Callum Thomas

@Callum_Thomas

Head of Research, Founder: @topdowncharts Global Macro & Asset Allocation Research (tweets = not advice) NOTE: I will never DM you -- beware of scammers.

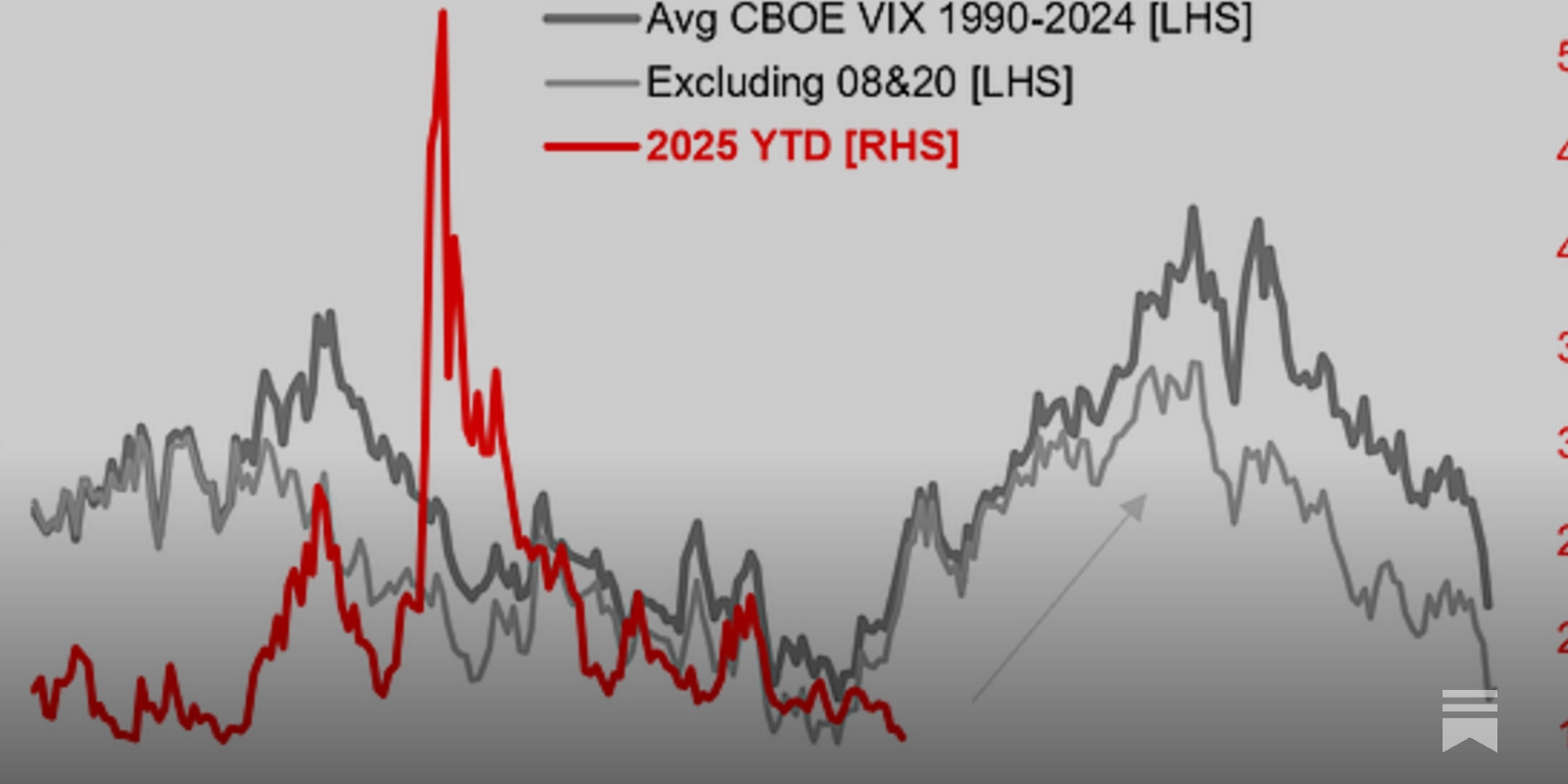

Learnings and conclusions from this week’s charts: 1. Volatility season is here (VIX tends to rise Aug-Nov). 2. VIX made a 5-month low, realized volatility is very quiet. 3. Stocks/Bitcoin/Gold are riding waves of liquidity and speculation. 4. The Equal-Weighted S&P500 made a…

