Ben Kizemchuk

@BenKizemchuk

Portfolio Manager & Investment Advisor at Wellington-Altus. Tweets are not investment advice. DM with your financial planning and investment questions.

Conversation with @BenKizemchuk He has a really interesting thesis about deep transformations happening in our economy where federal spending increasingly runs the show. Breaks it down into 4 components. Worth a listen if you’re curious about finance/econ

Investment professional @BenKizemchuk joins us to unpack the “4 Fs” shaping a bizarre new paradigm where the federal government becomes a prime mover of the economy. 📌 Fiscal dominance 📌 Financial repression 📌 Fiat liquidity 📌 Passive Investment Flows Listen in. And see…

A new podcast where I unpack the 4Fs framework and explore the enterprise-owned state, plus some thoughts on what a post-scarcity world looks like. Tune in! 🤖📈🔮👇

Investment professional @BenKizemchuk joins us to unpack the “4 Fs” shaping a bizarre new paradigm where the federal government becomes a prime mover of the economy. 📌 Fiscal dominance 📌 Financial repression 📌 Fiat liquidity 📌 Passive Investment Flows Listen in. And see…

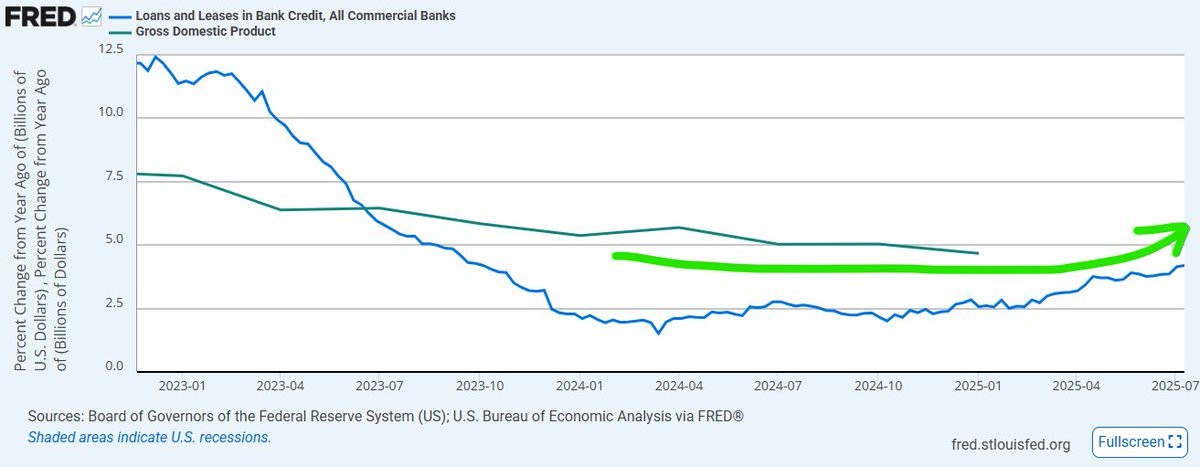

You're in the first Inning of the Minsky Cycle. Credit growth is ramping but still flying under the radar for most people, while those who do see it are still bearish. Classic textbook setup

An Update/Reminder on Rent Inflation inflationguy.blog/2025/07/24/an-…

Meanwhile…Vietnam and Thailand port volumes up 🤣

Not really seeing a slowdown in Chinese export volume growth -- 1/3

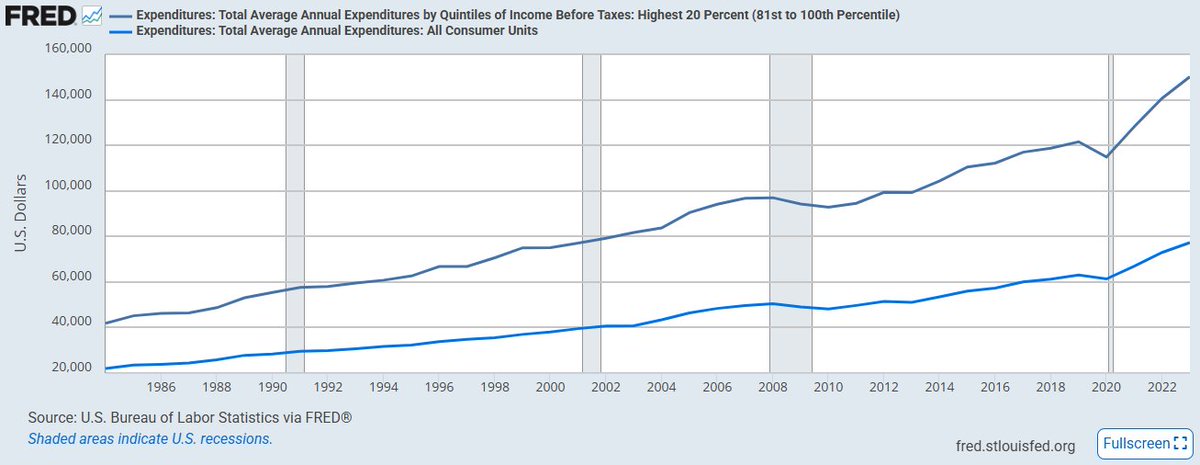

Econ bears fixate on economic gains accruing to the rich, who have a lower marginal propensity to consume. True, but irrelevant. The rich may spend a smaller share of income, but their incomes are so large that their absolute dollar value of consumption dominates. The top two…

