David Thomas

@DavidThomasOH

Ohio State Rep. 65th District Former Ashtabula County Auditor & Austinburg Fiscal Officer W&L '15 BW '18 John 16:33 *Personal Account*

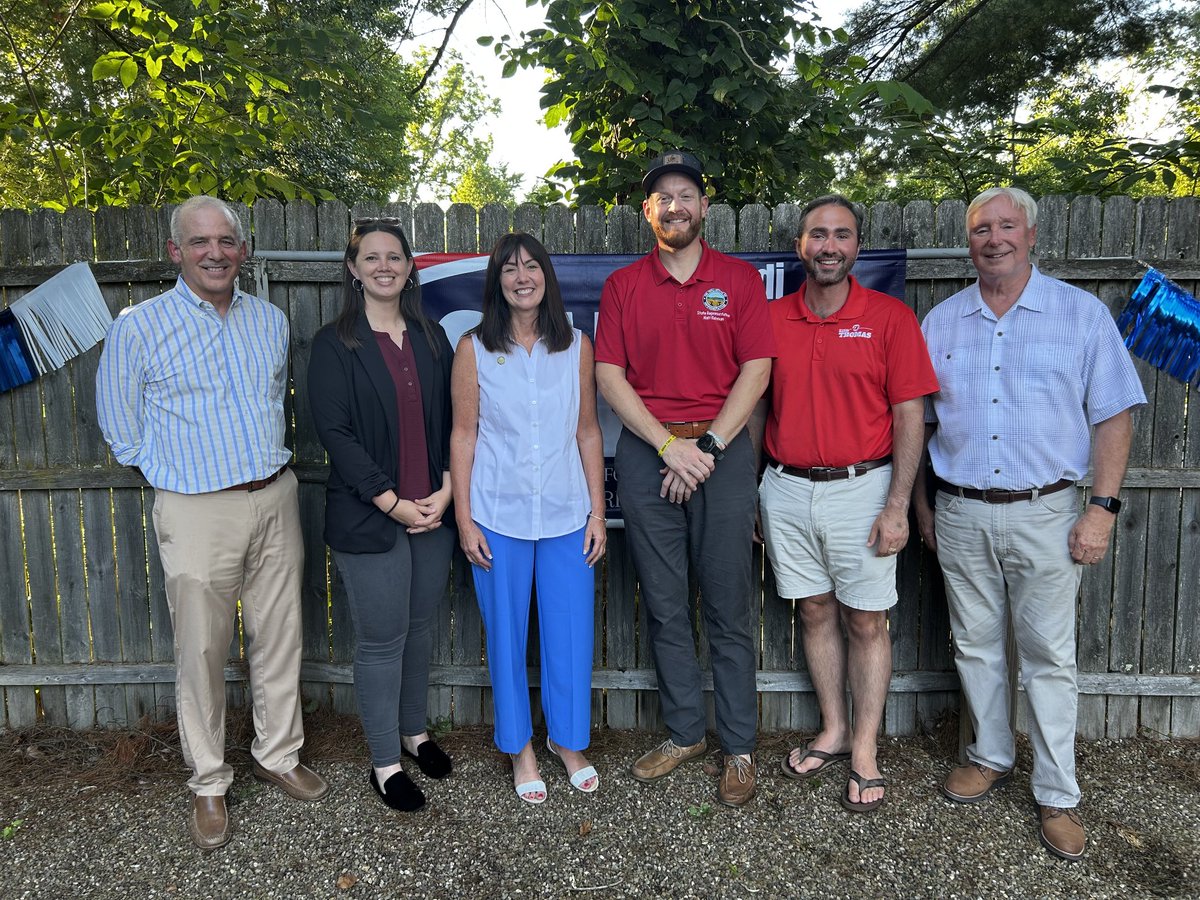

Thank you 65th District! Today was awesome being surrounded by family, friends, and colleagues 🇺🇸 more photos coming tomorrow! It is an honor to serve as your State Representative.

