Quant Insider.io

@QuantINsider_IQ

Quant Finance Education| GenAI Backed Algo Trading Platform http://quantinsider.algobulls.com| Daily Thread on Quant Trading/Research/Dev | Linkedin 125k+

Quant Insider is the Fintech Partner and an official Sponsor of the 21st Quantitative Finance Conference in Palermo, Italy 🇮🇹 Stop by our kiosk Sept 24–26 to explore quant finance education, algo-trading tools, Real time Risk systems, & talent hiring solutions. Learn more…

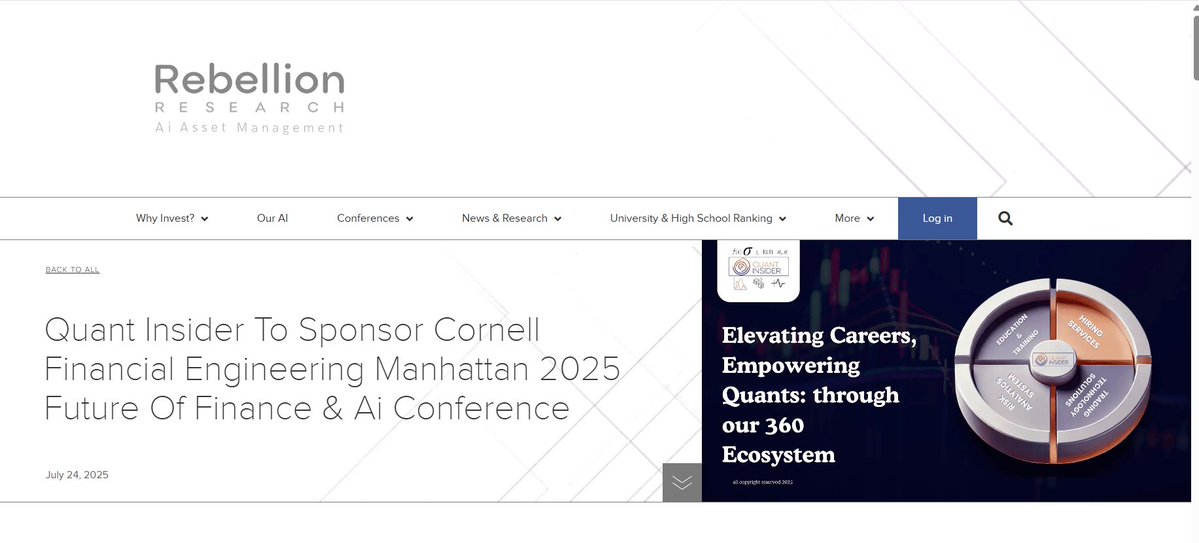

Shaping the Future of AI in Finance – Quant Insider at CFEM 2025 We are proud to sponsor the Cornell Financial Engineering Manhattan 2025 Future of Finance AI Conference – a gathering of the world’s leading thinkers, innovators, and decision-makers redefining the financial…

