Joseph Wang

@FedGuy12

Subscribe at http://Fedguy.com for latest thoughts and analysis. YouTube: http://youtube.com/@Fedguy12

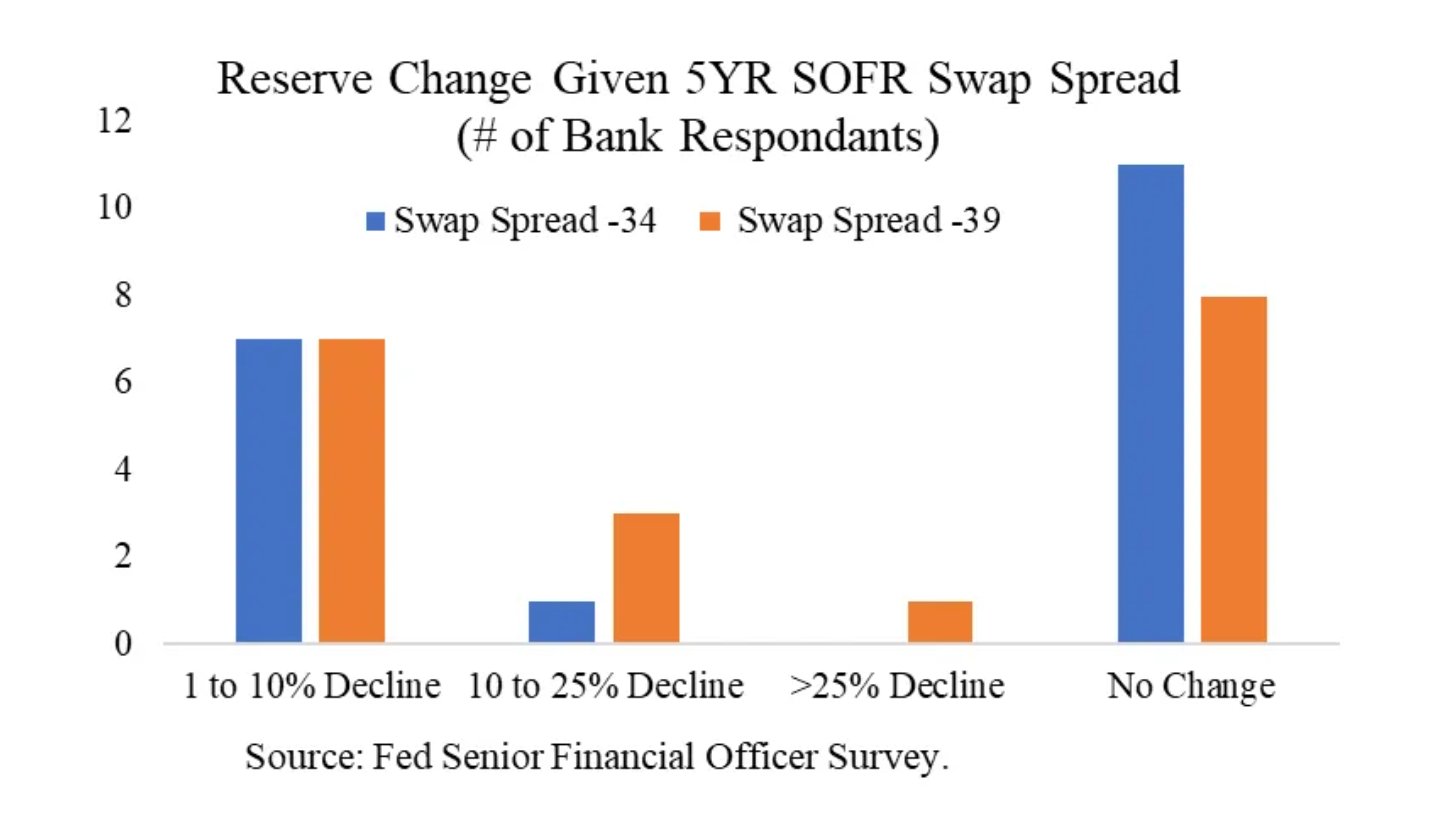

SLR reform increases the Treasurer holding capacity of banks by $1t, but they also require higher returns. Surveys suggest even modest changes in return influence bank demand. Banks could end up as an investor class that polices the belly of the curve. fedguy.com/if-you-build-i…

Trump has a field trip scheduled this week. * WHITE HOUSE VISIT TO FED HQ PLANNED FOR THURSDAY: OFFICIAL

