MacroPru😷

@MacroPru

The #MacroPrudential Reader #macropru #NBFI #systemicrisk #financialstability #economics #shadowbanking #bubbles #spillovers #globalliquidity #macrofinance

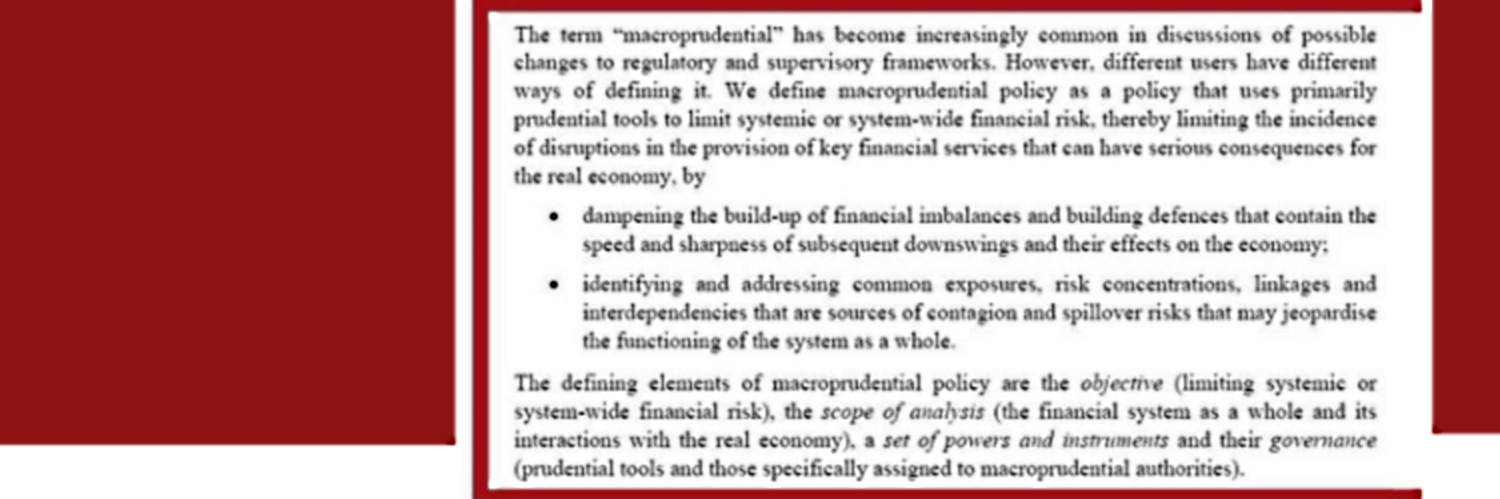

"Lesson 3: The need for #macroprudential supervision" -- Stanley Fischer 2011 @BIS_org bis.org/review/r110414…

The growing use of foreign currency-backed #Stablecoins could weaken foreign exchange regulations and threaten monetary sovereignty. bit.ly/44rc0C8 #BISBulletin #Regulation #Tokenisation #Cryptoassets

Bank of Italy selects 4 systemic risk countries for lenders, including Russia reuters.com/business/finan…

The Financial Services and Markets Act 2023 (Capital Buffers and Macro-Prudential Measures) (Consequential Amendments) Regulations 2025 jdsupra.com/legalnews/the-…

🏆 @bank_indonesia wins Best #Systemic & #Prudential Regulator in Asia Pacific by TAB Global recognised for safeguarding #stability & enabling sustainable growth through forward-looking #macroprudential policies #TABGlobal

"tighter monetary and #macroprudential policies may contribute decisively to shifting lending outside the regulatory perimeter, amplifying #FinancialStability risks." @VoxEU @cepr_org #NBFI cepr.org/voxeu/columns/…

From #banks to nonbanks: #Macroprudential and monetary policy effects on corporate lending cepr.org/voxeu/columns/… @voxeu @cepr_org #NBFI

The rise of NBFIs is a response to bank regulation, no question. The vertical line and text are mine. The picture is from this nice paper: cepr.org/voxeu/columns/…

U.S. Regulators propose eSLR easing (bank capital rules) to 3.5% from 5% bloomberg.com/news/articles/… @federalreserve @USTreasury @FDICgov #SIFI #GSIFI #regulation

"EU Seeks Input on Securitization Revamp for Banks’ Buffers" bloomberg.com/news/articles/… (European Commission, source: finance.ec.europa.eu/publications/c…) #bank buffers

Álvaro Fernández-Gallardo has received the second prize for his PhD thesis titled “Essays on Macroprudential Policy, Tail Risks and Financial Stability” in the 2023–2024 Enrique Fuentes Quintana Awards. Congratulations! 🎉 #bdeResearch #PhDAward

#UK Capital Buffers and #Macroprudential Measures Regulations 2025 regulationtomorrow.com/eu/the-capital… #regulation

#Macroprudential: "I believe the claim that the post-crisis prudential framework is significantly undermining #banks’ businesses has yet to be convincingly substantiated." -- Fernando Restoy Chair, Financial Stability Institute, @BIS_org @FinStbBoard bis.org/speeches/sp250…

The Capital Buffers and Macro-prudential Measures Regulations 2025 jdsupra.com/legalnews/the-…

🧵New Working Paper by J. H. Lang, M. Rusnák & T. Herbst: “The impact of monetary policy and macroprudential policy on corporate lending rates in the Euro area” ecb.europa.eu/pub/pdf/scpwps… 1/3

Join our JVI / Bank of England course on Macroprudential Tools and explore how to design and apply policy tools for both 🏦 banks and 🏘️ non-bank institutions. 📅Read more & apply🔗 bit.ly/3HzOQAy @bankofengland

This is a first draft, so comments and feedback are very welcome. Link to paper: pascalmichaillat.org/17/ Main figures:

Public Debt #Bubbles - Kocherlakota @nberpubs nber.org/papers/w33897

#Pendin #Regulation Change? @federalreserve's Bowman says she will seek changes to crucial rule over capital holding levels @FT ft.com/content/d5d85f…

Stan Fischer was the most influential macroeconomist of his generation—not only to me, but to the world. He was, in turn, my teacher, my colleague, my friend, my predecessor, and my counterpart. But more than any of those roles, he was the person who best exemplified how…