Pendle Intern

@PendleIntern

Chief Meme Officer (CMO) @pendle_fi || Shitpost Extraordinaire🥇|| Grand Wizard of Pendle 🪄 || Wingardium Leveyieldsa ⬆️ Powered by @KaitoAI

This is even more true today than before. Ethena PTs are now up to 10%-15% Fixed APY, even better than what the ultra junk CCC-rated bonds are offering at ~12%. If you can stomach junk-rated cruise lines still floating on pre-pandemic hopium, or ghetto REITs with tenants like…

Ethena PTs are serving up 7.5%–8.5% Fixed APY. To put that into TradFi terms, that’s right between bond yields with a B rating (~6.8%) and CCC rating (~12%): B-rated bonds: Speculative, non-investment grade, high credit risk. CCC-rated bonds: Basically junk. Poor quality,…

The Three Horsemen of Fixed Dollar Rates. Introducing the 3 new @Ethena_labs Pendle PTs on Euler. Now live to lend or use as collateral: - PT-sUSDE - PT-tUSDe - PT-USDe

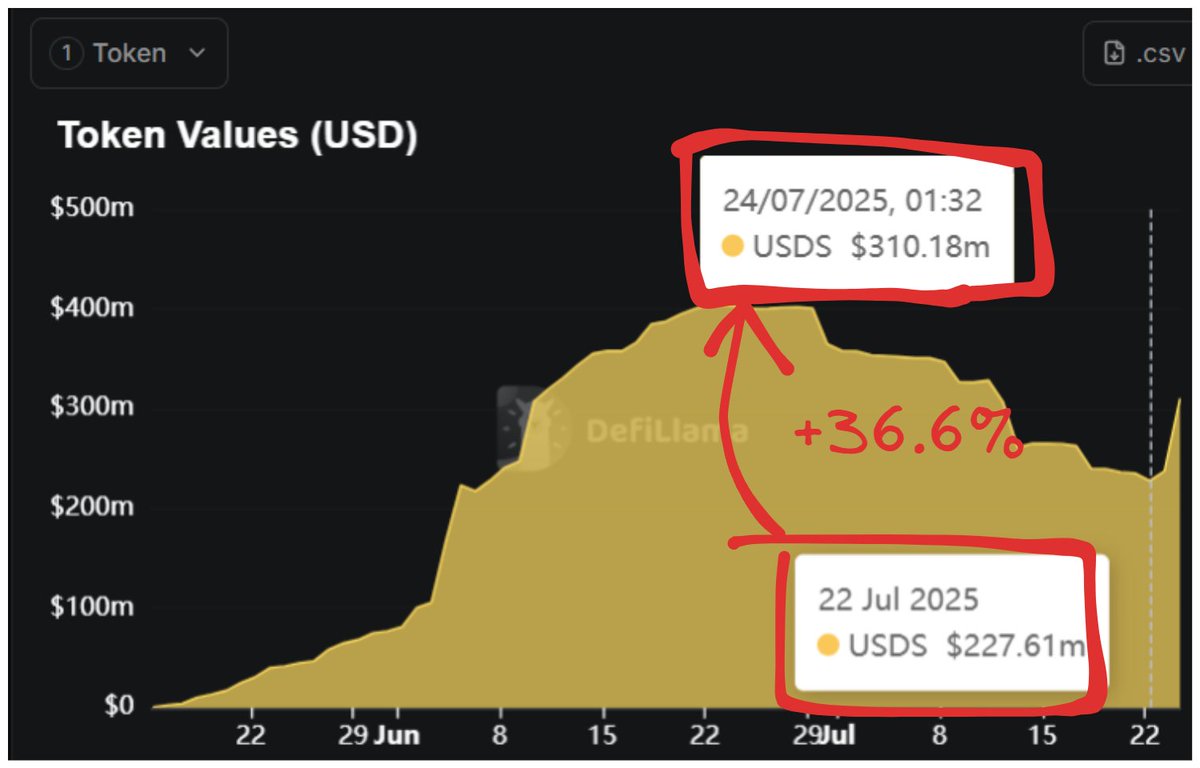

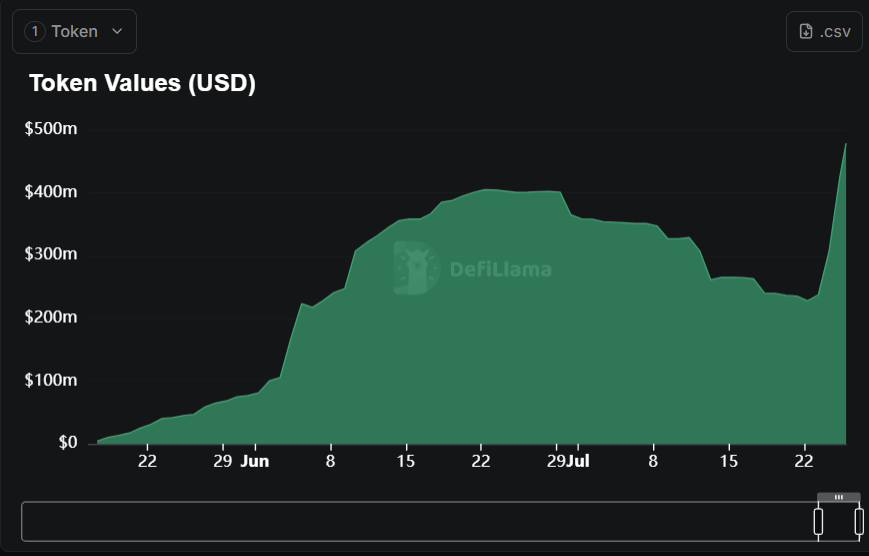

What 2 days of Implied Yield volatility does to a mf (i.e. USDS supply on Pendle): 👉 TVL ATH of $478m 👉 +$251m TVL (+110%) in TWO days 👉 10.3% of total $USDS supply Pendiddle'd I'm not saying Pendle is a DeFi Sparkplug. I'm saying Pendle is THE DeFi Sparkplug. Pendle

Highly profitable 243m Spark Points for $500 All you had to do was buy low sell high 👍

零废话,直接书签 又轮到 $ENA 爆拉 立即更新 @ethena_labs 第4季积分价值/年化算表 以下分别按 $ENA = $0.55 / $0.45 试算 每1M分大概可换15币或等于~$8 (ENA@$0.55) Pendle上 60x Sats的 $USDe 市场 积分年化大约就是17.8%

PT-tUSDe yielding 13.46% LP-tUSDe yielding 9.28% What if you could borrow against it and loop? Don’t be afraid to dream a little bigger dear tUSDe yield enjoyoorr Stay connected

The hwHLP market has scaled to $3m in deposits in 2 days with hwHLP reaching ATH TVL of $14m TVL. Pendle liquidity is fully synergistic, allowing protocols to grow TVL while leveraging our distribution network. Pendle Hyperliquid - Great Technology

