🇺🇸Paul Mampilly

@MampillyGuru

Ex hedge fund mgr, 30 yr Wall St Pro. Now @atgdigital_ Posts are my opinions/takes/views not investment/financial advice.

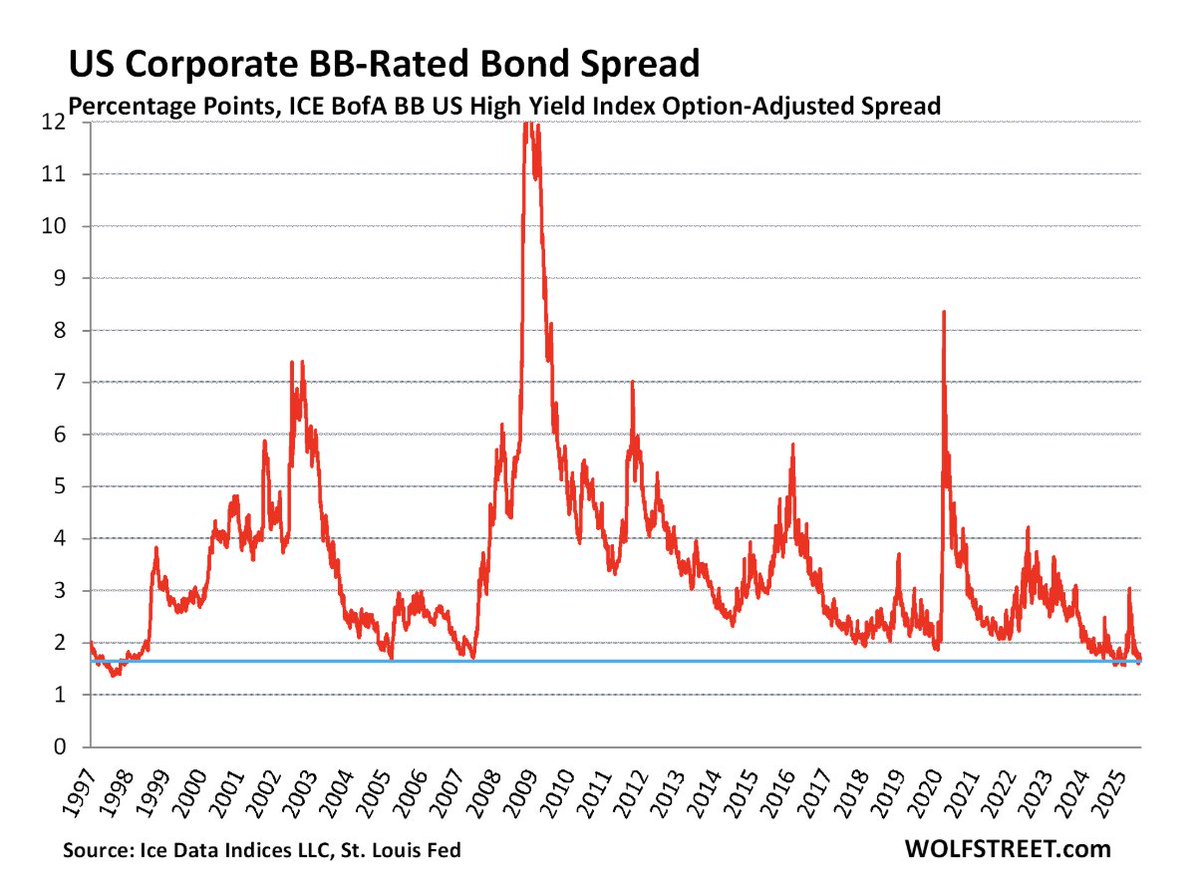

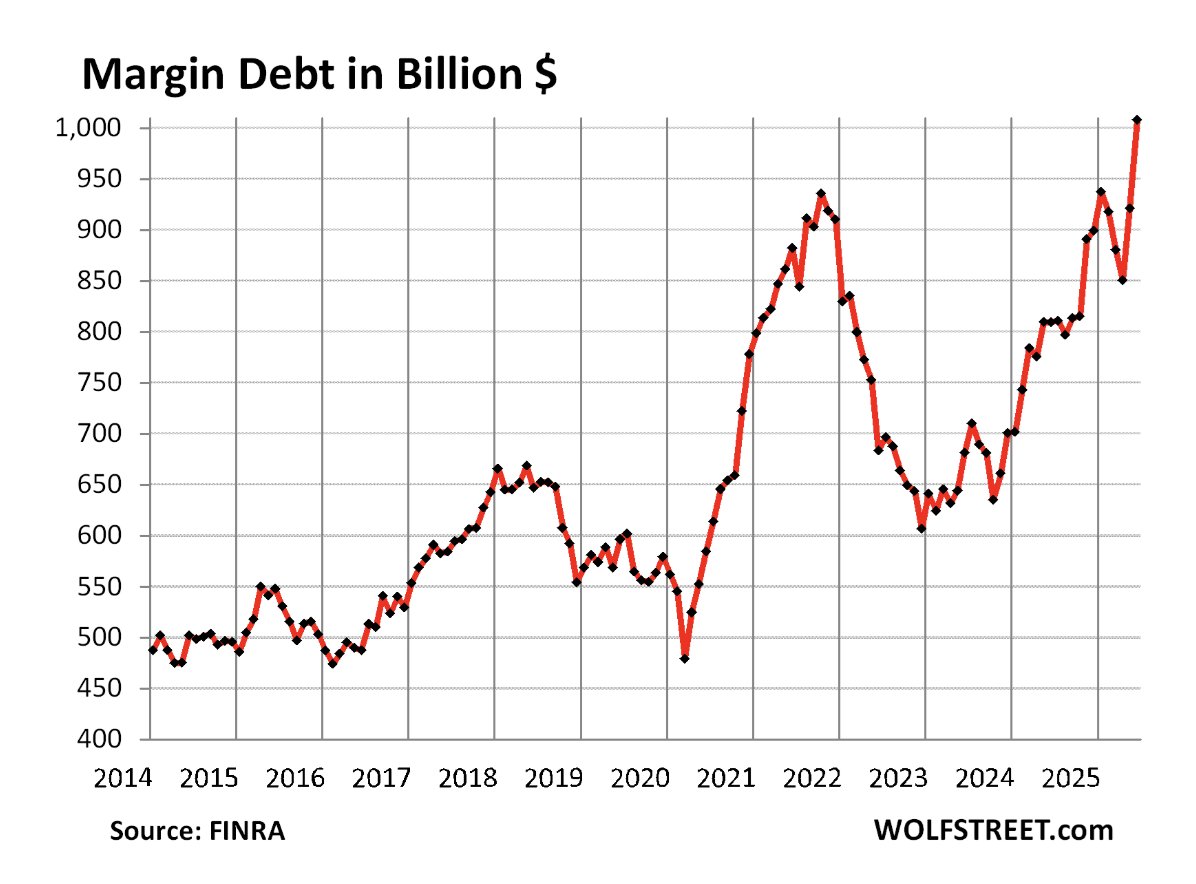

margin debt blowing out, jnk spreads at lows are things you see at turning points

Junk bond spreads are also in la la land. spreads are low at peaks/top and high at lows/bottoms

Margin debt blowing out past $1 trillion. Mkt risks keep rising.

Tsy secy Bessent's 'let the economy run hot' because of AI is music to the stock market's ears, but anathema to LT bond investor who are nervous about inflation.

September Fed meeting is going to become a hinge/pivot point for all markets. Shape of yield curve says LT tsy bd mkts dread a cut. LT ylds will likely blow out if Fed cuts.