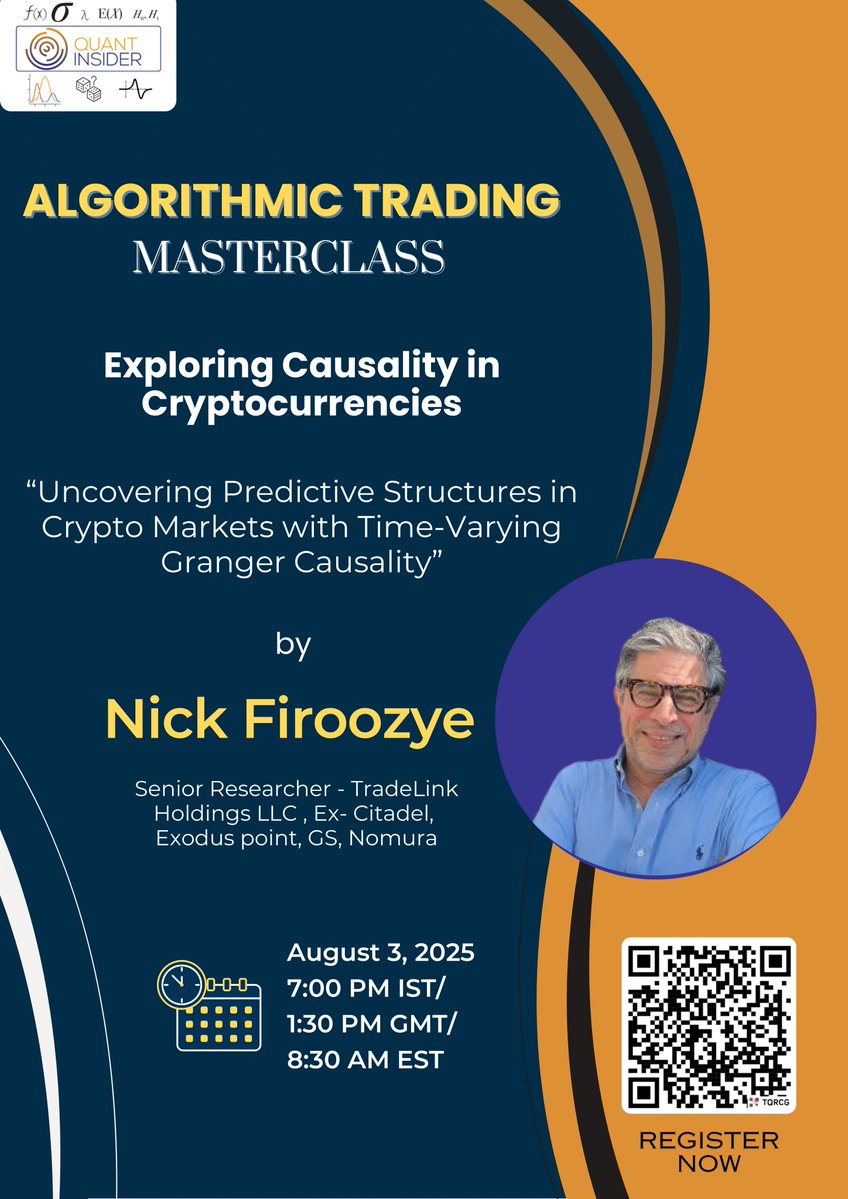

Can one crypto predict another? Can causality boost your alt-coin forecasts? Join us for a hands-on free workshop with Dr. Nick Firoozye, where he decodes causal relationships in crypto markets and builds robust forecasting models. "Uncovering Predictive Structures in Crypto…

Hey @grok who was the most famous person to visit my profile in the last 3 years? It doesnt need to be a mutual, don’t tag them, just say who it was using handle without the @ sign.

This 👇🏻describes what kinds of degrees/background, and personality traits SIG hires for from Todd, the trader of traders himself. Short read if you are an aspiring trader!

