Kiva Dickinson

@KivaDickinson

Founder of Selva Ventures | Investing in emerging health & wellness brands | Formerly: @tpg @circleup | Toronto sports fan |📍LA, CA

Today we’re thrilled to share that Selva Ventures has closed its second fund, raising $34 million! (thread)

2025 is the start of a very acquisitive era of CPG I don’t see this stopping Great breakdown from @drewfallon12 as usual And they said no big outcomes in men’s care…

UNILEVER TO ACQUIRE MEN'S CARE BRAND DR SQUATCH Private Equity group summit partners was reportedly exploring a $2B sale last year for the brand when it was generating $90m in EBITDA Dr. Squatch raised one VC round before being acquired by Summit in 2021 2024 sales for Dr…

If you have 5 minutes this weekend I really recommend watching this clip from world #1 golfer Scottie Scheffler’s press conference With incredible honesty, he very publicly describes the “now what?” feeling that I have heard articulated in private by many super high performers…

Why oral health is the next big topic in longevity — great breakdown from Selva partner Madeline Kaplan open.substack.com/pub/emergentla…

the goal of life is to be excited to go to work and excited to go home

All jokes aside, Bill Ackman entering that tennis tournament is great evidence of how hard it is for rich/successful/powerful people to get honest feedback on their abilities

One of the world’s biggest candy companies buying one of the world’s biggest cereal companies says all you need to know about what cereal really is

Breaking News: Ferrero, the Italian candy maker that also makes Tic Tacs and Nutella, has agreed to buy WK Kellogg, the American cereal giant, in a deal valued at $3.1 billion. nyti.ms/3U4rTbC

2025 is the year of CPG M&A

SCOOP: The Italian candy maker behind Ferrero Rocher and Nutella is nearing a deal to buy the breakfast-cereal conglomerate WK Kellogg. $KLG w/ @BenDummett wsj.com/business/deals…

Raising a seed fund is hard, but the changes in QSBS are a nice tailwind for those investing. Most companies at seed (and A/B for that matter, as unlikely to have $50MM in assets) are QSBS eligible, and reducing the clock for getting at least partial QSBS treatment to 3 years is…

💯 Best CMO in Fintech!

we’re going to completely change the future of credit, full stop.

I am biased but @ChantalRapport is awesome

We’re here to change the future of credit. Watch Upstart CMO and SVP of Growth Chantal Rapport describe our vision for the future: youtu.be/sRrkRD3mz-4

If you regularly need to apologize for your boss then you probably need a new boss Otherwise, the best case scenario is you'll be apologizing for your business partner

If I could only know one number before making a CPG investment, it wouldn’t be sales, margin, or even growth I’d want to know something I call the Traction Efficiency Ratio (TER) TER is calculated by dividing a company’s last twelve months (LTM) net revenue by the total equity…

Is there a major US airport with worse food than Chicago? Just walked over a mile for a connection at ORD and the best option I passed was Jamba Juice @PeterRahal @Nrcoope @_dhruv_1 how do you live like this?

Two ideas can be true: - public grocery stores is a bad idea - dunking on people who think it’s a good idea does nothing to address (and partially causes) why we got here in it soon becoming policy for the biggest city in the country

Peter Thiel on why 70% of Millennials say they are pro-socialist: “When one has too much student debt or if housing is too unaffordable, then one will have negative capital for a long time… and if one has no stake in the capitalist system, then one may well turn against it.”