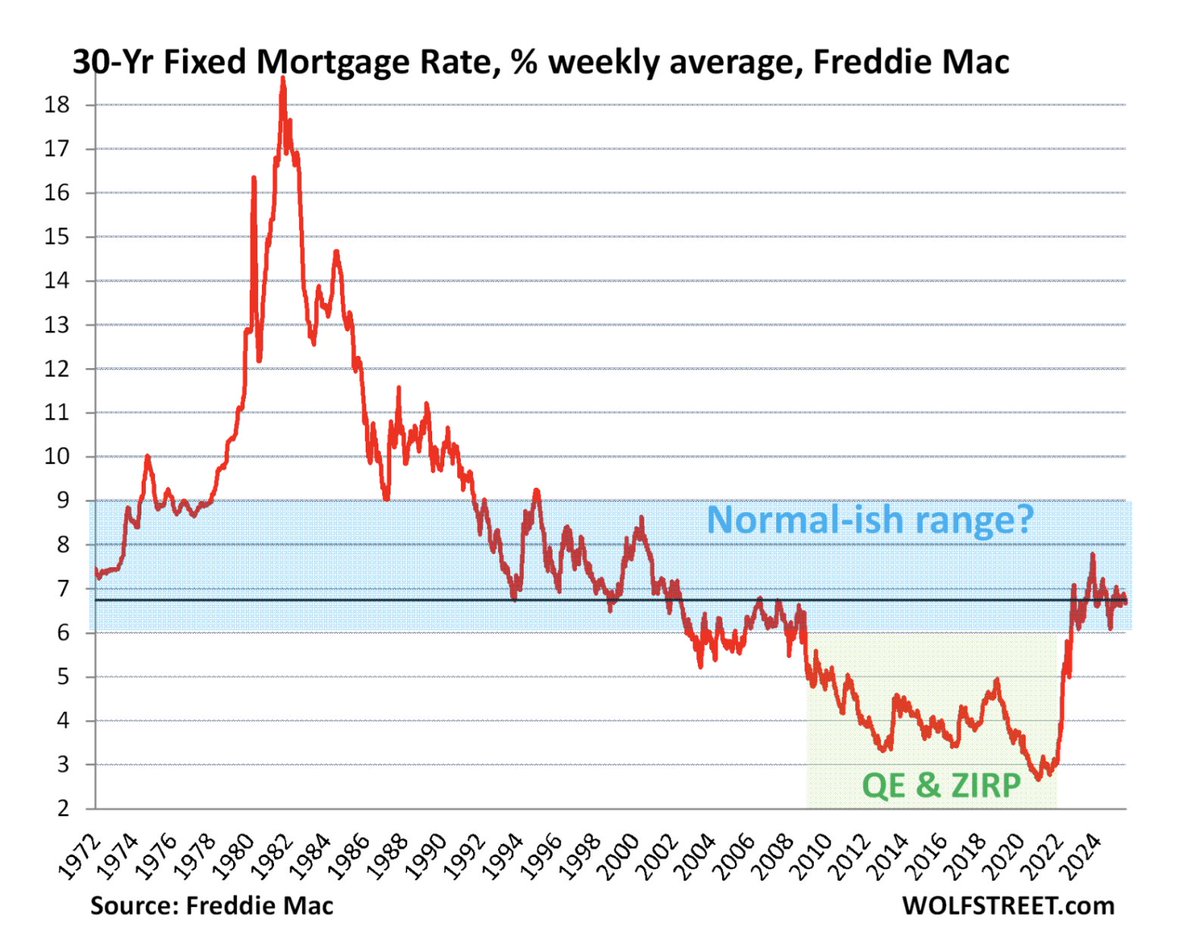

#1 reason to releae $FNMA $FMCC is to "manage" mtg rates again. Fed managed rates post-conservatorship until 2022. Mtg mkt can be wild like others—needs a buyer to stabilize rates. FNMA/FMCC need to be released to go back to doing this.

