Global Markets Investor

@GlobalMktObserv

Investment, Equity (on Wall Street), Macro Research background. ~10 years markets experience, supporting investors in succeeding. Join 5700+ FREE subscribers

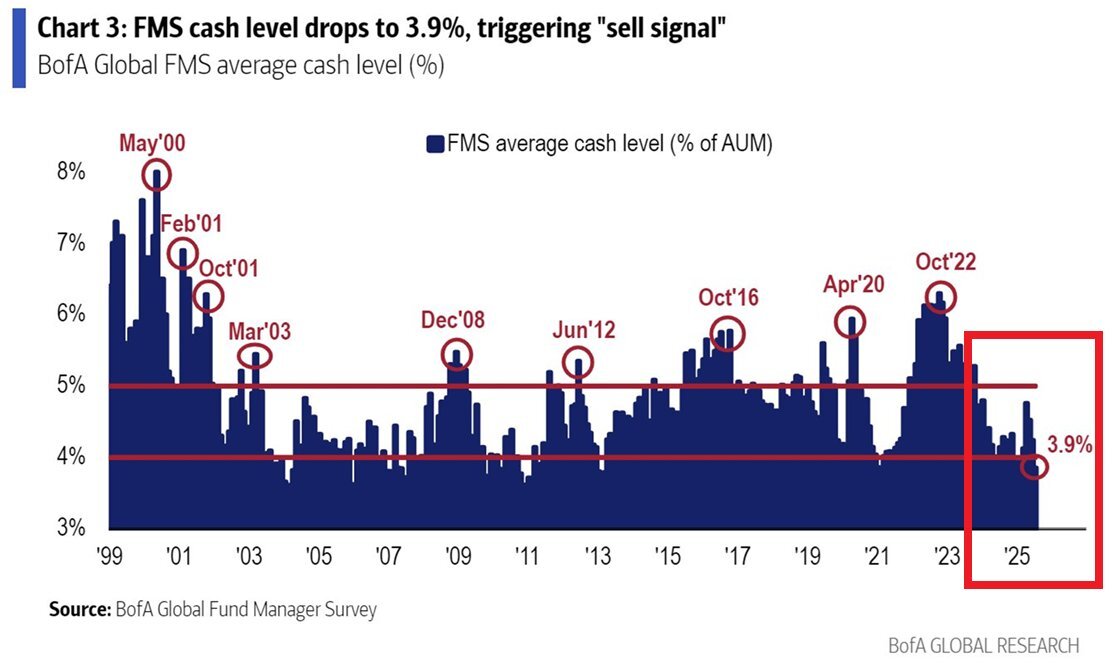

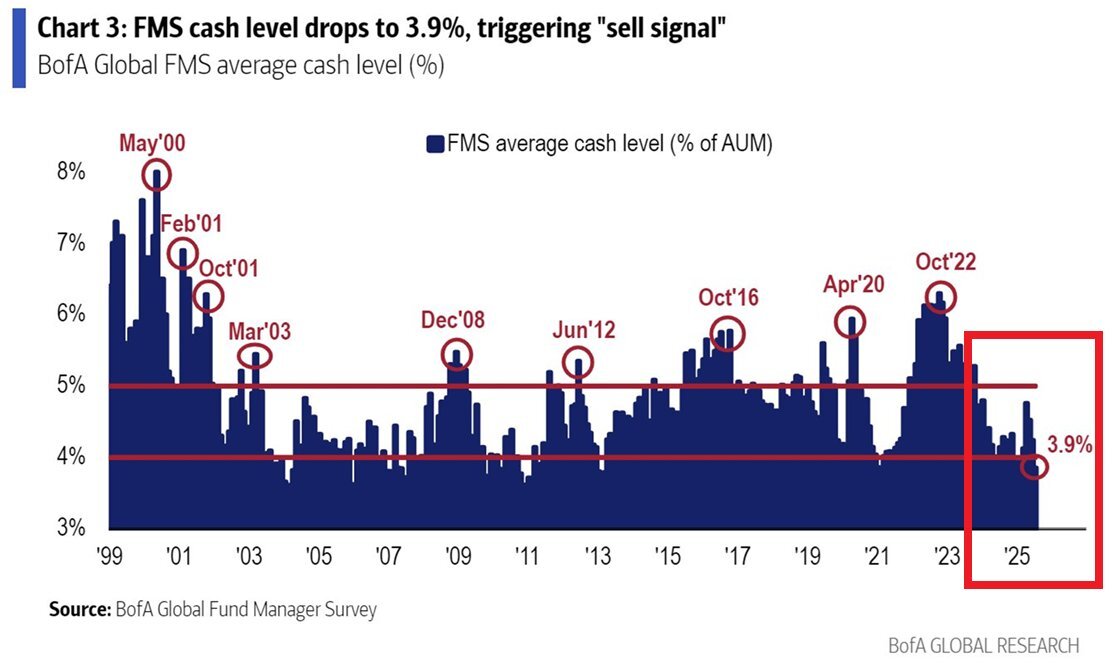

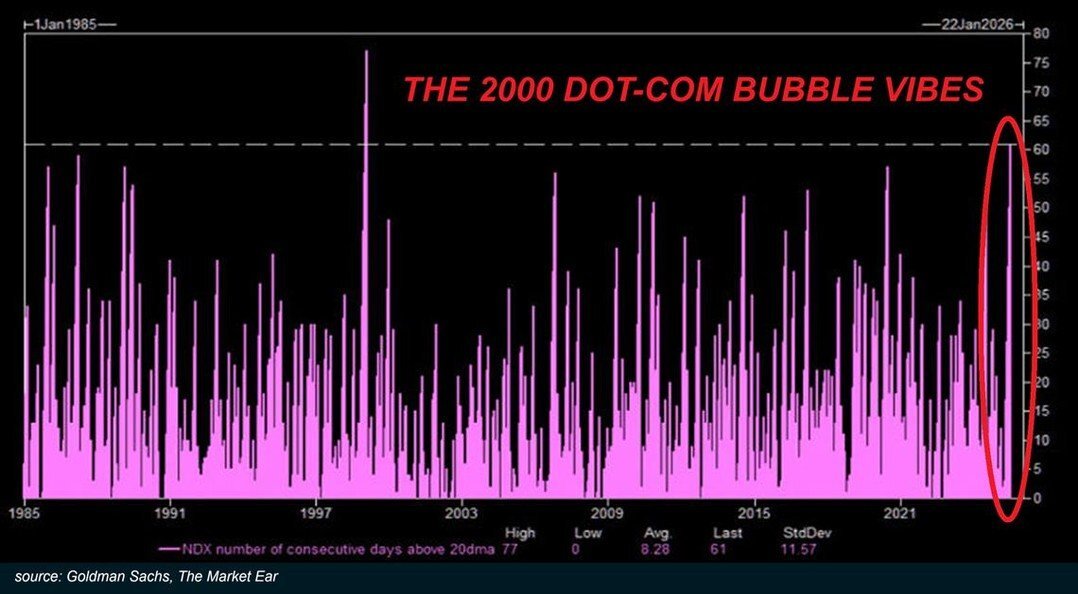

