CME Active Trader

@CMEActiveTrader

@CMEGroup's place for active traders looking for new trading opportunities or capital efficient ways to manage risk with futures or options on futures.

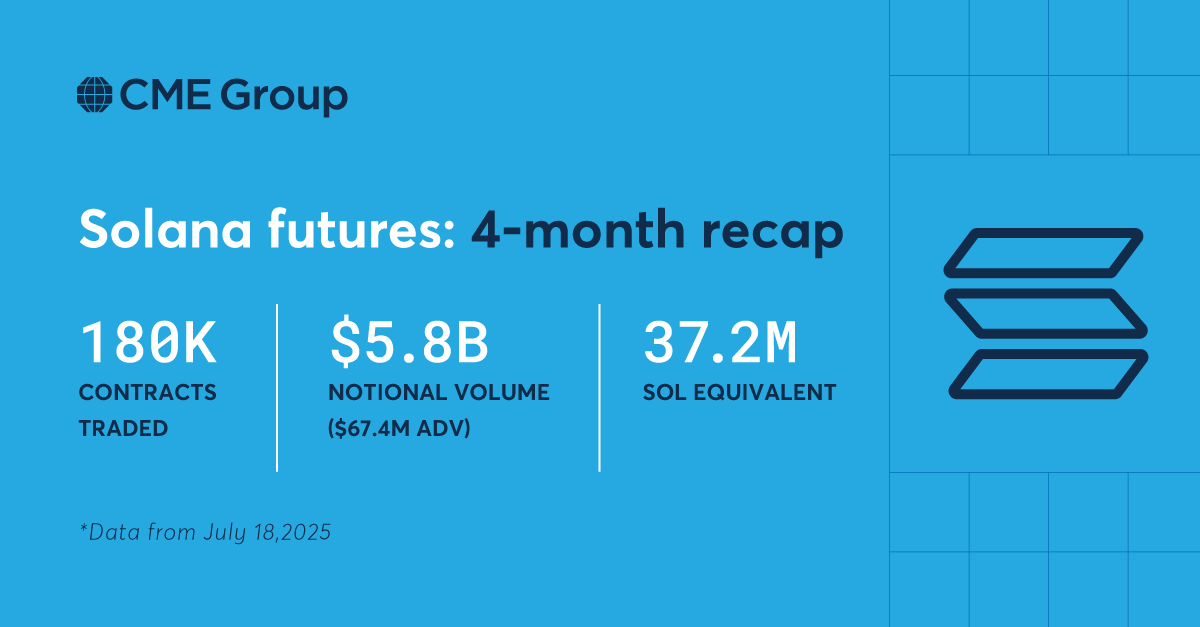

Four months in, and the traction continues. 📈 SOL and Micro SOL futures suite are helping traders access trusted, regulated exposure to SOL with precision and confidence. Explore Solana futures ➡️ spr.ly/6016fHYY8

Great energy at the #MooFest panel last week. 🔥 Our own Minah Kim broke down how regulated products are the access point to tokenization, helping to connect traditional finance with Web3. 🚀 The future is integrated. ➡️ spr.ly/60144Cy2A

