Duality Research

@DualityResearch

Get our thoughts straight to your inbox — sign up for our Substack if you haven’t already! substackfwd.xyz/?url=https://d…

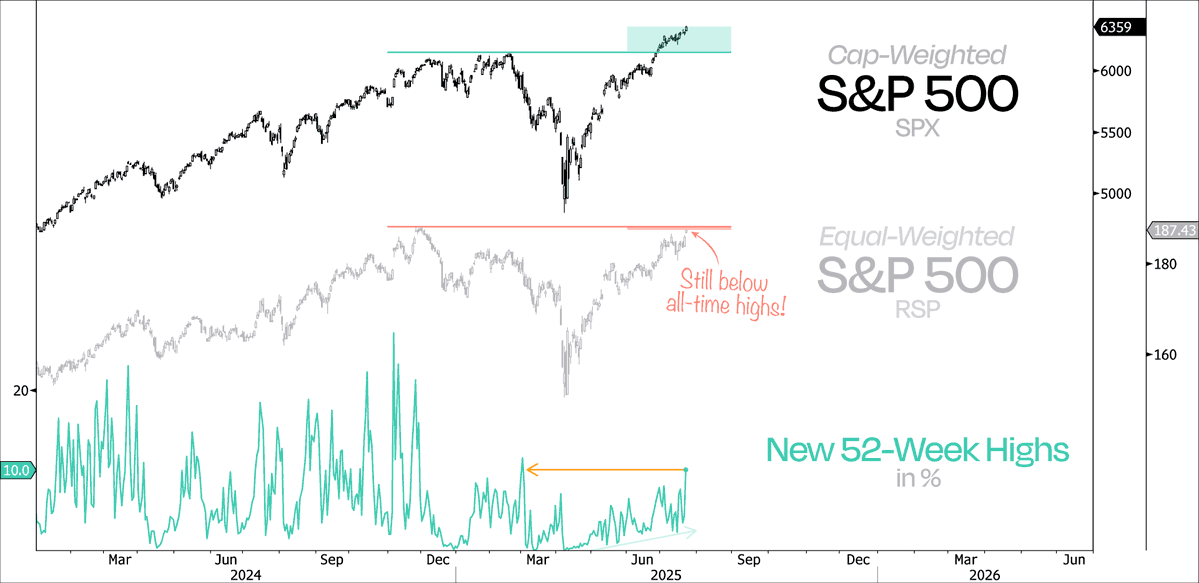

The S&P 500 just tagged another all-time high, with 10% of stocks hitting new 52-week highs — the most since early March. Once the equal-weighted S&P 500 finally breaks out to new highs, expect that number to shoot even higher.

