Chuck Marr

@ChuckCBPP

Vice President of Federal Tax Policy at the Center on Budget and Policy Priorities.

They’re breaking stuff alright - American diplomacy, humanitarian aid, science research, millions of people’s health insurance Lots of tearing it down - for what?

State Dept. layoffs led by team of outsiders willing to ‘break stuff.' Interviews with more than 60 people detail a frenetic, arbitrary process underpinning the Trump administration’s far-reaching overhaul, by @mradamtaylor @hannah_natanson @John_Hudson washingtonpost.com/national-secur…

Good thing Republicans just enacted a massive anti-clean energy bill - What are they thinking?

This 👇 Electricity prices surging and they're going to continue rising 😓 CPI Energy Services + 1% in June +12% annualized last 3M @RyanDetrick and I talked about this on a recent Facts vs Feelings episode, incl PJM price increases podcasts.apple.com/us/podcast/jer…

This is what failure looks like:

The GOP megabill Trump signed July 4 would increase federal deficit by $3.4 trillion and cause 10 million people to lose health insurance, per CBO forecasts subscriber.politicopro.com/article/2025/0…

Republicans could have extended all the tax cuts for people with incomer under $400,000 -- and kept their hands off Medicaid and SNAP -- and still would have had more than $1 trillion lower budget deficits than this

CBO's score for reconciliation under current law baseline: $3.4 trillion increase in deficits over 10 years "Increase in the deficit is estimated to result from a decrease in direct spending of $1.1 trillion and an decrease in revenues of $4.5 trillion" cbo.gov/publication/61…

Trump admin has already cut billions of dollars in funding for R&D - which funds your mom's cancer treatment; innovations; even our space program. Now the admin wants to cut +$30B - huge cuts to science. Go to ProtectScienceAndInnovation.org to say no.

This proposed 45% cut to IRS enforcement funding would come on top of Rs nearly zeroing out the IRS’s extra enforcement funding from the IRA. The cuts are shortsighted & deeply irresponsible. They will cost significant & much-needed revenue & make the government less effective.