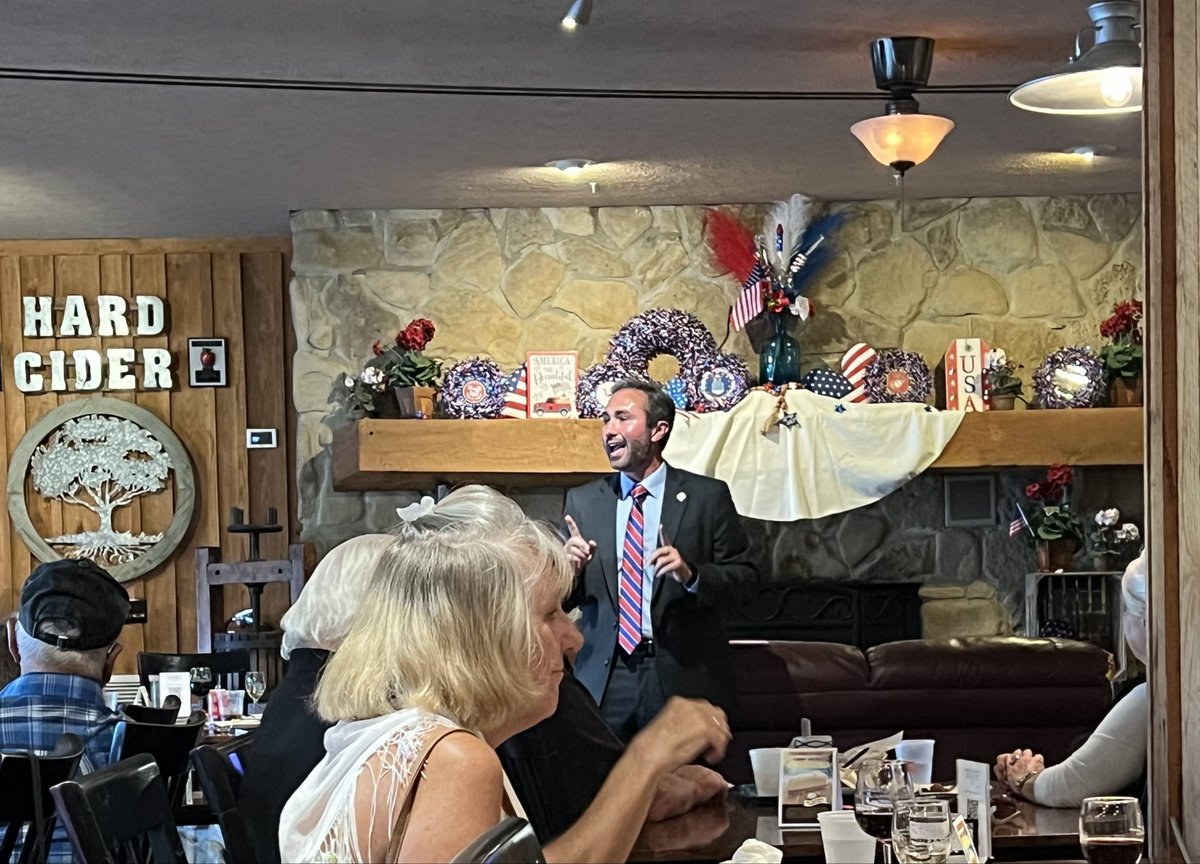

Took a trip to support my colleague Rep. Jodi Salvo in Tuscarawas County recently alongside Speaker Huffman, Rep. Kishman. Rep. Craig, and Senator Landis!

We will get it done, more is needed to help our taxpayers!

Thanks to the members of the @OHRGOPCaucus who voted to override the Governor’s veto and provide much needed property tax reform. The Ohio Senate has the votes to override the same veto. We also have the votes to override any other property tax veto the House is able to send us.