Always thankful to make it on the list 🙏🏼

5 of Tuesday’s best charts and insights: dailychartbook.com/p/dc-lite-404

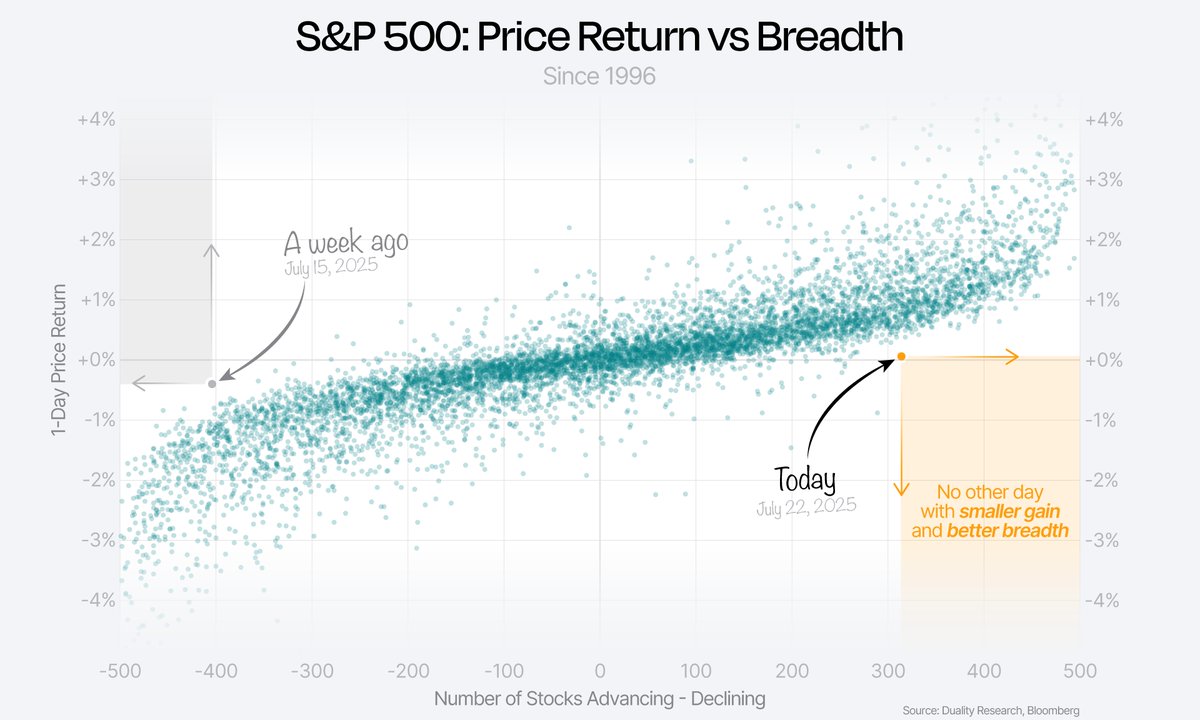

While the big cap strength and "other 493" weakness saw the best return on the worst breadth a week ago, as Duality notes, today we "flipped the script".

And today, we flip the script! There has never been a day with a smaller gain and better breadth!

🔥

And today, we flip the script! There has never been a day with a smaller gain and better breadth!

And today, we flip the script! There has never been a day with a smaller gain and better breadth!

Last week snapshot $SPX +0.59% Avg stock -0.16% 191 outperformers Best sector: Tech +2.1% Worst: Energy -3.9% Top stock: $IVZ +14.3% Worst: $ELZ -18.7% via @DualityResearch

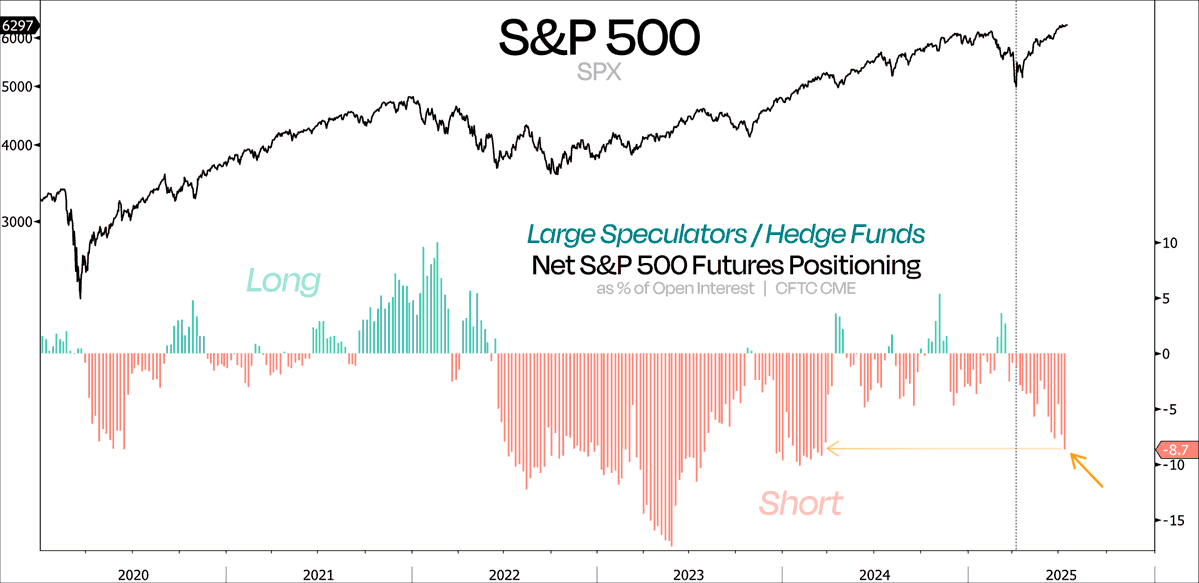

Large speculators / hedge funds are holding their largest net short positions since the market bottomed in early April. Let that sink in.