Trump has a field trip scheduled this week. * WHITE HOUSE VISIT TO FED HQ PLANNED FOR THURSDAY: OFFICIAL

The International Role of the U.S. Dollar – 2025 Edition federalreserve.gov/econres/notes/…

I’m joined on @HiddenForcesPod by @FedGuy12 to discuss his monetary and public policy frameworks, how they help us make sense of the White House’s trade policy, and the downstream consequences for financial markets and the broader economy. 🧵👇🏼 hiddenforces.io/podcasts/capit…

Markets Weekly July 19, 2025 Economy is Fine The case for 25bps Pressure on Powell youtu.be/blYjXNzYmE4

Waller makes a clear and reasonable case for a July cut. Looks like we're going to get a couple dissents! federalreserve.gov/newsevents/spe…

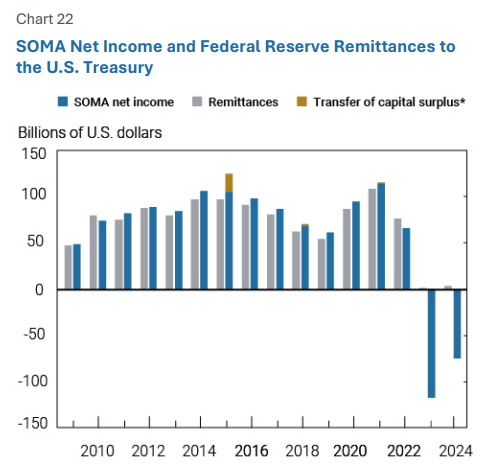

Fed is not self-funded, but indirectly funded by the public. This is because the Fed remits its net income to the Treasury - the more the Fed spends the less it income it remits to Treasury. Large Fed spending on things like new buildings increases the federal deficit.