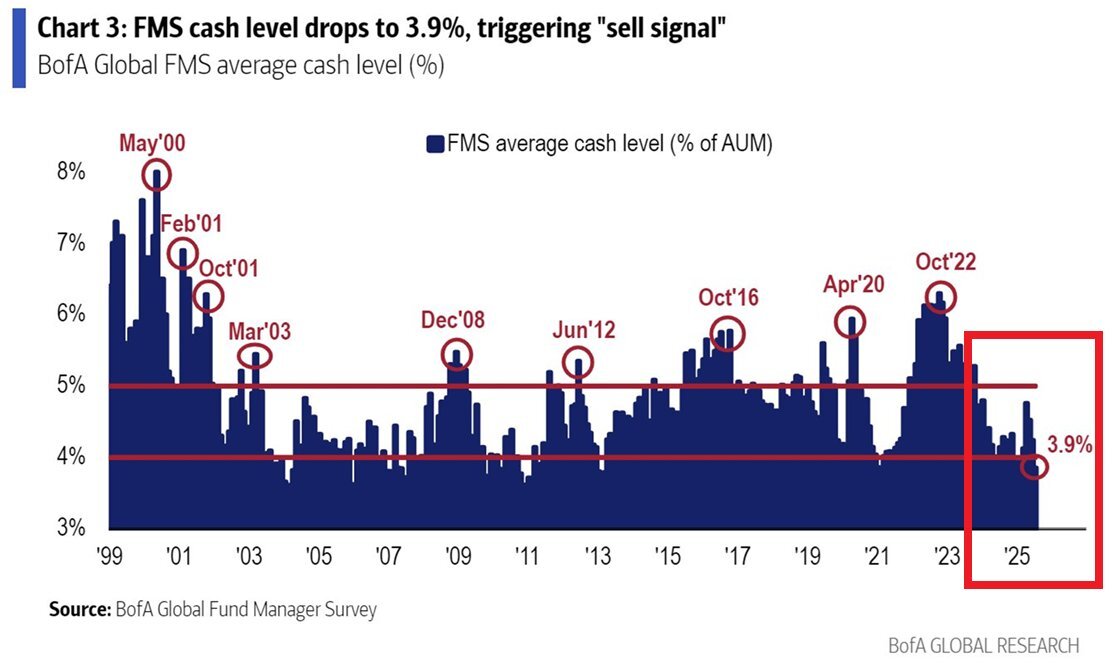

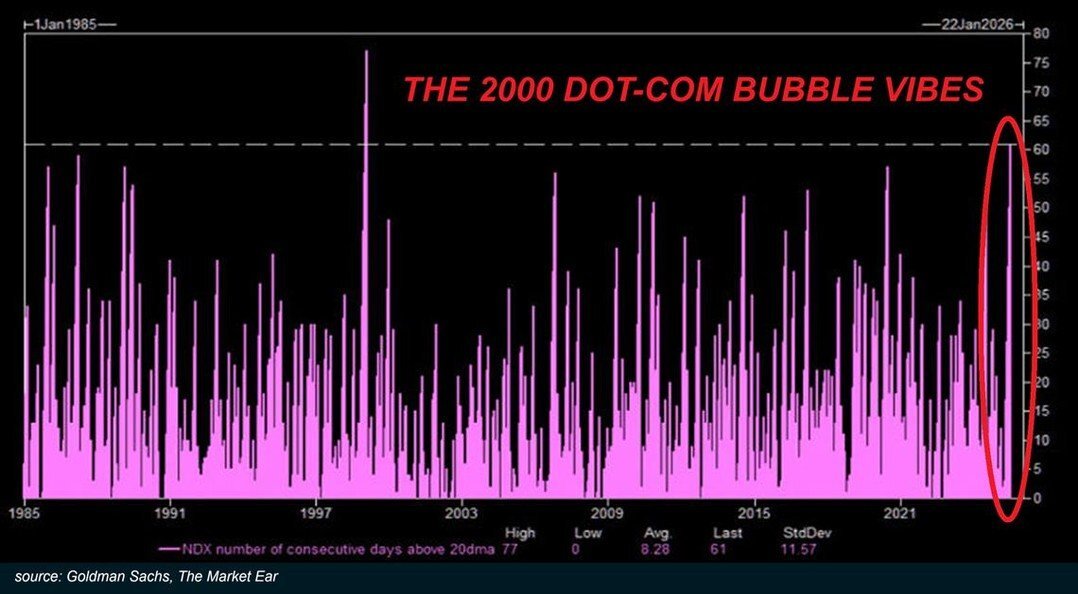

🚨 Market Euphoria Reaches Dot-Com Levels: Speculation is surging, tech is skyrocketing, and valuations are reaching extremes. From retail mania to record concentration, the signs increasingly resemble the Dot-Com Bubble. The parallels are too SERIOUS to ignore. (Thread) 👇

⚠️Is China DUMPING US Treasuries? China, the third-largest Treasury holder, saw its holdings decline $900M in May, to $756.3BN, the lowest in 16 years. Belgium, whose holdings include Chinese custodial accounts, saw its stockpile go up by $4.5BN.👇 globalmarketsinvestor.beehiiv.com/p/chart-of-the…