SIGs Todd Simkin actually describes their screening on a podcast

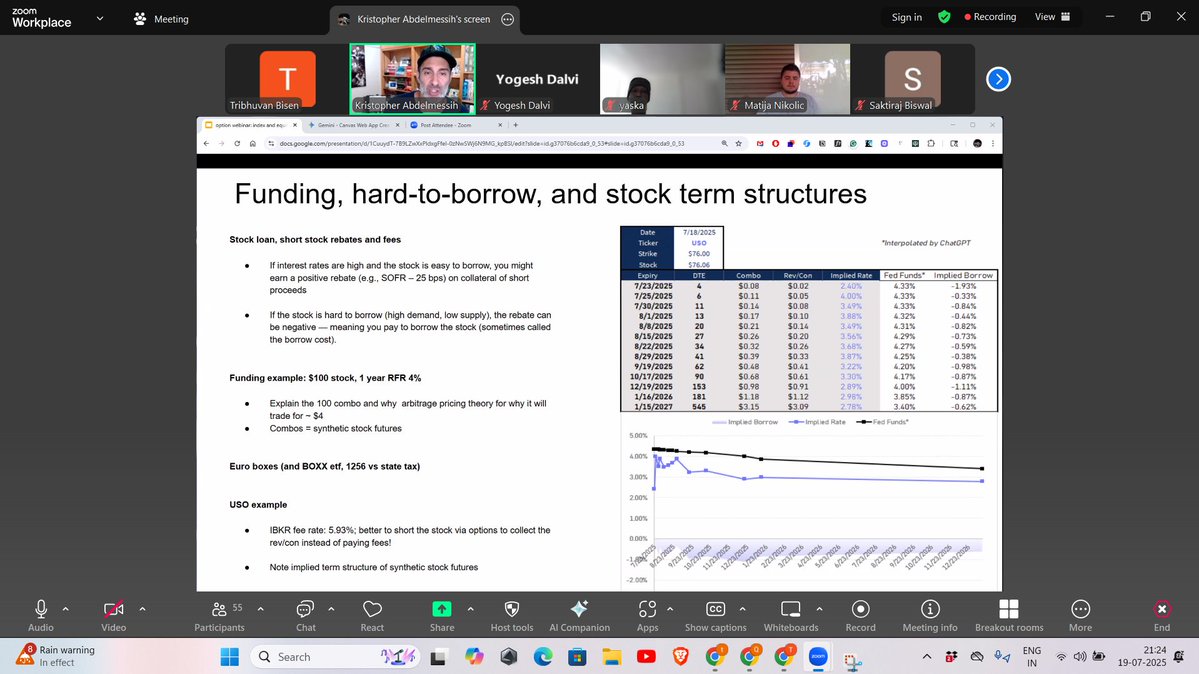

Live with @KrisAbdelmessih on Day 2 of "Index and equity Options" Workshop

We are live with @KrisAbdelmessih on Day 1 of "Index and equity Options" Workshop

"We trade the volatility smile" – gets crushed by the volatility term structure shift Last 24 hours left to register for our intensive two-day workshop with @KrisAbdelmessih on Options Trading in Equities and Index Options, designed to bring you from foundational principles to…

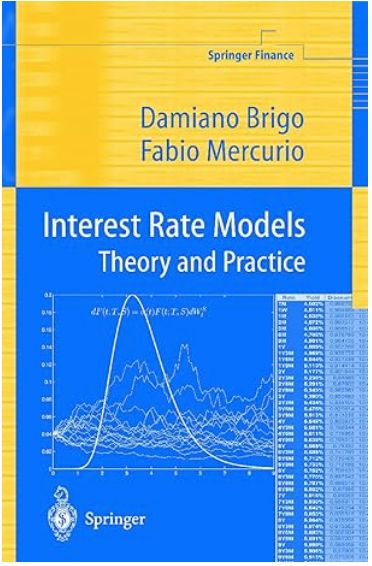

"Interest Rate Models: Theory and Practice" by Damiano Brigo and Fabio Mercurio, is one of the most comprehensive books in the field of interest rate modeling and is widely used by quants in both academia and industry. Join us for an intensive two-day workshop, with…

Join us for an intensive two-day workshop, with @KrisAbdelmessih , on Options Trading in Equities and Index Options, designed to bring you from foundational principles to real-world trading insights. Whether you’re a relative newcomer seeking a solid introduction or an…

How is market-making in commodities options different from equities @KrisAbdelmessih Register for our intensive two-day workshop, with @KrisAbdelmessih , on Options Trading in Equities and Index Options, designed to bring you from foundational principles to real-world trading…

Watch this video to learn "What is Relative Value in volatility trading?" from @KrisAbdelmessih Register for our intensive two-day workshop, with @KrisAbdelmessih , on Options Trading in Equities and Index Options, designed to bring you from foundational principles to…

Here @KrisAbdelmessih addresses the question, “How do you decide if a premium is cheap or expensive? What metrics do you use?” Kris recommends a robust approach: Register for our intensive two-day workshop, with @KrisAbdelmessih on Options Trading in Equities and Index…

Deconstructing a Volatility Spread Trade @KrisAbdelmessih Register for our intensive two-day workshop, with @KrisAbdelmessih , on Options Trading in Equities and Index Options, designed to bring you from foundational principles to real-world trading insights. Whether…

