Michael J. Kramer

@MichaelMOTTCM

Independent Macro & Market Strategist | Founder, Mott Capital | https://www.youtube.com/playlist?list=UUMOIIr1ooRsSukPL7rKNr0VHQ

For anyone curious, I posted this to my website, showing how 1Q'25 went for me. It is not a solicitation or offer to sell any product or service. Being transparent in how I use my own analysis. mottcapitalmanagement.com/first-quarter-…

some deal

Trump cuts tariff on Philippine goods to 19% from 20%.

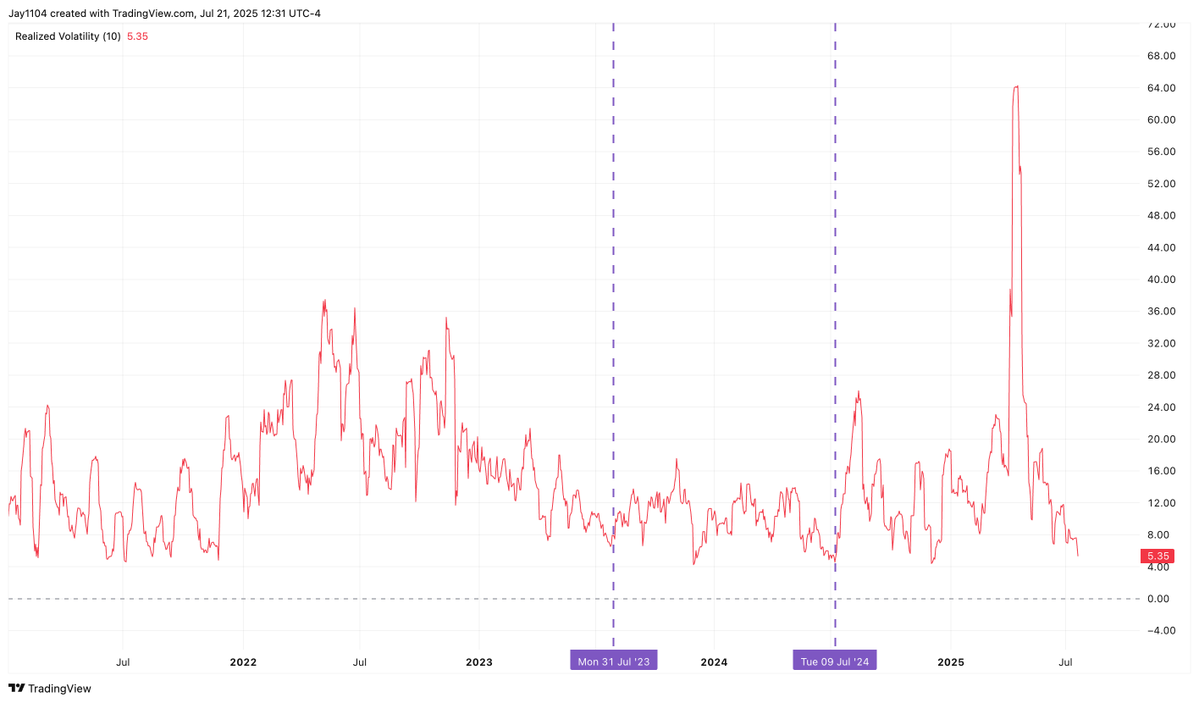

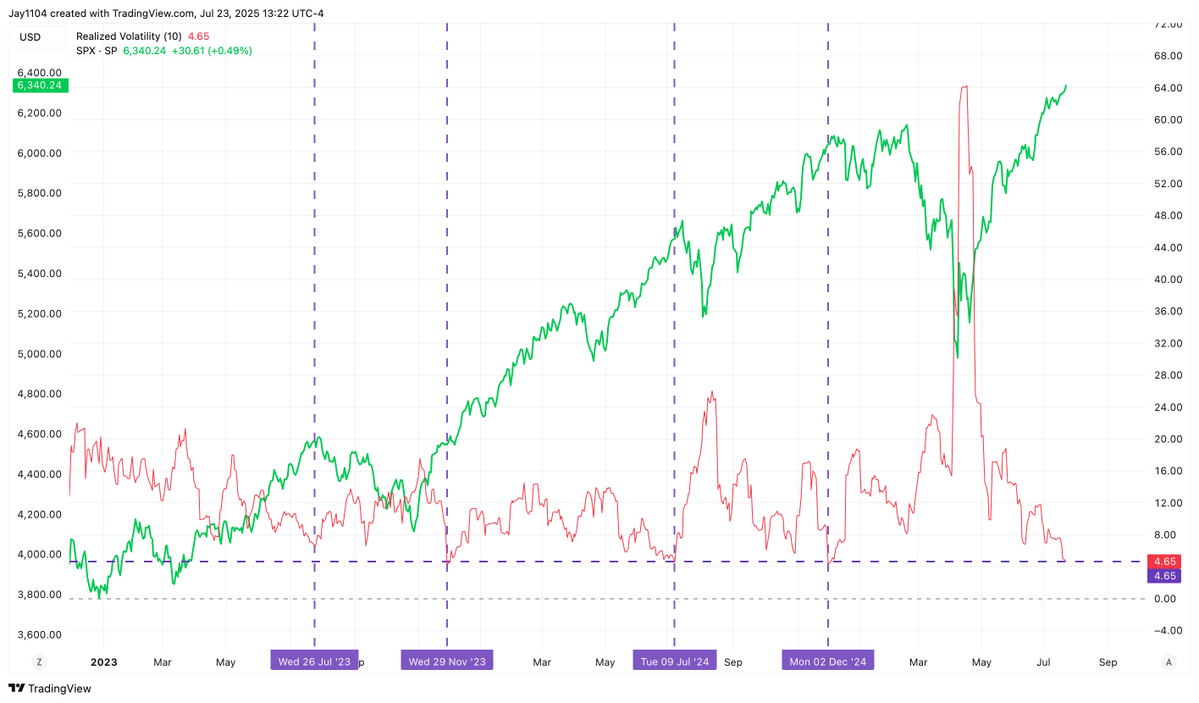

10-day realized vol is at 4.5, it hasn't gone much lower in recent years.

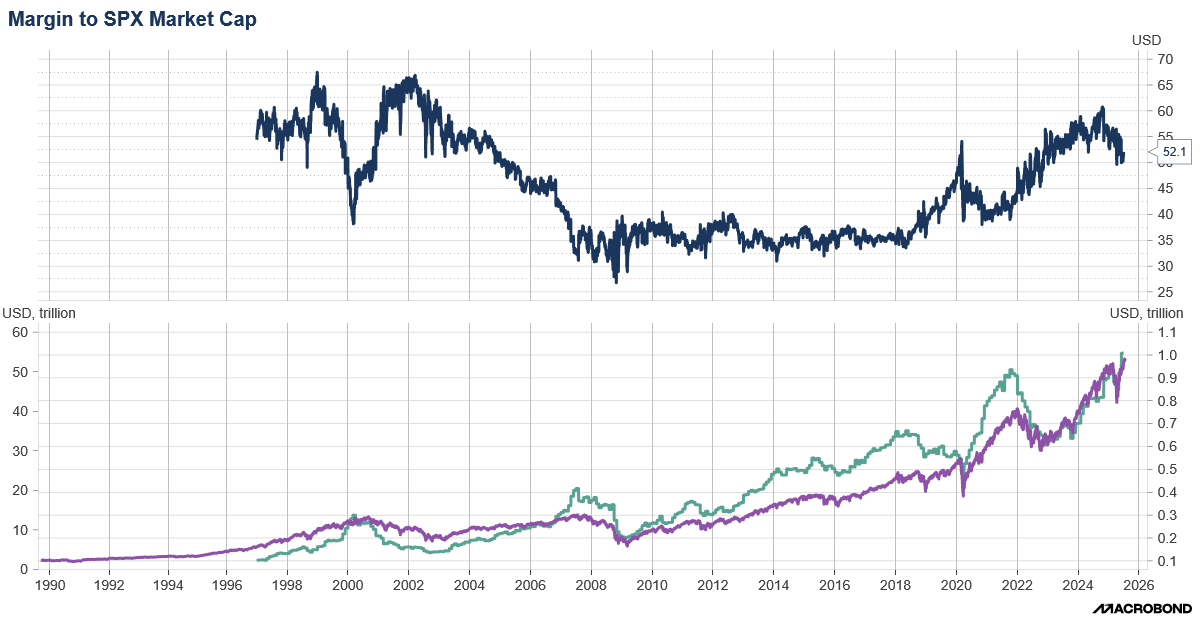

Here is a better picture of the margin debt to S&P 500 ratio at 52 to 1.