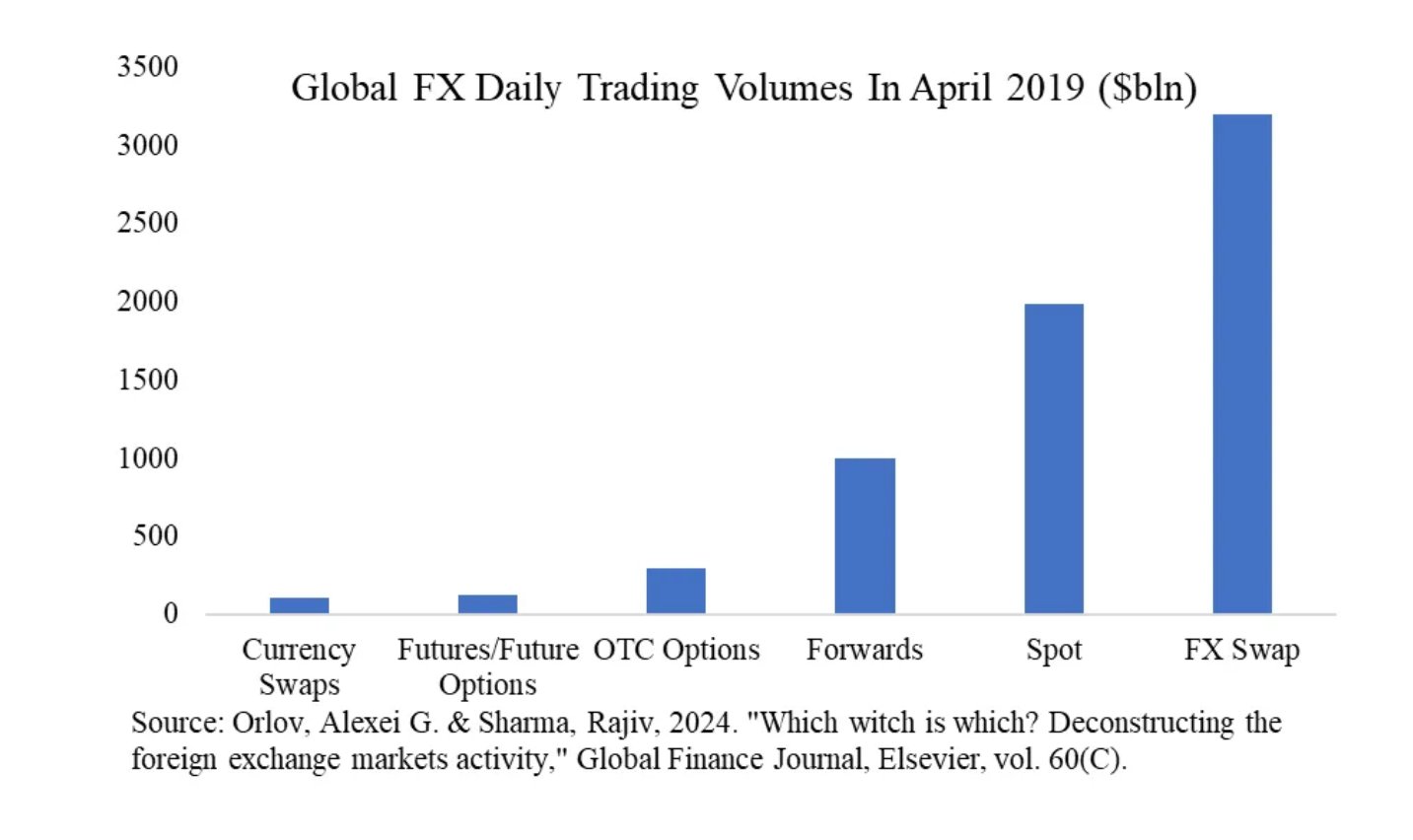

Global investors are very long dollars, with exposure climbing with asset prices and the trade deficit. CFTC positioning is misleading as futures are a small part of the FX world. Dollar weakness is painful to foreign investors and will require rebalancing fedguy.com/dollar-positio…

No one really knows how big the U.S. repo market is. Or rather, no one 𝑑𝑖𝑑. We combed through the appendixes to a decade of annual reports for over 150 dealers and banks to get the full picture. The total? $12 trillion, almost doubling previous estimates.

Markets Weekly July 12, 2025 Tariff Man returns Silver breaking out Pressure builds on Powell youtu.be/y2owYAa3TPY

Almost all political donations by Fed employees go to one party. The Fed is already politicized. opensecrets.org/orgs/federal-r…

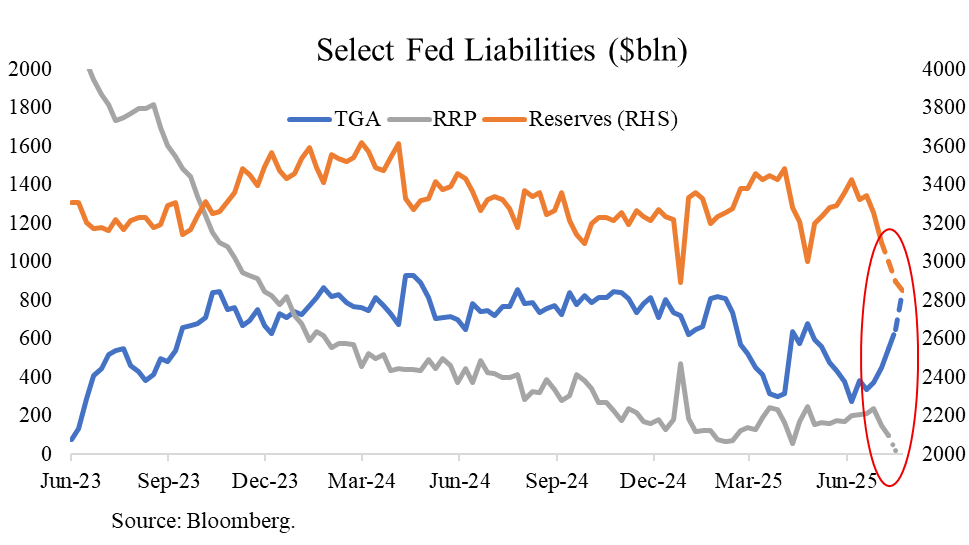

The TGA rebuild will send the RRP to 0, reserves to multi-year lows, and push up repo rates. Along with the recent spike in SRF usage - there is cover for an outright end to QT. This could be a compromise to the intensifying disagreement on the FOMC. fedguy.com/zero-rrp/

Taiwan's central bank confirmed intervention in the month of June; its reserves rose by over $5b -- The $24b plus rise in reserves and forwards over the last 3ms is the largest increase since late 2020. Very clear that the CBC is resisting appreciation pressure 1/2

Markets Weekly July 4, 2025 UK Market Kerfuffle BBB and NFP Trade War Heating Up youtu.be/jNjUTH4HJfM