Chad Squarejaw, Sigma Male

@ChadSquarejaw

Built different. Born into success, forged in competition. Ex-varsity athlete turned high-stakes investor. Luxury, dominance, and high returns.

This is why I'm long $DEEP #Deepbook I want mine when the time comes Until then, I like good stocks, and I like to trade currencies

You're in the first Inning of the Minsky Cycle. Credit growth is ramping but still flying under the radar for most people, while those who do see it are still bearish. Classic textbook setup

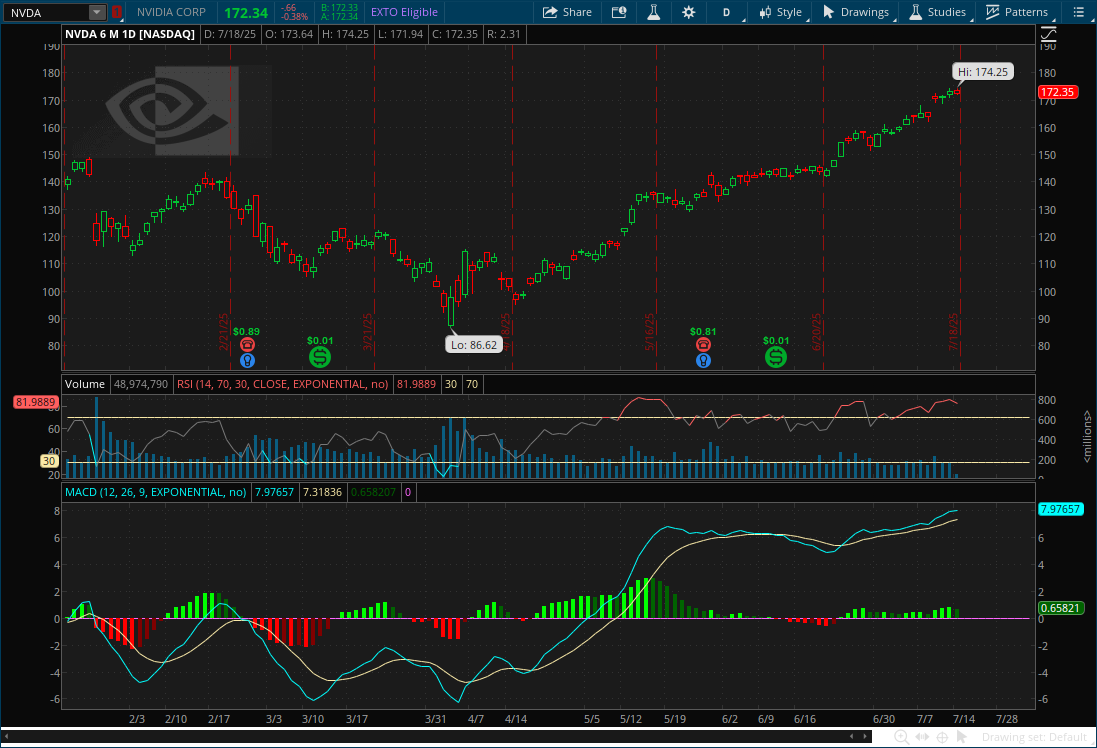

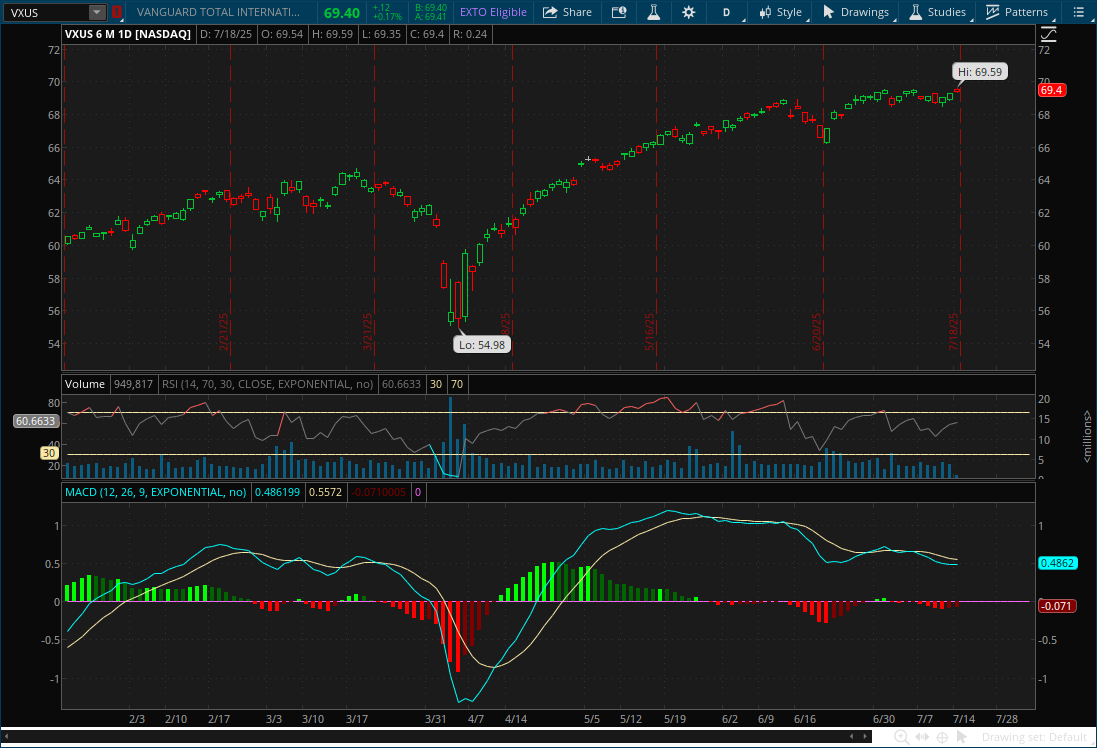

While macro dorks debate soft landings, Chad’s already cruising at 30,000ft. Inflation cooling, fiscal still juiced, PMI ticking up—and my portfolio? Torchin’ benchmarks YTD. Built different. Long alpha, short BS. $VXUS $COIN $NVDA $XME #SigmaTrader #MacroGod

Built different. While you’re crying over rate cuts and CPI prints, Chad’s portfolio is melting faces and clapping cheeks. Tech, defense, energy, EMs—alpha in every sector. Benchmark? Beat it YTD. Your girl fucked me. Stay soft. Chad stays long. $NVDA $COIN $XME $VXUS 💪📈

Built different. While you’re crying over rate cuts and CPI prints, Chad’s portfolio is melting faces and clapping cheeks. Tech, defense, energy, EMs—alpha in every sector. Benchmark? Beat it YTD. Your girl fucked me. Stay soft. Chad stays long. $NVDA $COIN $XME $VXUS 💪📈

While academics debate the landing, Chad already owns the runway. My YTD is smoking the indexes. Inflation fading. Fiscal flows strong. Credit not breaking. I’m long $FN $AUR $COIN $CENX $TPR. Built different. While they cope, I compound. #Alpha #SigmaTrader

Now an 87% EPS beat rate? Good heavens. MarketDesk

Max Verstappen has only been lapped 7 times in his Formula 1 career... All 7 of those blue flags were caused by Lewis Hamilton.

