Matt Graham

@MG_MBS

http://MortgageNewsDaily.com, http://MBSLive.net

Spent my career poking fun at central bankers (see pinned tweet) but now things are so bad I actually have to defend them 🤣

This has to do with the yield curve and the portion of it that the Fed controls (overnight rates--the very shortest end). They pin the tail on the donkey, but the rest of it can wave in the wind. A lower Fed Funds Rate, all else equal, would raise inflation expectations…

The bond market is currently showing everyone what would happen if Powell were replaced with a more dovish Fed Chair. The shortest-term debt is rallying and longer term yields/rates are rising. This is 110% as expected.

While core inflation remained relatively mild in May using the Fed's preferred gauge, this chart shows how goods prices are no longer helping and have in fact started to make a contribution to inflation, as measured on a 12-month basis. Last year, almost all of the overshoot…

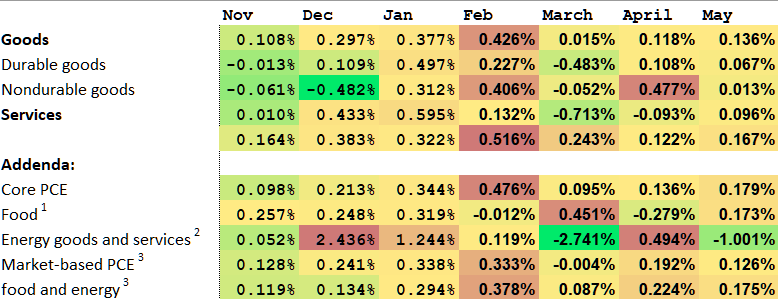

Core PCE inflation was +0.18% in May. 12-month core prices rose 2.7% from 2.6% in April (and April was revised up from an initially reported 2.5%). Headline prices rose 0.14% in May. The 12-month reading ticked up to 2.3% (from 2.2% in April, revised up from 2.1%)

Economists at Deutsche Bank did back of the envelope math: Attempting to remove Powell as Fed chair might send short-term rates a bit lower but long-term rates a bit higher. The net savings would be a mere $12-15 billion through 2027 even if Treasury implemented an activist…

The president says that if the Fed lowered short term rates, interest expenses for the U.S. would fall by $1 trillion per year. The U.S. spent $1.1 trillion on interest expenses in 2024, and so there's almost no way this claim is remotely true.

Faulty conclusion and one the admin should acknowledge after last week's Powell ouster trial balloon proved the theory that artificially lowering the Fed Funds Rate would only help the shortest rates and likely push longer term rates (like mortgages) higher.

TRUMP: HOUSING LAGGING BECAUSE POWELL REFUSES TO LOWER RATES

June Retail Sales beat expectations up 0.6% m/m (0.1% consensus), with Control Group (which feeds directly into GDP) also up 0.5% vs expectations for a 0.3% gain. Very solid figures in nominal terms, but it's important to note that core goods inflation has picked up in recent…

Hat tip to Ed, who mentioned this before I posted my chart.

Not hard to imagine front-end becoming absurdly rich as real-money reduces duration.

The bond market is currently showing everyone what would happen if Powell were replaced with a more dovish Fed Chair. The shortest-term debt is rallying and longer term yields/rates are rising. This is 110% as expected.

I see a lot of reminders this morning that tariffs and imports are excluded from PPI. That is a very valid point, but there's a lot more nuance to it than taking it at face value to say we won't see tariff impacts in the PPI report - I'll explain more in the🧵 Despite the big…

About that "no evidence of inflation" from tariffs... If you know where to look, it seems pretty clear that inflationary pressures are building in the product categories most exposed to tariffs. Case in point from today's June CPI report: Household Furnishings & Supplies, which…

A recent study by two Fed staff economists (federalreserve.gov/econres/notes/…) highlighted many of these categories as more exposed to China tariffs, so it makes sense we're starting to see some initial signs of pass-through. However, this is just the beginning and we're likely to see the…

Biggest drivers of disinflation: - lodging away from home - transportation commodities - new and used cars/trucks - eggs Biggest drivers of inflation: - Housing - medical care services - gas - professional services

Core goods CPI 0.7% YoY...fastest in almost 2y...there's your tariffs folks...

Pounding the table for Fed rate cuts is all well and good assuming 2 things: 1. tariff-driven inflation never shows up 2. the bond market isn't worried about #1. Otherwise, despite lower rates on T bills, etc., longer term rates like mortgages would end up higher. Bottom…

Some unrounded MoM changes in PCE going back to Nov. Perhaps the cooling in Nondurables was a pleasant surprise?

pretty big for a 2nd revision to consumption

Contributors and subtractors to GDP

Q to Powell in the Senate today: Why isn't the Fed willing to look through tariff-driven price increases? A: "As I said, a one-time [increase in the price level] could be the base case. But in a situation like this where the process could go on for a long time, where the effects…

The US Federal Reserve proposes changes to ease the enhanced supplementary leverage ratio for large banks. The proposal would reduce aggregate tier 1 capital requirements for global systemically important banks by 1.4% or $13 bln Proposal would reduce capital requirements for…