Lance Roberts

@LanceRoberts

Chief Strategist http://RIAAdvisors.com, Host: RealInvestment Show, Editor http://realinvestmentadvice.com, PM for http://SimpleVisor.com Newsletter Signup: http://tinyurl.com/BBR-2023

The #BullBearReport is out!. The #market continued its #bullish ways last week, adding gains every day. While the bullish bias remains strong, there are #technical #risks and some deterioration on the rise worth paying attention to. open.substack.com/pub/lancerober…

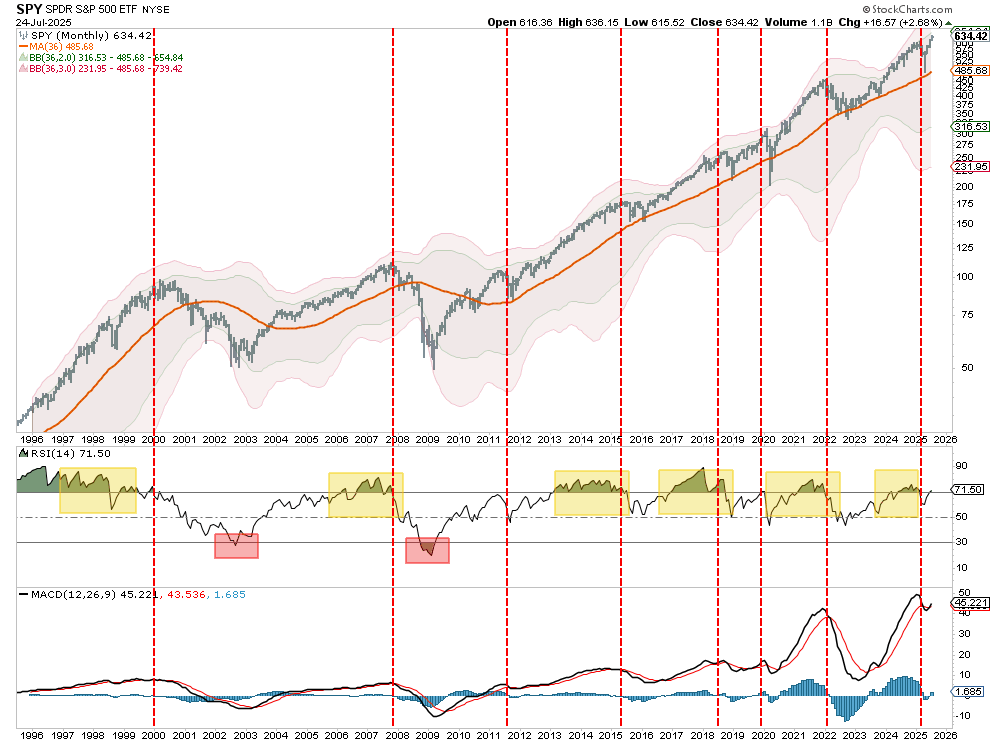

Just reviewing some charts this morning, and this one jumped out at me. The ~20% correction in April was a successful test of the running 36-month moving average which is the 7th test since the #GFC. The monthly #RSI is creeping back into overbought territory but not at levels…

Is #Private #Credit A Wolf In Sheep's Clothing? An examination of the recent push by #WallStreet to get PE #investments into the hands of #retail #investors and #401k plans. Is this really a benefit for you....or a dumping ground for Wall Street? open.substack.com/pub/lancerober…

If the S&P can stay above the 20-DMA through next Friday, it will be the longest stretch since 1965.

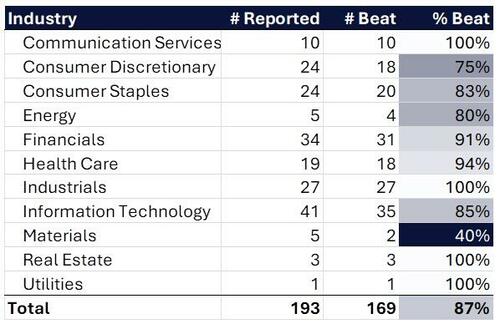

It has been a "G-R-R-R-E-A-T" #earnings season so far with 169 of 193 companies (87%) who have reported beat earnings #estimates. Confidence and clarity have become key themes of US corporate earnings thus far.