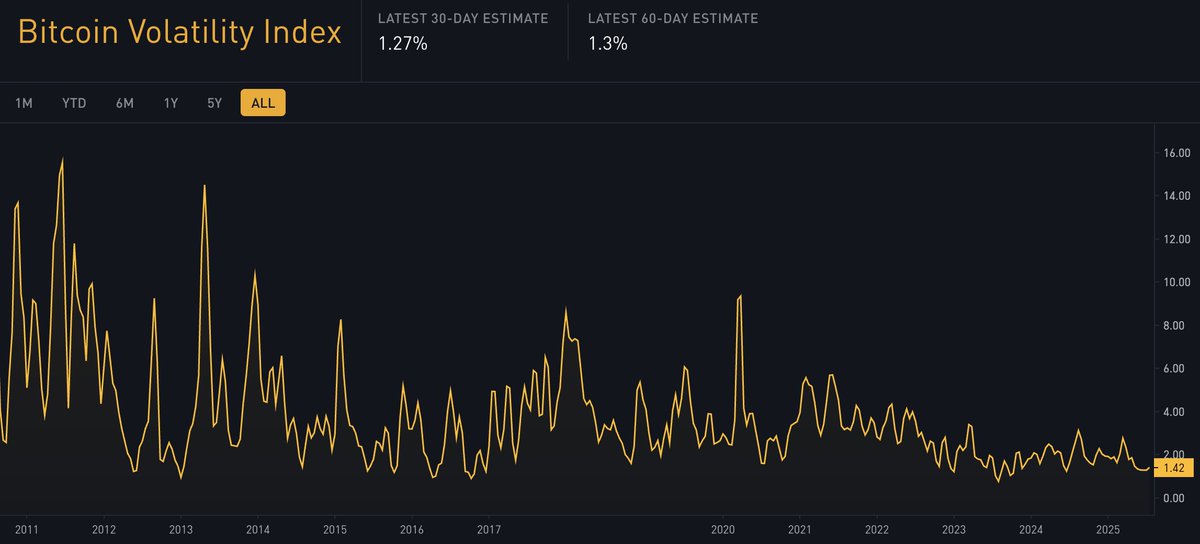

Bitcoin volatility is not what it used to be. Maybe later this year, it'll make up for this stability.

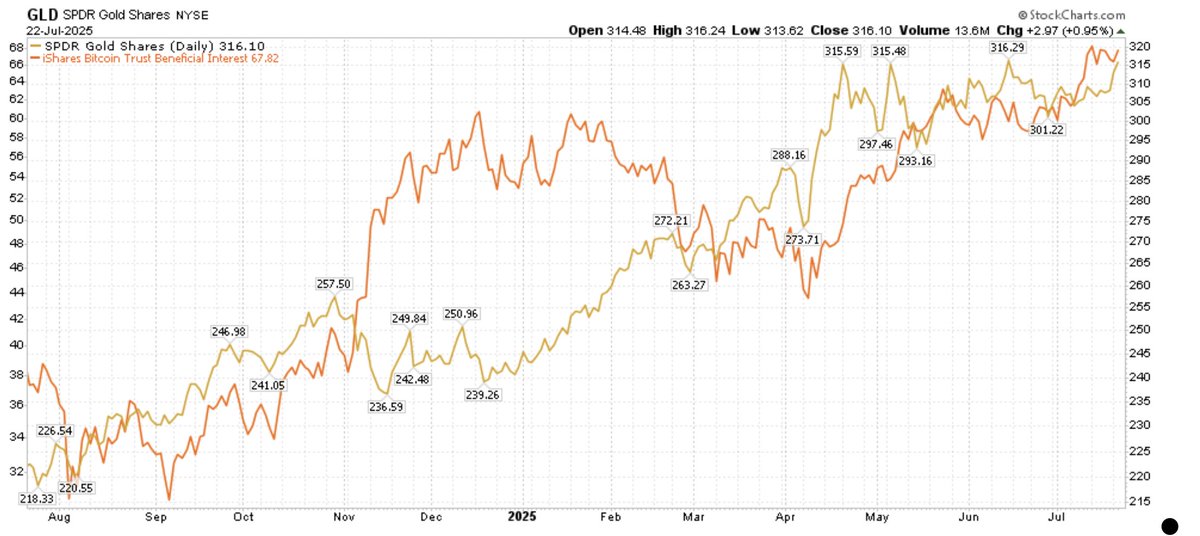

Bond & Gold mkts don't think LT interest rates & inflation are temporary - higher yields for 30 yr, 20 yr, 10 yr bonds & gold prices since 2020

Many/most risk assets - stocks, junk bonds, real estate etc are priced as if higher LT interest rates & inflation are temporary and will go back to where they were in 2021

The S&P 500 has never been more concentrated in a single stock than it is today with Nvidia representing close to 8% of the index.

It's pretty incredible,but the #meme #stock craze of 2021 has re-emerged. The only question is whether it will end differently this time. "2021 vibes … feels chasey out there: #calls are almost 70% of the total market volume … hasn’t been this high since 2021 meme days." -…

Gold, Bitcoin setting up for new ATHs signalling, that most mkts except stk market unconvinced that long term inflation is under control. mkts bidding up scarcity.

