Shawn Hackett

@feridex11

President of Hackett Financial Advisors Inc. providing Ag price forecasting for Farmers around the world

“The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.”

In todays video interview with Casey Seymour we talk grain markets heading into year end, increased recent volcanic eruption activity, the cooling Atlantic ocean trends and what lies ahead for weather the decade from 2028-2038 where almost no sunspots, cooling oceans and large…

Please take the time to watch our 25 minute video interview this am with Casey Seymour of moving iron regarding grain markets, short term technical support levels to watch and what possible extreme downside targets may be possible heading into August if the bearish trends gets…

Be sure to watch our TV Interview last week on the nationally broadcast agricultural show "market to market" from Iowa-Pbs. We talk grain markets, livestock markets and cotton and emphasize what could be very counter seasonal weather for the US growing season what might be a…

Be sure to watch our TV Interview last week on the nationally broadcast agricultural show "market to market" from Iowa-Pbs. We talk grain markets, livestock markets and cotton and emphasize what could be very chaotic spring weather for the planting season and post dormancy…

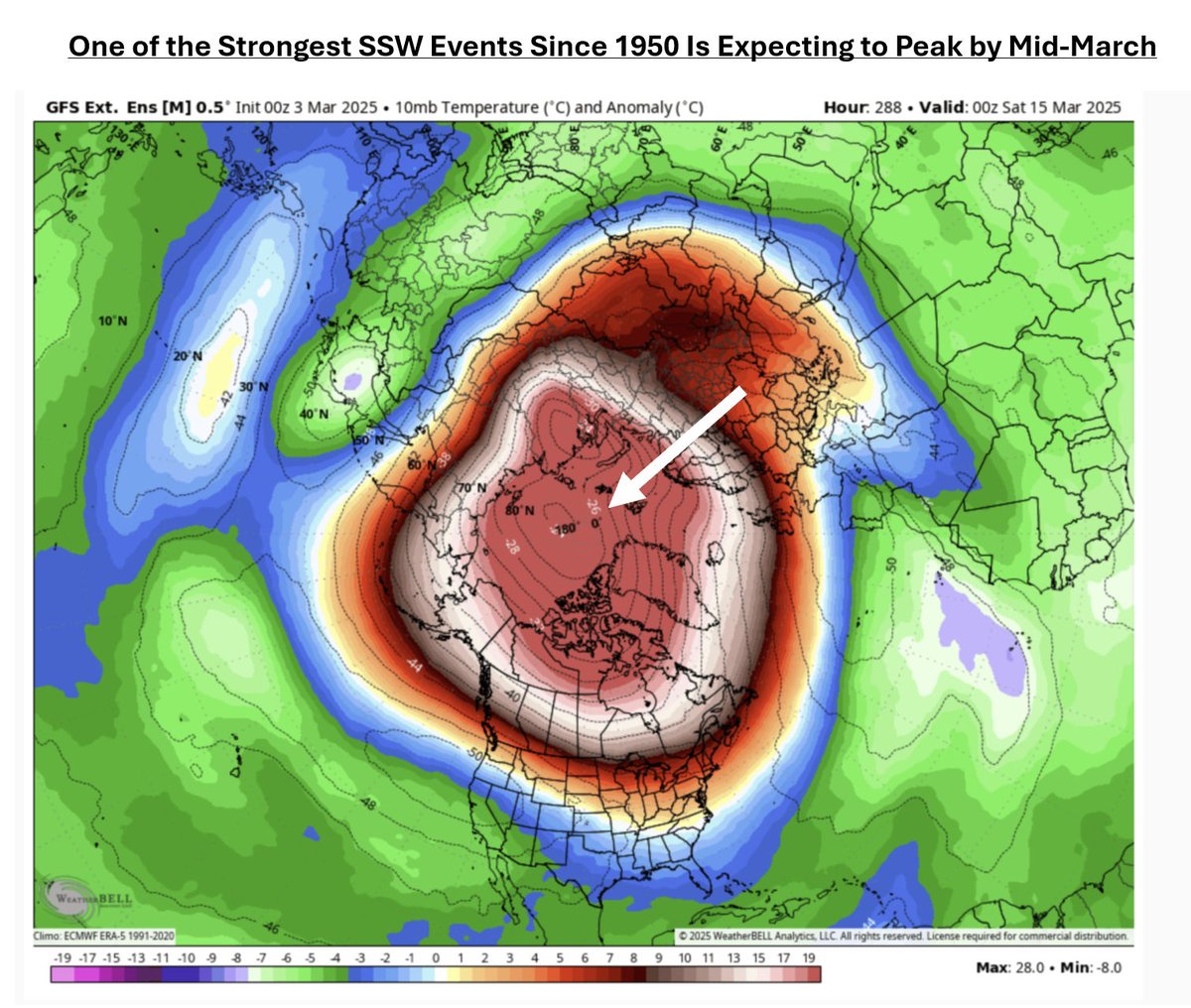

The grain markets and especially the wheat market have come under intense pricing pressure from the headline fears over an escalating global tariff trade war. Under the surface however, are a building set of highly correlated teleconnections that spells a higher order risk for a…

