Derivatives Don

@DerivativesDon

Fist pounding table very hard Process Start out with macro Use Daily and 4 Hour to determine tone Operate against 30/60 minute charts with strength of tone in mind. Never trade against macro Never trade against charts When they both line up - make your living.

Leads me to believe that someone is entering a position (recession crash) vs exiting a position Will give the exit argument this - all have been profitable trades, and/or if top of the house at a pod shop doing it, they are not panicking, just conducting business in a smart way

Keeping end of year public debt constant What’s the difference between 4% Fed Funds and associated interest on TBills Vs 1% Fed Funds and associated interest on TBills? Answer Congress, (or in current world) Administration gets to chose explicitly who gets the fiscal spend…

You want to get a sense of how risk averse people are in general…… Watch Jeopardy See how often those in 2nd and 3rd place don’t bet it all when they hit a Daily Double, especially in situations where they are all but mathematically eliminated unless they go all in.

The spending behavior of those who receive stimmies is very irrational Stimmies lead to inflation Inflation leads to drop (n real consumption Marginal propensity to consume (on a real basis) should fall But stimmie receivers think they just won the lottery……….

Life

In comments in one of my posts I came across a person with no risk target for his portfolio and a view that his job is to maximize return without regard to risk. I said the job of every investor is to know what their risk tolerance is and hold a portfolio that takes roughly that…

The same thing that may make housing more affordable in the short term is the same thing that makes inflation higher. What amount of Fed Funds cuts do you need to affect home price affordability? And what will that translate to in inflation? Who do you want to tax? Dollar and…

Forced liquidation in reverse, innit

Imagine liquidity as oil in a pipeline. When central banks inject liquidity (QE, rate cuts, balance sheet expansion), the pipeline floods—money has to flow somewhere. Just like in commodities, where rising demand and constrained supply push prices up, liquidity expansion creates…

Great post by Mike! FINANCIAL ENGINEERING HAS HIGH FRAGILITY The more dependency, the more fragility. Derivatives are always about more dependency than just the underlying. If you own the underlying with your cash, things are pretty straight forward If you bought the…

Everything I do is mostly systematic. This year I haven't done many discretionary trades. Systematic has been long stocks and gold for most part. I sense a euphoria, and I'm afraid most people have no idea of what is coming. Financial engineering has high fragility. $SPX #ES_F

6. "They should actually have to have jackets with the names of all the people who are sponsoring them. Wouldn't that be cool?"

Nooooooooooooooooo. I was told by 69 macro experts that tariffs are not inflationary.

Fed’s Williams says tariffs are pushing up inflation, and he expects even higher prices in coming months

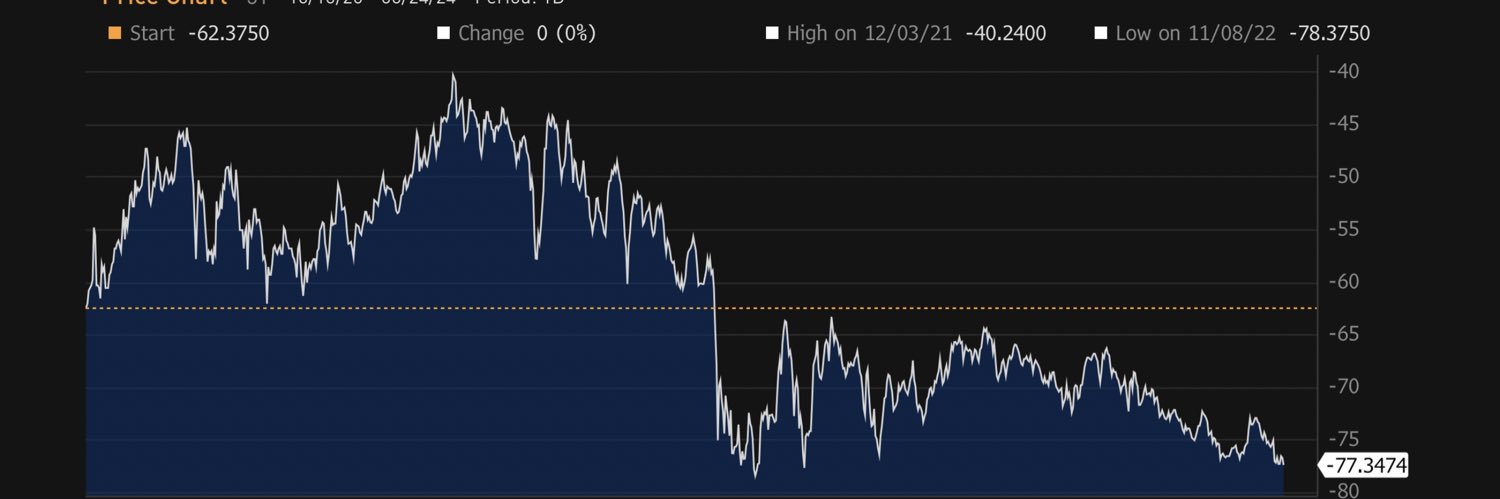

Dear Mr Sophisticated, If you are using an ISDA for this trade, it would be helpful to show the returns on these instruments inclusive of the implied funding rates, not simply the cash returns. Unless you say otherwise, safe to assume the results are worse, especially once you…

This is an incredibly unsophisticated take. You must not have an ISDA or even know what that means.

To our friends in Congress Rather than browbeat, would suggest you take one of 2 other approaches to reduce net interest expense on the public debt 1) Reduce the number you multiply the interest rate by - I believe it is called the public debt 2) Pass a targeted tax on…

House Speaker Johnson suggests lowering interest rates to stimulate the economy, as reported by CNBC

🙏 Ran derivatives trading across all asset classes at a big real money account for more than 20 years, 30 years total on that same desk. I am actually not a big fan of the few books from the past couple of years that have tried to tackle this - a couple with alternative…

Do you know how mis-priced the equity market was yesterday for SPX to go up 54bps in one day when Funds are at 430bps?

Very good episode. @BrianYelvington one of the real good and knowledgeable guys in this business - I still remember the hour he dedicated to me a couple of years back like it was yesterday.

NEW ODD LOTS: How to get and KEEP your job at a multi-strategy hedge fund In a continuation of one of our favorite stories, we talked to industry vet @BrianYelvington about the path to becoming a PM, and then not getting fired by losing a ton of money podcasts.apple.com/us/podcast/how…

People need to be more discerning about how policy works, especially given the size of the public debt. Main source of easy policy is residual QE and ATI. In other words, FCI. With so much public debt (and relatively low private credit), Fed Funds likely has relatively…

During April selloff I suggested Powell is wrong for not cutting rates. In retrospect Powell was, and is right. If crypto and tech can make daily ATH (with bubble like valuations), rates are not restrictive enough.

Great video at the proper pace.

If you're curious how OpEx works and what the "window of weakness" is, here's a fantastic explanation by @perfiliev and @jam_croissant

Most times people hand out candy to make others forget about bad things Instead, we are seeing larger and larger dumpsters set on fire in an attempt to distract

Just finished listening to this (for the first time). 2 of the best in interviewers out there. In fact, I have never heard @DavidBeckworth allow himself to speak so much, which is an important quality David and Felix possess as interviewing hosts. This episode packed with…

Is it really cheaper to issue TBills than 10 year notes? Of course it is clear to see that the current yield on TBills is below 10 year notes, BUT Why shouldn’t you apply a Sharpe Ratio concept to that “savings?” If you really want to issue cheap debt, why not just print…