REMINDER: each week we put out 5 of the best charts from around the web on gold, precious metals, miners, and commodities (+FX) -- all with the aim of helping commodity investors get better informed, avoid risks, and make more money! Sign up now 🧐🫡👇📩

Subscribe to the GoldNuggets Digest [free] for regular "nuggets" of research and charts on gold and precious metal markets (see recent editions pictured). Click: gold.topdowncharts.com/s/goldnuggets

There's a good reason the black line looks so different from the blue or grey lines on this chart... Explained: gold.topdowncharts.com/p/goldnuggets-…

Rotation Stations 🚨👀🫡

US equities have peaked vs Global on both a relative price performance and earnings performance basis. It begs the question as to whether this is just another bump in the road onwards and upwards, or the early stages of a major turning point... Key chart to keep track of. 🧐

ICYMI: Weekly S&P500 ChartStorm blog post chartstorm.info/p/weekly-s-and… Thanks + follow reco to chart sources @topdowncharts @Barchart @WarrenPies @GunjanJS @goldchartbook

Weekly Insights - Edition 221 entrylevel.topdowncharts.com/p/weekly-insig… This week: global markets update, cross-asset seasonality, global policy pulse, Fed funds rate outlook, stocks vs bonds, credit spreads, treasuries...

On the radar -US house prices, consumer confidence -BOC, FOMC, BOJ -PMIs & Payrolls Markets: US 10yr yield still stuck in a tight range, DXY also range-bound, ditto gold and crude oil (and bitcoin), stocks onwards and upwards... (wow, everything is range trade)

(...is it 2004 or 2007?)

Emerging Markets credit spreads are back to 17-year lows... Confidence or Complacency?

Investor allocations to #Gold ETFs remain historically low, despite the Gold Price hovering around all-time highs. There's just not the same enthusiasm for Gold funds as there is for crypto and tech stocks. Investors are also opting for physical gold, and central banks are…

Weekly S&P500 ChartStorm chartstorm.info/p/weekly-s-and… This week: volatility harbingers, seasonality, speculative waves and liquidity, equal-weighted index, sentiment, valuations, penny stocks, issues in asset allocation...

Weekly ChartStorm coming soon... Meantime, check out last week's edition + Subscribe: chartstorm.info/p/weekly-s-and…

PODCAST: "Do You Own Enough Emerging Markets? With Callum Thomas" checkyourbalances.com/1607113/episod…

Latin American equities are an undervalued and overlooked corner of global equities...

Reminder to check out the ChartStorm + excellent follows 🧐👇

ICYMI: Weekly S&P500 ChartStorm blog post chartstorm.info/p/weekly-s-and… Thanks + follow reco to chart sources @TheDonInvesting @topdowncharts @Marlin_Capital @dailychartbook @crudechronicle @Mayhem4Markets @MikeFritzell

The base-building process before last year's big breakout for Gold was a 13-year work in progress... Something tells me this bull market has room to run just yet. What do you think? How much has it got left? (in time and/or price)

It seems like everyone's excited about Gold, but from a valuations standpoint -- we see a much greater opportunity in Commodities... It's time to talk about rotation: entrylevel.topdowncharts.com/p/chart-of-the…

🚨A food for thought: The deeper the portfolio drawdown, the greater the required recovery just to break even. Remember to manage your risk carefully during these crazy times. Great chart by @Callum_Thomas

Weekly report highlights: topdowncharts.pro/p/weekly-macro… (main report from my institutional service)