⚠️The market is EXTREMELY expensive: The Shiller P/E ratio on the S&P 500 is now at 38.8x, the highest since the 2000 Dot-Com Bubble burst. The Shiller P/E ratio is higher than it has been 96% of the time in history. That is extreme by any standard👇 globalmarketsinvestor.beehiiv.com/p/us-stock-mar…

⚠️US money supply is rising: US M2 money supply jumped 4.5% year-over-year in June, to a record $21.02 TRILLION. In May, M2 has officially surpassed the 2022 all-time high. For perspective, the 2000-2025 annual growth rate has been 6.3%.

‼️Rapidly rising prices are a global phenomenon: Since January 2021, average prices have surged 27.4% and 22.6% in the UK and the Euro Area. US CPI inflation has risen 22.4% In Germany, France, and Japan, prices have increased 19.9%, 15.4% and 11.9%👇 globalmarketsinvestor.beehiiv.com/p/the-s-p-500-…

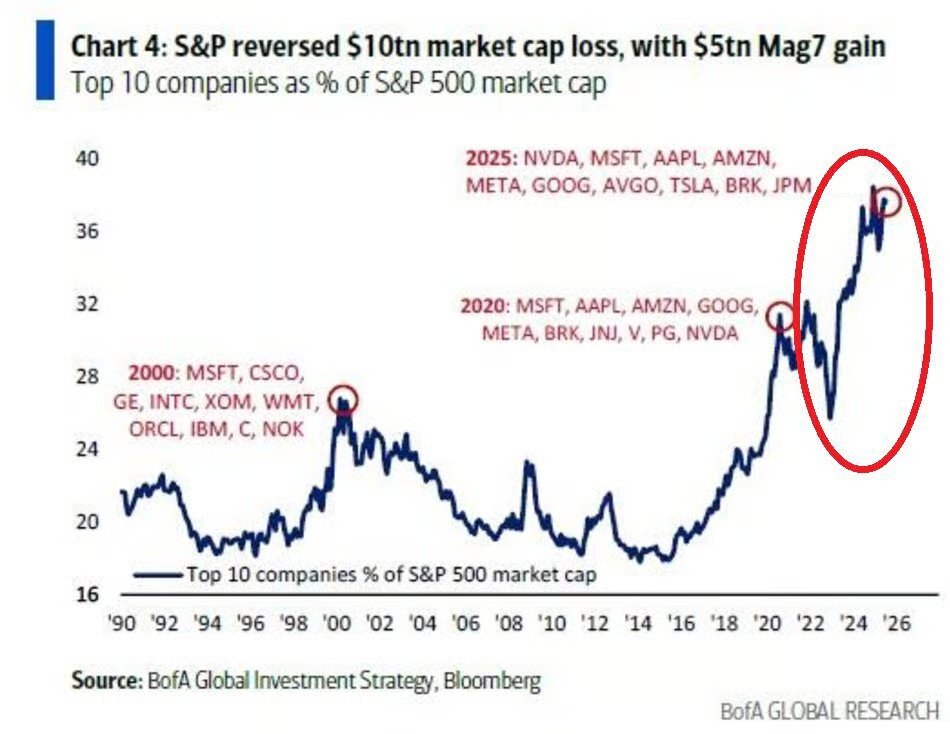

⚠️Big Tech has never been bigger. Technology stocks now account for 46% of the S&P 500. At the 2000 peak, that figure was just 33%. The top 5 names now reflect 27% of the S&P 500 index and 52% of the Nasdaq 100.👇 globalmarketsinvestor.beehiiv.com/p/us-stock-mar…

🚨US recession alert: The Conference Board Leading Economic Index (LEI) drawdown is now 17.8%, the biggest since the Financial Crisis. The LEI fell 4.0% Y/Y in June, to the lowest in 11 YEARS, and posted the 3rd straight month in which it has triggered a recession signal.

