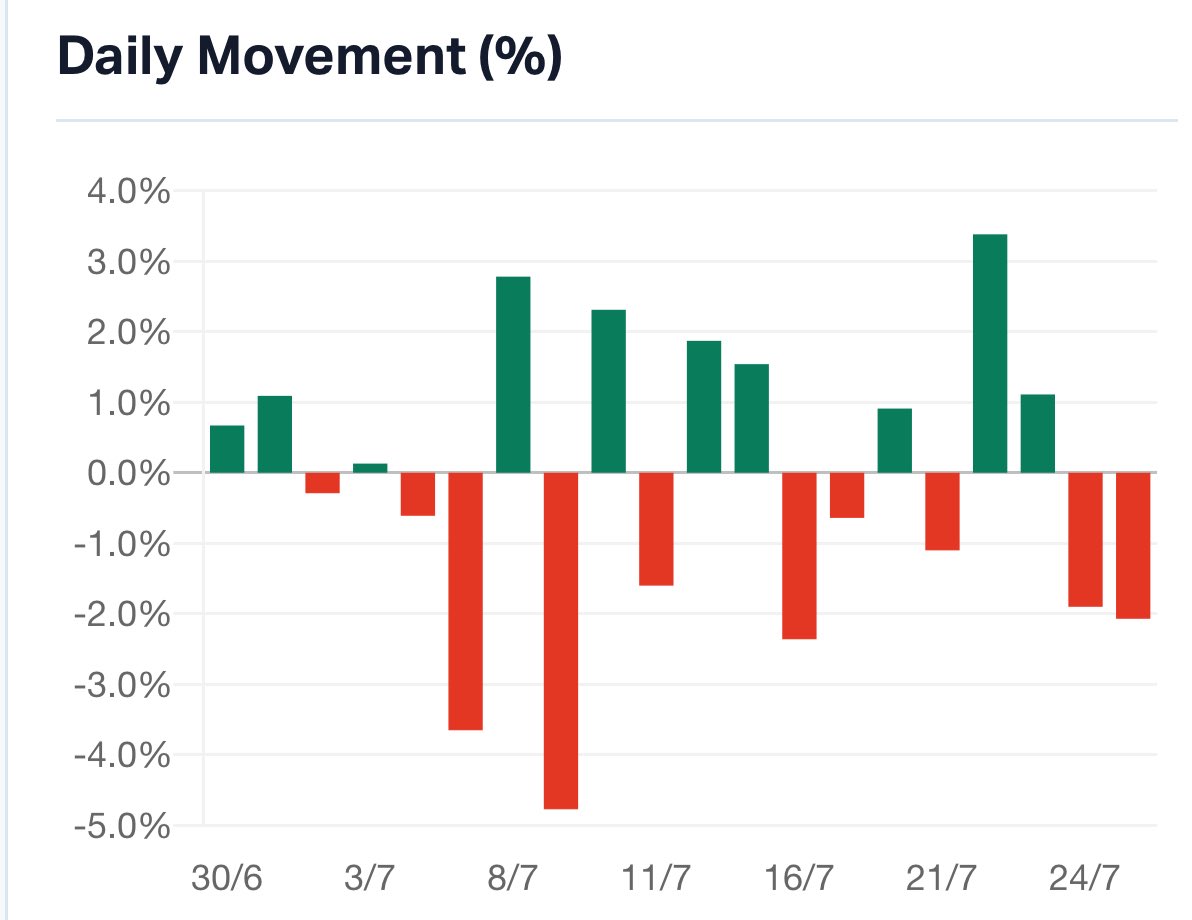

Okay that's the wrap for FY25, it was a modest return +10.76% (H1 did the heavy lifting), nth to brag about unfortunately🫠 Oh well, it could have been a lot worse I guess😉 Top 10 Contributors: TNE, EOL, PME, TLX, OCC, CAT, AIM, XRO, CDA, CGF Top 10 Detractors: AD8, MIN,…

I had a fabulous May. Portfolio up 7.6% ⬆️, finally got back above water ytd 🥹 Who would have thought, after all the madness and switches here and there 😵💫, most of the original names I have or had are back above new high 🤷🏻♂️ And all the “hedges” and “values” I switched to in…

Why $CPU popping 3% today? Not like yields popping or anything 🤷🏻♂️

Nice base (A.T.) here on $CPU

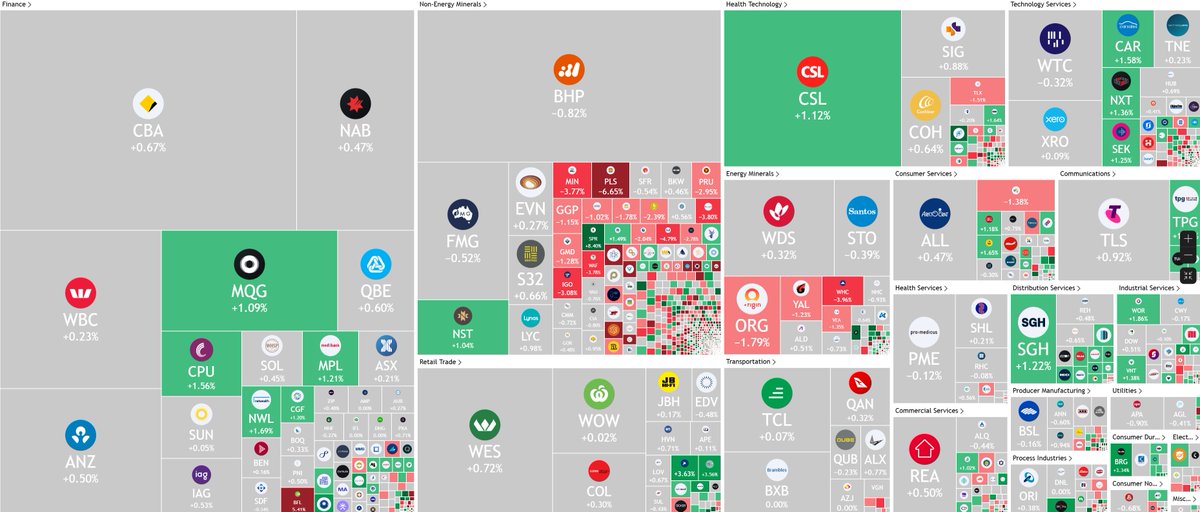

Typical risk off Monday with money fleeing into large caps of each sector, dumping everything in resources. Is this the end of resources boom or just profit taking? Healthcare continues to see inflow while spec stocks getting whacked today.

#AL3 has received strong demand signals from the UK defence market, similar to those that underpinned AML3D’s successful entry into the US defence market

Reminder that @vonderleyen nuked EU-China relations to suck up to Trump. She could have tried to play one side off against the other. But she just doesn’t have the IQ for that - which is why the Americans promoted her. In the end Europe got nothing but more humiliation. 🇪🇺🚽

#Lithium bros absolutely rug pulled today That was lucky quick trade on $PMT

guess who's back!? #LITHIUM 💥

Pretty bad breadth, tiny greens across sectors but big dump in small names. Lithium, Uranium getting whacked~

$STN “One ounce per 80 tonnes – that’s what miners can make money on now. At gold north of US$2300 an ounce, the economics of what’s considered ‘mineable’ have changed dramatically” afr.com/companies/mini…