Tax Notes

@TaxNotes

Your #1 source for everything tax. News, commentary, analysis. Nonpartisan nonprofit. #LetsTalkTax & #TaxTwitter | Follow our journalists: http://taxnotes.co/3dvFynI

HM Revenue & Customs’ transformation roadmap announces over 50 measures intended to revamp the United Kingdom’s tax and customs system, including scrapping plans to introduce Making Tax Digital (MTD) for corporation tax. Read more from @santhiegoundar: taxnotes.co/45g3hmA

The tax guidance multinational corporations and international tax practitioners want to see most has nothing to do with the sweeping new tax law that was just enacted. Read more from @jtcurry005: taxnotes.co/3IY24Yn

The U.K. government is seeking stakeholder feedback on proposals to further update the country’s multinational and domestic top-up tax rules by incorporating OECD administrative guidance issued in January. taxnotes.co/3GMVDH9

Tech giant Google has confirmed it will stop charging a fee on ads shown in Canada in response to the Canadian government’s plans to abolish its controversial digital services tax. Read more from @StephanieSoong: taxnotes.co/44J7peP

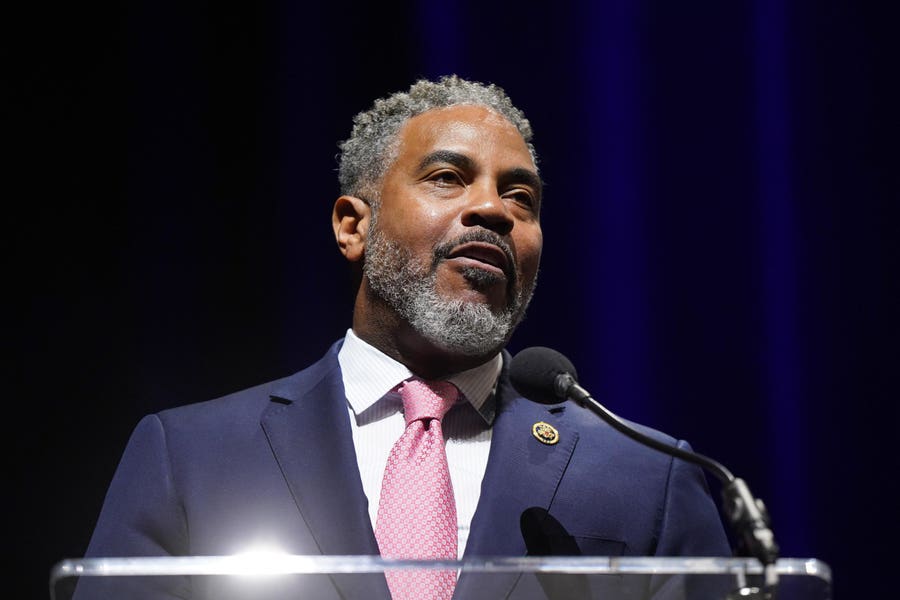

"The question is, how will Republicans pay for it? They just put a $4 trillion hole in the federal deficit, added $4 trillion by giving more tax breaks to billionaires." @RepHorsford said about the possibility for a bipartisan tax bill later this year. forbes.com/sites/taxnotes…

A trip to the Third Circuit to successfully challenge application of a sentencing enhancement resulted in a reduced tax conspiracy sentence for a restaurant operator’s cash payroll scheme. taxnotes.co/4m4Rxcf

The One Big Beautiful Bill Act is expected to increase deficits by $3.4 trillion over a 10-year period, according to the @USCBO's final conventional score of the legislation. Read more from @KatieLobosco: taxnotes.co/3IziHK3

The New York State Tax Appeals Tribunal has rejected a taxpayer couple’s request to estop the state's Division of Taxation from denying their refund of over $115,000 but remanded a question regarding a potential typo in the initial rejection. taxnotes.co/3GChH7l

The Trump administration is arguing before the Federal Circuit that the president's tariff orders are consistent with the International Emergency Economic Powers Act (IEEPA) and with U.S. Supreme Court and Federal Circuit precedent. taxnotes.co/4m0LiWU

From @benmvaldez: Elizabeth Askey, head of the IRS Independent Office of Appeals, will resign September 1, according to the agency. taxnotes.co/4fb2bMw

House appropriators piled on another $300 million, or 12 percent, in cuts on top of the administration’s request that the tax collector’s budget be slashed 20 percent in fiscal 2026. Read the full story from @doug_sword: taxnotes.co/4f2NURY

Governments in the Middle East and North Africa (MENA) should introduce income and wealth taxes to rein in harmful emissions and curb income inequality in the region, according to a new @Oxfam report. taxnotes.co/4lEjmIw

A significantly higher percentage of businesses of all sizes reported a positive overall experience with @HMRCgovuk than tax agents did, research by the U.K. tax authority found. Read more from @santhiegoundar: taxnotes.co/46m9mPs

Luxembourg has announced draft legislation that would reform its property tax regime and create a new land mobilization tax to better reflect land value, curb land speculation, and encourage new housing development. @PaezWrites explains: taxnotes.co/45earYz

Massachusetts has unveiled a live theater tax credit pilot program aimed at supporting musical and pre-Broadway productions. Read more from @EmilyHoll9: taxnotes.co/3TLMFga

"Ultimately, however, Musk’s biggest problem may be rather mundane: Americans don’t seem to care that much about fiscal austerity — even if they say they do," @jthorndike writes. forbes.com/sites/taxnotes…

The Center for Taxpayer Rights compiled multiple examples of federal rulings allowing mostly individual litigants an opportunity to have their day in court after missing a filing date, frequently not to their fault. taxnotes.co/4nYTclv

A California bill to provide a de facto full sales and use tax exemption for many equipment purchases by manufacturers is advancing, following Democratic Gov. Gavin Newsom’s veto of a previous proposal last year. taxnotes.co/44GBJqs

Several EU member states said it is not within the EU's competence to collect a financial contribution from companies to finance the bloc's budget and that such a measure would harm competitiveness. taxnotes.co/3UrY056

Two New York hedge funds have filed Tax Court petitions challenging the IRS’s position that “active” state law limited partners don’t qualify for the limited partner exception to self-employment tax. taxnotes.co/40uBjRp