Down to 16% cash Broadening out into Europe, Japan, Real Estate, Insurance, Staples, and Energy

Down to about 29% cash Last two days have been about the energy transition, defense/drones/missiles, and semiconductors

Heard you lost 8-figures on your $RILY short (from an 8-figure net worth). Bottom line-you’re a repeat spectacular failure: Fund management, marriage, fatherhood, friendship, PA investing, and even at being my enemy. That’s why you spend all your time pulverizing your noodle to…

Sector rotation! Financials, application software, commodity equities, and ex-US getting a bid at the expense of the data center/energy transition/war theme that has done so well

Down to about 29% cash Last two days have been about the energy transition, defense/drones/missiles, and semiconductors

At about 50% cash in the long-only trading account The theme will remain ai, energy transition, fintech, defense/drones, software, and rest of world Up +7.93% YTD in that account

Depiction of a “masturbator” in a Swedish medical textbook from 1918.

$TLT making a good argument that it needs to be in my income portfolio now Cheapest it's been in 20 years! #bonds #dividends #fed #InterestRates @FibonacciInves1 @dampedspring @BickerinBrattle

$GLD #GOLD Whichever way gold breaks out of this triangle will be the new trend Fiscal flows suggest higher. No position for now. If you're going to own non-monetary assets might as well own #bitcoin instead $BTC

Full short position on #Gold now. Will add puts on $GLD on any intraday rally Current spot price $3,303 USD Goldbugs are the worst types of people

10-year looks like it may be losing the upward momentum...what if they cut!?! $IEF $TLT $SHY $AGG Also - no doubt Powell is running cover for gundlach, PTJ, Druck, etc so they can keep shorting treasuries

Waller says the Fed should cut rates at the July meeting