It’s Ethena season y’all Now if only there were something that could give you hyper exposure to both Ethena and its beta plays… HMMMM

For the first time in 6 months average funding across BTC and ETH has broken above baseline funding at 11% The last period we saw funding sustain above these levels in Q4 last year the supply of USDe increased 2.5x in 6 weeks Data: app.ethena.fi/dashboards/mar…

Introducing Pendle Intern's Intern

GM @phtevenstrong. hwHLP deployed directly into HLP. USDT/USDE is bridged to hyperevm through @USDT0_to and @LayerZero_Core These are then bridge from EVM to Core Both USDT0 and USDE are sold for USDC and then deposited into HLP We have an oracle that tracks all balances…

Forget stablecoins. Forget RWAs. Forget tokenized treasuries. The real fight is right here. Crypto was made exactly for this.

1609% long yield APY 20% fixed APY 58% LP APY literally everyone who’s in this pendle market is winning lmao

Time to reveal the hottest stablecoin on @pendle_fi: tUSDe by @Terminal_fi – The Liquidity Hub on Converge But why are people farming both PT and YT? It's Pendle's magic. Let me explain👇

Pendle's early integration with @Terminal_fi is more than just another 'yield opportunity'. This signals the dawn of a new financial era: The convergence of TradFi <> DeFi-native primitives at the most foundational level. This is herald by Converge (built on @arbitrum): a…

The SSR by @SkyEcosystem is for many people the CLOSEST thing we've to an on-chain Risk-Free Rate. This refers to the return one can receive on an investment with *theoretically* zero risk which forms the foundation of benchmarking and economic modelling; both core components of…

What's after Expedition 33? I need names. Titles. Suggestions.

Many protocols don't know this - the biggest driver for TVL growth on Pendle is speculation: > Buy YTs to speculate > IY 🔼 > Loop high yield PTs > IY🔽 > Repeat Both actions grow TVL meaning fostering YT speculation = fostering growth 2 Days for +36.6% USDS in SIZE Pendle