Kris Sidial🇺🇸

@Ksidiii

Co-CIO of Ambrus| (Focus: Volatility Trading / Tail risk hedging )| @penn guy ( These are my personal thoughts and not the opinions of Ambrus)

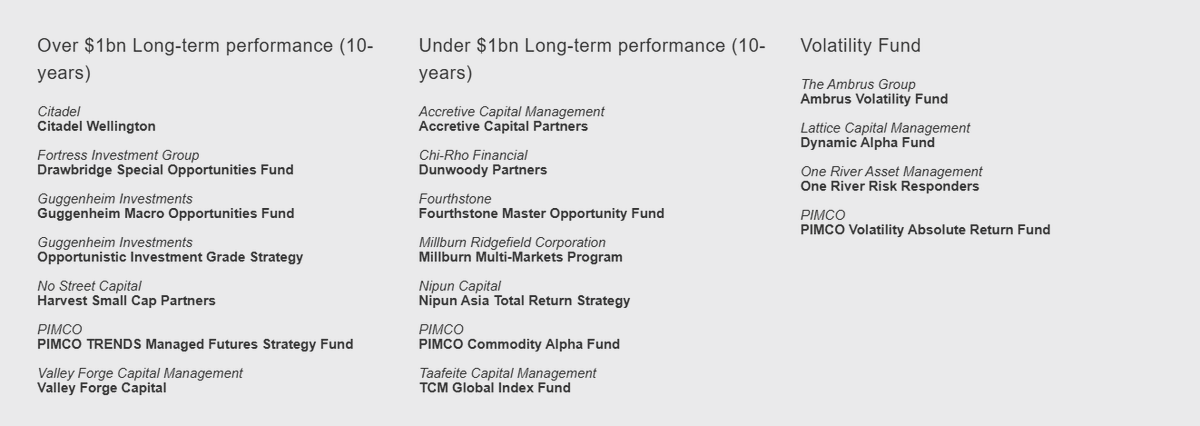

Just found out that Ambrus is nominated for Volatility Fund of the Year. It is truly humbling and I'm very grateful 🙏🙏🙏

Equity vol getting absolutely clobbered. Nice to see that Contango spread in the /VX curve opening up a bit.

Thanks to @Ksidii for sharing some very interesting research and commentary $VIX

If you trade in the $VIX complex, this might be helpful to you.

Over the past decade, increased competition among market makers has led to tighter spreads and more efficient derivative markets overall. However, in recent periods of market stress, we’ve observed a growing trend: market makers pulling back from quotes during volatile moments,…

Finance twitter is a peculiar place. So much overconfidence across many accounts selling stuff with so little objective and measurable track record of success.

And yes I felt like an assclown lol somethings are simpler than we make them.

Now that ISDAs are the topic of the day, here’s a funny story for you. Once, I was asked to make a market on this absolutely absurd swap…..it had 11 different legs, was contingent on time, and involved some sort of volatility shift. I don’t even remember the full details (lol).…

Meanwhile, in Chamathland:

The jokes must write themselves

Subway taps Burger King veteran as next CEO cnbc.com/2025/07/21/sub…

I would like to give you guys some interesting volatility commentary but there is none 🤣. Front month /VX is annoyingly sticky. Short dated techy upside is wildly expensive, but a straight delta play / call spreads continue to pay. S&P 3-5M slightly OTM upside remain cheap.…

We also stepped up and provided liquidity as well, but at that point the pit had more capital than the funds. Now the HFT guys just fad away until they see edge again. Markets much more fragile! The best guys understood how to make markets, own wings, and buy/sell vol.