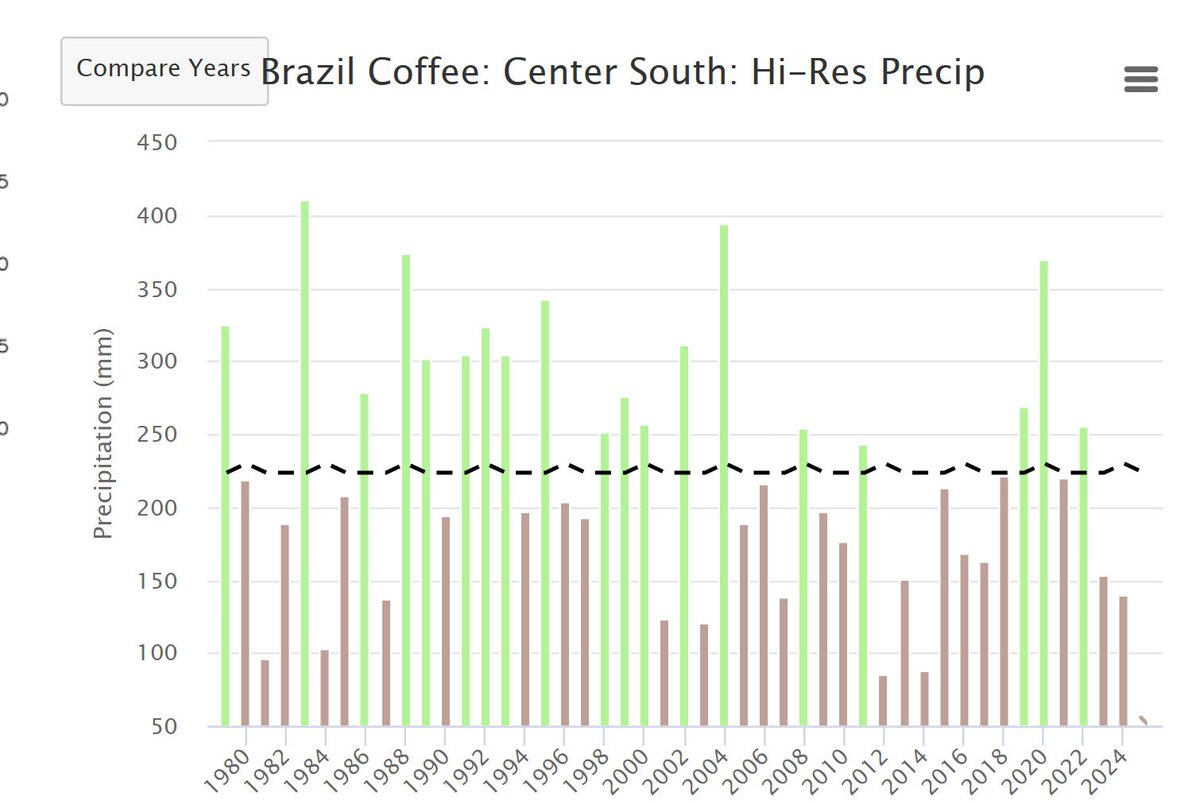

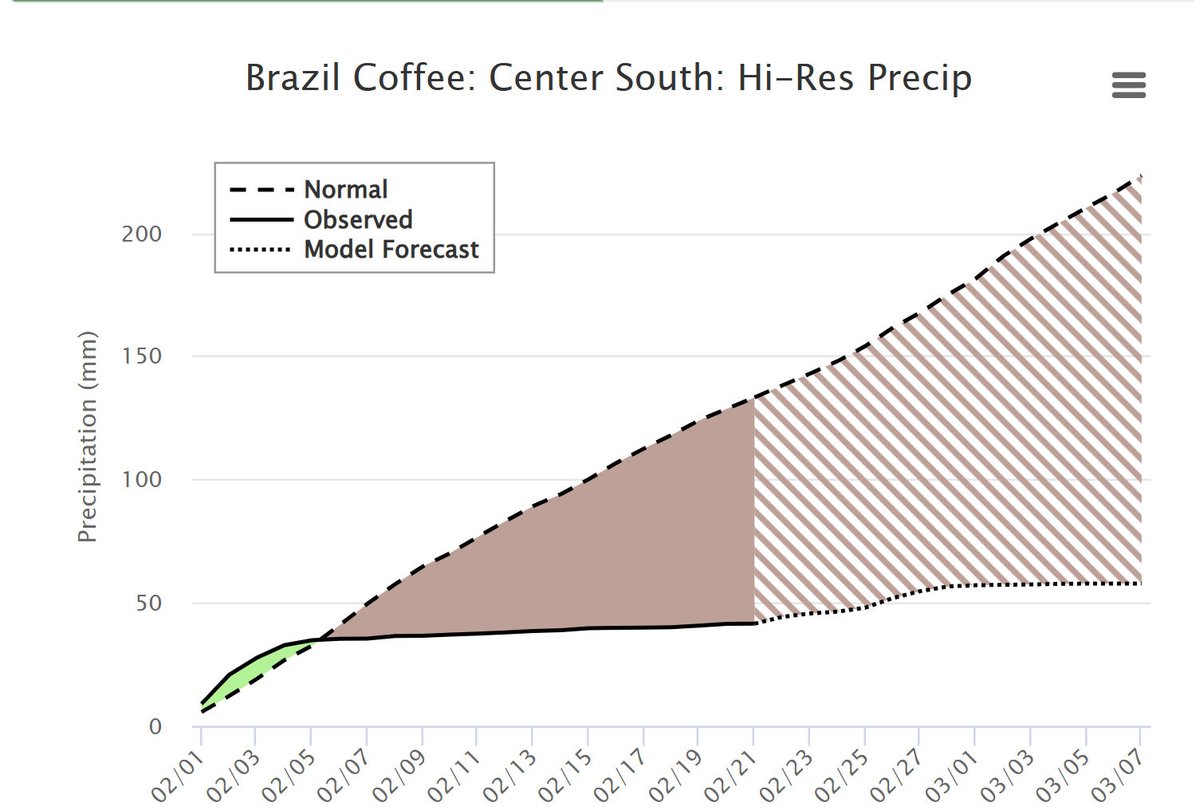

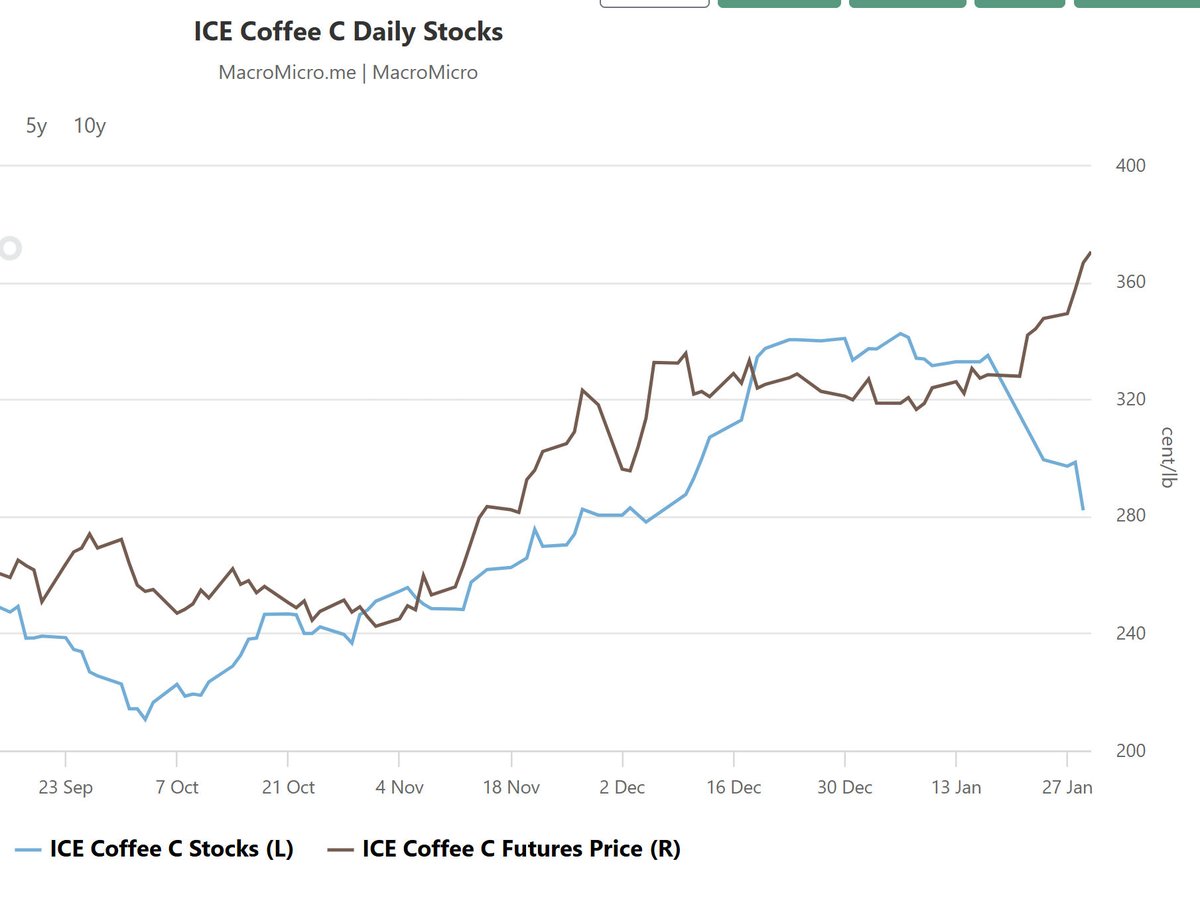

The coffee market has experienced its first bout of price vertigo stemming from a lack of liquidity within the cash market from bankruptcies and bank credit line withdrawals etc. that is forcing hedge books to be unwound, a reduction in cash coffee inventories adding short term…

It is always important to understand the narrative in any market as the drivers can change suddenly and making sure you are monitoring the correct variables is very important to determine the state of the current trends in any Ag commodity market. The latest spike in coffee…

Be sure to check out or recent interview with Chip Flory's Agri-talk program where we talk the weather risk points in the upcoming 2025 growing season which feature higher order elevated risks for US and Canadian Prairies drought and equally elevated risks for a 2nd year in a row…