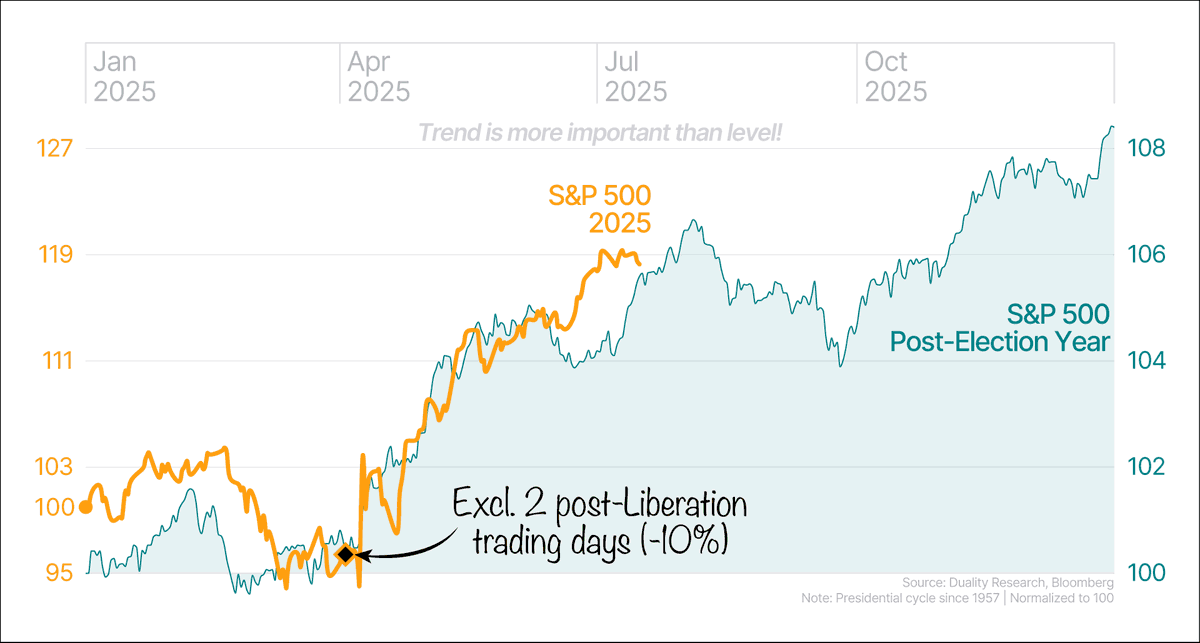

If we take out the 2 trading days following Liberation Day — which were the worst of the year, with the S&P 500 declining by 10% — 2025 has so far largely tracked the typical post-election year. That said, from a seasonality perspective, a near-term market peak wouldn’t be…

What an honor to be Chart of the Day! 🙏🏼🚀 Always makes me smile like a 6-year-old in a candy store. 🍭📈 Huge thanks to @TheChartReport & @Pdunuwila — hands down the best daily technical chart list out there! x.com/TheChartReport…

Today's Chart of the Day was shared by @DualityResearch Click here to read more! thechartreport.com/cotd/07-25-25 $SPX

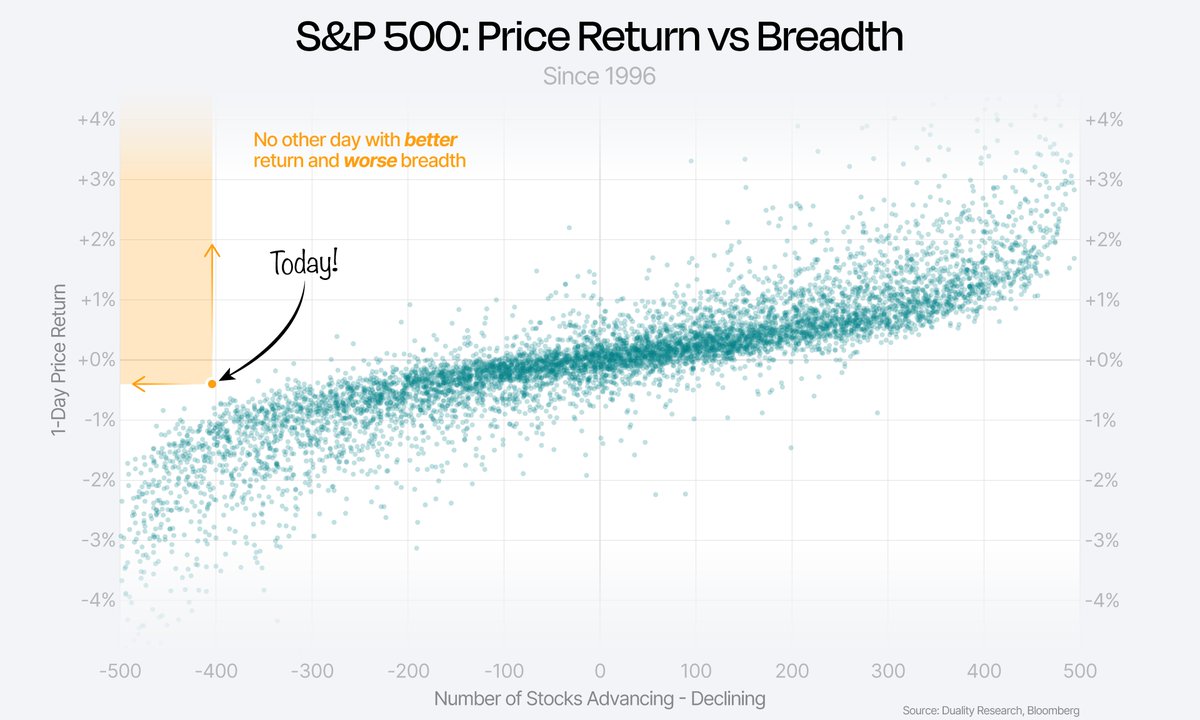

Today’s weak participation really stands out given how the S&P 500 performed. There has never been a day with better returns and worse breadth!