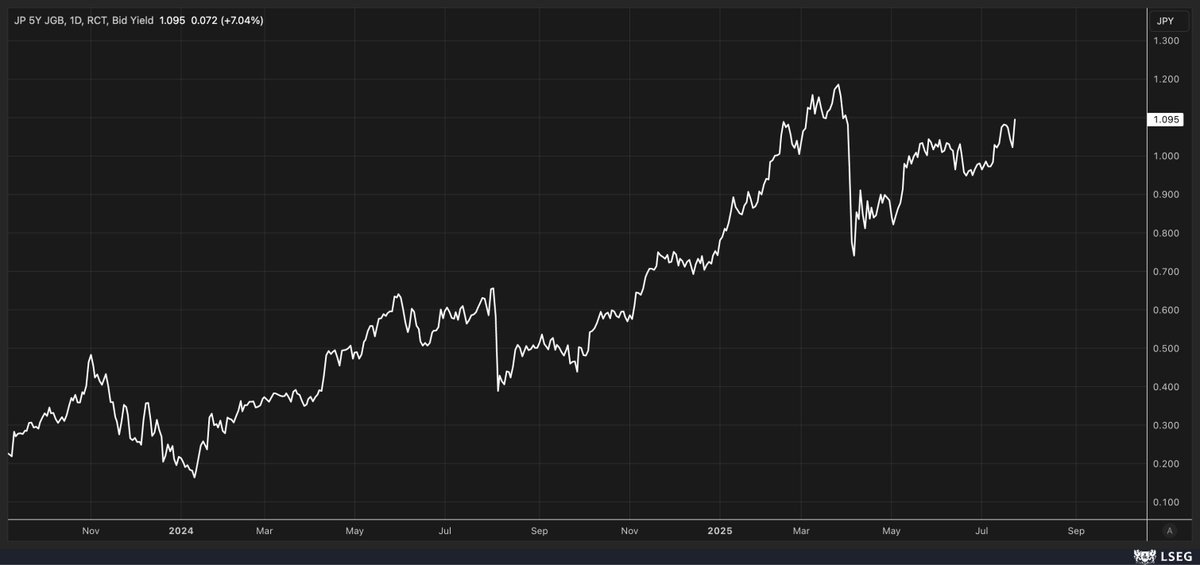

So Japan is going to invest 10%+ of GDP into the US.. that doesn’t sound right? No wonder rates are surging.

Even the bond market is excited about the 15% tariff! a 5-Yr JGB rate is rising 7 bps.

So i guess we aren't going to have a 10% tariff rate

*TRUMP: ANNOUNCES TRADE DEAL WITH JAPAN - $550 INVESTMENT AND 15% TARIFF

Gold Eyes Breakout as Yields and Dollar Falter mottcapitalmanagement.com/gold-eyes-brea…

Gold Eyes Breakout as Yields and Dollar Falter mottcapitalmanagement.com/gold-eyes-brea…

I think it has more to do with rising commodity prices like copper than the Fed.

Market Pushed to the Max as Volatility Measures Hit a Wall Ahead of Earnings mottcapitalmanagement.com/market-pushed-…

Panic bid for NDX at open looks so unhealthy. All the price action happens in a few minutes, unrelated to information flow 12 hours before (or after). Plus, most of institutions don't trade open.

1/4 People keep asking why the market continues to go up, w/ no care (seemingly) for @POTUS' tariff threats, particularly the reciprocal ones set to take affect 8/1. And, after a chat w/ @MichaelMOTTCM the answer appears clear. As we all know, a lower court recently ruled...

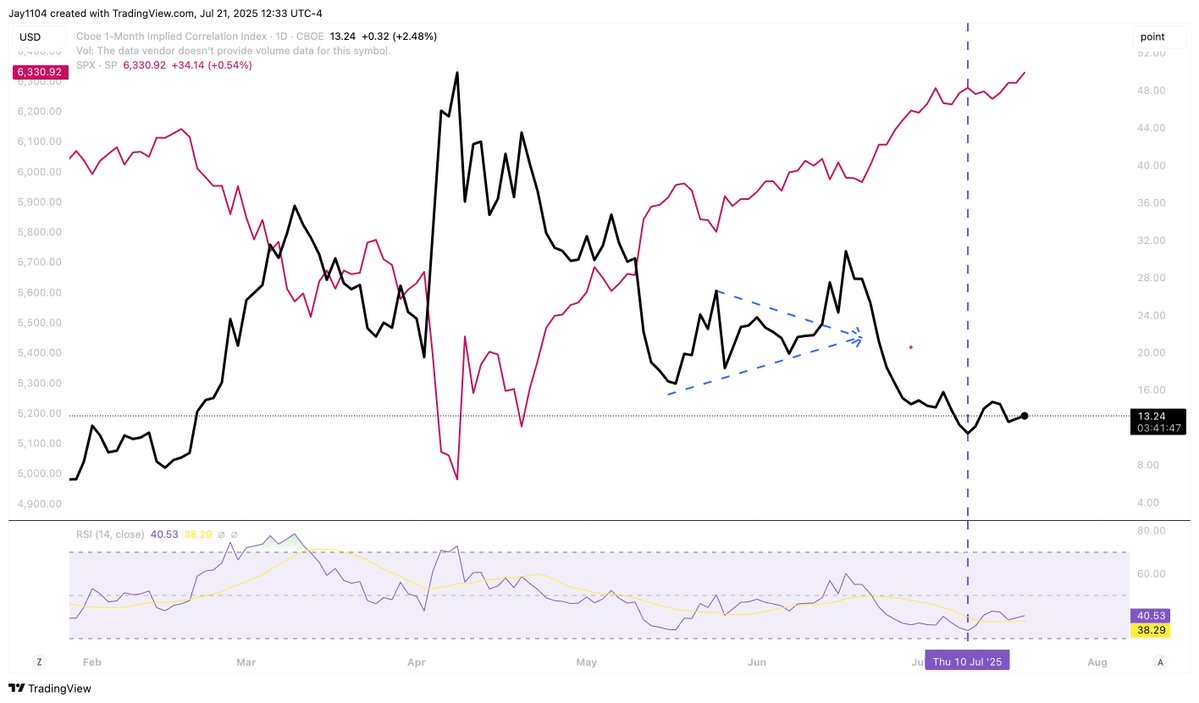

stocks and correlations are rising at the same time.

Realized vol. probably isn't going to be able to get much lower.