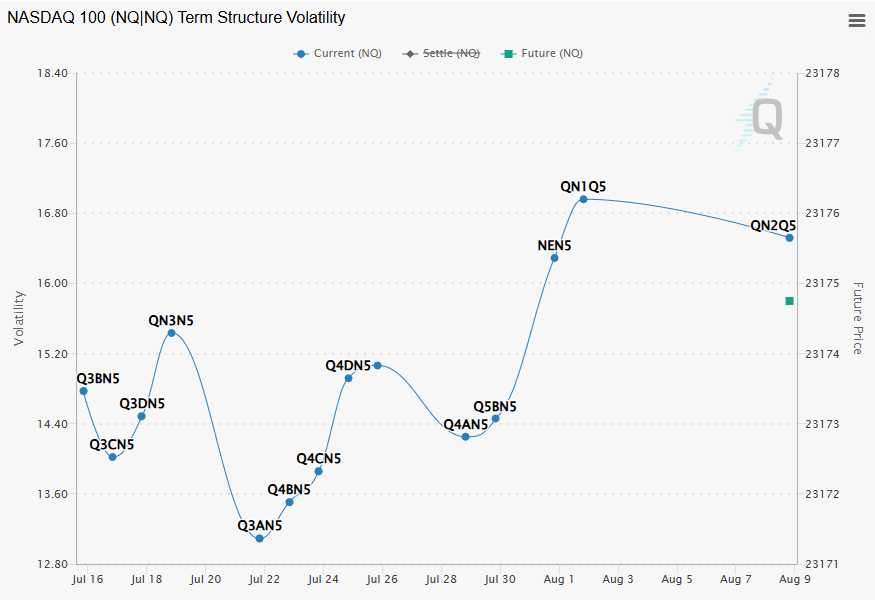

The Nasdaq-100 is up 10% year-to-date, but the journey has been anything but smooth from a 26% drop in Q1 to a 40% rally in Q2. Big tech earnings season kicks off on July 23, with #Microsoft and #Meta reporting on July 30. What will the numbers reveal? Insights by @jimiuorio

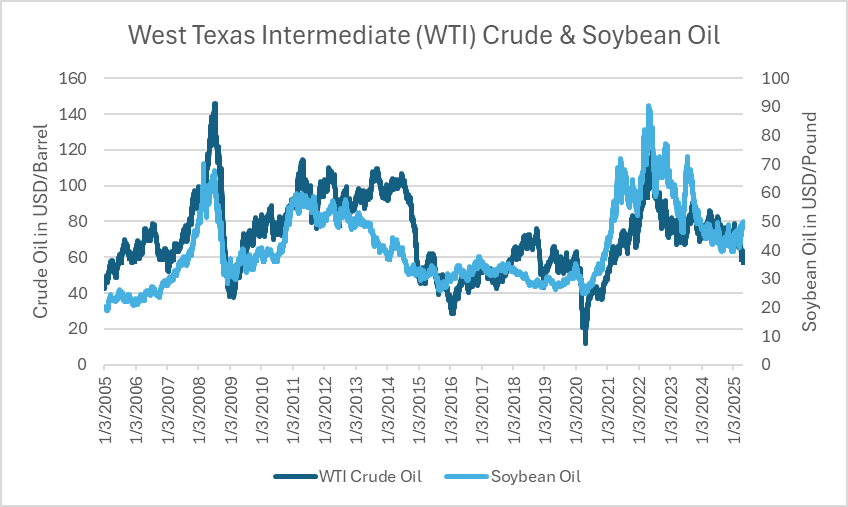

WTI Crude Oil traders, take note 📝 Soybean oil has shown a tendency to act as a leading indicator for crude oil price movements. This suggests that tracking soybean oil prices, particularly nearby futures contracts, could offer valuable insights for traders involved in crude…