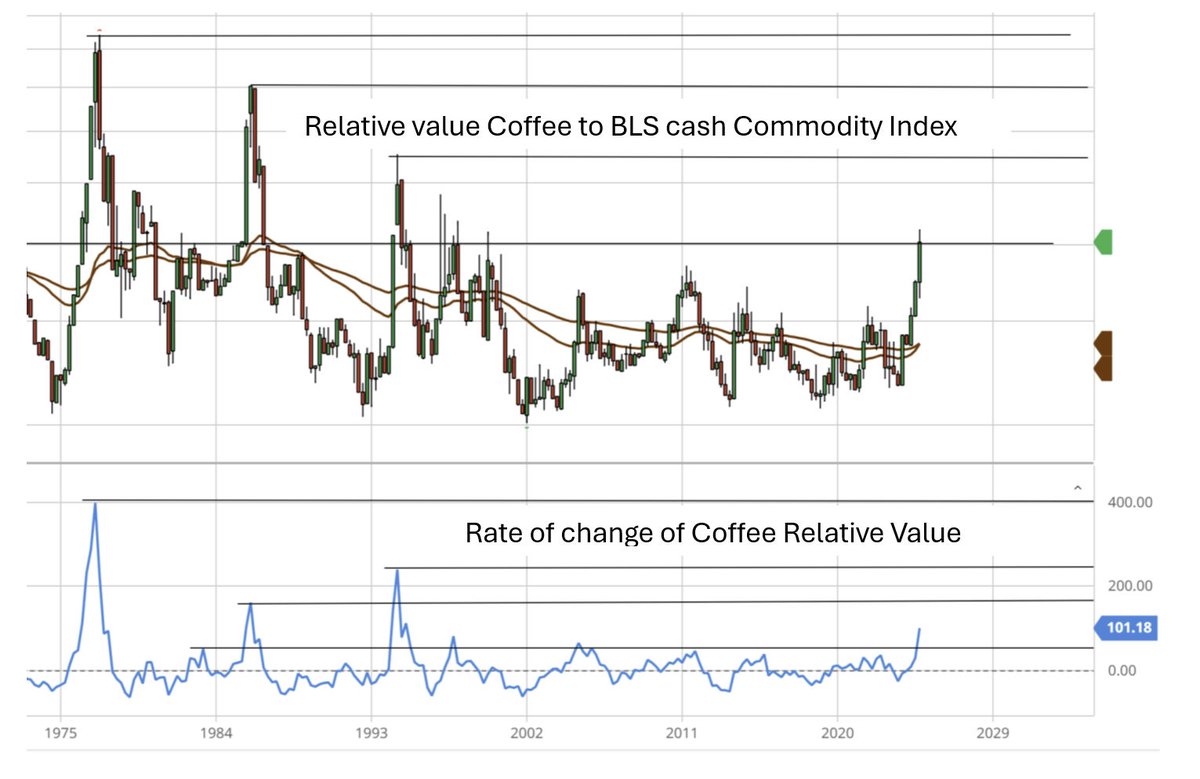

In my experience, the only way to adequately reflect upside/downside price potential in any commodity market is to measure the price of a particular commodity relative to all other commodities and then relate that to the historic DNA of that market over a 50 year pricing window.…

For those of you that have an interest can watch our Friday appearance on the national Ag TV show from Iowa-PBS "Market to Market" Using the green links below in which we go over grains, livestock, cotton and other factors. The post Trump election trade has been fast and furious…

Be sure to watch our recent interview with moving iron regarding grains, OJ, cotton, Cocoa and near the end the potential for a coffee market supply squeeze and what to look for. youtube.com/watch?v=dkcYlL…

For those that remain complacent about the current depressed values of #commodities and #energy prices should consider the musings of Jordi Visser who eloquently writes about the potential confluence of three synchronous cycles of exponential #ArtificialIntelligence adoption,…

Despite challenges, the US ag economy may be more resilient than expected Free Demo: info.ironsolutions.com/moving-iron-po… 🚀 🎥 Watch: loom.ly/Mz4Iuvk 🎧 Listen: loom.ly/9Rxf8Lw @AxonTire @AgDirect @IronSolutions @FusableData @EDAdata @Valleytransinc @TalbottBrothers

Please take the time to watch our recent video interview with Real-vision-TV where we go over various historical #weather #cycles that throughout history have created escalating #climate and #agricultural #price #volatility. We also discuss certain areas to watch over the next…

Be sure to check out our appearance/Interview last Friday on the National Ag TV Show "Market to Market" from Iowa PBS. We talk grains, livestock, cotton and why increased global liquidity growth at some of the highest growth rates since post covid may begin an overall commodity…

Be sure to watch our interview this week with @chipflory on our #weather #cycles @agritalk our segment starts at time 9:21 for #grains @MarketToMarket omny.fm/shows/market-r…

Join us on Tuesday, July 2nd @ 5:00 PM MST, as Shawn Hackett, President and CEO of @feridex11, discusses his work on long-term #weathervolatility and its effects on commodity prices. Shawn will discuss his work in depth and take questions live from the audience. I hope you join,…

Be sure to check out our appearance/Interview last Friday on the National Ag TV Show "Market to Market" from Iowa PBS. We talk grains, livestock and why this year may rhyme with 1983 and 2011 for a more severe US crop problem. You can watch our first segment using the link below…