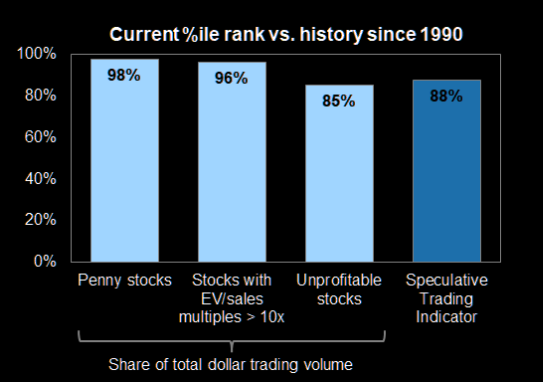

"Recent US #equity #trading volumes have increasingly centered on high-multiple #stocks. The median EV/sales multiple of the 50 stocks with the highest share trading volumes, a simple measure that has historically tracked closely with the Speculative Trading Indicator, has also…

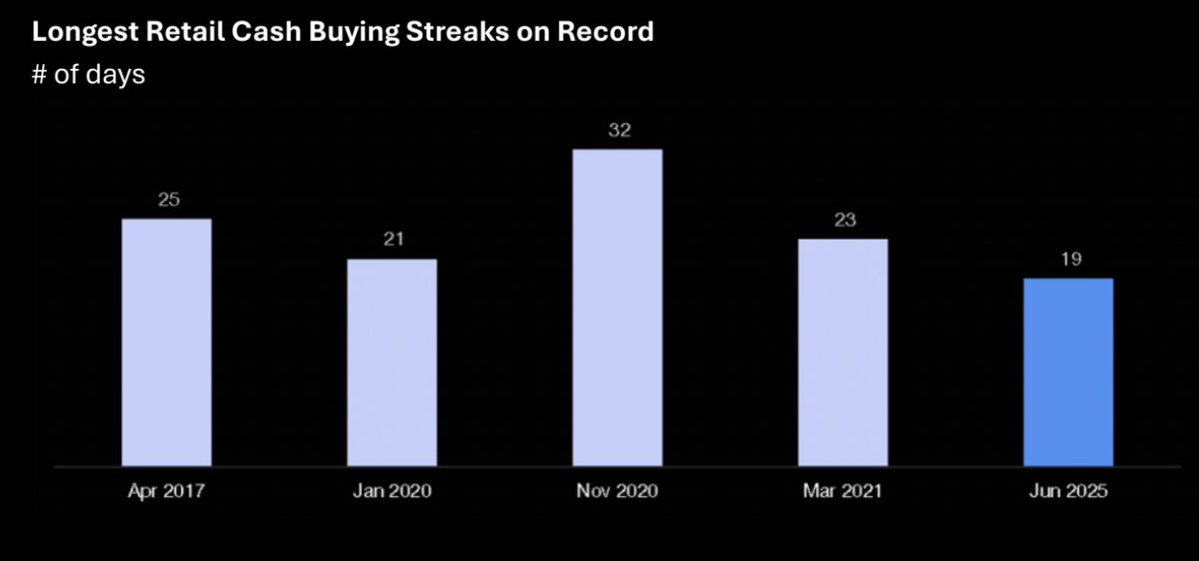

"Citadel Securities’ retail activity has been a buyer of cash equities for the past 19 straight trading sessions. This is the longest daily buying streak in the past 4 years (since March 2021) and 5th longest streak on record)" - Scott Rubner @themarketear

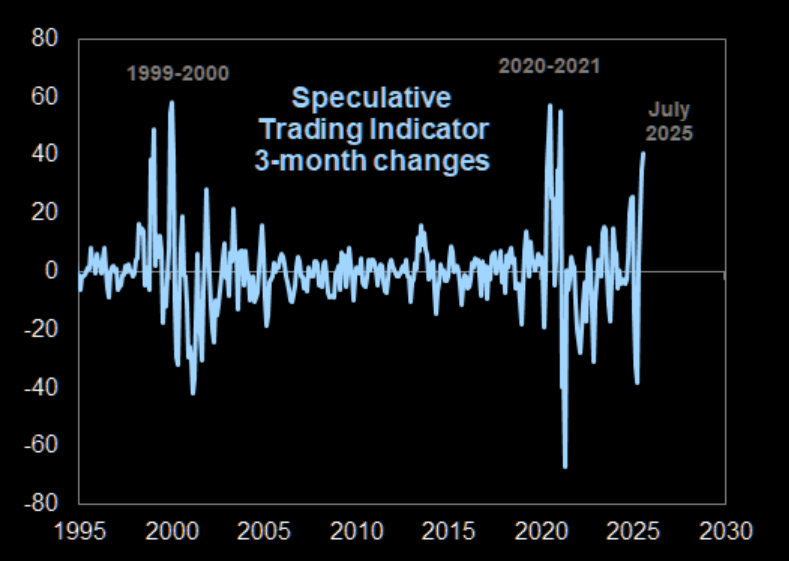

Goldman's #speculative #trading #indicator is comprised of three components all of which are trading in the more extreme upper deciles. These are #volume based measures which suggests that it isn't just #retail investors chasing returns. h/t @themarketear

#Speculative #investing lessons have to be repeatedly taught over time.

