Paulo Macro

@PauloMacro

Speculation is the search for truth in price and time. Not investment advice - just personal views. Blog at http://paulomacro.substack.com

Nothing I say should be construed as investment advice. I do not know your circumstance and so please treat my tweets as nothing more than what my thoughts are & what I’m doing with my own money. Please do your own work and consult your own financial advisor.

This isn’t normal. Worst breadth for the smallest loss a week ago. Now best breadth for smallest gain. All in a week. Something is very wrong in illiquid quant land right now

And today, we flip the script! There has never been a day with a smaller gain and better breadth!

Bingo

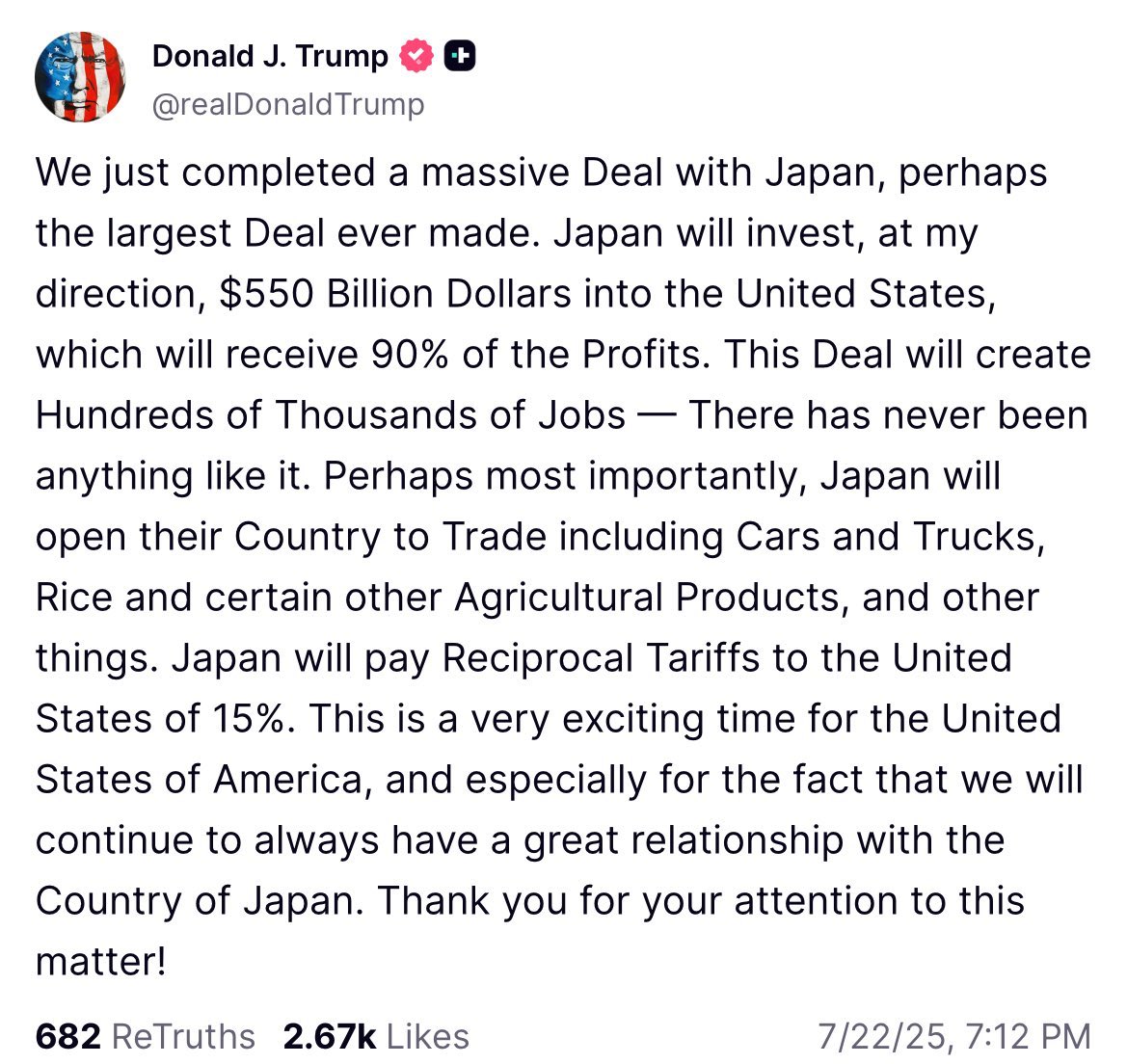

Toyota is up +8% on the news of a 15% tariff. Why? It's simple. Ford, GM, Tesla, and all the other American manufacturers are going to be paying 50% more for their steel, 50% more for their copper, 25% more for their Canadian production, 25% more for their Mexican production,…

At his direction. And at Ueda’s direction, the yen will depreciate by 15%.

New post up on the blog Let Pictures Tell the Story: Brazil, China, US Growth/Inflation/Tariffs/Bonds, Trump will fire Powell, Positioning & Sentiment, Crude Oil, and More! Link in my bio or click the image below...hope you enjoy! substackfwd.xyz/?url=https://p…

Bessent to Powell offline

so everyone can hear something they wanna hear.

Bessent’s sly comments on Powell are simply chef’s kiss. “There’s nothing that tells me that he should step down right now. His term ends in May. If he wants to see that through, I think he should. If he wants to leave early, I think he should.”

Bless 🥹

Live look at Mohamed @elerianm delivering his latest op-ed copy to the WSJ editors.

So unlike the vast majority of what has come out of the administration in recent months, I thought this deal was brilliantly designed given the objectives and bigger picture, and this FT piece smacks of sour grapes from industry players that wish the money were flushing in their…

Pentagon’s China-style rare earths deal triggers industry backlash ft.com/content/0b7f00…

Yes

Bidding wars are confidence-driven decision-making at its best. They only occur at extremes in confidence when there is an intense sense of scarcity as the crowd is convinced there won't be enough supply to meet the coming insatiable demand.

The signs of EM-ification of the US are so frequent now (my whole “this is Brazil” and “this is Africa”). Related: When people tell me “but Bessent knows if Trump goes all Erdogan, curves and rates detonate so he will keep Trump from doing something truly insane like firing…

It’s all fun and games, til Treasuries go no bid…

$CEPO performance is the tell that the bitcoin treasury nonsense has peaked.

I used to think the greatest financial risk to the average person is the accelerating devaluation of fiat money's purchasing power Now I'm tilting towards the mass jobs destruction AI/robotics will create I think the latter is the nearer apex threat timing-wise

I used to think the greatest financial risk to the average person is the accelerating devaluation of fiat money's purchasing power Now I'm tilting towards the mass jobs destruction AI/robotics will create I think the latter is the nearer apex threat timing-wise

Lol

Yellen: I don't talk to Secretary Bessent. He has undone everything I worked on at Treasury. Bessent: "I couldn't even tell you what Secretary Yellen's China policy was, aside from consuming beer and mushrooms." via @bobdavis187 thewirechina.com/2025/07/18/jan…

Lol we live in a simulation

i vibe coded a little game called Coldplay Canoodlers you're the camera operator and you have to find the CEO and HR lady canoodling 10 points every time you find them 👇link

The astronomer coldplay memes are absolute fire out there today