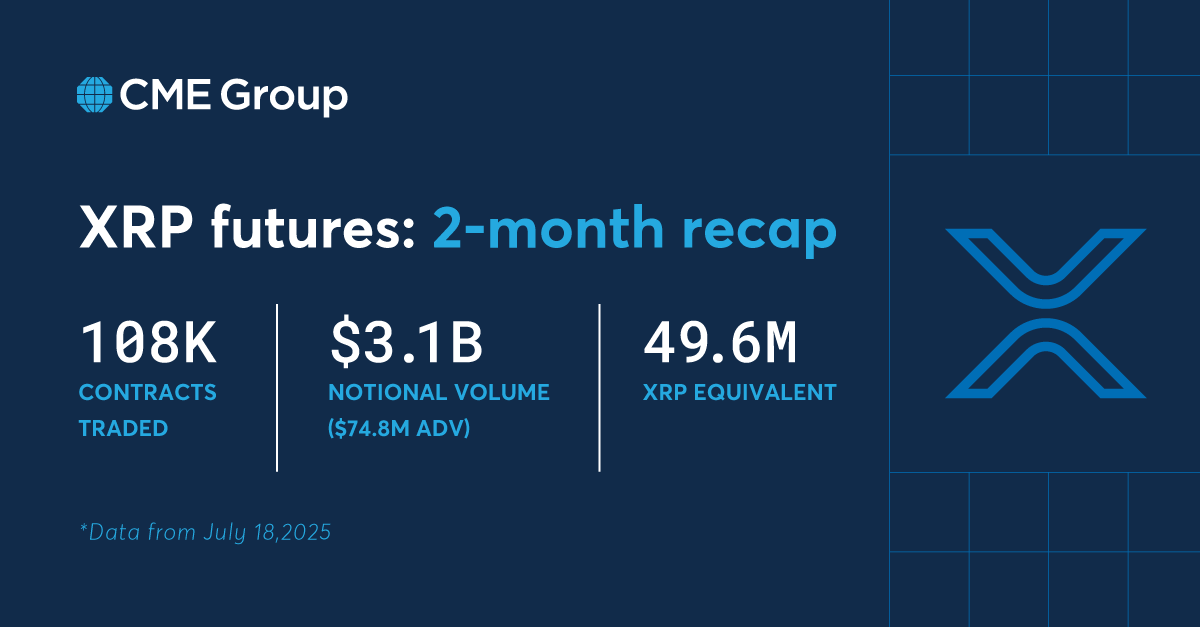

Last week, XRP futures hit their biggest trading day yet, just in time for their two-month mark. The growth speaks for itself. 📈 Discover XRP futures ➡️ spr.ly/6010fGezy

Last chance to sign up for our webinar, "Real Traders, Real Strategies: How Individuals Use CME Group Products." Join us tomorrow at 10:30 a.m. CT to gain valuable insights into navigating uncertain markets ➡️ spr.ly/60114AEDJ

E-mini Nasdaq-100 options implied volatility curve showing a potential for outsized price movements for August 1st, which coincides with the latest tariff deadline along with key employment data from July.

The record-setting streak for Ether futures (ETH) continues. 📈 July 16 was the fifth consecutive day of record OI, now surpassing a notional of $6.5B (equivalent to over 1.75M Ether) Explore what's possible with Ether futures. ➡️ spr.ly/6018f6uS4

While the U.S. equity market remains strong, the options market is pricing in increased volatility for August 1st. Earnings, the Fed, tariff negotiations and key economic data are all on the radar. Insights by Craig Bewick, Senior Director of Education at CME Group.

We heard you, and it's finally here. Dive into our new, fully customizable Trading Simulator, where you can: 📈 Experience cutting-edge charting tools. 😎 Tailor your trading environment to fit your style. 🖥️ Learn to trade the futures market, not just watch it. Practice now…

Bitcoin’s latest surge goes beyond a technical rally; the cryptocurrency’s role is evolving. Once viewed as a high-volatility asset, Bitcoin is now being seen as a hedge against inflation and fiat currency. With the dollar down 12% against the euro this year, Bitcoin’s 24% gain…

Join us on July 23 for our upcoming webinar, "Real Traders, Real Strategies: How Individuals Use CME Group Products." Discover how active traders leverage our tools to succeed ➡️ spr.ly/60174ATI5

🚀 Major milestone: XRP and Micro XRP futures crossed $235M notional traded on July 11, bringing total notional traded since launch over $1.6B. The record underscores the rapidly growing demand in our new XRP futures suite. 📊 Key stats for July 11: ✅ 9.1K+ total contracts…

Bitcoin's implied volatility is at near-record lows while Ether's is trading around its two-year average. What is the options market telling crypto traders? CME Group’s Senior Director of Education, Craig Bewick, shares his insights.

The recent decline in the British pound is influenced by a combination of global and domestic issues, including U.S. tariffs and U.K. fiscal worries. Despite these challenges, the pound has shown resilience throughout the year. As both the U.S. and U.K. prepare to release new…

SOL and Micro SOL futures just passed $4B+ in notional volume traded. 📈 SOL is quickly becoming a core part of how traders manage risk and opportunity in today’s evolving digital asset landscape. ⬇️

Volatility doesn't have to mean trading uncertainty. Join us July 9 at 10:30 a.m. CT to discover how E-mini and Micro E-mini futures can help you navigate changing markets with confidence. Reserve your spot ➡️ spr.ly/60144qNFY

On June 30, the Nasdaq 100 reached new highs, fueled by AI and strong market breadth. But what if the job number surprises to the upside? According to @jimiuorio, a better-than-expected jobs report could delay the next rate cut and slow the equity rally.