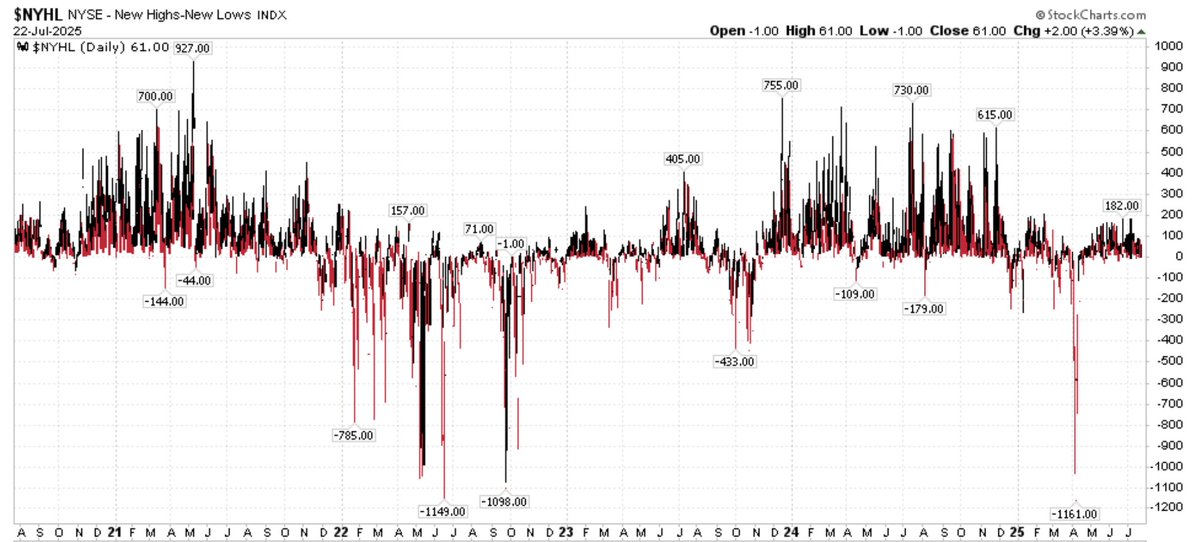

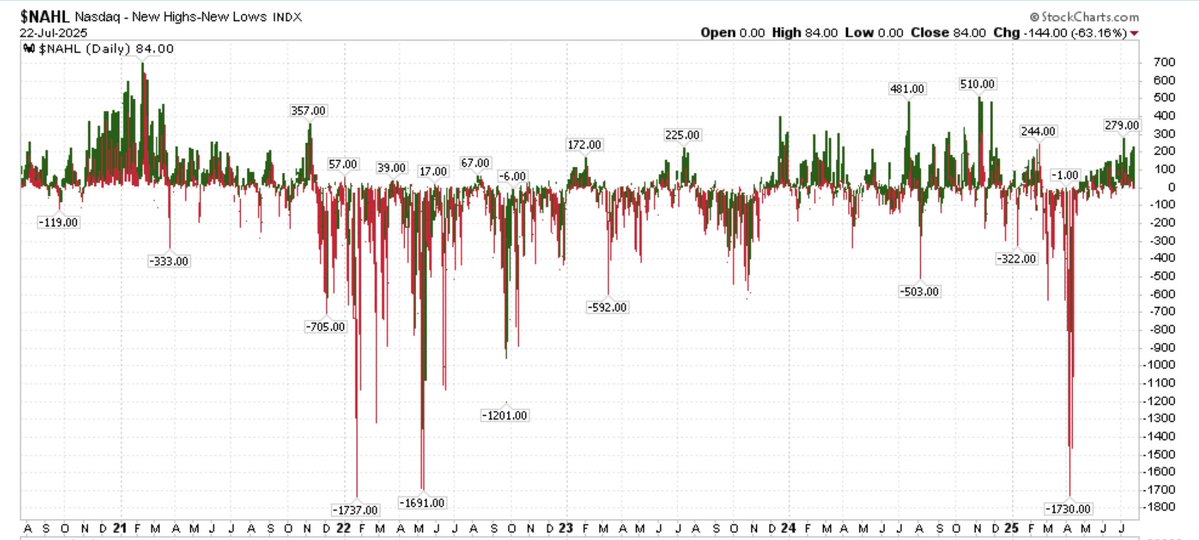

this daily chart of Nasdaq 52 wk hi/lows shows the entire post LIberation day bounce is thin, focused on a few stocks.

Most interest rate cuts happen because suddenly there's no liquidity. What once was easily saleable has no buyers.

People forget most rate cuts come as a result of unanticipated, unexpected exogenous events that no one was focusing on. Those kinds of cuts come because markets are locking up and falling.

Wages rising, money issuance up. Economy is 🚂. Markets tho are showing similar kinds of wackiness like the meme stock craze like in 2021