hell0men.hl Pro DeFi

@hell0men

⚡My top picks $CRV $HYPE $PENDLE Investor, remember. Instability, uncertainty, and risk are the price of freedom.

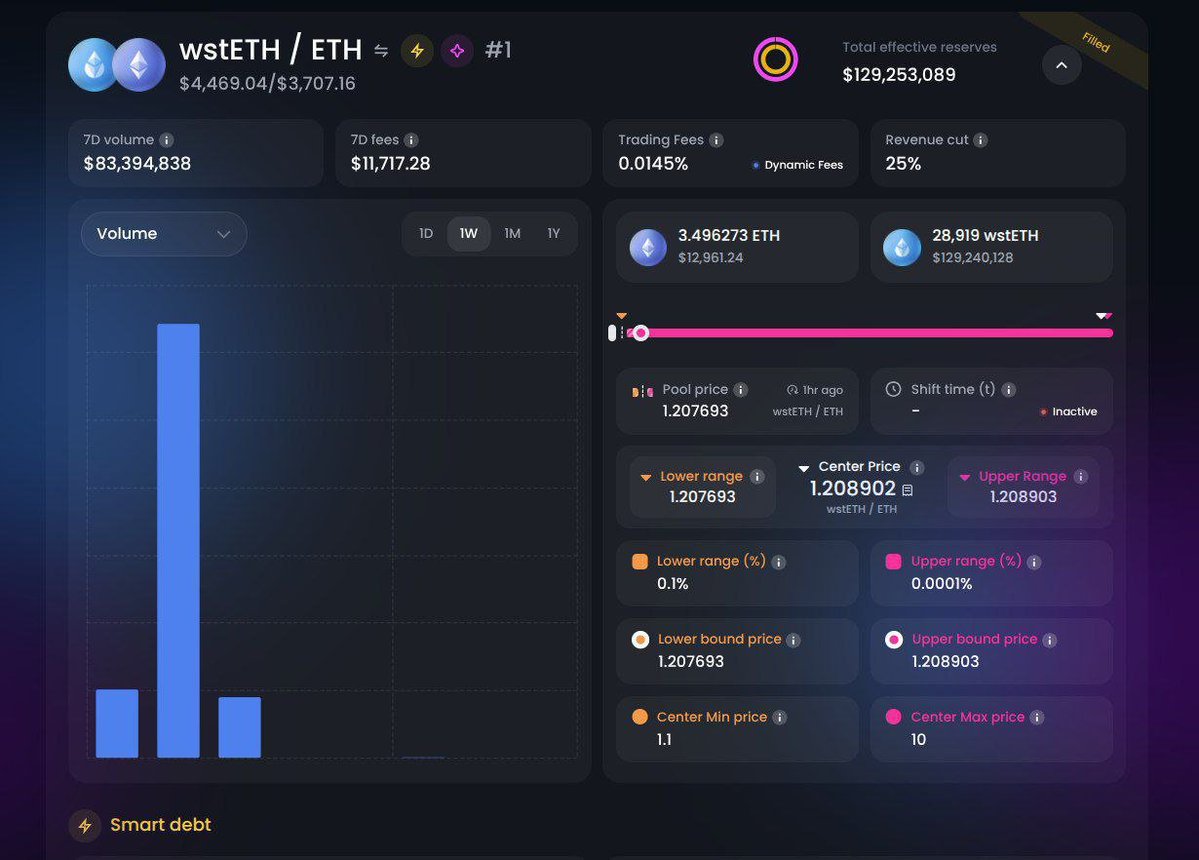

🩸wstETH Liquidity Crisis 1. Major ETH providers withdrew liquidity from AAVE 2. Farmers with wstETH/ETH looping positions are at loss and forced to sell at market, taking leveraged losses and driving down wstETH value 3. Arbitrageurs buy discounted wstETH and unwrap through…

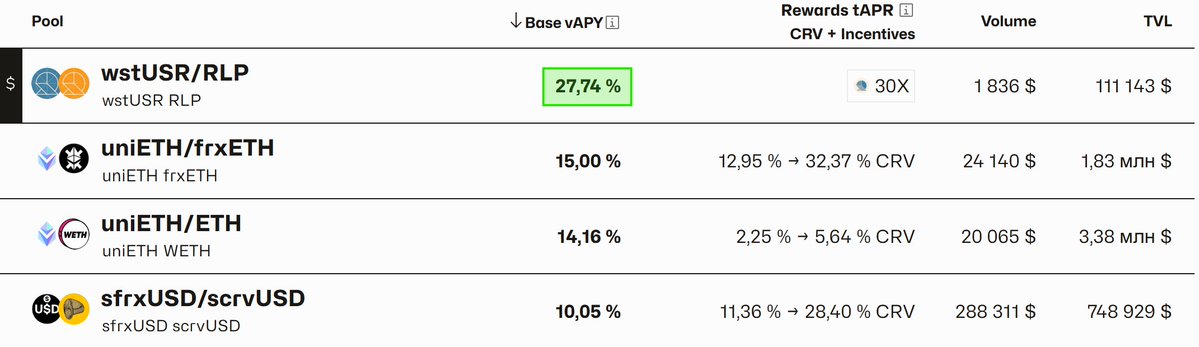

Top @CurveFinance stable pool by organic yield. No dilution, no incentives (only points), just high-yield basis trading.

Maybe TVL of this little pool not rising even after my active shill because some of you thinking that it will BE DILUTED, but it won't. As you can see, there is no incentives, and mostly no volumes. It's NATIVE INTRISTIC APY of RLP and wstUSR. x.com/hell0men/statu…

🧑🌾 Hey farmer: Discovered a new unannounced Curve pool with juicy yields You can earn high returns from pair of yield-bearing stable tokens: @ResolvLabs wstUSR (11% APY) + RLP (22% APY) from funding rates. 👀This is beating Ethena sUSDe yields. When you provide liquidity to…

Interesting. HyperEVM DEX with the less TVL got highest 24h volume? @gliquidx is @CryptoAlgebra fork, that has highest predicted APY, if we count pre-token incentives. gliquid.xyz/?referral=0ze9…

Around 90% of holders locked $usualx for 12 month, plus emission rate was decreased after UIP-10. Buyback not even started. Now $USUAL can draw impressive charts, like I said before.

USUALx earnings in USD0 are already less with a 12 month lock than before UIP-9. That's because 70% goes to $USUAL buyback. If the majority of holders will lock USUALx for any period of time, only the remaining liquid $USUAL + rewards, received from USD0++ (should be less than…

The same products: DeFi + AI smart wallet with self-farming, but so different market cap. @gizatechxyz $GIZA FDV $174M 🐇 AUM: $11 M APR 15.00%, mostly $GIZA emission Token utility: ? @ZyfAI_ $ZFI FDV $9M 🐌 AUM: $2 M APR 19.00%, mostly USDC Merkle compaign Token utility: 10%…