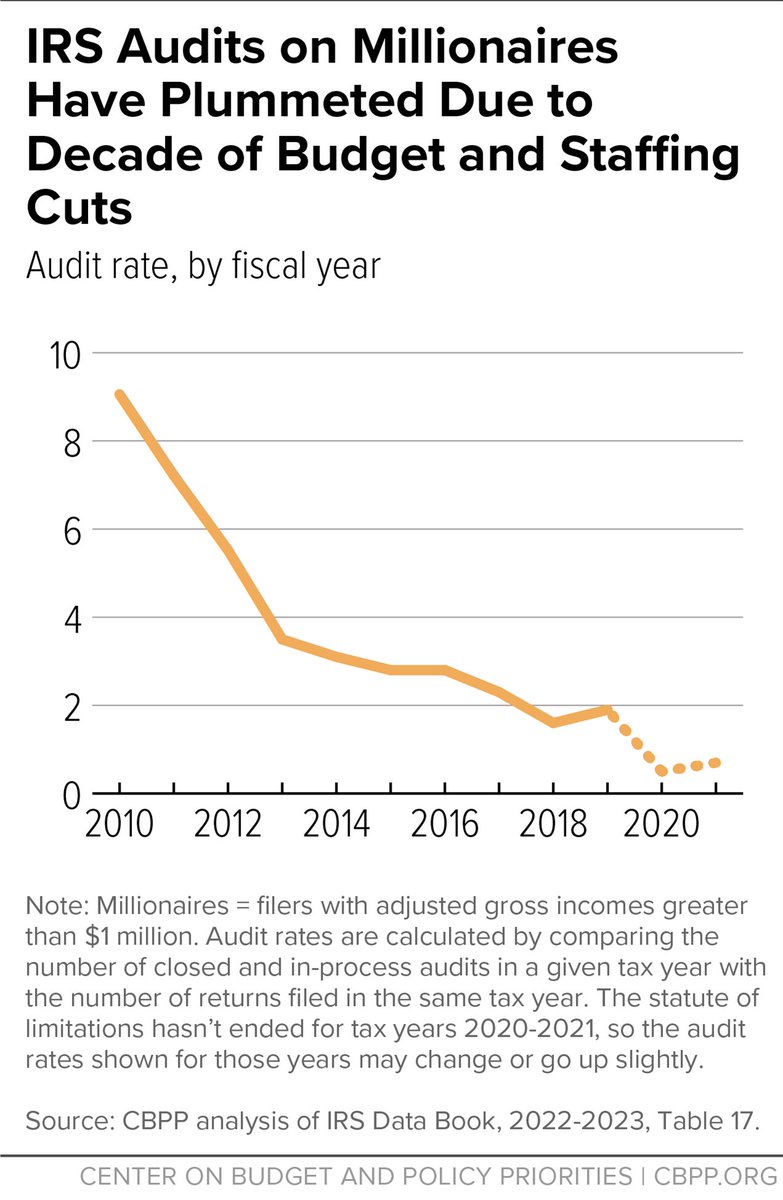

The Trump Administration has been on a reckless path to decimate the IRS & make it easier for people to cheat on their taxes Instead of checking Trump, House Rs are proposing even more reckless cuts- including a 45% cut in enforcement Imagine what this chart will look like

Up is down? No, it's not Try again

President Trump is further SECURING AMERICAN ENERGY by: ❌ Eliminating subsidies for unreliable “green” energy sources. ✅ Preventing American taxpayers from funding expensive and unreliable energy policies from the Green New Scam.

This would encourage more tax cheating and lose revenue -- i.e. the exact opposite of what the IRS is designed to do

JUST IN: House appropriators released a proposed 23 percent cut in the IRS budget for fiscal 2026, including a 45 percent slashing of the tax collector’s enforcement funding. Read more from @doug_sword: taxnotes.co/4kQzLsa

The Trump Administration’s time limit plan would end assistance to 3.3 million people in every state, over half of them children and most in working families. cbpp.org/research/housi…

Not to sound naive in a cynical town - but wasn't there a time when conservatives at least pretended to care about things like basic honesty -- Seriously, some of their constituents actually believe in it -- and here again are House Republicans just inviting tax cheating -- why?

Among his pro-corruption moves, President Trump has pardoned several high profile tax cheaters Instead of standing up to cheating, House Republicans are sending their own pro-cheater message today, cutting tax enforcement 45% forbes.com/sites/howardgl…

The Trump Administration has been on a reckless path to decimate the IRS & make it easier for people to cheat on their taxes Instead of checking Trump, House Rs are proposing even more reckless cuts- including a 45% cut in enforcement Imagine what this chart will look like

MaGa now McGa??

For decades, the National Cancer Institute, or NCI, has spearheaded breakthrough advancements against the disease. Since the 1990s, cancer deaths have been reduced by a third. But now, the world's premier cancer institute is in the midst of a fierce battle over its future.…

WATCH: “So who is the high tax state? If your only constituency is rich people, I understand.” Gov. @GavinNewsom points out the secret @GovBillLee & Republicans don’t want you to know — regressive taxation states like TN are NOT really low tax states for low income families.

We wrote about this earlier this week. GOP leadership has no idea how they’ll handle these expiring ACA credits and it’s a big deal. punchbowl.news/archive/71625-…

Insurers are hiking ACA premiums by a median of 15% next year, based on early reports. ACA enrollees will see their out-of-pocket premiums skyrocket by an average of over 75% if enhanced premium tax credits are allowed to expire at the end of this year. healthsystemtracker.org/brief/individu…

One reason Clare will pay more for health care is Trump and Republicans in Congress thought it was extremely important that the wealthiest Americans be able to pass on $30 million to their heirs tax free instead of just $14 million.

Health insurance premiums going up by ~25% in 2026 is going to be a major economic and political problem. And there is no real attempt from the Administration to do anything about it. wsj.com/health/healthc…

Health insurance premiums going up by ~25% in 2026 is going to be a major economic and political problem. And there is no real attempt from the Administration to do anything about it. wsj.com/health/healthc…