‼️Crypto markets are making HISTORY: The total crypto market cap surpassed $4 trillion for the first time, fueled by altcoin rallies and bullish sentiment from advancing US regulatory legislation. The market value has DOUBLED in less than a year.👇 globalmarketsinvestor.beehiiv.com/p/the-s-p-500-…

🚨HOLY COW: Margin debt* just crossed $1 trillion in June for the first time since 2021. July could come in near $1.1 trillion. Risk appetite among retail investors is off the charts. *The amount of money that an investor borrows from its broker.👇 globalmarketsinvestor.beehiiv.com/p/us-stock-mar…

🇯🇵HOLY COW: Japan's rice prices have DOUBLED year-over-year, the biggest increase in at least 25 years. Major food firms plan 2,105 price hikes in July, 5 TIMES more than last year, according to a report by the Teikoku Databank. Inflation pressure is not easing in Japan.

🚨Global fund managers are underinvested in US stocks: Professional investors have remained UNDERweight US equities versus global stocks for the 5th consecutive month. Will the US continue to underperform?👇 globalmarketsinvestor.beehiiv.com/p/the-s-p-500-…

⚠️US job market is weakening: 58% of Americans expect HIGHER unemployment in the next 12 months, one of the highest readings since the GREAT FINANCIAL CRISIS. Such readings have never occurred outside of recessions. This suggests further deterioration in the job market.