If there is a powerful intro you can make for somebody you deeply respect you should do it ASAP It is selfishly one of the highest ROI things you can do it surprises me how many people don’t think this way (I think a form of scarcity vs abundance mindset) They think it’s a…

“Bias to action” is one of the most powerful traits in an employee It can’t really be taught But it can be learned by observing and modeling a good mentor The highest performers I know: 1. Don’t let themselves get stuck 2. Don’t wait for someone else to do something important

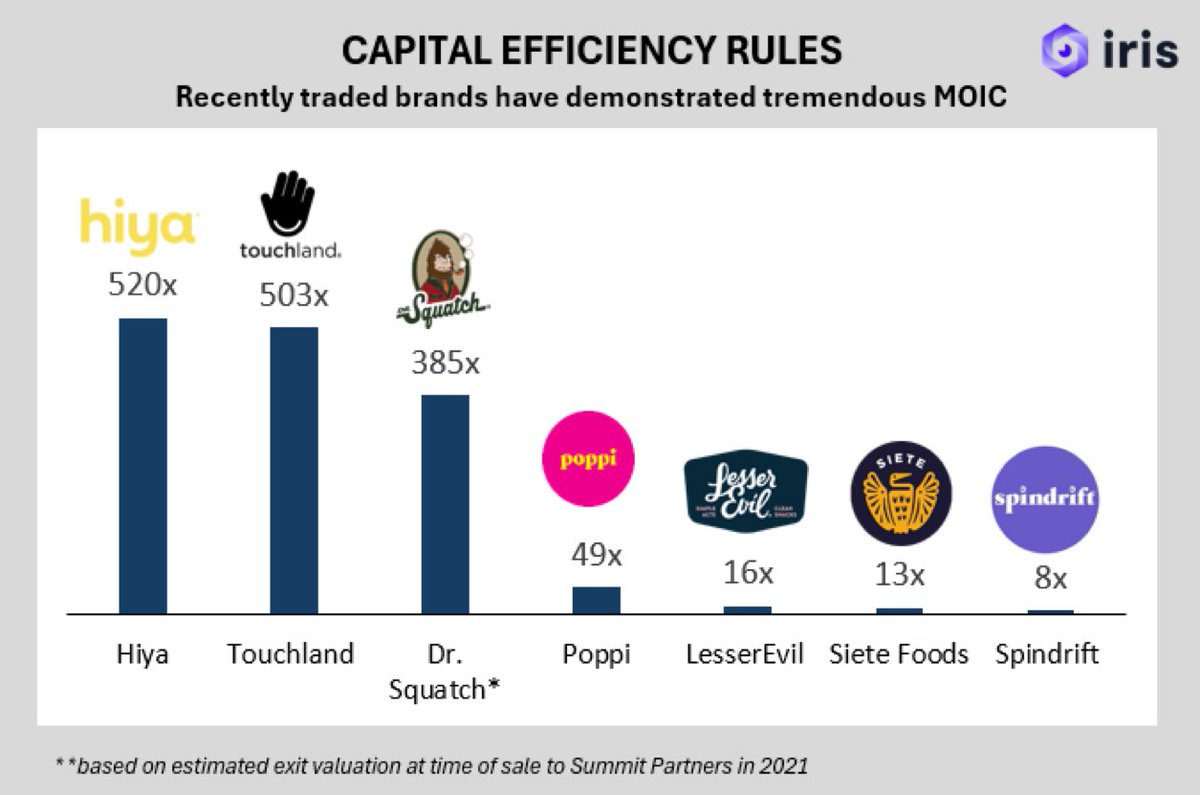

“The outcomes are small in CPG”

It has been a crazy year in consumer products M&A Dr. Squatch > Unilever Poppi > Pepsi Alani Nu > Celsius Siete > Pepsi Rhode > E.L.F. Medik8 > L'Oreal All deals in excess of $1 Billion and without the rate cut we originally expected in the first half of this year

The scale, category, extendibility and leadership (Foraker has already been a public co CEO) make this the first brand in this generation of wellness CPG to make real sense for an IPO My bet is O'Farm becomes a regular acquirer of disruptor brands in the coming years

According to a report from Reuters, Once Upon a Farm confidentially filed for an IPO. The offering could value the company at $1B. Cassandra Curtis and Ari Raz launched Once Upon a Farm in 2015. In 2017, Jennifer Garner and John Foraker, the former CEO of Annie’s, joined the…