Matt Reustle

@ReustleMatt

Crossing the wall between capital and content Host: @bizbreakdowns Former: Raven Capital + GS Research

I'd guess Pritzker is the investor blueprint most would romanticize being: - Insane returns - Generalist, mainly opportunistic - Napkin math + sophisticated structuring - Admired by other GOATs - Mysterious via avoiding media - Humble in any interview

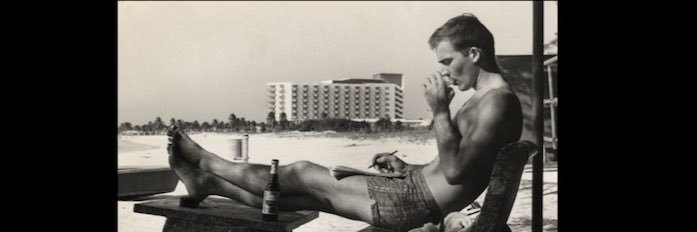

Rainmakers is back with another episode. This time on the legendary investor Jay Pritzker. In his father's first ever TV appearance he tells a panel of fellow businessmen why he disdains the media for the ways they portray his family. 41 years later, I give it my own shot.

I always respected John Collison, but he hit another level by incorporating this hybrid "ring a bull" game. And as someone very opinionated on interviewers, he is top tier.

While most people tighten up to look credible, @PabloTorre is showing us there is another way. It's hard to find better investigative work out there.

While I am more of a catch-and-release guy, this is a fun read. Kudos to TheMaterialReview for consistently finding entertaining reads. life.com/destinations/j…

One of my favorite podcast episodes of the year. Great behind-the-scenes looks from a great writer. Plus history lessons and reality checks. Kudos @bryancurtis

I am almost certain he knew the market leader $EXPD had a $10bn market cap at the time. Genuinely curious why he didn’t mention that… seemingly big enough and gives the market context? Also, this was entertaining.

Watch @typesfast pitch Flexport to Paul Graham and Sam Altman for the first time at Startup School 2013:

A thank you to @EverestBrady for letting me pepper him with questions about “being a machinist” for 30 minutes. The definition of “you learn something new every day”

This is another $30bn+ market ap company that I didn't know existed. (Note: There are 720 so give me a pass) Marc was excellent - and especially for explaining "chromatography" in simplified terms.

Today, we break down Agilent. Agilent is a leader in instruments, software, and services to 285k labs - or the "picks and shovels" to Biopharma, Pharma, and Diagnostics. Marc de Vos, Fund Manager at Troy Asset Management, joined to cover this HP-born market leader.

Dejounte Murray says Gregg Popovich tried to use his own money to move Dejounte’s mom to San Antonio after finding out she had been shot “It was so crazy—a lot of my people don’t even know this. From family, friends, and the penitentiary… Pop didn’t want me to go to Seattle.…

This is selling NVDA in 2016 after “a nice run”.

I’m afraid I can’t help but cringe when thinking about linen anymore. It’s too old money tiktoker-coded now