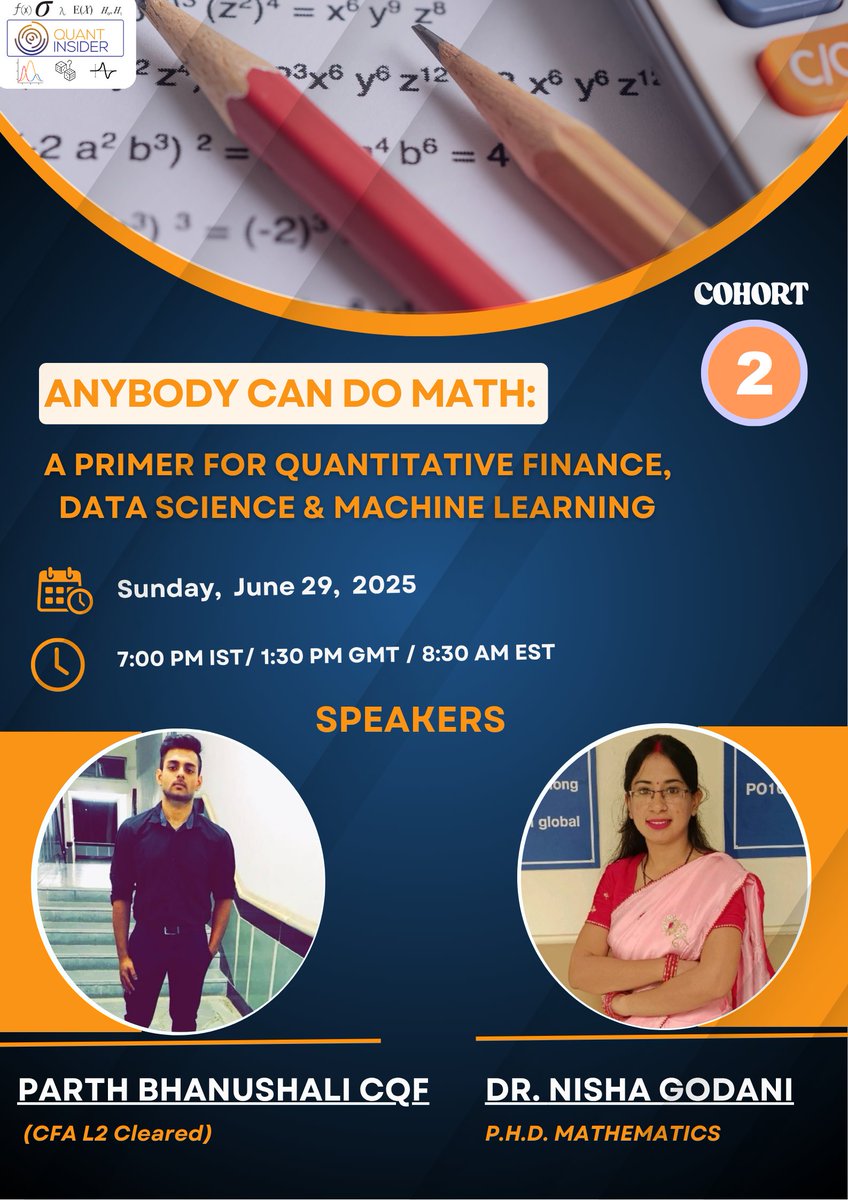

Join us on an exclusive free Webinar: "Anybody Can Do Math – A Primer for Quantitative Finance, Data Science & Machine Learning" 📅 Date: Sunday, June 29, 2025 📷 Time: 7:00 PM IST / 1:30 PM GMT / 8:30 AM EST Register Now for the Webinar - topmate.io/quant_insider/… We will…

Citadel, IMC, Virtu and other PFOF firms have formally asked the SEC to pause a proposed IEX-style options exchange, noting that its planned latency protection could tighten bid–ask spreads and affect existing PFOF system. Why Citadel, IMC, Virtu and other players are worrying…

Citadel Securities is asking the Securities and Exchange Commission to stop a new exchange founded by the stars of Michael Lewis’s 2014 book “Flash Boys” from entering the options market bloomberg.com/news/articles/…

Our Article on "Vector-Based vs. Event-Based Backtesting" is up on @IBKR Quant interactivebrokers.com/campus/ibkr-qu…