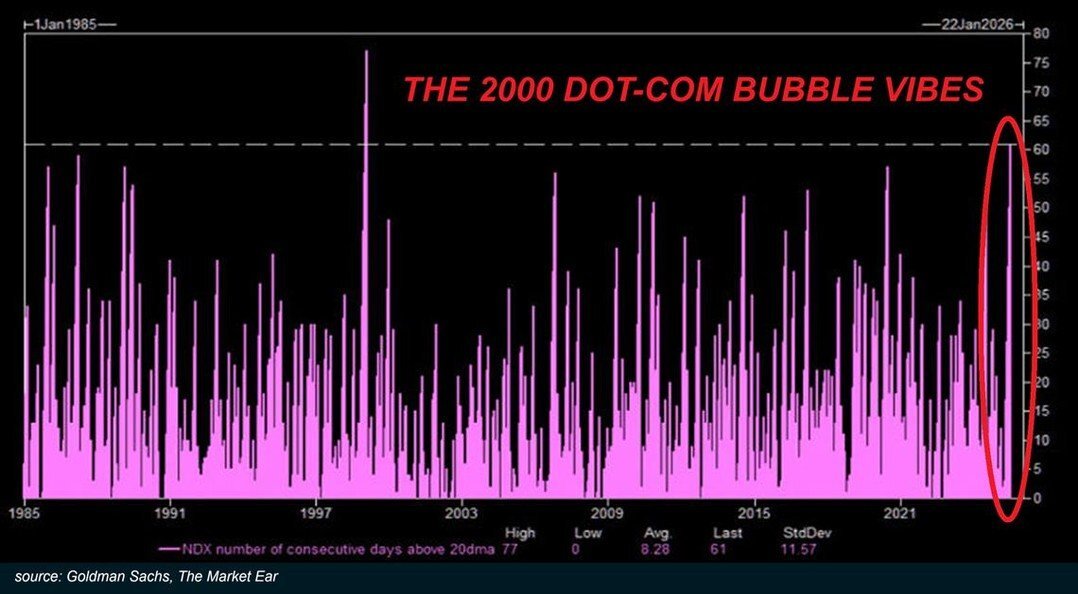

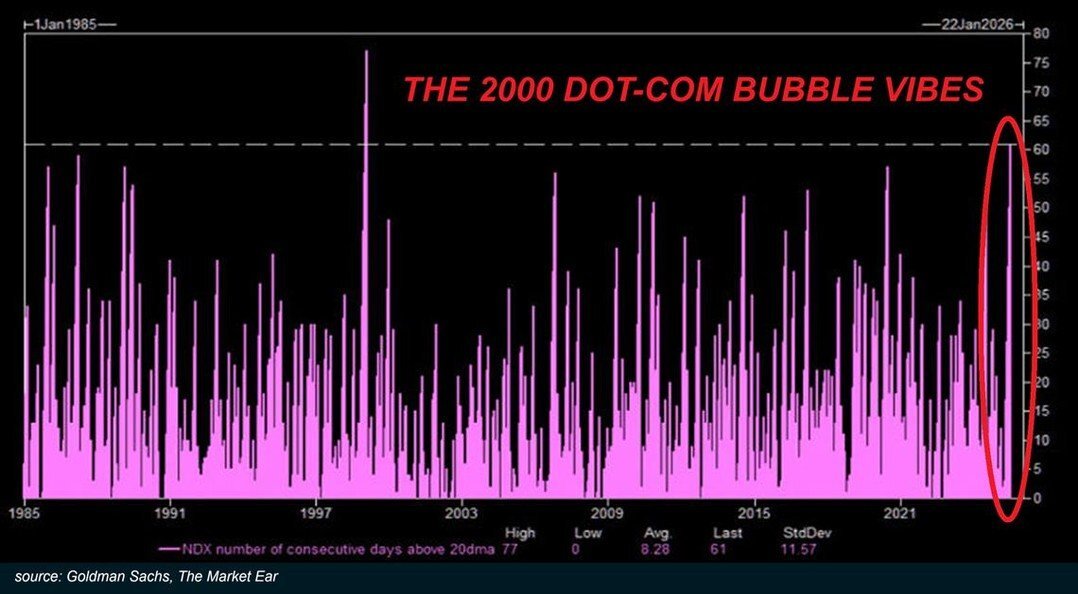

🚨 US stock market euphoria reaches Dot-Com Bubble levels: The Nasdaq 100 has now closed above its 20-day moving average for 66 consecutive sessions. That is the longest streak since 1999 during the Dot-Com run, which ended at 77 sessions.👇 globalmarketsinvestor.beehiiv.com/p/us-stock-mar…

🚨Crypto is making history: The largest Bitcoin ETF, $IBIT, hit $80 BILLION in total assets value for the first time in history. It took 374 trading days to achieve this milestone, 5x FASTER than the previous record set by the S&P 500 ETF, $VOO.👇 globalmarketsinvestor.beehiiv.com/p/the-s-p-500-…

‼️The US debt crisis is getting worse: The US federal debt has hit $36.66 TRILLION, an all-time high. The public debt has skyrocketed $441 billion over the last 2 weeks after the statutory debt limit was extended. Over the last 2 years, the US debt has risen $5 TRILLION.

⚠️Is inflation re-surging in the US? Are tariffs having a significant impact on US prices? Read the full analysis below👇 globalmarketsinvestor.beehiiv.com/p/is-inflation…

‼️Silver industrial demand is surging: Global usage is set to hit an all-time high of ~775 million ounces by 2027, up ~50% from 2014. Photovoltaics (solar) is the biggest driver, soaring from just 48Moz in 2014 to a projected 256Moz in 2027. Watch the silver market.

⚠️HOLY COW, Japanese bond demand just collapsed. Japan’s 40-year bond auction saw its weakest demand since 2011. The bid-to-cover ratio fell to 2.127. The 10-year yield jumped back to 1.6%, the highest in 17 YEARS. Concerns are SKYROCKETING over rising government spending.

🚨The world is replacing the US Dollar reserves with Gold: Over the last 4 years, gold prices have risen an impressive 125%. At the same time, 20+ year Treasuries, $TLT, have dropped 37%. The ratio between the two has fallen to an ALL-TIME LOW.👇 globalmarketsinvestor.beehiiv.com/p/this-is-the-…

‼️China cannot get rid of DEFLATION: China producer prices FELL 3.6% YoY in June, the most since July 2023. CPI rose just 0.1%, but remains in deflation excl. metals. Weak domestic demand, overcapacity, and price wars are behind the major drivers.👇 globalmarketsinvestor.beehiiv.com/p/the-s-p-500-…

⚠️Japan's automakers are eating tariffs: They slashed export prices to the US by a RECORD 19.4% to offset auto tariffs, sacrificing profits to stay competitive. Car exports to the US by value FELL nearly 25% in May, while volumes fell just 3.9%.👇 globalmarketsinvestor.beehiiv.com/p/the-s-p-500-…