NYSE #Margin #Debt is elevated but not as extreme as 2021. While it suggests there is room for additional leverage, previous market peaks have formed at these levels. Margin debt is the fuel for a #bullmarket, but it is also the fuel for the #correction. h/t @ISABELNET_SA

Well.....at least he has a firm grasp on his financial goals. Of course, he may be single soon as well. 🤣🤣

literally

Daily Market Trading Update: July 25, 2025 open.substack.com/pub/lancerober…

7-25-25 Are You a Meme Stock Mania DORK? x.com/i/broadcasts/1…

Are you chasing meme stocks without knowing the risks? Catch the #FinancialFitnessFriday episode of #TheRealInvestmentShow w Jonathan Penn & Jonathan McCarty starting at 6:06a CDT on KSEV AM 700, and streaming-live on YouTube: youtube.com/c/TheRealInves… #MemeStocks…

Inert ingredients for correction are all in place: Compression in credit spreads, credit default swaps, and investor complacency. All they need is a catalyst... Catch my latest #BeforeTheBell report on our YouTube channel: youtube.com/watch?v=T-N20D… #MarketCorrection…

7-24-25 How AI is Driving the Market x.com/i/broadcasts/1…

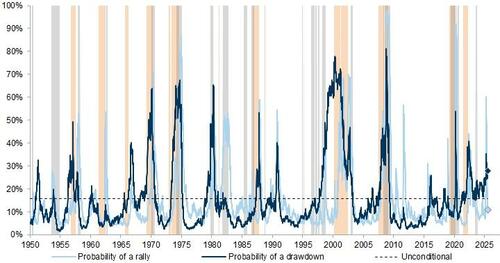

Probability of S&P 500 drawdown/rally based on multi-variate logit model (Orange/ light grey shading = S&P 500 subsequent drawdown >-20%/ rally >+35%)

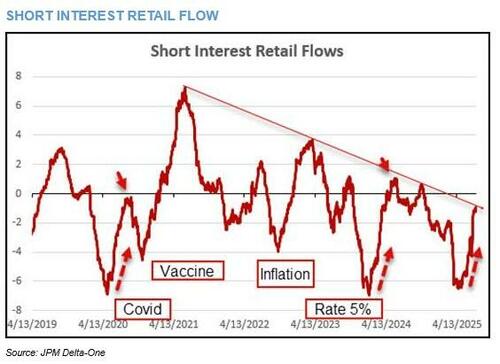

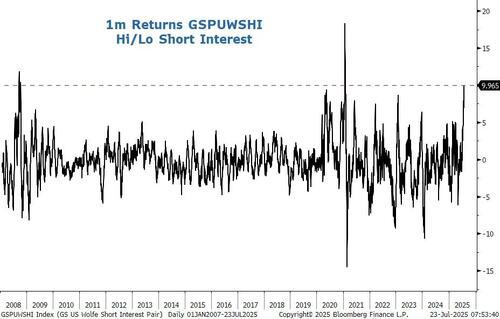

We are moving back into the #meme #stock #squeeze that we saw in 2021 with stocks with the largest short positions are posting the largest returns.

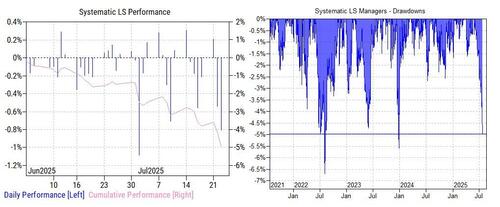

"I’m old enough to remember the #quant #quake of August 2007, and how quickly that unwind unfolded." -- Goldman Delta-One head Rich Privorotsky #Systematic funds are now down 3.6% MTD, down 5% from the start of June, and on track for the worst month in almost 5 years.

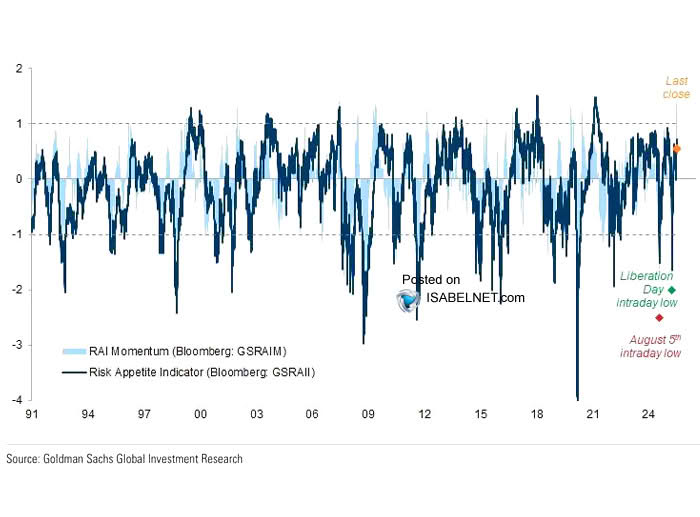

The $GS #Risk Appetite Indicator’s current risk-on signal points to a very #bullish #market environment. As noted over the last couple of days, #investors are willing to take on increasing risk levels. However, the good news, is that while risk is elevated, according to this…