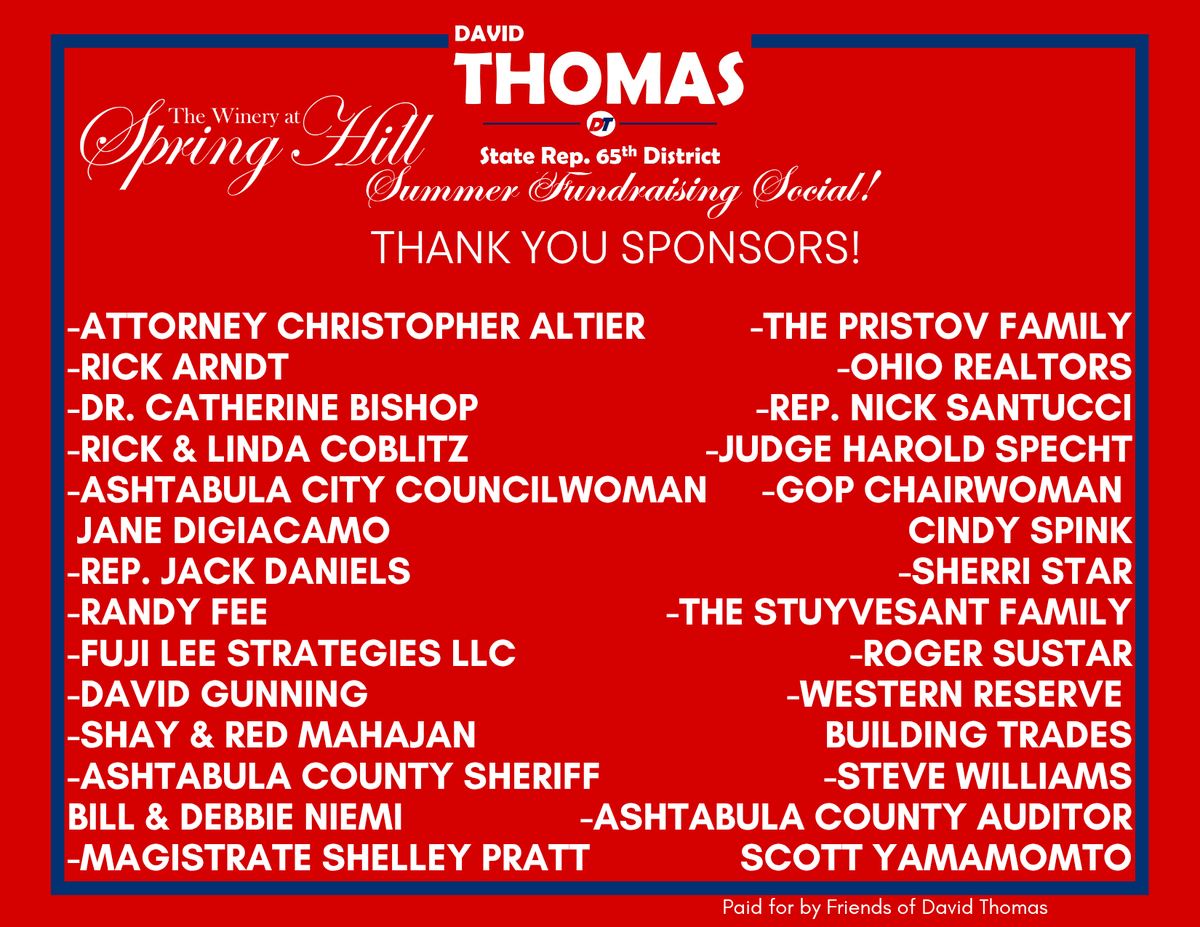

Thank you to all who supported and attended my annual summer social fundraiser last night at the The Winery at Spring Hill! Your support allows me to continue fighting for taxpayers and the issues that people care most about. Running every two years means being on the ballot and…

There are those who say the state should be paying to subsidize property taxes. Who is the state? It's us, we are the state, we are the taxpayers. It is better for Columbus to take less, and you to keep more and decide how to fund local services. Using our tax dollars, to…

Today we voted 61-28 to override Veto #66 to provide transparency in the voting and property tax process. For too long, government has used confusing tax levies like replacements, emergency, substitute, and renewals with an increase to raise taxes on homeowners without total…

"When we hear the state should pay for this, who is the state? The state is us." --@DavidThomasOH as the House begins debate on overriding the governor's property tax vetoes.