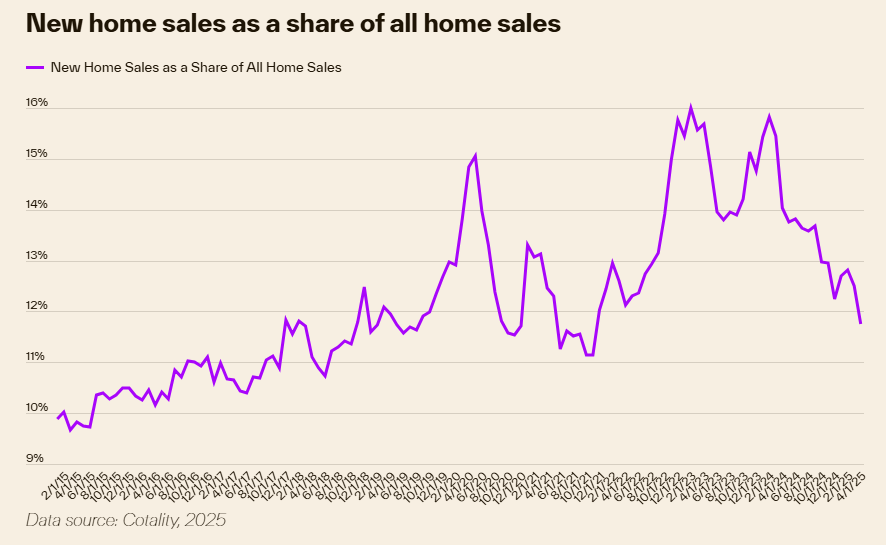

🏡As I have been saying, everything you think you know about the housing cycle is different now. Home sales aren't indicative of economic growth. "Buyers are now forced to rent longer as they compete for a limited number of homes. And rents are only rising. Rents rose 3.7% over…

All eyes on July 31

Ed Yardeni: Upcoming Court Ruling on #Tariffs "Oral arguments on the appeal scheduled July 31. But in an unusual move, we expect the court to hear oral arguments en banc, which means that all 11 active judges in the court will participate to send a unanimous court decision."

$qqq refreshing the composite Should note Dec 2025 is also an arbitrary cutoff.

$qqq I've been asked to extend the analysis beyond August 👇 August was initially selected as an arbitrary cutoff. The years 2009, 2018, and 2020 were chosen to illustrate examples of short-term, V-shaped, "take-no-prisoners" breadth thrust rallies, all occurring within the…

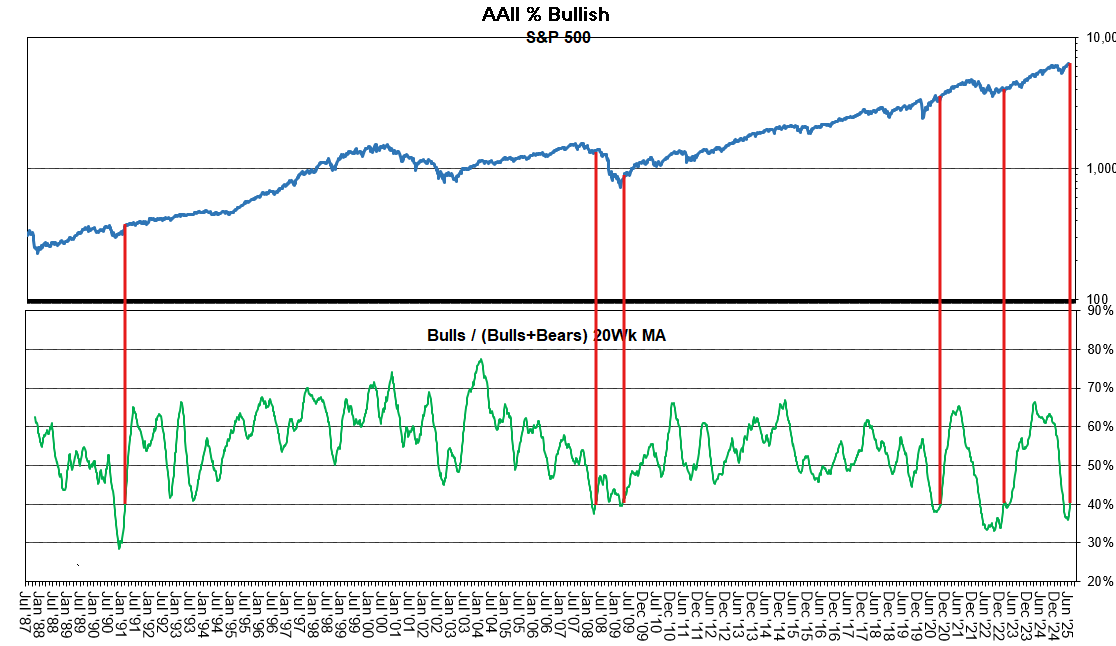

Investor sentiment is emerging from a major reset. The 20wk moving average of Bulls / (Bulls+Bears) just crossed above 40%. I see this as extraordinarily bullish.

June margin debit balances up ✅ Still a bull market 🐂

May margin data back up. Bull market still underway.

Econ bears coming out of the woodwork trying to explain away or otherwise massage the acceleration in credit growth since Jan. Reminds me of 2023 but back then it was fiscal. The economy doesn’t care where the dollars come from — gov or banks. The important thing is that dollars…