You either believe the level of taxation on our residents and spending is not enough or is too much. If it is not enough, the current property tax system works great for unvoted windfalls and large increases in revenue. If taxation and spending is too much, curbing the automatic…

Overriding the Governor's vetos on Property Tax Reform will happen on July 21st. These 3 reforms are important, but much more will still be needed. These provide transparency at the ballot box, separating value increases from tax increases for many homeowners, and gives tools to…

Government efficiency has to be the priority with cutting taxes. I traveled to Erie County recently to sit in on their Blue Ribbon Commission discussion for how to cut property tax costs to taxpayers and more efficiently operate the county. It was excellent!

This past Tuesday, @DavidThomasOH stressed that skyrocketing property taxes are a major and disproportionate burden for folks. @GovMikeDeWine’s vetoes of urgent property tax relief in the budget is a gut punch to Ohio homeowners. The legislature needs to override those vetoes.

Rep. @KellieDeeter and my HB 64, the Senior Sportsmen License Fairness Act has been signed into law! Gary, a constituent, reached out the first day of my term to ask us to correct a seeming oversight with the age Ohioans can qualify for their discounted Senior Huting and Fishing…

Why are Property Taxpayers losing trust in the system? Letters and policies like this below from schools. Property owners aren't asked for tax spikes, but they're forced to pay huge unvoted windfalls. We're trying to fix that and give property owners more control. When they do…

New artwork displayed in our Columbus office from Individuals with the Ashtabula County Board of Developmental Disabilities ! Nicole did this beautiful patriotic work 🇺🇲

The system needs changed. 44,000 delinquent properties in Cuyahoga, 20% of property in Mahoning, 16% delinquent in Montgomery, doubling in Greene County. We must return property taxation to the people, fighting for continued spikes and windfalls in unvoted property taxes isn't…

Thank you Treasurer Sprague!!

As State Treasurer, I agree with the legislature that we have to protect homeowners from runaway property tax bills. The General Assembly has passed reasonable, thoughtful property tax reform, and it's time to listen to the countless Ohioans smothered by property tax hikes.

Ohio's next Governor @VivekGRamaswamy speaking at @ALEC_states conference introduced by Senate President @Rob_McColley 🇺🇸 Introducing the Ohio Doctrine!

The Property Tax Reform efforts in the Ohio Budget are the baseline changes needed, the changes to build upon for stronger future reforms to help our taxpayers. Removing many schools from the 20 Mill floor to prevent spikes in bills in January, creating oversight to lower tax…

"The voters can still decide to fund these entities as high as they'd like,” Thomas said. “But the biggest impact of these veto overrides are to prevent spikes of unvoted property taxes moving forward and give voters much more of that control.” abc6onyourside.com/news/local/ohi…

Ohio taxpayers…do you want to know who is fighting for YOU to fix the property tax crisis in Ohio? This is a great list of the champions leading the way to bring relief to Ohio taxpayers!! @BrianStewartOH @JoshWilliamsOH @DavidThomasOH @matthuffman1 @mikedovilla @clickforohio…

I made a list of #Ohio Republicans who are publicly pushing to override the governor's budget vetoes......So we can push everyone else to say NO to overrides: open.substack.com/pub/rachelcoyl…

Quick trip but a memorable one! Thankfully could join my family for a few days in North Carolina in-between work. Lots of sun, board games, and phone calls! Just a small portion of the bigger family could join this summer.